S&P Futures Soar Above 3,100 On Trade Deal Optimism

After several days without soothing trade deal commentary by Trump et al, US-China trade deal “optimism” stormed back on Thursday evening after upbeat trade deal comments from Trump’s top economic advisor Larry Kudlow sent US equity futures, European bourses and Asian markets higher, even as the escalating wave of global protests from Hong Kong to Chile hints that it will all end in tears and guillotines.

US equity futures rose to a new all time high above 3,100, with E-mini S&P and Nasdaq futures rising +0.3% and +0.4%, respectively..

… while Europe’s main bourses followed Asia and Wall Street higher after White House economic advisor Larry Kudlow said on Thursday that the U.S. and China were getting close to an agreement and were talking every day.

“We’re getting close,” he told an event at the Council on Foreign Relations in Washington. “The mood music is pretty good, and that has not always been so in these things.” This sentiment was echoed by Commerce secretary Wilbur Ross on Friday morning who told Fox Business that the trade deal will be done in “all likelihood.”

The comments kept alive hopes that MSCI’s 49-country world index and Europe’s STOXX 600 could both avoid their first weekly falls since the start of October, but others had little chance. Europe’s Stoxx 600 Index fluctuated as the prospect of a money laundering scandal widening weighed on bank shares; the index was up as much as 0.6% before dipping into negative territory in late morning trading only to erase the drop of as much as 0.2% to trade little changed with tech shares, miners and chemical companies the best performers, while personal-and-household goods shares and banks were the worst.

Earlier in the session, Asian stocks advanced led by technology firms, as optimism grew for Beijing and Washington to close an initial trade deal. Most markets in the region were up, with South Korea and Australia leading gains. The Topix climbed 0.7%, recovering from its biggest two-day decline in six weeks, as electronic companies offered strong support. However, the Shanghai Composite Index fell 0.6%, a fresh three month low, dragged down by PetroChina and Jiangsu Hengrui Medicine. Chinese blue-chip shares ended the day down 0.75% and 2.4%, their biggest fall since August. Hong Kong’s Hang Seng Index closed little changed to cap its worst week since early August, down 4.7%, as protesters continued to block roads in the city. India’s Sensex rose, heading for a third week of gains, amid hopes that borrowing costs will drop further.

Shane Oliver, chief economist at AMP Capital in Sydney, likened regional markets’ bullish reaction to positive trade news to being in a relationship with an alcoholic, driven by entrenched hopes for recovery.

“Markets want to believe that there will be some sort of resolution to this issue, some sort of lasting truce at least, even though the experience of the last 18 months doesn’t give a lot of cause for comfort,” he said. However, Oliver said weaker Chinese and U.S. economies as well as the U.S. presidential election next year put pressure on both sides to come to an agreement

In rates, higher U.S. Treasury yields also illustrated the risk-on tone in the Asian session, with the 10-year yield rising to 1.848% from a US close of 1.815% on Thursday. The two-year yield rose to 1.6101% from 1.593% on Thursday after U.S. Federal Reserve Chair Jerome Powell said the risk of the U.S. economy facing a dramatic bust is remote. Borrowing costs also inched up in Germany and France on Friday, but were set for sizeable weekly declines, in contrast to southern European countries that have come under heavy selling pressure again this week. Germany’s 10-year Bund yield was at -0.33% off more than one-week lows hit on Thursday. But it is down 8 bps on the week, set for the biggest weekly fall since mid-August. Dutch 10-year bond yields are down 7 bps this week, and French yields are 5 bps lower,.

Data on Thursday had showed Germany’s economy grew just 0.1% in the third quarter, with consumer spending helping the country to avoid a mild contraction and a technical recession of two quarters of economic shrinkage. “In general, there has been risk aversion in recent days and a shift to core bond markets from the periphery,” said Daniel Lenz, a rates strategist at DZ Bank.

In geopolitics, North Korea government reportedly warned South Korea of a last chance to remove their facilities before they demolish joint resort buildings near the border. Elsewhere, Turkish Vice President says Faith Drilling Ship has commenced operations off the coast of Northern Cyprus.

