“The Market Script, For Now, Remains Similar To 2007…”

Authored by Sven Henrich via NorthmanTrader.com,

The Key

Markets keep flirting with new highs following the recent rate cuts by the ECB and the Fed and keep rallying on trade optimism in the face of disappointing global economic data. While the bear case remains challenging in face of a stubborn bid, the market script, for now, remains similar to 2007. And that script does not preclude new highs. Recall in 2007 markets rallied to new marginal new highs following the September rate cut before peaking in early October.

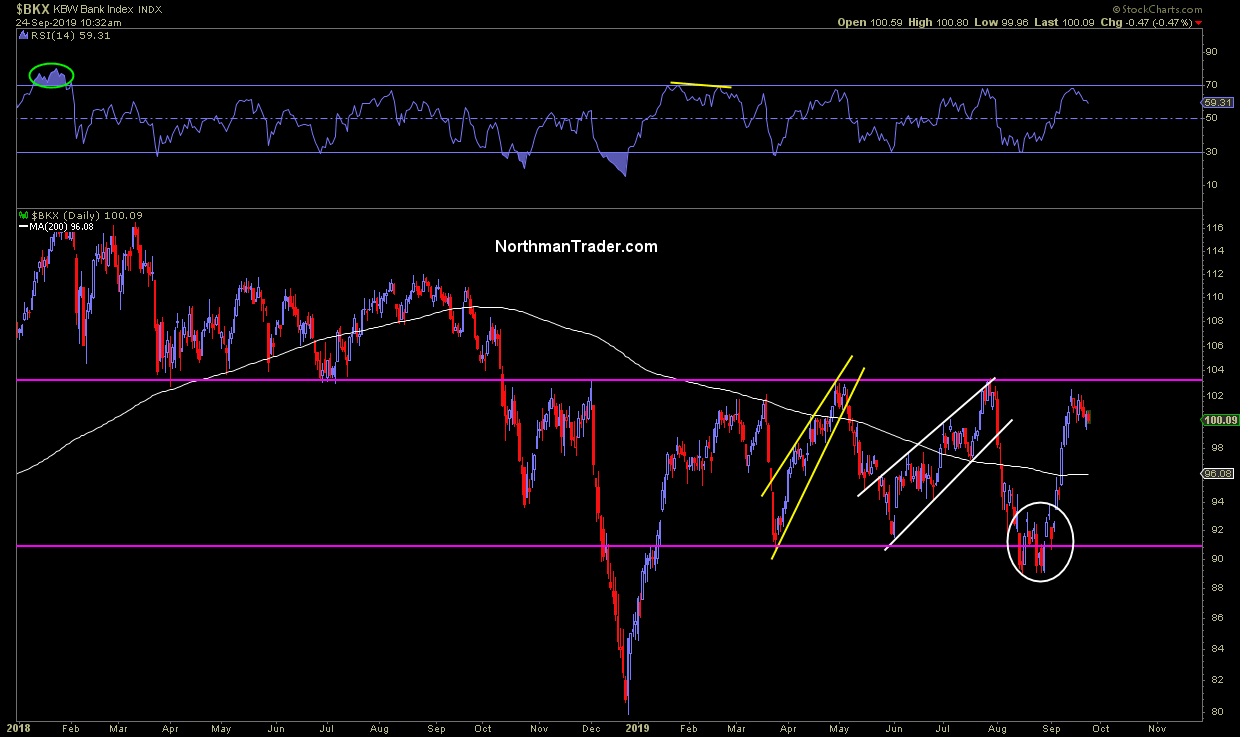

One sector may be key to watch in the days and weeks ahead: $BKX, the bank index. While it recently rallied along with markets it remains stuck inside its larger range:

