China’s Credit Creation Unexpectedly Collapses At The Worst Possible Time

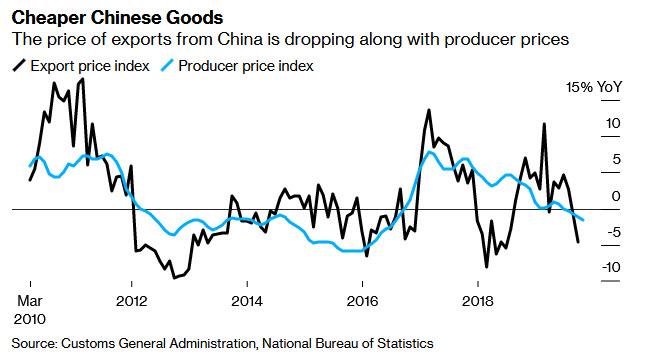

Over the weekend, we observed that China’s slumping wholesale inflation, or PPI, which is so critical for corporate profits and sparking benign, demand-driven inflation in the economy, and which in October tumbled to a three year low assuring that Chinese dumping and exports of deflation will only further depress global reflation efforts…

… will not reverse until Beijing injects another elephant-dose of credit into the Chinese financial system.

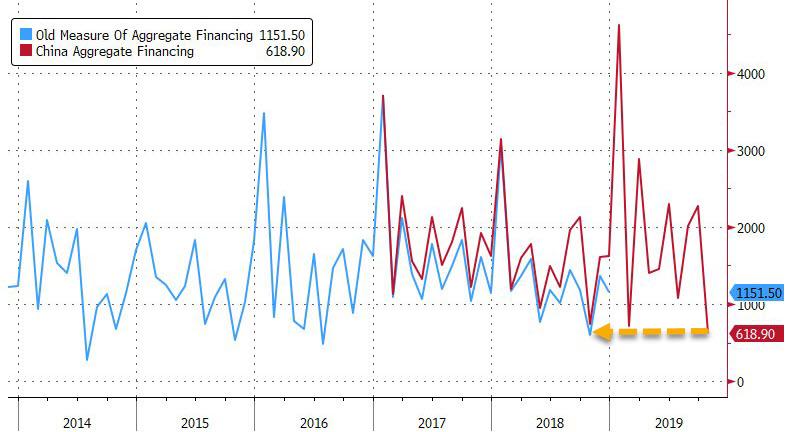

Just 48 hours later we can confirm that there is zero risk of either a sharp spike in Chinese inflation, or of China flooding the financial system with cheap credit – as it has been known to do during key economic inflection points – because according to the PBOC, China’s credit growth slowed far more than expected in October to the weakest pace since at least 2017 as a continued collapse in shadow banking, weak corporate demand for credit and seasonal effects all signaled that efforts to prop up the economy through bank lending still aren’t working.

The central bank reported that Aggregate Financing, China’s revised version of the old Total Social Financing, was a paltry 618.9 billion yuan ($88 billion), missing the median conservative estimate of 950 billion yuan, and down a whopping 72% from the 2.27 trillion yuan in September and 737.4 billion yuan in the same month of 2018. Today’s print was the lowest in the revised series history which goes back to the start of 2017, and only a slightly lower print in the old series prevents today’s total credit injection from being the lowest since 2016!

New CNY loans of 661.3 billion yuan also missed the consensus print of 800 billion yuan, resulting in outstanding CNY loan growth of 11.9% annualized in October, well below the September 13.3% annualized print. As has been the case recently, two thirds of yuan-denominated bank loans were borrowed by households in the month, while the borrowing by non-financial companies was the least in amount since August 2016.