In commodity markets, crude prices rebounded after sliding Thursday on rising U.S. crude inventories. WTI crude was 0.44% higher at $57.02 a barrel, while Brent crude added 0.37% to $62.51 per barrel. Gold retreated from gains that had been prompted by trade uncertainty. Spot gold was last trading at $1,463.90 per ounce, down 0.48%.

In FX, the safe-haven yen weakened, with the dollar rising 0.17% to buy 108.57 yen; the USD/JPY gained for the first time in six days, advancing on demand from fast money accounts after Kudlow’s comments. The euro was barely changed at $1.1023 while exporters bought the Australian and New Zealand dollars following Kudlow’s remarks. The dollar index, which tracks the greenback against a basket of six major rivals was off just 0.02% at 98.143. Fierce anti-government protests in Chile gave its currency its worst week since 2011 with a 7% plunge.

Expected data include retail sales and industrial production. J.C. Penney is set to report results

Market Snapshot

- S&P 500 futures up 0.3% to 3,106.00

- STOXX Europe 600 up 0.4% to 405.98

- MXAP up 0.5% to 164.30

- MXAPJ up 0.5% to 524.48

- Nikkei up 0.7% to 23,303.32

- Topix up 0.7% to 1,696.67

- Hang Seng Index up 0.01% to 26,326.66

- Shanghai Composite down 0.6% to 2,891.34

- Sensex up 0.3% to 40,424.28

- Australia S&P/ASX 200 up 0.9% to 6,793.72

- Kospi up 1.1% to 2,162.18

- German 10Y yield rose 1.1 bps to -0.34%

- Euro down 0.05% to $1.1016

- Italian 10Y yield rose 7.9 bps to 0.977%

- Spanish 10Y yield fell 0.5 bps to 0.452%

- Brent futures down 0.8% to $61.77/bbl

- Gold spot down 0.5% to $1,464.02

- U.S. Dollar Index little changed at 98.20

Top Overnight News from Bloomberg

- White House economic adviser Larry Kudlow said negotiations over the first phase of a trade agreement with China were coming down to the final stages, with the two sides in close contact

- Germany will maintain its disciplined approach to spending as lawmakers look set to confirm the government’s balanced budget for 2020, despite calls for fiscal stimulus to boost the country’s slowing economy

- Global oil markets are likely to remain “calm” next year as soaring production outside OPEC and high inventories keep consumers comfortably supplied, the International Energy Agency said

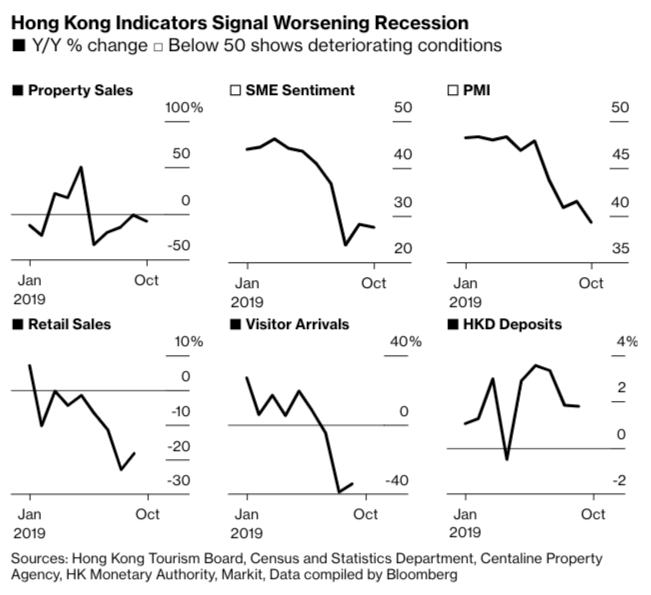

- Hong Kong revised down its estimate for economic growth this year as political unrest grips the city, with the government now forecasting the first annual contraction since the global financial crisis a decade ago

- China lifted its four-year-old ban on U.S. poultry shipments, a small sign of trade-deal progress at a time when agriculture purchases have become a sticking point in negotiations

