Morgan Stanley Capitulates: Upgrades Global Stocks To Neutral, No Longer Sees A Recession In 2020

Just over 4 months ago, on July 8, Morgan Stanley took a defiant position against the bullish consensus, and in a note penned by the bank’s chief cross-asset strategist, Andrew Sheets, he said that “we’re putting our money where our mouth is” and downgraded “both equities and credit” to underweight while going equal-weight government bonds and overweight cash.

Specifically, the bank said that in light of concerns that “bad data should be feared rather than cheered because it will bring more central bank easing” (it most certainly did, and just three months later the Fed launched QE4), and that “the market is too optimistic on 2019 earnings and is underestimating the pressure from inventories, labour costs and trade uncertainty” (here too the bank was right because Q3 earnings season is now effectively over with S&P EPS down more than 2% and Q4 EPS are also projected to also drop as an earnings recession accelerated), the “time has come to put our money where our mouth is. In light of these concerns and others, we are downgrading our allocation to global equities from equal-weight to underweight.”

The most straightforward reason for this shift is simple – we project poor returns: Over the next 12 months, there is now just 1% average upside to Morgan Stanley’s price targets for the S&P 500, MSCI Europe, MSCI EM and Topix Japan (including dividends and equally weighted). If we ignore those targets and estimate returns for those same regions based on current valuations, adjusting for whether returns tend to be better or worse given current economic data, the upside is very similar (3%).

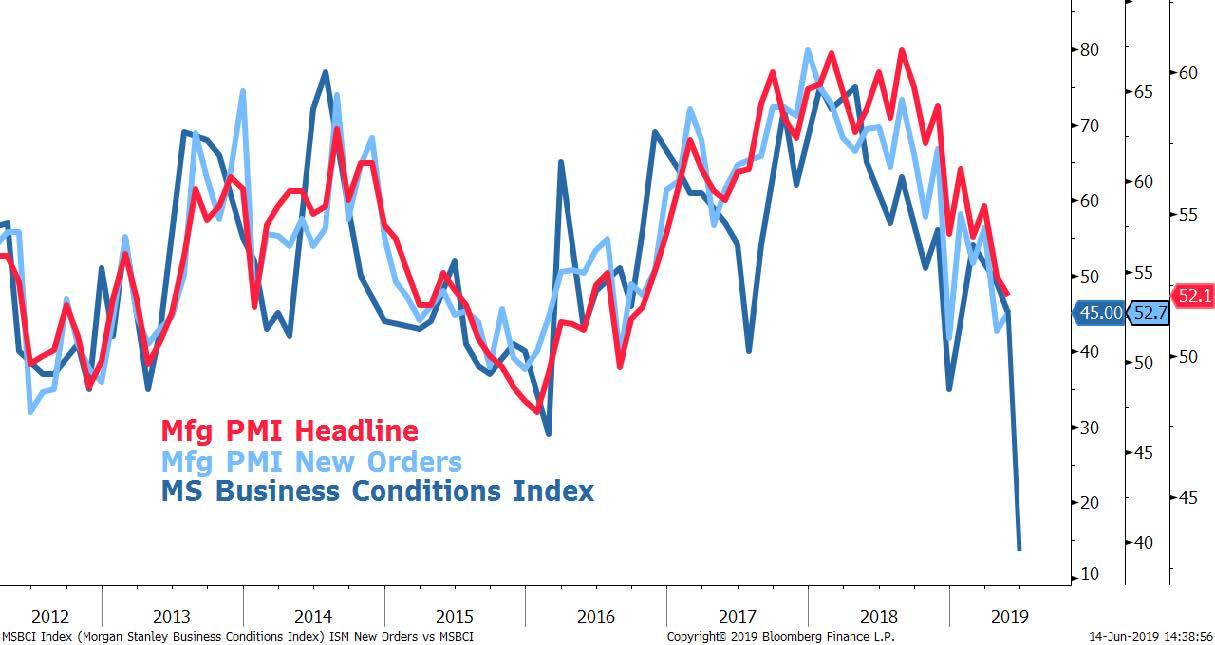

Morgan Stanley also underscored its bearish case by pointing out that its Business Conditions Index had just tumbled to the lowest level on record.

Putting it all together, Morgan Stanley then concluded that “there comes a point for every analyst where you need to change your forecast or change your view. We’re doing the latter.“

It did… but not for long, because after fielding countless angry client calls with the S&P now above 3,100, and the Dow and Nasdaq also at all time highs, all the while advising said clients not to chase the rally, earlier today Andrew Sheets finally capitulated and said that just a few months after downgrading global stocks to a sell, Morgan Stanley has once again turned “neutral” on stocks. In other words, Morgan Stanley finds itself upgrading its view on risk assets just as the market hits all time highs.

And that’s how you “change your forecast” after “changing your view” failed to work in a time when activist central banks simply refuse to even consider a modest drop in risk prices.