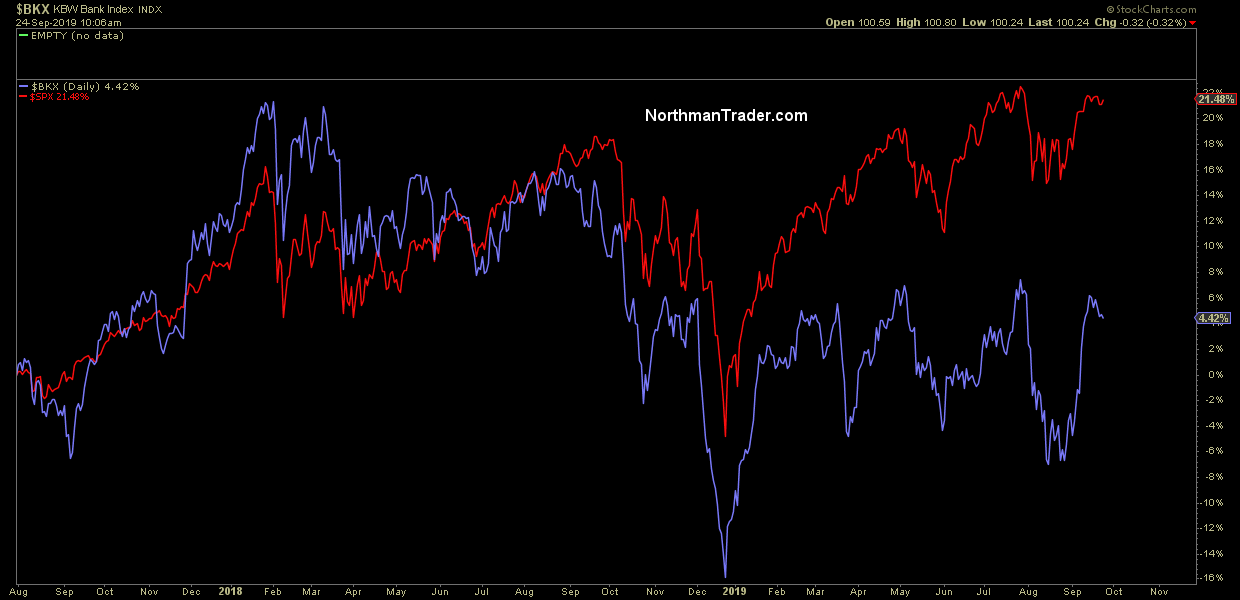

The bank index has horribly underperformed $SPX in 2019, a very pronounced divergence:

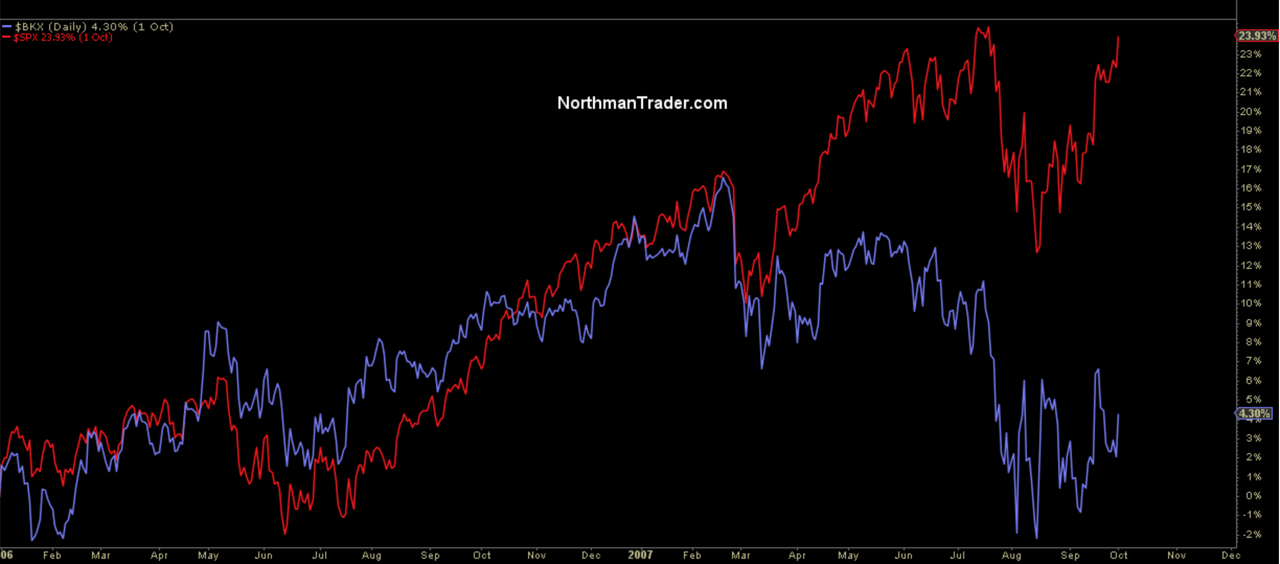

Blame falling yield and an inverted yield curve. But buy doing so one must acknowledge that we can observe another similarity to the bull run in 2006-2007:

Back then $SPX disconnected from the banking index for most of 2007 as $SPX has done in 2019.

For new highs to convince and give sense of sustainability the banking index needs to follow suit. A bull market without banks participating is suspect.