- Chinese President Xi Jinping called an end to violence Hong Kong’s “most urgent task,” as a scuffle involving the city’s justice minister and the second protest-related death in a week heightened tensions in the paralyzed financial center

- Boris Johnson made a pitch for votes in “overlooked” towns with a promise to revive high streets through tax breaks for local businesses and reopening provincial railway lines, while the main opposition Labour Party pledged to roll out free full-fiber broadband for all with a plan that includes nationalization of BT Group Plc’s Openreach unit

- Federal Reserve Chairman Jerome Powell says short-term interest rates are back under control. Not everyone’s convinced with evidence traders expect pressure to build in the weeks ahead

- Reserve Bank of New Zealand Assistant Governor Christian Hawkesby said February is a “live” interest-rate decision but there would need to be a material change in the economic outlook to warrant a rate cut

Asia equity markets traded mostly higher as sentiment remained at the whim of the temperamental trade rhetoric with risk appetite spurred after White House Economic Adviser Kudlow suggested they are getting close to an agreement and the sides were on the short strokes of a phase 1 deal, and although Kudlow noted US President Trump was not yet ready to sign off, his comments were at a sharp contrast to prior reports the trade teams were struggling to complete a deal. ASX 200 (+0.9%) and Nikkei 225 (+0.7%) are positive with Australia underpinned by the recent increase in rate cut bets after chances for a cut next month more than doubled to 29% according to ASX 30-Day Interbank Cash Rate Futures and with its implied yield curve heavily leaning towards a cut at the subsequent meeting in February, while a deluge of earnings has been a key driver in Japan alongside tailwinds from a weaker currency. Hang Seng (U/C) and Shanghai Comp. (-0.6%) were mixed as Hong Kong attempted some composure from this week’s protest-triggered declines, although the mainland was somewhat unconvinced by the conflicting trade headlines, as well as the PBoC’s tepid actions in which it skipped reverse repos and instead opted for its medium-term lending facility, albeit at half the amount of the prior operation. Finally, 10yr JGBs were choppy as they initially extended above the 153.00 level although prices then reversed from intraday highs amid the positive risk tone and after a relatively light BoJ Rinban operation for just JPY 130bln in longer-dated JGBs.

Top Asian News

- Hong Kong Poll Shows 80% Supports Setting Up Independent Inquiry

- IHH’s Fortis Takeover Halted After Contempt of Court Ruling

- Arcelor Wins Approval to Complete $5.8 Billion Essar Deal

Major European Bourses (Euro Stoxx 50 +0.5%) are modestly in the green, albeit off highs amid tailwinds from encouraging US/China trade comments from White House Economic Advisor Kudlow overnight, albeit upside may be capped by earlier FT reports that China’s stance is jeopardising chances of a final Phase One agreement being reached in the coming days. DAX Dec’ 19 futures for now sit well within this week’s range, appearing bound by 13140-13300 parameters for now. The sector performance table is reflective of the markets tentative risk-on tone; Materials (+0.6%) and Tech (+0.6%) lead the way, while Utilities (+0.1%) and Consumer Staples (-0.2%) lag. Energy (-0.2%) is lower and weighed by lower crude prices. In terms of stock specific news; Whitbread (+2.9%) is the top Stoxx 600 gainer, buoyed by an upgrade to overweight from equalweight at Barclays. Closely behind is Subsea 7 (+4.0%), higher on the news of a potential merger agreement with Saipem (+1.3%). Elsewhere, Orange (+2.1%) is on the front foot on reports that the Co. intend to split its mobile towers into a separate company to capitalise on investor interest, boosting its valuation by up to EUR 10bln. ArcelorMittal (+1.4%), meanwhile, is firmer on the news that is has secured approval from the highest Indian court regarding the completion of the Essar Steel takeover for USD 5.8bln. In terms of the laggards; Elekta (-13.2%) sunk after a downgrade at SEB Enskilda. Similarly, Uniper (-1.6%) was pressured by a downgrade at SocGen. BT (-2.4%), meanwhile, managed to pare the worst of early losses, triggered by jitters over UK Opposition Labour Party proposals to nationalise the company as part of a push to provide free full-fibre broadband to the whole of the UK.