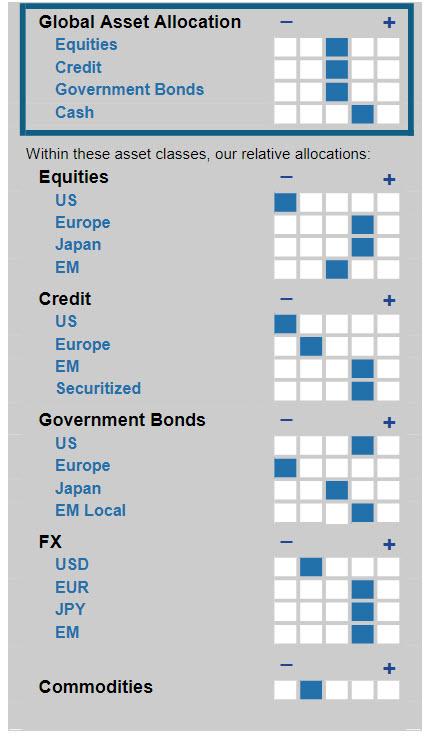

That said, Morgan Stanley still retains its bearish positioning on the US, and as the following summary of the bank’s relative allocations show, when it comes to equities and credit, MS is still quite pessimistic for a positive outcome for US risk assets.

Below is the full note from Andrew Sheets, titled “Sequencing the Cycle” in which he explains why he and his peers capitulated to their former global bearish bias, although it remains unclear if their US-focused equity strategy colleague, Michael Wilson, will be explaining to gloating CNBC hosts why he was wrong sticking bearish on the S&P500 for most of 2019, as at least for now, the bank is certainly not optimistic on US stocks.

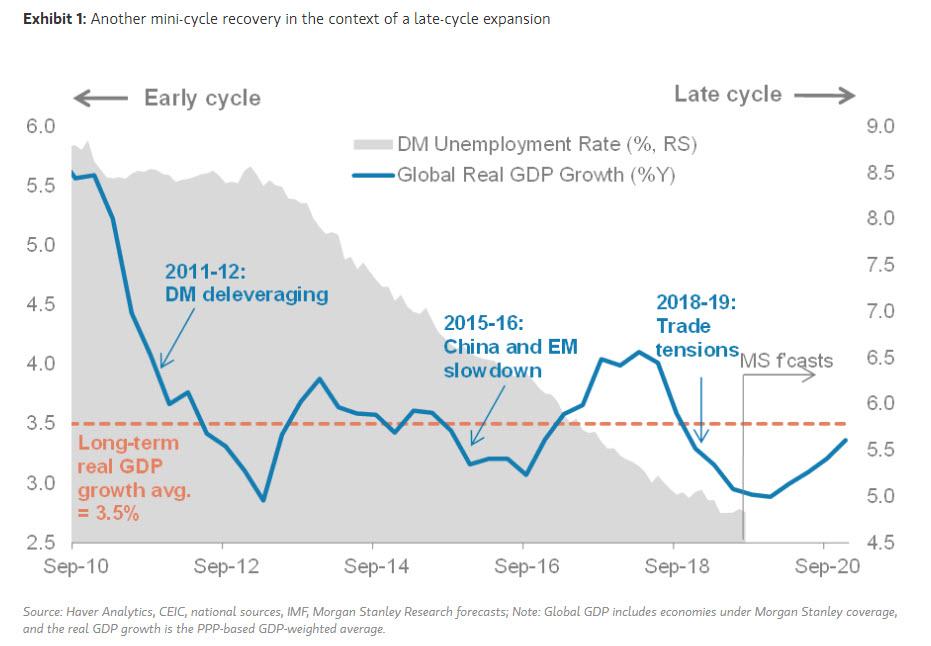

2019 saw global growth weaken substantially, but very strong markets. 2020, we think, will see better growth but muted headline returns. After almost 18 months of decelerating global economic activity, Morgan Stanley’s global economics team expects growth to bottom in 1Q20 and improve thereafter. Recent easing by central banks is supporting this recovery, but importantly, we don’t expect any further action by the Fed, ECB or BoJ beyond programmes already in place. In 2020, we’re on our own.

The improvement will be modest compared with past recoveries, and will be a mini-cycle recovery in the context of a late-cycle expansion, but it means that a recession next year would be avoided. Importantly, this recovery will also be uneven, with the greatest acceleration in corners of emerging markets against flat-lining growth in the US.

