Brexit-Bounce Fades As Short-Interest-Slump Signals Crash Concerns

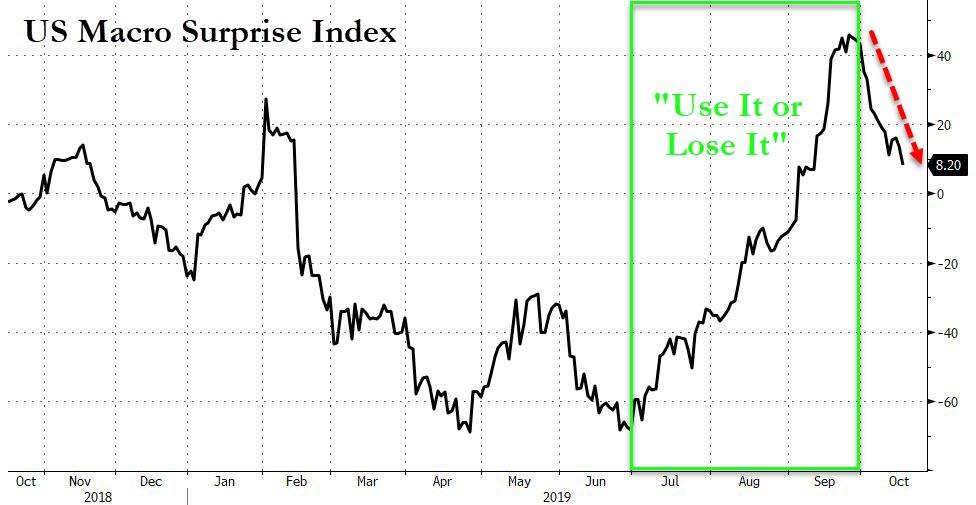

Surprise!! After Q3’s “use it or lose it” spending spree sent US macro data soaring unilaterally, October has begun with a collapse…

Source: Bloomberg

A trade deal (or not)? Brexit deal (or not)? Turkey peace deal (or not)? But retail sales slump, industrial production tumbles, housing starts/permits plunge…

Chinese stocks were flat overnight, with small-cap/tech-heavy ChiNext the biggest loser on the week so far…

Source: Bloomberg

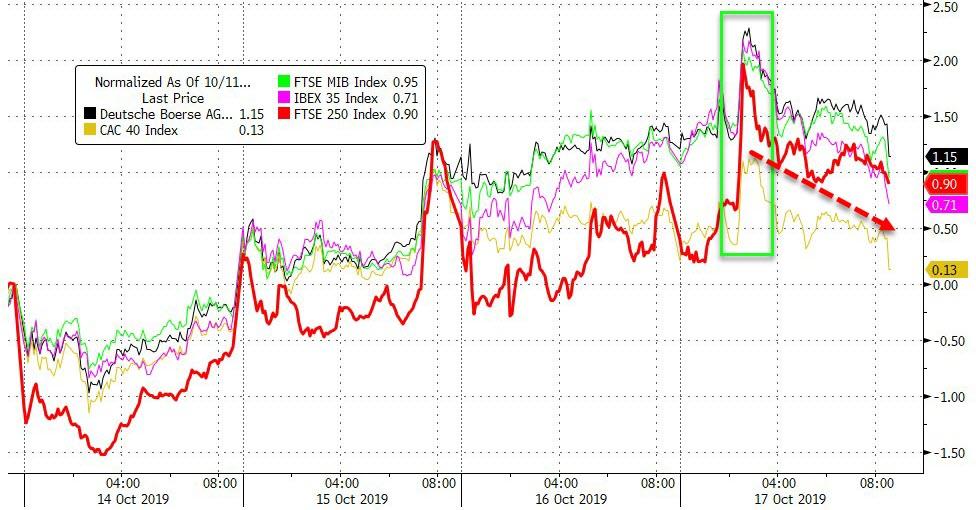

European stocks ended lower, despite a surge on Brexit hopes…

Source: Bloomberg

US equities were mixed with Trannies and Small Caps best (squeezed) while S&P, Dow, and Nasdaq were all scrambling to hold gains…