Top European News

- SEB Bank Falls Most in a Decade Amid Money Laundering Report

- EU Bank Takes ‘Quantum Leap’ to End Fossil-Fuel Financing

- German Stimulus Craved by ECB Probably Hinges on Job Losses

- Germany Sticks to Debt-Free Budget Despite Calls for Stimulus

In FX, trade developments set the stage for the European session thus far as participants balance mixed newsflow, with sources cited by the FT noting that China is jeopardising chances of an imminent Phase One deal whilst NEC Director Kudlow stated that the two sides are ever closer to an accord. Nonetheless, DXY remains contained within a tight band thus far (98.12-23), albeit closer to the top of the range and in anticipation of further clarification. The Yuan meanwhile has derived modest impetus on the back of Kudlow, which saw USD/CNH retest 7.000 to the downside overnight, but the pair has drifted off lows and almost back to pre-Kudlow levels with participants sceptical amid conflicting reports.

- AUD, NZD, CAD – The high-beta currencies have unwound some of its Kudlow-induced APAC gains in which the Aussie climbed to a whisker away from 0.6800 vs. the Buck, whilst its Kiwi counterpart edged towards 0.6400 before fading gains. The antipodeans meander just below the respective round figures but have drifted lower in recent trade as the Buck prints fresh session highs and again the currencies await clarity on the status of US-Sino talks. The Loonie meanwhile saw a more pronounced move overnight amid the risk-driven pop higher in the crude complex in which USD/CAD tested 1.3220 to the downside (ahead of its 50 DMA at 1.3208) before advancing back up towards the half-figure in early European trade with around USD 1.2bln of options expiring between strikes 1.3240-50.

- CHF, JPY – Despite the pull-back in high-betas, the overnight softness in the safe haven FX has persisted, although more-so as the Greenback gains traction in early trade with USD/JPY eclipsing its APAC high of 108.62 with the next level to the upside the round 109.00 which coincides with its 200 DMA. The Franc meanwhile has reclaimed 0.99+ status against the Buck and resides near the top of the range alongside its JPY counterpart with the next level to the upside its 50 DMA at 0.9923.

- EUR, GBP – Sterling remains little moved on the day amid a lack of fresh catalysts on the UK election front and with little action derived by news that the European Commission has opened a legal case against the UK for failing to name a new EU Commissioner as its hands are tied by the general election. Cable remains modestly softer within a 1.2868-86 band, albeit closer to the bottom of the range and at the whim of the USD. Meanwhile, EUR/USD remains flat intraday and closer to the bottom of today’s 1.1030-15 band as in-line final EZ CPI figures unsurprisingly did little to excite traders. It’s worth noting a hefty EUR 1.2bln expiring at strike 1.1000 at today’s NY cut which may see a gravitation of price depending on news-flow.

In commodities, Crude markets are lower during early Friday trade after unwinding gains from the positive US/China trade comments from White House Economic Advisor Kudlow since the arrival of European participants as traders balance hot and cold trade news. Brent Jan’ 19 futures have now fallen below support in the form of yesterday’s USD 62.15/bbl low, with WTI Dec’ 19 futures following and also breaking below yesterday’s low at USD 56.64/bbl. In terms of crude specific news; in its monthly oil report, the IEA maintained its forecast for oil demand growth for 2019 and 2020, at 1mln BPD and 1.2mln BPD respectively. Moreover, the report highlighted that Global oil supply rose 1.5mln BPD in October as Saudi Arabian production returned to normal and on increases from Norway, Canada and the US. Meanwhile, OPEC crude oil production was 29.9mln BPD at 101 mln BPD, with world oil supply was 1.2 mb/d below year-ago levels with OPEC down 2.5 mln BPD. As a reminder, yesterday OPEC also maintained its forecast for global oil demand growth for 2019 and 2020 at at 980k BPD for 2019 and 1.08mln BPD for 2020. Earlier in the week, the US EIA cut its forecast for 2019 oil demand growth 90k BPD to a 750k BPD increase but raised its 2020 forecast by 70k BPD to an increase of 1.37mln BPD. Looking ahead, US Retail Sales, NY Fed Manufacturing, Industrial Production and Import Prices populate an otherwise modest data docket, while traders will as always have their ears to the ground for further US/China trade updates. In terms of the metals; Gold is on the back foot amid the market’s lukewarm risk tone and a stronger Dollar and is consolidating around the USD 1465/oz mark. Meanwhile, Copper, which has been on the back foot in recent days, appears to be have stabilised, with support at the USD 2.615/lbs level (23 October and yesterday’s lows) providing a floor for the time being.

