One Bank Asks If The Market’s “Explosive” Melt Up Will End In A Flash Crash

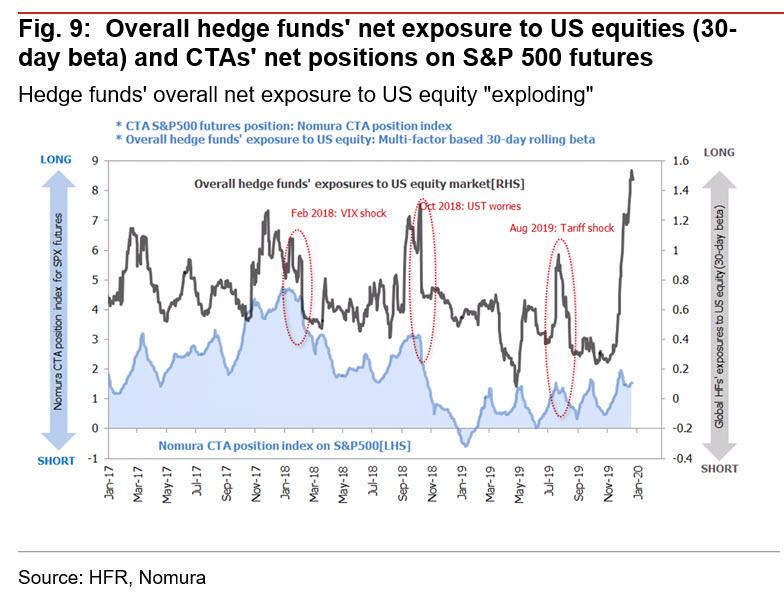

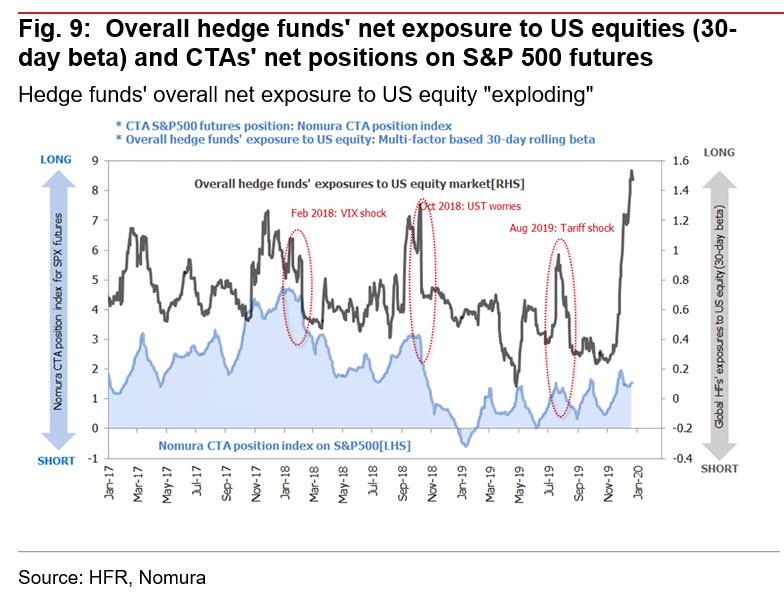

Earlier we pointed out something which under normal circumstances would be seen as an ominous sign (although the current market is anything but normal as Morgan Stanley pointed out), namely the market’s record euphoria and pervasive trade optimism amid what Nomura dubbed was an “explosive” increase in hedge fund net exposure to US stocks.

And while extrapolating the unprecedented trend of the past two weeks which has seen the Nasdaq post fresh record highs for 11 consecutive days, the longest such stretch since 2009, suggests that stocks are set to close up around 30% for the year, which would surpass the return of 2013 and result in the best annual gain for the S&P500 sine 1997…

… some are wondering if the euphoria-driven meltup in stocks hasn’t sown the seeds of the market’s own imminent destruction and/or a flash crash.

