Why Illinois Property Taxes Won’t Drop Without Major Spending Reform

Authored by Mark Glennon via Wirepoints.org,

A commenter here recently asked it this way: “How high would income taxes have to ramp in order to offset reducing Illinois’ property tax burden to that of Indiana, Iowa or Wisconsin?”

That’s a great angle to look at it from because you learn much by seeing that math. Don’t worry, we’ve done the math for you below. You’ll see that no meaningful property tax relief is possible without major, structural reforms that cut spending. You’ll also see that Governor JB Pritzker’s property tax relief task force cannot be expected to come up with much. Its report is due out by the end of this month.

The reason is simple. The numbers are overwhelming. Meaningful property tax cuts can’t be achieved without real spending reforms.

Here is the answer to that commenter’s question:

-

If we cut Illinois’ residential property tax rates to match Indiana’s and shifted the burden to the state income tax, we’d have to cut property tax rates by 56% and nearly double the income tax. Seventeen billion dollars of property tax revenue would be lost, which represents 92% of what Illinois collects on the state income tax.

-

Even to match Wisconsin’s property tax rates, which are fourth highest in the nation, Illinois would have to cut its property tax rates by 24%, and shifting that to the income tax would mean a $7.6 billion income tax increase – a 40% jump.

-

Iowa’s property tax rates are one-third lower than ours, and cutting ours to match theirs would mean a $10 billion income tax hike – a 54% increase.

For perspective on how big those tax hikes would be, consider that the pending progressive income tax proposal – the “Fair Tax” – is optimistically estimated to raise just $3.5 billion of additional revenue. So, it would cost five times that to match Indiana’s property tax rates through an Illinois income tax hike. New revenue from the Fair tax is less than half of what it would take even to match high-tax Wisconsin’s property tax rate.

That’s just part of the absurdity of claims that the Fair Tax will help cut property taxes meaningfully. The $3.5 billion of new revenue from the Fair tax has already been promised away several times over. Endless messaging from supporters says the tax would also provide for fixing the state’s structural deficit, investing in schools and health care, fixing our crumbling infrastructure, creating thousands of jobs, “paying off the Republican Party’s old bills,” assuring that domestic violence shelters are kept open, helping stabilize our pensions, putting us on a path to fiscal stability and more. Truly paying for all that’s been promised from the Fair Tax would require tax rates that become absurd, which we’ve estimated before.

Nor can you expect much help from the Property Tax Relief Task Force. It’s not charged with producing the kinds of drastic spending reforms that are truly needed, including genuine pension reform and the constitutional amendment needed for that. Besides, the Pritzker Administration has ruled that out. The task force now has over 80 members, making it difficult to see how it will agree on anything bold. They already rejected a measure on perhaps the most obvious, albeit small, reform needed, which is putting an end to lawmakers running property tax appeal businesses as side jobs.

What about the pending legislation to consolidate investment functions of suburban and downstate police and firefighter pensions? Isn’t it supposed to relieve the property tax burden? It will only save an estimated $164 to $500 million per year, according to Pritzker, and that’s entirely speculative. That’s only 1.6% of property taxes at best, and nobody knows whether any savings from the plan will really go into property tax relief instead of being spent elsewhere.

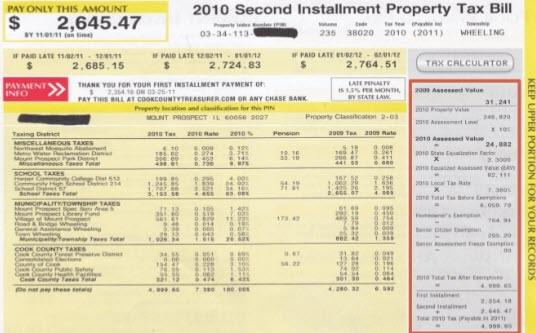

The initial aspect of the problem is that Illinois property taxes are monstrous – highest in the nation along with New Jersey. They total $31 billion across the state, which is far higher than any other source of government revenue for Illinois and its municipalities.

But the ultimate, core problem when you add them together with all other taxes imposed statewide and locally is that we end up as America’s “least tax-friendly state,” as Kiplinger Personal Finance recently put it. It’s that total that’s the problem.

Maybe the Property Tax Task Force will suggest at least some of the reforms that would help, such as consolidation of school districts and other units of government. But returning Illinois to competitive levels of taxation and services will require a long list of reforms small and large that address the state’s total tax burden. They include real pension reform, collective bargaining reforms, ending unfunded mandates imposed by the state on municipalities and much more.

In summary, any meaningful property tax reduction, such as matching rates for neighboring states, would require reforms that our political establishment won’t consider.

Tyler Durden

Sun, 12/15/2019 – 20:35

via ZeroHedge News https://ift.tt/2sr88Se Tyler Durden