US Event Calendar

- 8:30am: Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.0%; Retail Sales Ex Auto MoM, est. 0.4%, prior -0.1%

- 8:30am: Empire Manufacturing, est. 6, prior 4

- 8:30am: Import Price Index ex Petroleum MoM, est. 0.0%, prior -0.1%; Import Price Index YoY, est. -2.2%, prior -1.6%

- 8:30am: Export Price Index MoM, est. -0.1%, prior -0.2%; Export Price Index YoY, prior -1.6%

- 9:15am: Industrial Production MoM, est. -0.4%, prior -0.4%; Manufacturing (SIC) Production, est. -0.7%, prior -0.5%

- 10am: Business Inventories, est. 0.1%, prior 0.0%

DB’s Jim Reid concludes the overnight wrap

Until I acquired a dog and three kids in the last 5 years it’s fair to say that emotional responses weren’t a big part of my life. Nowadays though, my eyes well up when I hear about dogs that get lost or mistreated, children that get hurt or upset, and other such sad news. Yesterday I even had to fight back the tears when I saw the annual institution that is the John Lewis Xmas advert. Every year our biggest department store in the U.K. issues a heartstrings tugging song and story about Xmas. This year’s (spoiler alert) is about an ugly baby dragon who gets hounded out of town for not being able to control his fire breathing tendencies (he accidentally melted the town’s ice rink for one). He was very sad and locked himself away to hide until a young girl takes pity on him and tries to befriend him and gets him to come back. He eventually does and becomes a hero by lighting the town’s Xmas pudding. The little girl was thrilled. Yes this made me shed a tear. Or maybe that was the REO Speedwagon cover for the soundtrack.

Maybe for next month’s survey I’ll add a question asking for your favourite Xmas song. On that a reminder that we published our first monthly survey (link here ) yesterday with 700 responses. So many thanks. The interesting highlights were that those replying were more optimistic on the S&P 500 over 3 months than 12 months with 54% expecting it to be higher in the former period against 40% over 12 months. Perhaps the fact that 96% of those in the US thought a Warren Presidential win would be negative for the S&P 500 helped that. 79% of US respondents thought Donald Trump would win the 2020 US election though. Also only 21% thought the global economy was improving (44% deteriorating)in spite of the fact that only 14% thought that the trade war would re-escalate from here. 54% thought the US recession risk was 30% or below over the next 12 months with only 14% scoring it above 60%. There was a bias for higher German yields but lower US yields and a higher EURUSD. There were only 5% who thought European inflation would be over 2% in the next 3-5 years. Less than 1% thought the Labour Party would win an outright majority in next month’s UK election. These are the brief highlights. See the full survey for much more.

We also published a new Corporate Tax note aimed at our Corporate Clients where we highlighted the contrast between precarious state finances and healthy company balance sheets. The headline tax rates they pay have almost halved in rich countries over the last three decades. The conditions appear set for an inflection point over the medium term. Politicians with higher corporate taxes in their sights are gaining in popularity – Elizabeth Warren in the US is just one example. Meanwhile, the incoming President of the European Commission, Ursula von der Leyen, says she will target firms that “play our tax system.” Also key will be the OECD’s proposals for global tax coordination which it aims to have approved in 2020. They include calls for a minimum corporate tax rate and will lower the incentive for countries to ‘compete’ with each other on corporate tax rates. As a result, it will become easier, both politically and practically, for countries to raise corporate taxes without having to worry about scaring away future investment. Please see the link here for more details.