Once again S&P 500 algos were focused on the 3,000 level…

Chaos in NFLX stock price…

SDC shareholders aren’t smiling now…

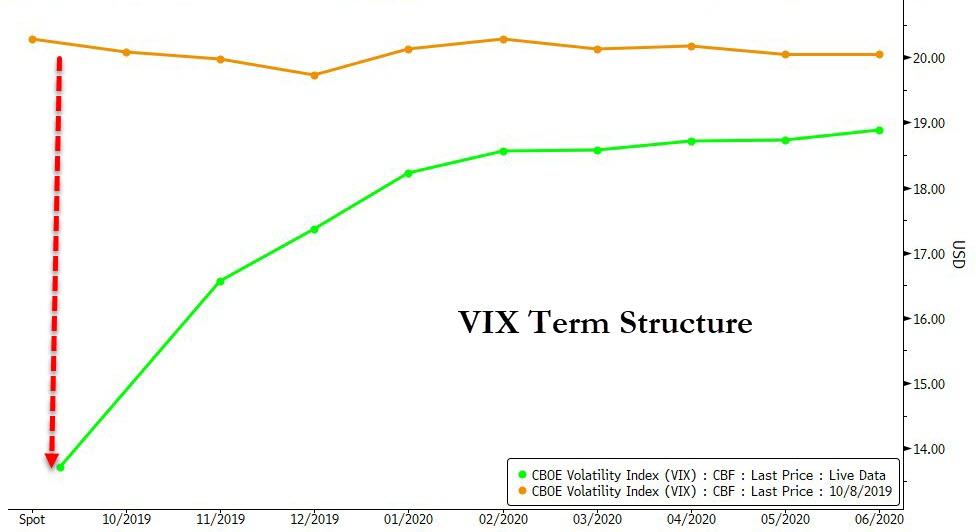

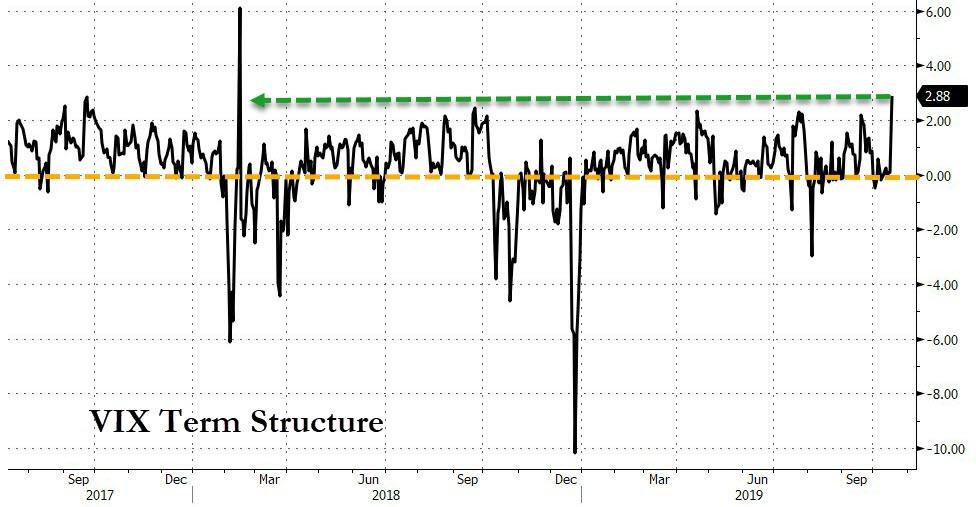

The VIX term structure has steepened dramatically in the last week…

Source: Bloomberg

Now at its steepest since Feb 2018…

Source: Bloomberg

Treasury yields were uniformly higher by around 1bps on the day…

Source: Bloomberg

But there was some vol intraday…

Source: Bloomberg

Despite a lot of jawboning (and stocks within 1% of record highs), the market is still demanding a rate-cut in October…