In a recent note from Nomura’s quant, Msanari Takada, the Japanese strategist notes that this week is the time of year when global markets enter their traditional holiday slowdown, when discretionary investors such as global macro hedge funds and investors with longer-term horizons tend to absent themselves from major markets at the year’s end.

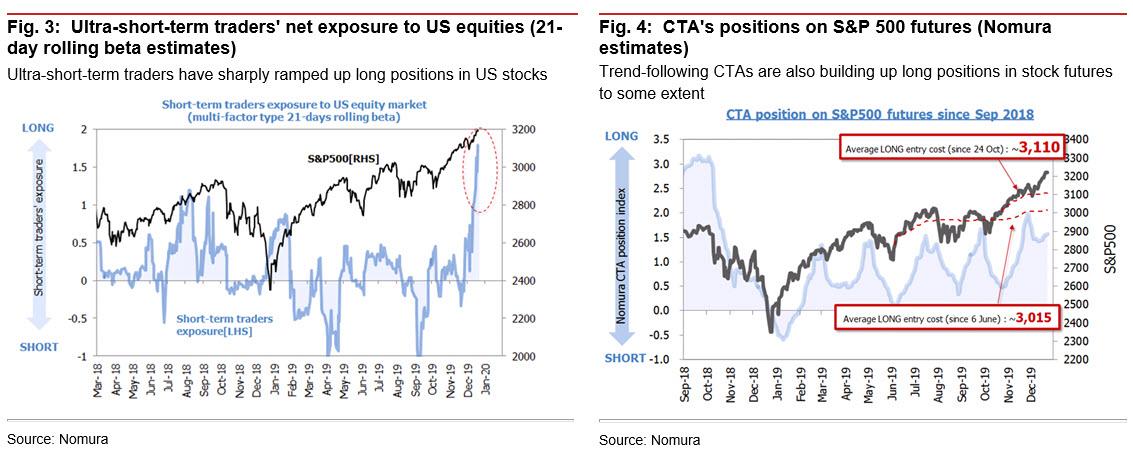

However, as Takada cautions, speculative players with short-term investment horizons are not necessarily entering shut-down mode for the holidays. In particular, “ultra-short-term traders, which move continuously from one trade to the next at an average holding period of less than 10 trading days, and CTAs, at the forefront of trend-following program traders, are continuing to make trades, albeit intermittently, and will probably keep all systems ready through the year-end holidays and start of next year.”

So to address the risk of a possible violent reversal, Nomura has taken a look at what the aforementioned classes of ultra-short-term traders are up to in the US stock market.

- First, the Japanese bank notes that ultra-short-term traders are long in US equities to an extreme degree and as such appear increasingly likely to take a time-out to cash out some profits sometime after Christmas.

- Second, CTAs are currently in the process of building up a net long position in equity futures. If, for example, profit-taking by ultra-short-term traders were to push down share prices, then we see good prospects for trend-following dip-buying by CTAs to lend some support to market levels, assuming that the S&P 500 holds above 3,110 (which is estimate to be the average breakeven cost for CTAs’ recent net long position).

As such, at a time of year when fundamentals-driven investors are thin on the ground, price action may well continue to be driven by players with ultra short-term horizons. These traders, however, tend to be limited to smaller and more sporadic transactions at this time of year, and their trades may appear as background noise just barely discernible to the human observer, according to Takada.