Turning to yesterday’s market action now. The biggest catalyst was once again the trade war. Shortly after the EMR went to print yesterday, China’s Ministry of Commerce spokesman Gao Feng said that “China has stated that the trade war has begun with tariffs and should end with removing tariffs. To remove existing additional tariffs is an important condition for reaching a deal.” This encouraged the belief that China’s negotiating stance is for a rollback of existing tariffs, rather than just a delay of pending ones. If agreed, this would presumably be a more positive outcome for markets, but it will also be harder to finalise. Nevertheless, late US session breaking headlines suggested that the two countries held a deputy-level call yesterday, which ended up boosting risk assets into the New York close.

After the US close, White House economic adviser Larry Kudlow said of trade negotiations with China that, “We are in communication with them every single day right now,” while adding, “we are coming down to the short strokes,” and a deal is “close” but “it’s not done yet”. However, late yesterday evening the FT carried a report saying that getting the “Phase One” agreement across the line remains difficult as China has still not offered enough concessions on “stronger language” on intellectual property and forced technology transfer while is also refraining from agreeing to written numerical targets for a planned ramp-up in purchases of US agricultural products. The article suggests that this makes it difficult for the US to justify a rollback in tariffs on Chinese goods. Similarly, Bloomberg also ran a story saying that a US demand that China spell out how it plans to reach as much as $50 bn in agricultural imports annually has been one sticking point. The report further added that the US officials have proposed that China provide them with monthly, quarterly and annual targets for purchases. Bloomberg also reported that China has also taken actions that could signal imports of US farm goods are in jeopardy if talks sour as it is now delaying the unloading of US soybeans at its ports which could slow down further purchases. So it seems like there are still matters yet to be resolved.

In other news, the PBoC offered CNY 200bn of one-year loans to banks today while keeping the interest rate unchanged at 3.25%. The addition of liquidity comes after weaker than expected economic data released yesterday. The PBoC said along with the injection that liquidity in the banking system is at a “reasonable, sufficient” level as the operation offsets companies’ need for funding to pay tax. Meanwhile an additional CNY 40bn also got released into banks today as a previously-announced reduction to banks’ reserve ratios by the PBoC came into effect.

Asian markets are trading largely higher this morning with the Nikkei (+0.74%), Hang Seng (+0.26%) and Kospi (+0.82%) all up while the Shanghai Comp (-0.12%) is down. The Japanese yen is -0.16% this morning while the onshore Chinese yuan is up +0.17% to 7.0086. Elsewhere, futures on the S&P 500 are up +0.35% while yields on 10y USTs are up +2.5bps after a big rally yesterday (see below).

Before all this the S&P (+0.09%%) finished near the highs for the session and inched to a new record high, though the NASDAQ (-0.04%) and the DOW (-0.01%) declined. All the indices were well off their earlier lows of as much as -0.45% though. Trade-sensitive stocks underperformed, with the Philadelphia semiconductor index down -0.30%, and the S&P 500 autos index down -0.67%. Europe missed out on the late rally, with the STOXX 600 ending the session down -0.36%. Some additional cheer was provided by Walmart, America’s largest employer, whose earnings beat expectations with adjusted EPS of $1.16 (vs. $1.09 expected). Oil prices had been trading up +1.17% but higher-than-expected US inventories data sparked a reversal with it ending -0.40%.

There was a broad flight to safety yesterday, with 10yr Treasuries -6.7bps to 1.819bps, their third consecutive rally, while 10yr bunds (-5.1bps), OATs (-3.6bps) and gilts (-5.1bps) also made gains. Other safe havens also benefited, with gold +0.51% rising for a third successive day, while the Japanese Yen (+0.37%) and the Swiss Franc (+0.15%) were up against the US dollar. Sovereign bonds in the periphery sold off however, with Italy seeing the most dramatic moves as yields rose +8.0bps and the spread over bunds increased +13.1bps, both reaching their highest levels since August. This was a theme across the periphery yesterday, with sovereign debt in Spain, Portugal and Greece all losing ground.