Source: Bloomberg

The Dollar tumbled for the 3rd straight day (down 6 of last 7 days)…

Source: Bloomberg

Almost entirely erasing the year-to-date gains…

Source: Bloomberg

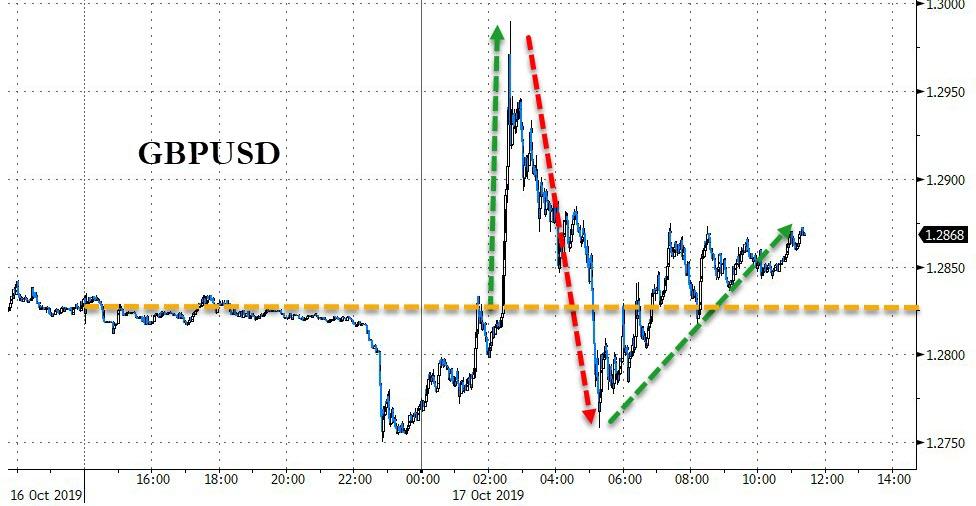

Cable chopped around all day on various Brexit headlines but ended higher…

Source: Bloomberg

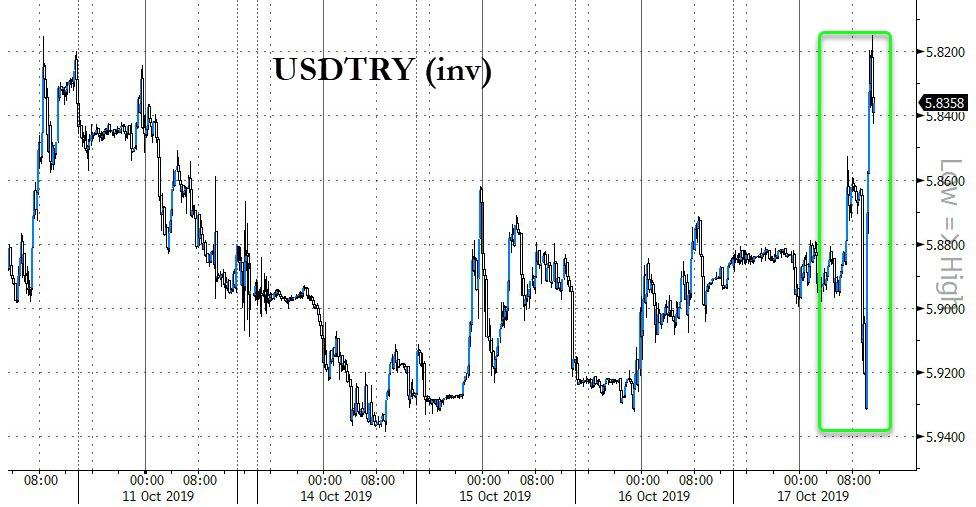

The Turkish Lira was insanely volatile (stops run both ways) as Pence-Erdogan spoke and agreed a ceasefire…

