Gundlach: Stocks ‘Will Get Crushed’ In The Next Downturn

DoubleLine’s Jeff Gundlach sat down with Yahoo Finance and discussed how US stocks would get absolutely crushed in the next recession.

Gundlach said 2019 was the year when investors could pick “just about anything…Just throw a dart, and you’re up 15-20%, not just the United States, but global stocks as well.” He warns that it could all change in 2020, as a recession is fast approaching.

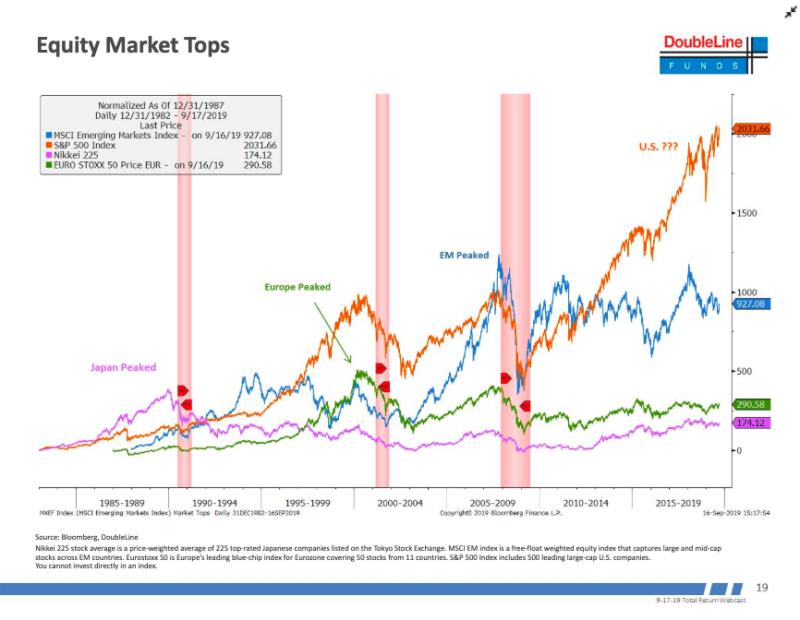

He shared his “chart of the year,” which divides global equities into four regions (the US, Japan, Europe, and Emerging Markets). What it shows is an alarming market top forming in US stocks, similar to what happened with the Nikkei 225 in the early 1990s or the Euro Stoxx 50 Index in the late 1990s or MSCI Emerging Markets in 2007/2008.

“So, where are we today? Today, we have the S&P 500 is killing everybody else over the last ten years, almost 100% outperformance versus most other stock markets,” he said.

“My belief is that pattern will repeat itself,” said Gundlach, who has spent much of 2019 warning of a downturn ahead of the 2020 elections.

“In other words, when the next recession comes, the United States will get crushed, and it will not make it back to the highs that we’ve seen, that we’re floating around right now, probably for the rest of my career, is what I think is going to happen,” he added — suggesting that a recovery won’t be seen for years.

Last month, Gundlach warned about the levels of government debt, and the US equity markets are not sustainable. He told investors that they should brace for significant disruptions.

“The corporate bond market in the United States is rated higher than it deserves to be. Kind of like securitized mortgages was rated way too high before the global financial crisis. Corporate credit is the thing that should be watched for big trouble in the next recession.”

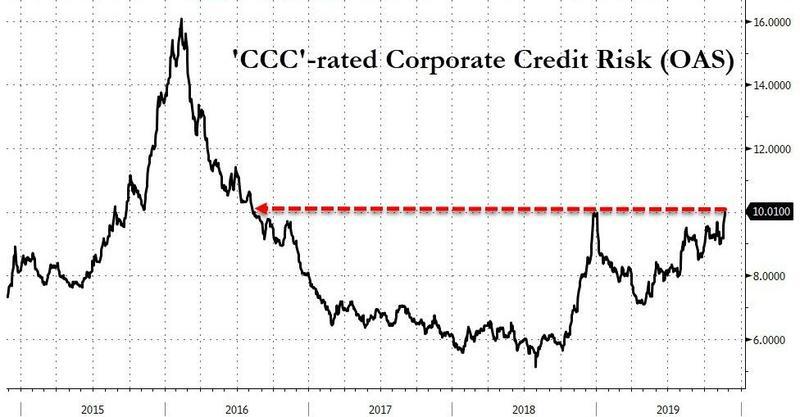

And maybe a downturn in the economy has already started, considering credit markets usually lead. As shown below, significant cracks in the junk bond space are beginning to appear:

The spreads on CCC US junk bonds have jumped above 1,000bps for the first time in more than three years as a sell-off in energy weighs on the lowest-rated debt.

