Desperation: Markets Remain Risk-Free… Literally

Authored by Sven Henrich via NorthmanTrader.com,

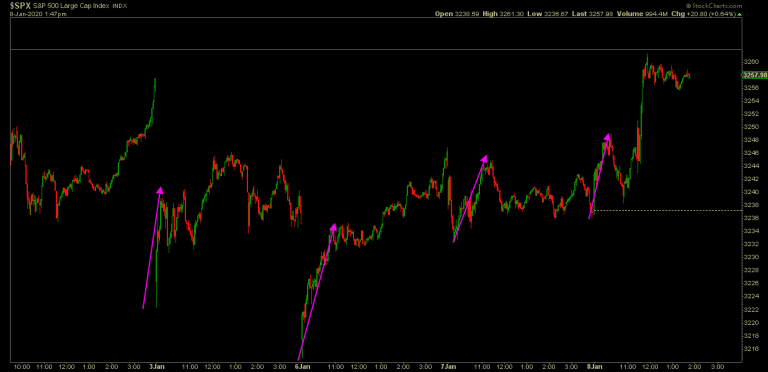

Spoos 50 handles down in overnight, 12 hours later new all time highs. If you called that last night step forward and show me. Nobody of course called this. But these are our markets these days.

Now stuck in permanent technical greed the year 2020 continues on the same path as 2019 ended: Fed liquidity trumping, well, even Trump.

Markets remain risk free. Literally.

Why worry about risk? So what if we gap down one day? It’ll be green in 30 minutes. So what if we drop 50 handles in overnight? It’ll be green by open.

And that’s been the trend, every open is jammed higher no matter what:

Bears live in the dark and feast at night and hibernate during the day. And don’t kid yourself. Last night was a feast for bears many of which covered or closed some profits, the first real volatility event of 2020, and unlikely to be the last (see also $VIX 46). But actually there’s been quite a bit of 2 way action offering something for everyone. But more often than not the volatility and wider price ranges take place in the overnight scene.

But you can see no evidence of today’s overnight carnage. It never happened.

Too great is the desperation. The desperation to be long. Jim Cramer described it quite accurately this morning:

“The desperation to get into this market is extraordinary,” Cramer said on “Squawk on the Street.”

“It’s frantic. They don’t even wait until the opening bell to get in. They try to take advantage of every little bit to be able to get in.”

There is no discipline. There is no consideration for value, valuations or technical overbought readings. No consideration for risk. Risk, what is what? Stocks are risk free assets now.

Does this not remind you of any particular time? If you were around in 1999 you may remember. No, this market continues on the same track and it’s all Fed driven. The Fed is now the primary investment criteria. We have no choice. We must be long even if we don’t want to be:

Markets remain a central bank market bubble operation, it’s the sole investment rationale for chasing historic valuations:

“I’m a reluctant bull, I suppose — it’s driven by central banks”

“My view is simple: central banks are flooding the system with liquidity” https://t.co/82xytMZIR5

— Sven Henrich (@NorthmanTrader) January 8, 2020

It’s a mockery of capitalism and market. It makes people reckless by force and bad habits are developed that would get you absolutely hammered in any other time.

And of course the desperation is taking place with the firm belief that this will continue.

And as far as we know it will:

They will never stop:

Central banks to unleash billions as QE is rebooted

“The Federal Reserve, BOJ & ECB are expected to buy almost £500B of debt this year and nearing £1 trillion by the end of 2021.”

h/t @LiveSquawk https://t.co/FtaYoe3Mae

— Sven Henrich (@NorthmanTrader) January 7, 2020

I won’t even bother making a point about valuations. Nobody cares. You can’ argue with drunks at the bar or desperate people to jump on a wagon even if that wagon is heading toward a cliff.

I maintain that the Fed has created a circus atmosphere with their repo and balance sheet operations and are blowing an asset bubble and are being entirely dishonest about it:

Anyone ever see an announcement by Jay Powell or the Fed that their plan is to expand the Fed’s balance sheet by over $400B in 3.5 months?

No? That’s because that statement doesn’t exist.The Fed is engaged in willful miscommunication with the public.

— Sven Henrich (@NorthmanTrader) January 7, 2020

Earnings are coming out soon. Earnings haven’t mattered in 2019. With the run we’ve had recently the onus is now on corporations to prove that they have the earnings growth everybody desperate enough to frantically chase stocks here must assume they have to justify the valuations that have been created.

No room for error. None:

$AAPL

Weekly RSI 87.57

Market cap $1.3T

PEG ratio 2.13

Quarterly revenue growth 1.8% (yoy)

Quarterly earnings growth -3.2% (yoy) pic.twitter.com/GK2dgif8ux— Sven Henrich (@NorthmanTrader) January 8, 2020

Frantic desperation to buy. I’m sure only the best investment decisions are made in such an environment. Best of luck.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 01/08/2020 – 17:25

via ZeroHedge News https://ift.tt/2Fyayl6 Tyler Durden