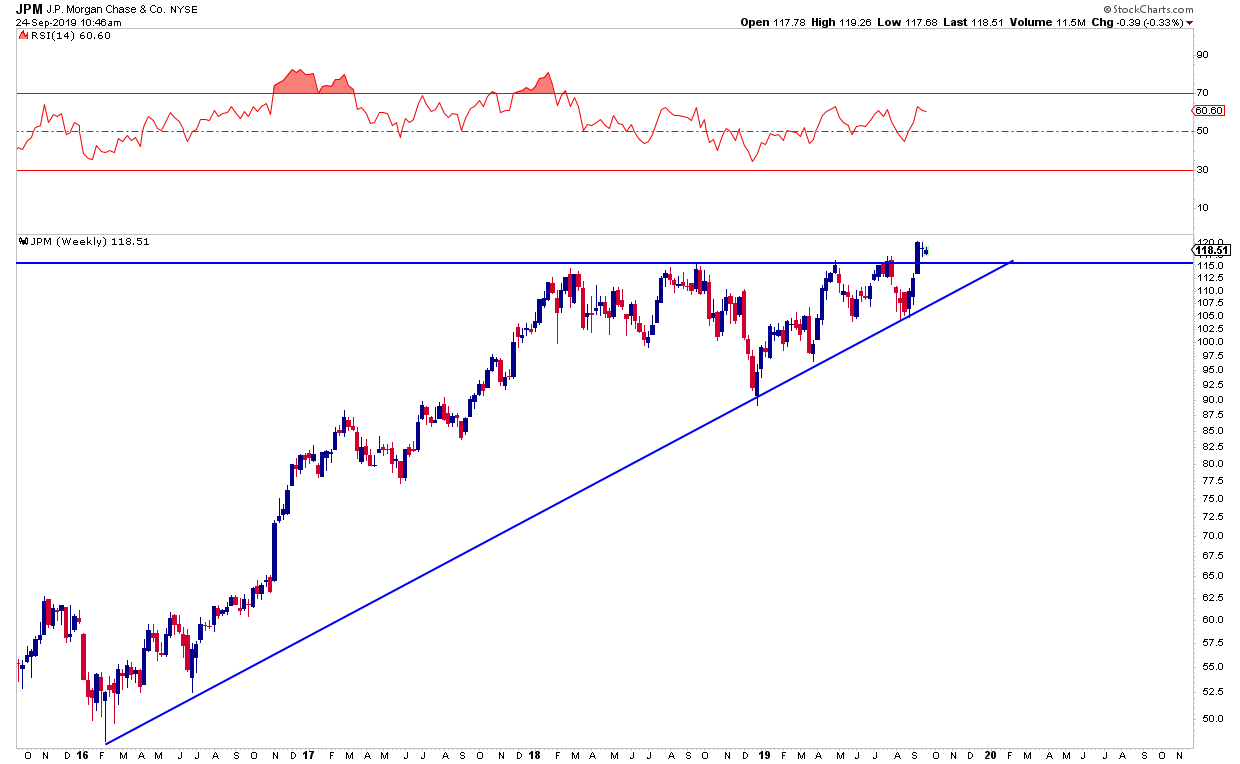

Now one may make a counter argument and point to a bank such as $JPM which is breaking out to new highs:

