Tesla Explodes Higher As Company Reports Blowout EPS, Even As CapEx Shrinks Again

Three months ago, the main question for Tesla’s second quarter results was whether the electric-car maker was on a stable path to finally turn profitable. The answer, at the time, was not as Tesla not only missed on the top and bottom line, but the company slashed its capex outlook, suggesting that its vision for the growthy future has become far more cloudy. It also sent the company’s stock tumbling.

Fast forward to today, when looking at Tesla’s Q3 earnings the question for investors will again be more or less the same: will Tesla finally be able to turn a profit in a quarter in which Tesla delivered a record number of vehicles (yet coming light of expectations) with focus increasingly shifting to whether the company can sell cars profitably.

Tesla’s margins have come under pressure in recent quarters, as the carmaker has been selling more lower priced, lower margin Model 3 sedans compared with the older Model S and Model X. A further squeeze could also come from rising battery prices, according to Roth Capital Partners analyst Craig Irwin. As a result, the average analyst estimate for Q3 gross margin had fallen sharply after the second quarter, and is down 27% over the past year.

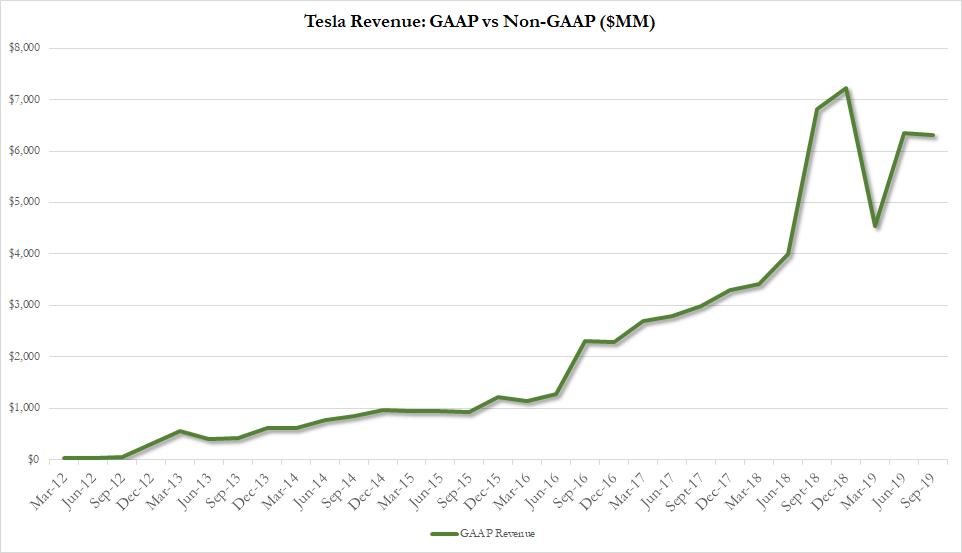

Separately, revenue estimates suggest the company’s top line will fall compared with last year, the first such drop for Tesla since 2012 when the Model S started production.

Another key metric will be cash flow with analysts expecting free cash flow to drop to $35.9 million for the period, which according to Bloomberg Intelligence is “The single most important number to track… Paying the bills, supporting global expansion and servicing the debt are the bottom line necessities. Almost all of the other metrics are just noise.”

Also under the microscope will be Tesla’s guidance – Musk has said he expects to deliver 360,000 to 400,000 vehicles in 2019, although many analysts believe it will be tough for the company to reach these numbers.