Meanwhile, Fed Chair Powell testified again to Congress, but he stuck diligently to his recent message and most of the focus was instead on the cascade of other Fed speakers yesterday. Evans, Kaplan, Evans, Bullard, Williams, and Clarida all spoke. They were mostly consistent with what we have heard before, but our economists noted that there is now an apparent divergence between the core leadership of the committee (Powell, Clarida, Williams), and some of the regional presidents. The leadership have emphasised weak inflation and downside risks, while many regional presidents have resisted rate cuts, and some only endorsed them on the condition that Powell also send a hawkish signal at the press conference. The fact that they still cut rates indicates that a) Powell and the leadership was able to convince the committee to go along with his preference, and b) Powell’s hawkish-leaning press conference likely overstates his own views, which are in fact probably more dovish.

In Europe, data showed the German economy avoided a technical recession in Q3, with an unexpectedly positive +0.1% GDP reading (vs. -0.1% contraction expected), following the -0.2% contraction in Q2. This echoes some other positive surprises from recent German manufacturing data recently, such as September’s better-than-expected factory orders out last week. The fact that the economy didn’t fall into recession means that the pressure for German fiscal stimulus is likely to diminish further for now, and finance minister Olaf Scholz said yesterday at a Bloomberg News event that there wasn’t a reason for doing fiscal stimulus because the German economy wasn’t in a crisis.

Elsewhere in Europe, Q3 GDP data from the Netherlands also surprised to the upside, with a +0.4% expansion (vs. +0.3% expected) and in terms of the Euro Area as a whole, data confirmed the initial estimate that the economy grew by +0.2% in Q3, with the year-on-year reading revised up a tenth from the initial estimate to +1.2%.

Wrapping up the rest of the data, UK retail sales fell -0.1% (vs. +0.2% expected), while US initial jobless claims rose to 225k (vs. 215k expected), their highest level since June but perhaps partly influenced by recent Californian fires. The 4-week moving average rose to 217k, its highest level since July. Finally, US PPI rose by +0.4% (vs. +0.3% expected) in October, with the core measure rising +0.3% (vs. 0.2% expected), which nevertheless failed to arrest the decline in yields. There was some chatter about healthcare costs starting to consistently overshoot now as opposed to the opposite in recent years.

Here in the UK the Brexit Party leader Nigel Farage didn’t back down from his stance of putting forward a candidate in every Labour-held seat. While he’s said the Brexit party won’t stand in the seats the Conservatives won at the last election, this means that they will still be standing in the seats the Conservatives need to win from Labour in order to win an overall majority in Parliament.

Staying with politics, in the US presidential race the Democratic primary field got another candidate yesterday with the entrance of Deval Patrick, a former governor of Massachusetts. It comes ahead of today’s deadline to file for the New Hampshire primary, which is the second state to hold its primary after Iowa. Meanwhile, House Speaker Nancy Pelosi said that she thinks a finalised deal on the new NAFTA, named USMCA, is “imminent” and suggested it could pass before year-end.

Finally in Chile, the peso fell -0.88% to another record low against the dollar yesterday, as the currency fell for a 6th successive session amidst widespread unrest that has seen the government supporting a rewrite of the country’s constitution. The move brings the Peso’s losses to -6.55% this week so far. The central bank did announce a $4bn swap program that will continue until January 9 the previous evening, but this failed to stem the decline. Meanwhile, the central bank said overnight that it is widening the list of eligible collateral on repo operations and is also increasing the frequency of FX swap auctions while also suspending sales of short-term PDBC bills at least until December 8.

To the day ahead now, data releases from Europe include the final October CPI and core CPI readings for the Euro Area, as well as Italy’s final October CPI reading. From the US, we have the November Empire State manufacturing survey, along with October’s retail sales, industrial production and capacity utilisation. From central banks, the ECB’s Mersch, Weidmann and Costa will be speaking today.

Tyler Durden

Fri, 11/15/2019 – 07:52

via ZeroHedge News https://ift.tt/32RD6iC Tyler Durden