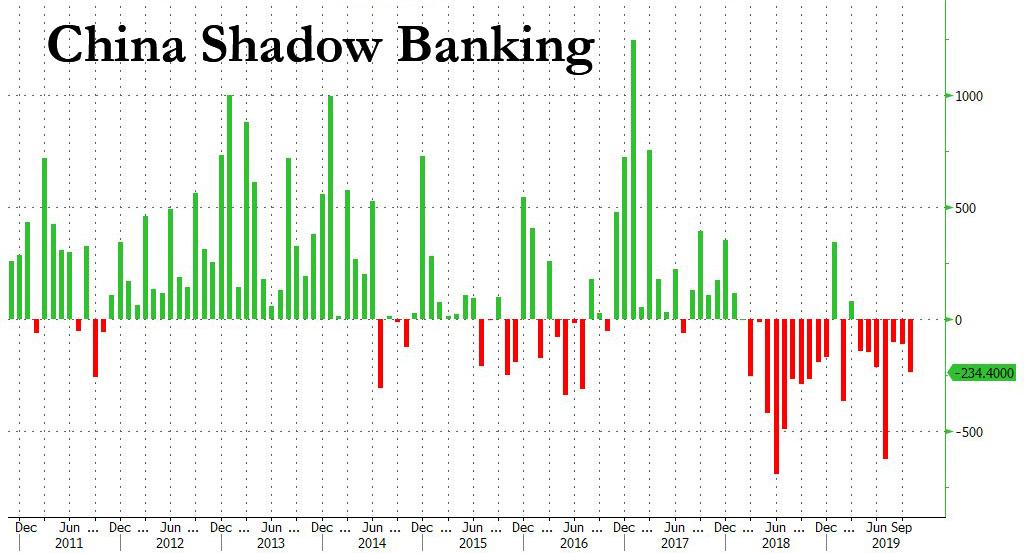

But it was China’s shadow banking that was the main culprit for today’s steep total credit drop, which tumbled by 234 billion in October, the second biggest one month drop of the year, and the 7th drop in a row as well 18th of the past 20! Specifically, entrusted loans fell by 66.7 billion yuan, trust loans declined 62.4 billion yuan and undiscounted bankers acceptances fell 105.3 billion yuan.

While bank lending traditionally falls in October compared to the previous month as the week-long National Day holiday affects business activity, the continued collapse in shadow banking as well as the completion of local government special-purpose debt sales has magnified the downward trend, resulting in a far lower credit impulse to the economy than China so desperately needs.

Separately, China’s all important M2 rose 8.4% yoy in October, in line with expectations, and just shy of the all time low print.

“The data itself is kind of expected in terms of the trend,” Commerzbank analyst Zhou Hao said, nothing however that the market is concerned about two things – that it hit another record low (for the current series) and that this means that banks seem to have no place to funnel money after lending to smaller and private firms earlier waned. The deflationary omen also pushed China’s 10 year government bond yield lower by 5 basis points to 3.22%.

Others, paradoxically, saw in the data which confirms that the PBOC is unable to dramatically expand credit a sign that the PBOC would instead seek to ease further, even though as we noted over the weekend, soaring Chinese pork prices make that very unlikely: “The anemic credit data — coming on the heels of data showing deepening deflation in the industrial sector — reinforce our expectations that the PBOC will continue to ease monetary policy” said Bloomberg economists Chang Shu and David Qu.

Meanwhile, as Goldman notes, despite the targeted RRR cut on October 15, the 7-day repo rate remained relatively high at 2.8% in October. As such, the major tool of loosening is more likely to be administrative measures (i.e. window guidance) to boost broad credit growth. The administrative pressures which can affect both the supply of and demand for credit likely came down in October after the government tried successfully to boost September credit and activity data.

Adding insult to injury, and limiting the central bank’s ability to ease more, the latest high frequency data indicate November CPI data may reach an even higher level on a year-on-year basis. But the weak TSF and expected weaker activity growth data will likely put policy makers under more pressures to keep policy stance loose. As a result, Goldman expects frontloading of government bond quota next year to this year though the size of the issuance may be relatively limited because of

- concerns about inflation,

- policy prudence to ensure the investment projects are economically sensible, and

- better prospects of the US-China trade negotiations.

For now however, expect more disappointment, with Wall Street and Beijing all bracing for a the first sub 6% GDP, (5.9% to be specific) print on record as early as 4Q.

Tyler Durden

Mon, 11/11/2019 – 09:18

via ZeroHedge News https://ift.tt/2CzZ13q Tyler Durden