‘Soft’ Survey Data Signals S&P 500 Is Past Its Peak

The S&P 500 is well past its peak for 2019, warns Bloomberg’s Richard Jones, as the lack of any material progress on trade talks with China collides with nascent signs of a deteriorating U.S. economic backdrop.

Although the S&P 500 has rallied about 19% year-to-date, it has been unable to sustainably crack 3,000 and the highs of early September. A pullback to August’s lows by year-end in the S&P 500 is conceivable.

Last week’s U.S.-China negotiations produced few tangible benefits. Neither side signed anything, and China has demanded further talksand the rollback of existing tariffs, before moving forward.

Moreover, China has also threatened to retaliate if Congress enacts legislation supporting Hong Kong protesters. This is not the kind of mood music that will lead to a trade breakthrough.

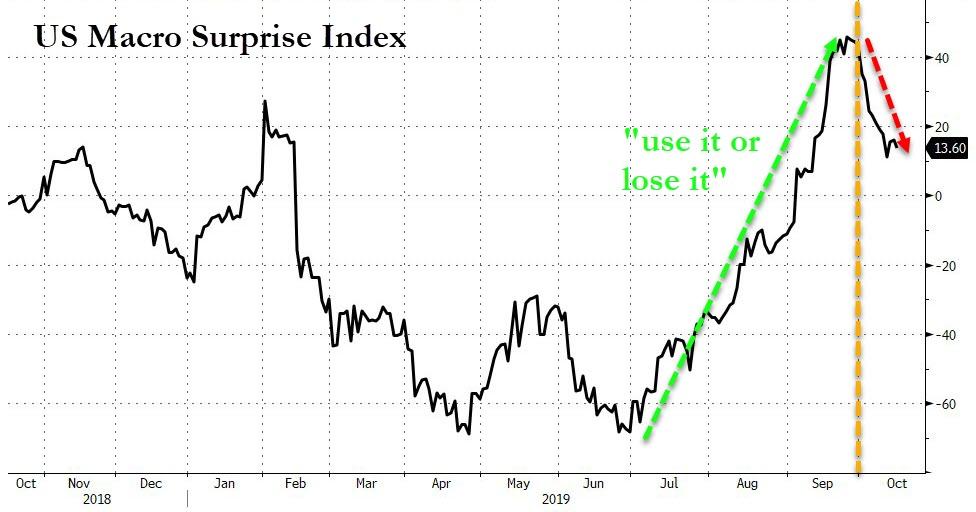

What’s different now is the effects of the trade war are starting to creep into the U.S. macro picture — and optimism over a deal may not be able to offset economic headwinds.

Until very recently, the U.S. economy had been able to shrug off the marked downturn seen in Europe. But the deterioration in U.S. ISM and PMI survey data earlier this month showed the U.S. will not be immune to the trade pressures that has put Germany on the edge of recession.

Source: Bloomberg

It’s not only survey data that is coming in softer. Weaker-than-expected September average hourly earnings and retail sales, with the latter declining for the first time since February, show the hard data is starting to suffer too.

Source: Bloomberg

Unless and until there is a substantial resolution to global trade issues, the nascent deterioration of U.S. economic data will gather steam and weigh on equities.

Any trade woes seen in 3Q U.S. earnings season may also weigh on the S&P 500. Last month FedEx cut its profit outlook, partly blaming trade and the economy.

Source: Bloomberg

To be sure, the Fed and other central banks will almost certainly enact further easing in coming months to combat this economic weakness. But rates are so low that central banks have less room to act and cushion equities.

The S&P 500 has topped out for the year, as bad economic news will also be bad news for equities, sending them to mulch-month lows by the end of 2019.

Tyler Durden

Thu, 10/17/2019 – 09:35

via ZeroHedge News https://ift.tt/32qJsGC Tyler Durden