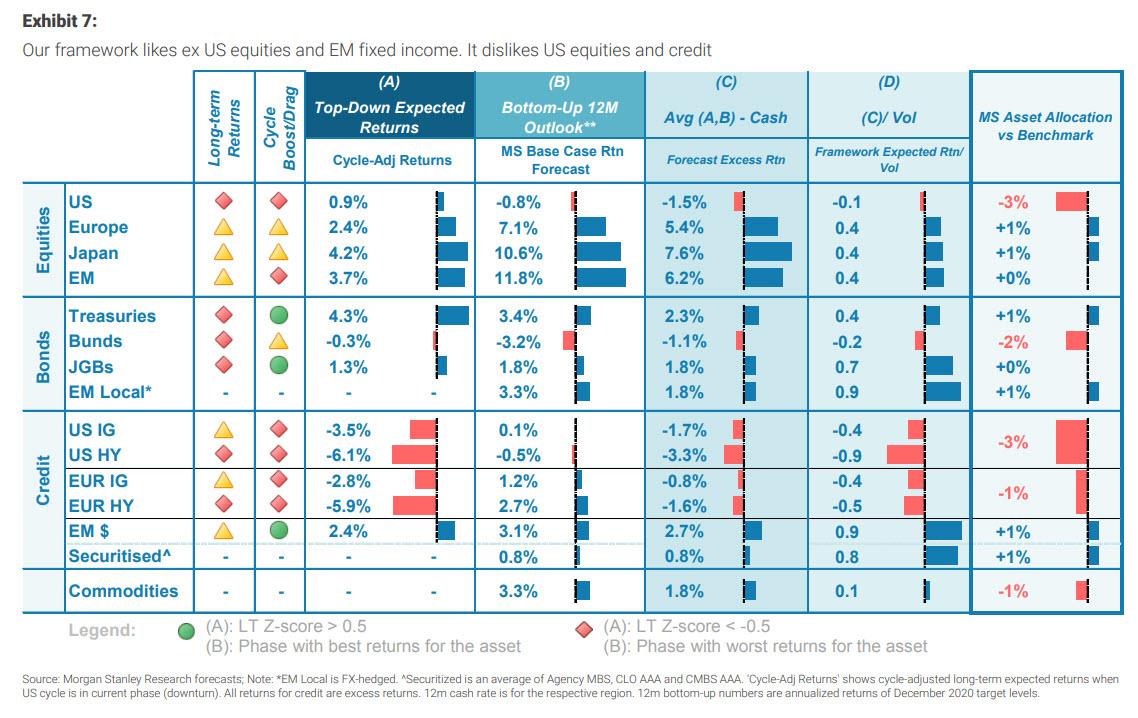

For markets, the benefits of better growth need to be balanced by what’s already priced in. Relative to past mid-cycle slowdowns, for example, US equity markets are significantly more expensive, US credit spreads are tighter and volatility is lower. In contrast, global equity valuations are in line with their average during past inflections of mid-cycle growth.

These valuations are one reason why we’re entering 2020 neutral on equities overall, given forecasts that call for mid-single-digit upside in global stocks. But our preference for non-US over US equities is greater than before, with our net ex-US versus US equity weight moving from +2% to +5%.

With this shift, we’re closing the underweight we’ve held on global equities since early July. At that time, we thought weaker growth would pressure valuations. Instead, despite a continued slowdown, the MSCI ACWI Global Equity Index has gained about 3%. With our economists now calling for a better outlook, we think it makes sense to bring our overall weight closer to neutral.

But another important theme is that varied market valuations overlap with the varied recovery that our economists expect. Growth should pick up in 2020, but unevenly. Getting the sequence right will be important.

First to recover, in our view, will be economies that saw the steepest declines in 2019 and were dampened by the slowdown in trade. Any stabilisation in trade will make a big difference here, while weaker current conditions will make incremental improvement easier to achieve.

This applies to both growth and earnings. To cite one example of the divergence we expect, we think that companies in Korea and Brazil could look early-cycle next year, with earnings growth north of 15%. US companies, in contrast, will see little or no earnings growth in 2020, on our estimates.

We think that sequencing the cycle should boost EM currencies and weaken USD. We think it will keep US yields range-bound near 2% while yields in the UK and Germany rise. We expect it to lift US high yield spreads modestly while spreads in Europe remain range-bound, as EM fixed income outperforms corporate credit. And in commodities, we don’t think the pick-up in growth will be enough to overcome the excess supply we see across a whole host of markets. We like copper, one pocket where we think supply is tight, while we’re more cautious on oil and other metals.

What are we watching? An unusual aspect of our 2020 story is its sensitivity to a single factor – trade. Our economic forecasts assume no further escalation in US-China tariffs. This is obviously an uncertain, evolving situation, and events could change in the hours between when I finish this note and it hits your inbox. An escalation in trade tensions would push out the 1Q20 growth recovery that our economists forecast and re-introduce the risk of non-linearity kicking in. Markets could face immediate pressure, given how high we believe expectations have risen that progress is imminent.

Tyler Durden

Sun, 11/17/2019 – 14:00

via ZeroHedge News https://ift.tt/2pv53iS Tyler Durden