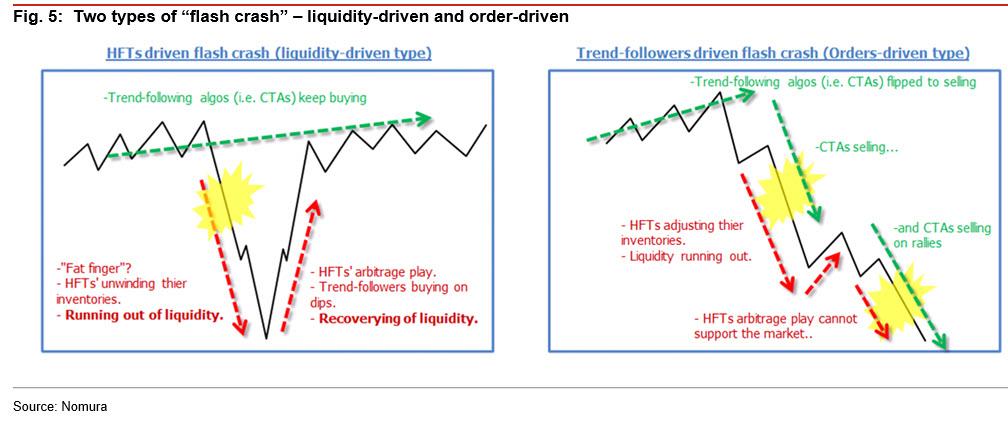

That said, with liquidity ultra low over the year-end holiday season and into the first days of the new year, trading by the aforementioned speculators can break beyond mere background noise to become clearly visible to the human eye. The clearest example of this, Nomura warns, would be a so-called “flash crash”. But while referred to with the same phrase, there are in fact two main types of flash crashes, distinguished in practice by the factors driving them. To fast-forward to the conclusion, while crashes caused by high-frequency trading (HFT) tend to be transient phenomena, crashes involving changes in strategy by trend-following algos can have more persistent effects.

Nomura illustrates these two types of flash crashes in the chart below. In these examples, a flash crash is assumed to occur an overarching upward trend in share prices.

- In the liquidity-driven type of flash crash (left side of figure), a crash is triggered by some irregular factor such as a “fat finger” incident, forcing market-making specialist high-frequency traders to close out their position inventories. The volume of “take” orders surges and market liquidity dries up. This results in a momentary market slip. But unless the direction of trading in their trend-following programs is altered, CTAs continue to buy on dips. HFT traders also make arbitrage moves, leading to a swift recovery in liquidity. Such a crash theoretically has a neutral impact on market trends.

- In contrast, in the order-driven type of flash crash (right side of figure), the crash is triggered not by mistaken orders but by an overabundance of orders on one side of trading. Such crashes tend to by catalyzed by one-sided position liquidation pressure via trend-following programs. The distinguishing characteristic of these crashes, Takada explains, is that they are driven not by fat-finger orders but by ongoing order flow based on the mechanistic decisions of these programs. In such cases, trend-followers incrementally shift to the selling side, so the collapse in actual market trends can persist for some time.