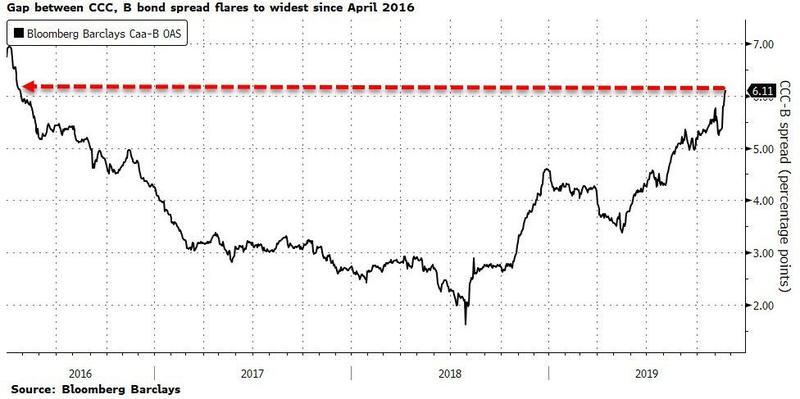

Blowing the CCC market’s risk out to its widest against single-B since April 2016…

Generic CLO BBB tranche is starting to flash very red…

The broader junk bond market posted negative returns last month… as stocks have soared…

Gundlach’s Sept. presentation titled “The Greatest Economy Ever!” made it clear that the next big move for the dollar is lower, and warned that when the next recession occurs, the US dollar and stocks will be in trouble, recommending investors to diversify into other currencies and markets.

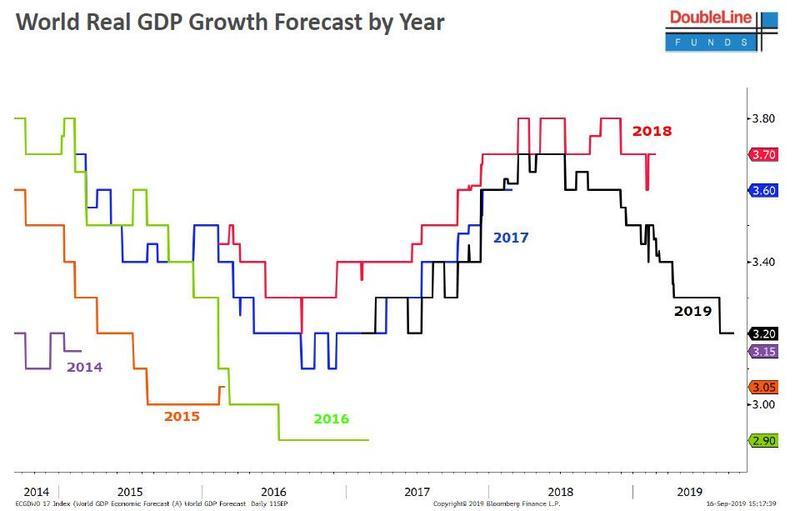

And since his view on the economy is that it is anything but the “Greatest Ever”, pointing out the sharp slump in 2019 global GDP projections…

And as we’ve said on multiple occasions, the next shoe to drop is likely the consumer. Something that Gundlach is waiting for as well explained in the latest interview with Yahoo.

Highlight: A recession probability “is around 40% right now,” @truthgundlach says. “The ISM looks bad… Consumer sentiment, though, remain at a decent level. What we have to watch for is consumer confidence declining, because that’s almost definitional we cause a recession.” pic.twitter.com/cI0JQil68b

— Yahoo Finance (@YahooFinance) December 2, 2019

Tyler Durden

Tue, 12/03/2019 – 19:05

via ZeroHedge News https://ift.tt/2LkwSCh Tyler Durden