Draghi Steamrolled Over Objections From ECB’s Own Policy Committee When Restarting QE

Shortly before the release of minutes from Mario Draghi’s parting meeting, the Financial Times published a leaked report Thursday morning claiming that Mario Draghi moved ahead with plans to relaunch an “open-ended QE” version of the ECB’s APP over the objections of an influential committee inside the central bank, setting the stage for his successor, Christine Lagarde, to confront these divisions as she begins her term at the central bank’s helm.

Though the minutes stipulated that a ‘clear majority’ supported Draghi’s plan, this was one of the rare examples from the president’s five-year term where there was such strident dissent on the central bank’s governing council.

Concern was expressed that not delivering sufficient stimulus, including through the APP, might trigger a reversal of the current favourable financial conditions. By contrast, restarting net purchases would provide a strong signal of the Governing Council’s determination and willingness to act in the light of the current subdued inflation outlook and the potential risk of an unanchoring of inflation expectations.

There was clearly a strong minority that supported a deeper rate cut of 20 bp, as opposed to the 10 bp authorized as part of the central bank’s stimulus, instead of reviving a more limited and size (but unlimited in scope) APP.

A very large majority of members agreed with Mr Lane’s proposal to lower the rate on the deposit facility by 10 basis points to -0.50%, which – together with the reinforced forward guidance – would act on the whole yield curve, especially in the short to medium-term segments, complementing the effects of net asset purchases on the long end of the curve. In this way, the measure would address the high level of short-term uncertainties that currently prevailed and help preserve very favourable financial conditions. While a few members expressed a readiness to consider lowering the rate on the deposit facility by 20 basis points at the current meeting, in particular as part of a package that would exclude net asset purchases, other members felt unable to support a cut of 10 basis points, as they were concerned about the possibility of increasingly adverse side effects from additional rate cuts.

According to the FT, the bank’s monetary policy committee, on which technocrats from the ECB and the 19 eurozone national central banks sit, advised against reviving the APP in a letter sent to Draghi and other members of the governing council in the days before the ECB meeting.

Not least of which because, as dissenters warned during the minutes, an open-ended APP could swiftly shrink the universe of eligible bonds, forcing the central bank to confront the possibility of buying more corporate bonds, or even equities.

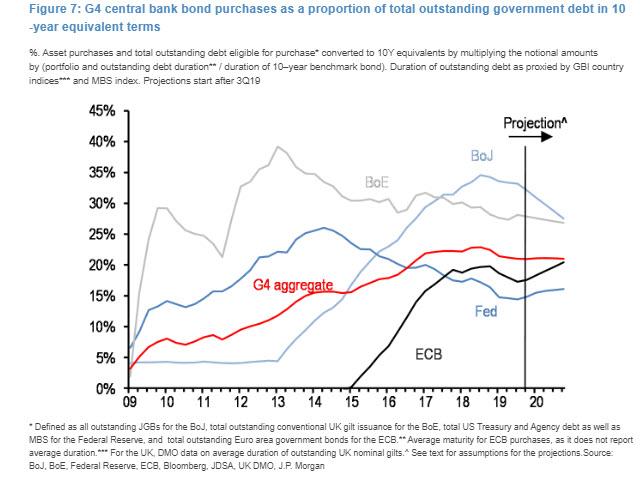

After all, the ECB is already owns a sizable chunk of the extant euro-denominated government debt market (and duration concerns further limit what the central bank can purchase).

As the FT openly admitted, the leak of the letter’s contents is merely the beginning of a battle to pressure Lagarde into changing course.

The leaking of the confidential contents of the committee’s letter comes as opponents to Mr Draghi’s loose monetary policy fight a rearguard action to put pressure on Christine Lagarde for her to change course after she takes over at the ECB on November 1.

This is one of the few occasions where the committee’s advice wasn’t followed during the eight years since Draghi first became ECB president.

It is one of the few occasions that the committee’s advice has not been followed in the eight years since Mr Draghi became president, a council member said. However, the committee’s opinion is not binding and has been ignored at least four times in as many years by the council, which is free to decide otherwise, an ECB official said. The ECB declined to comment.

And its not the only group within the central bank that objected to restarting APP. The heads of the central banks of Germany, France, Slovenia and Estonia, among others, also objected, while the central bank’s legal committee pointed out that the ECB would need to defend itself against accusations that it was breaking bloc rules about directly financing governments via monetization.

Of course, not everybody agreed that the ECB “whistleblowers” – who joined the ranks of former central bankers warning about Draghi’s monetary insanity – were so strident in their criticism. ECB Governing Council member Olli Rehn of the Bank of Finland told BBG that the FT’s report about Draghi ignoring the committee’s advice was “greatly exaggerated.”

With Draghi about to hand the reins to Lagarde, we can’t help but wonder: Will these internal objections make any difference in policy? Or will they be duly noted by Lagarde before she settles in to maintaining the status quo.

Perhaps she can find an alternative allowing her to ‘rebrand’ the APP as ‘not QE’ – just like the Fed has done.

Tyler Durden

Thu, 10/10/2019 – 10:50

via ZeroHedge News https://ift.tt/2VwaauP Tyler Durden