Peloton IPO Suffers 3rd Worst Opening For Unicorn Since 2008

Having priced the IPO at $29 – the upper-end of the range – and being lauded this morning by business media for being “oversubscribed“, everyone’s favorite clothes-rack, Peloton, is set to open dramatically below the IPO price.

The home-fitness company sold 40 million shares for $29 each. Peloton is valued in the listing at about $8.1 billion based on the shares to be outstanding as listed in its filings with the U.S. Securities and Exchange Commission.

Having been indicated as high as $31.50 early on, interest in PTON slipped until it finally opened at $27:

As Bloomberg pointed out, the worst opening trades for a $1 billion or greater IPO since 2008 are:

-

SmileDirectClub -11% (Sept. 12)

-

ADT -9.6% (2018)

-

Uber -6.7% (May 10)

The $27 open is a 6.9% drop opening and thus the third worst opening trade for a unicorn IPO.

There have been nearly 100 IPOs with better starts since 2008 after raising at least $1 billion.

This should not be a huge surprise, as Grizzle recently noted, looking at the value of Peloton on a fundamental basis, we also struggle to get anywhere close to $29/sh.

Based on the exercise equipment market we defined in the section above, there is $7.5 billion of sales up for grabs by 2030.

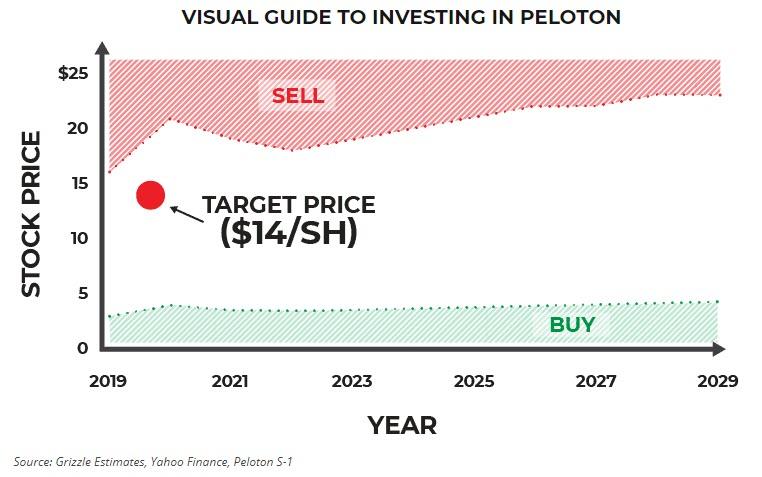

If as we expect, Peloton achieves a 30% share in its market or $2.3 billion in annual sales, the stock is only worth $14.00/sh, 50% lower than the IPO price.

Below is a chart showing the buy and sell bands for this stock over time.

Though we think Peloton is only worth $14/sh at most longer-term, if you do decide to trade Peloton use this visual guide to determine when you should buy, sell or hold.

And as we noted previously, Peloton has truly come closer than any other product to bringing the gym experience into your own home.

But though the product may be amazing, it requires significant ongoing commitment from the customer.

Consumers rarely stick with exercise goals and for that reason, Peloton has to work harder and harder just to maintain revenue let alone grow it.

For this reason, we think Peloton will struggle as a public company.

Once investors realize Peloton is on the New Year’s resolution treadmill just like every other exercise company, both the multiple and the stock price have a long way to fall.

Additionally, of note, 181 days after the S-1 was filed, the majority of insider shares can now be sold. This date falls on February 24th, 2020.

Under certain circumstances the lock-up period will expire 120 days after the filing of the S-1, falling on 12/26/2019.

Given the low cost basis of insiders, we expect at least some of the 84 million shares issued below $0.50 will be sold once the lockup expires.

We have a possible solution – pop this up on users’ screens…

They already sent a letter to users…

Tyler Durden

Thu, 09/26/2019 – 12:01

via ZeroHedge News https://ift.tt/2lRo9Ot Tyler Durden