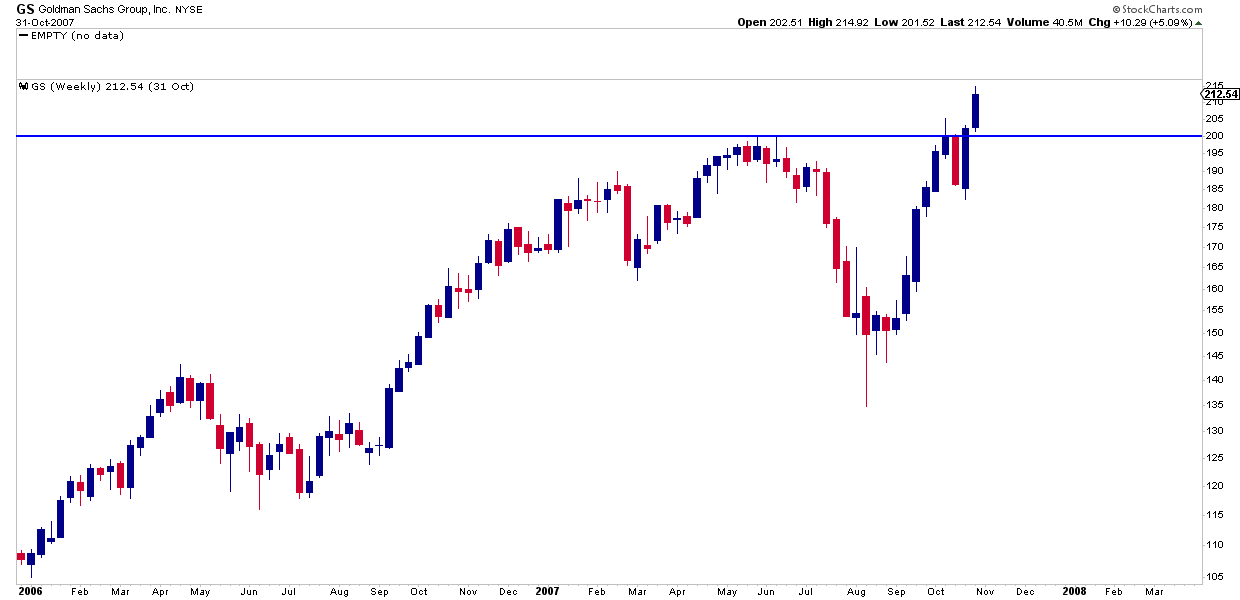

Is that in itself indicative of anything? Allow me to retort by pointing to Goldman Sachs as an example in 2007:

It too broke out to new highs in October 2007 even after the market had already peaked. Did it mean anything? No.

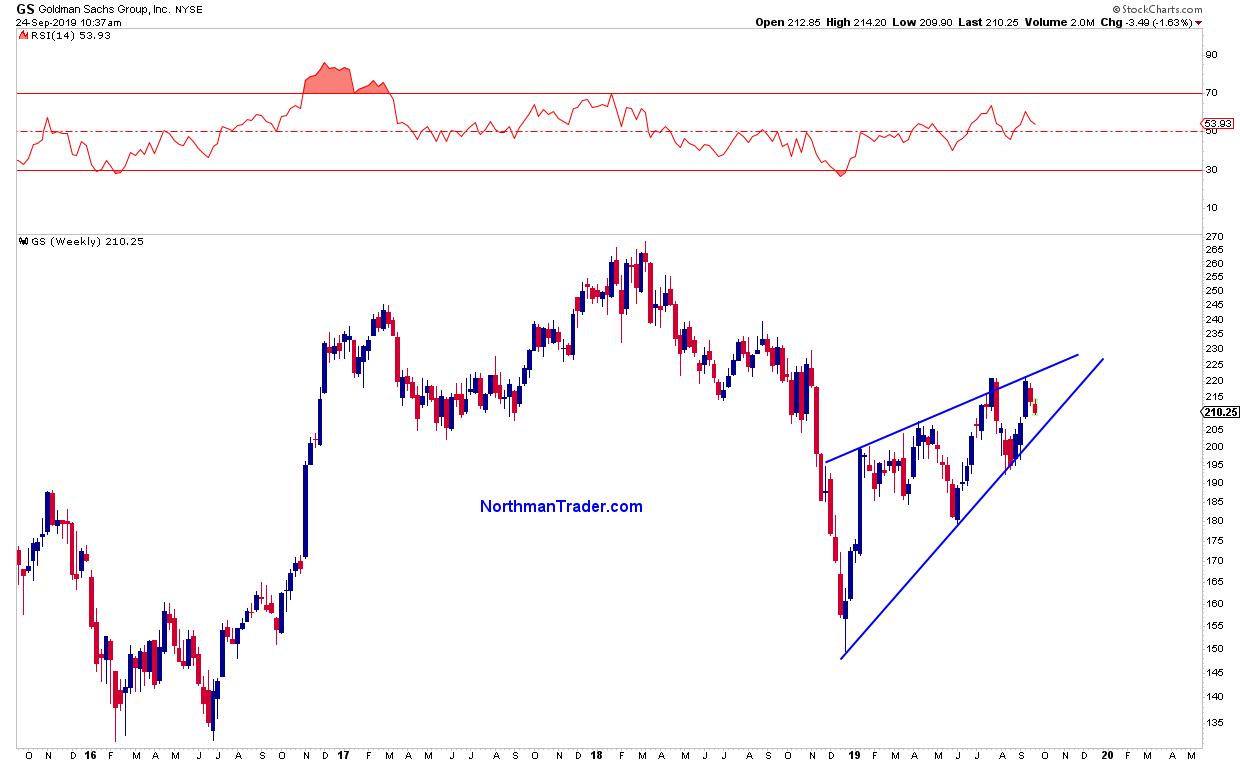

How’s Goldman stock doing these days?

For now it looks to be forming a bearish rising wedge in 2019 following a topping pattern built in 2018.

Bottomline: Nothing’s proven one way or the other. The banking sector as a whole has to convince here and so far it hasn’t. And until it does any new highs, if they materialize, have to be viewed with extreme caution. Continued failure on the side of the banking sector to break higher would suggest that new highs won’t sustain. The bank index may hold the key to the bull market’s future.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Tue, 09/24/2019 – 12:55

via ZeroHedge News https://ift.tt/2lnXEQ8 Tyler Durden