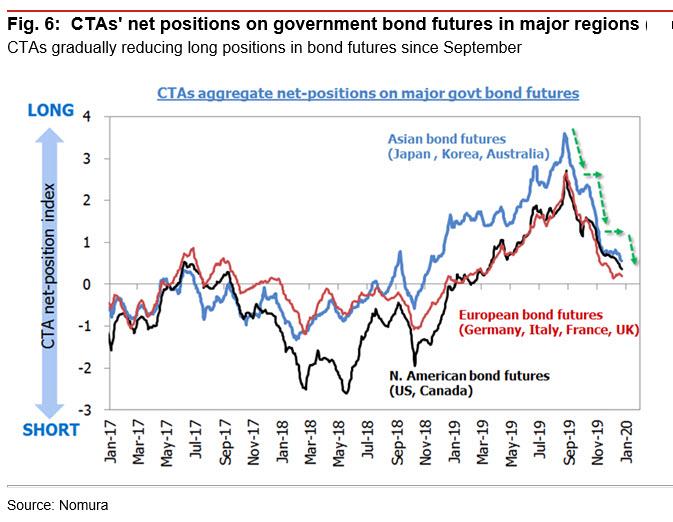

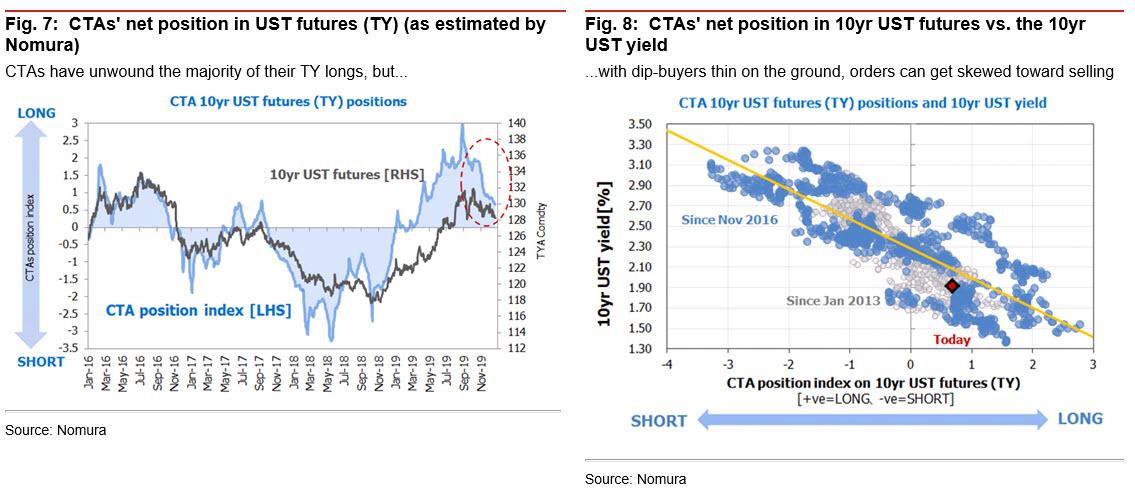

According to Nomura, it is the latter case – an order-driven flash crash – that would appear to be the type requiring caution from the perspective of fundamentals investors with longer investment horizons. In this sense, Nomura sees a modest risk in CTAs’ current positions in bond futures markets heading into the year-end liquidity vacuum. That said, and as we noted previously, CTAs have been gradually unwinding their long bond futures positions in major markets since September, so a large-scale selloff of bond futures is unlikely.

The risk is that despite selling much of their overweight, CTAs have not completely closed out their long positions in UST futures. On top of this, 10yr UST yields are currently just around 1.90% (the cost of CTAs’ net TY buying since April), so CTAs are obligated to continue unwinding these long positions, if in small amounts. When this happens, if there are no fundamental investors on the scene to buy on dips, Nomura cautions that there is a risk that systematic selling orders could stand out. While it is technically difficult to predict the scale of a crash ahead of time, Takada estimates the next trigger level for CTAs above 1.90% at 2.05% (the cost of net buying since March), and if yields were to break past 2.05%, CTAs could pick up their selling even further.

What about the US stock market?

As discussed earlier, CTAs are currently building long positions in equity futures, and at the very least Nomura does not see a change in trend-followers’ behavior that would seem to presage a crash. But it also appears that, above and beyond the current US equity buying by trend-followers, the persistent buying of long positions in US equities by strategies of all types has led to afore mentioned “explosive” increase in net exposure among hedge funds overall, as fundamentals-focused long/short funds and global macro hedge funds have also all been buying US equities (expanding gross long positions) in December.

In other words, in terms of potential “flash crash” catalysts, Nomura’s main focus is on whether an unforeseen rise in 10yr UST yields will cause hedge funds overall to cool off on their US equity long positions, which are already at record highs and have reached a saturation point. After all, once you hit max enthusiasm, the only way you can go is down.

Meanwhile, and perhaps most ominously, the CBOE SKEW Index – also known as the black swan index, perhaps the only remaining indicator of market nervousness now that central banks directly target the VIX – has been steadily creeping higher despite, or perhaps due to the market’s relentless melt up.

So while Nomura does not think this should be seen as forecasting a sharp stock market correction but rather an indicator that hedging costs against the risk of an unexpected downward price adjustment have jumped as a result of rapid growth in equity long positions, it does not take much for a hedge to become a consensus trade and for bearish sentiment to overtake bullish, especially if dealers are positioned in a way that they will make more money if a correction takes place. Either way, as Takada concludes, “some hedge funds appear to have begun to show wariness toward a backlash from optimism even against the backdrop of a ‘melt-up’ in global equities.”

Tyler Durden

Fri, 12/27/2019 – 15:33

via ZeroHedge News https://ift.tt/2Sx3xJd Tyler Durden