Source: Bloomberg

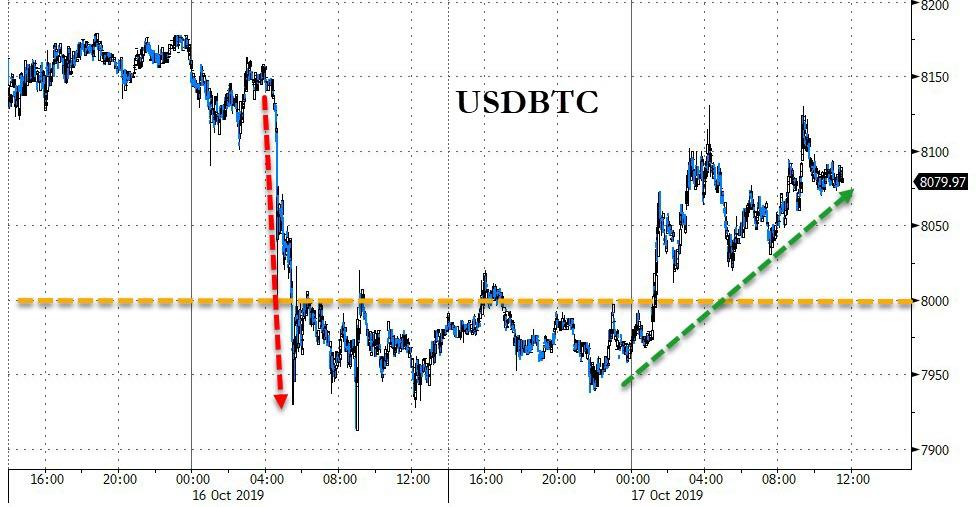

Cryptos were higher on the day, spiking early in European session…

Source: Bloomberg

Bitcoin rallied back above $8,000…

Source: Bloomberg

Dollar weakness supported commodities across the board with Silver and Crude best on the day (but only PMs are higher on the week)…

Source: Bloomberg

Despite a huge crude build and record production, the algos decided it was time to panic-bid WTI up to a $54 handle…

Gold futures tagged $1500 but were unable to hold it…

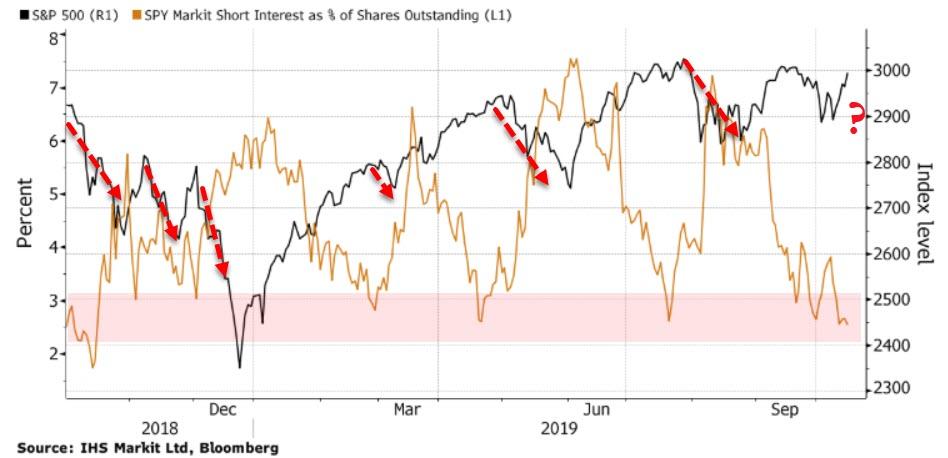

And finally, the most recent surge in stocks since the start of October has been a major short-squeeze…

Source: Bloomberg

Which has plummeted overall short-interest to a critical level that has, in the past, led to crashes in stocks…

Source: Bloomberg

Tyler Durden

Thu, 10/17/2019 – 16:00

via ZeroHedge News https://ift.tt/31uUKZa Tyler Durden