* * *

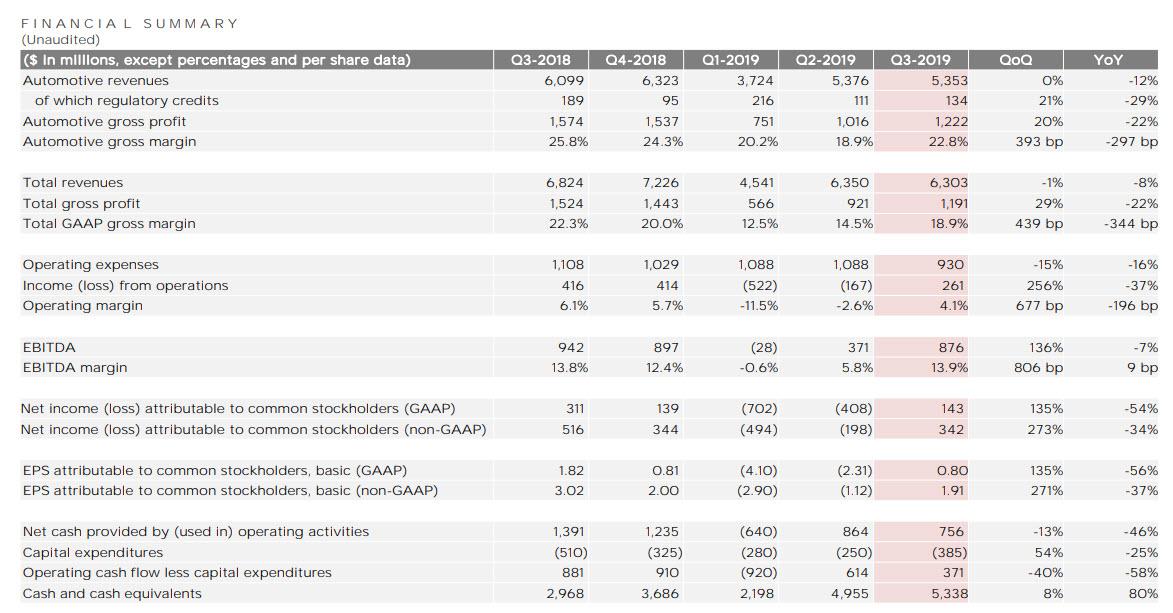

So with all that in mind, here are the main numbers that Tesla reported for the third quarter, bizarrely in a totally different format to Elon Musk’s previous investor letter:

- Revenue as expected, was a disappointment, at $6.30BN, far below the estimate of $6.45 billion

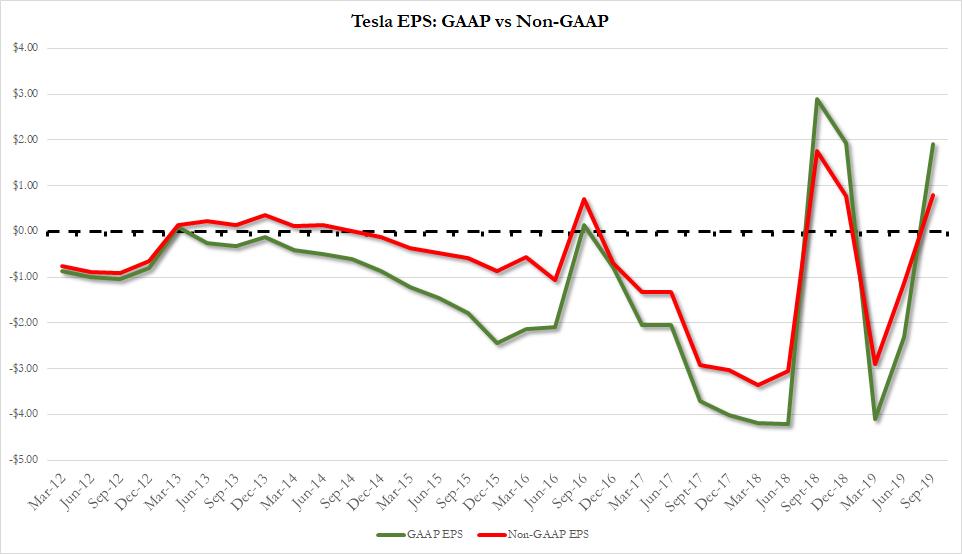

- But it was EPS that blew investors away, as Tesla reported a mindblowing EPS of $1.91, orders of magnitude above the 24c estimate. Non-GAAP EPS was even higher, at

- Free cash flow was $342MM, also far above the estimate of $35.9 million

- Automotive gross margin was 22.8%, below the estimate of 25.0%

- However, capital expenditures was just $385 million, once again far below the estimate of $561.9 milliond

The company’s new reporting format at least makes following the numbers somewhat easier:

And visually, revenues:

And EPS:

While analysts are scratching their heads to figure out just how Musk padded results this quarter, the stock is exploding higher in a furious short squeeze, trading up 17% to just shy of $300, the highest since April.

Bizarrely, while Elon Musk didn’t sign the actual quarterly letter – a first – he did Tweet his own summary of the company’s results.

Tesla Q3 results:

– Shanghai Giga ahead of schedule

– Model Y ahead of schedule

– Solar installs +48% from Q2

– GAAP profitable

– Positive free cash flow— Elon Musk (@elonmusk) October 23, 2019

Developing

Tyler Durden

Wed, 10/23/2019 – 17:10

via ZeroHedge News https://ift.tt/2MGr3QB Tyler Durden