And Another All Time High For World Stocks

With the Fed flooding the market with hundreds of billions of excess liquidity, it’s hardly a surprise that every single day is a new all time high. In fact, writing these daily updates is getting downright boring.

One day after the US stock market exploded higher in the last hour of trading, melting up before our eyes on no news, world shares followed apace rising to record highs on Friday, with markets across the globe a sea of green…

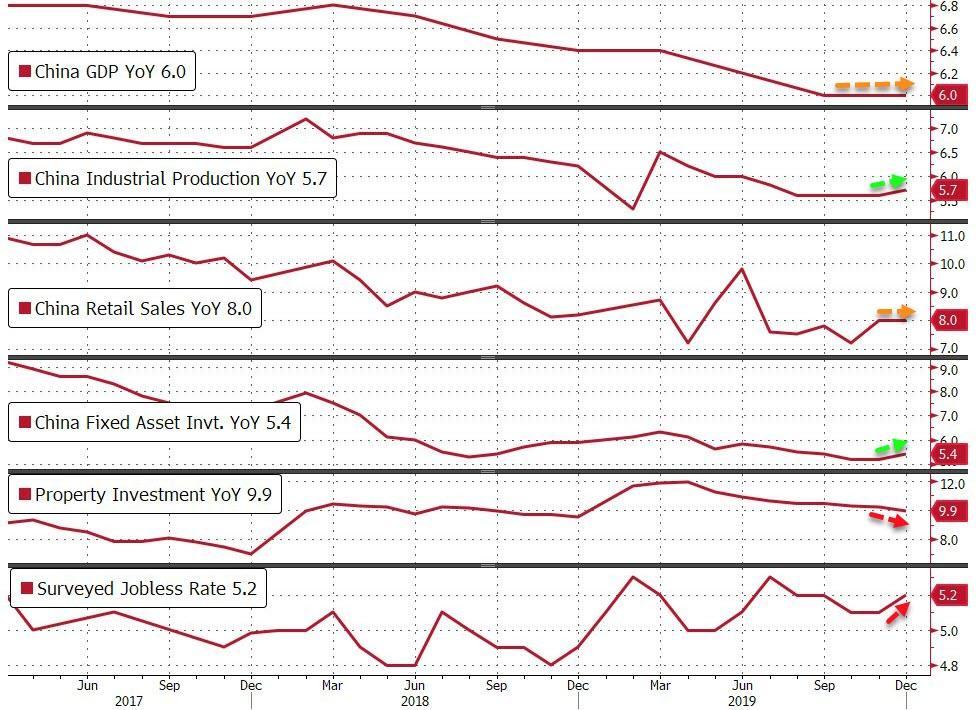

…supported by Chinese data that showed GDP slumping to just 6.1%, a fresh 29 year low, suggested the world’s second-biggest economy was stabilizing. As reported last night, China’s economy grew 6% between October and December last year. Anemic domestic demand and the trade war with the United States led to growth of 6.1% in 2019, the slowest in 29 years. However, the data also reinforced recent signs of an improvement in Chinese business confidence as trade tensions eased after Beijing and Washington signed an initial deal on Wednesday to defuse their tariff war.

China’s industrial production “is quite telling, because more broadly it speaks to the bottoming out in the global industrial-production cycle, which we’ve been looking for and the market’s been looking for for the last six to nine months,” John Woods, chief investment officer for the Asia Pacific at Credit Suisse, told Bloomberg TV in Hong Kong. This suggests “the global economy is on a recovering path.”

The continuing rebound in Chinese data, along with easing trade tensions with the United States, sent the MSCI world equity index up 0.2% and further into record territory. The Chinese data fueled a rise in the Chinese yuan, which touch a six-month high of 6.8660 to the dollar.

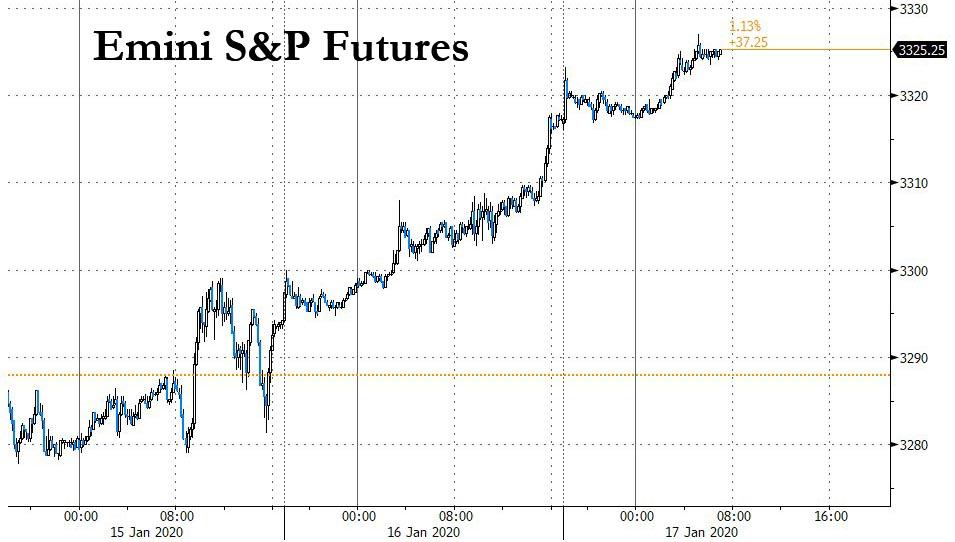

And with China stable for now, investors turned their attention to improved growth prospects across the world. European shares gained 0.7% in early trade, with Frankfurt, Paris and London indexes up 0.5% to 0.7%. Emini S&P futures were also pointing up, continuing a virtually straight line levitation since the Iran escalation faded away, while upbeat earnings from Morgan Stanley, rising U.S. retail sales, a strong labor market and robust manufacturing data had helped to lift Wall Street to record highs. Google became the fourth US company to top a market value of more than $1 trillion, after its shares rose nearly 17% over the last three months.

“Investors that were last year buying risky assets rather defensively – not really removing their hedging – right now are deploying cash,” said Olivier Marciot, a portfolio manager at Unigestion. “A number of investors that were sitting on big piles of cash are starting reallocating. People are unloading cash positions into financial assets.” In other words, as we said over the weekend, everyone is going “all in” in a manic chase of performance, something observed just before every blow off top ends in tears.

Europe’s Stoxx 600 Index headed for its biggest gain in two weeks, with International Consolidated Airlines Group SA surging after removing a shareholdings limit, even as French Supermarket Casino slumped 12% after slashing its forecast for 2019 operating profit growth because of the damage from transport strikes in the fourth quarter.

Earlier in the session, Asian markets also rose chasing the US momentum and after the Chinese data, with MSCI’s broadest index of Asia-Pacific shares outside Japan gaining 0.4% and headed for a seven-week advance, which would be the longest winning streak in two years. China’s own blue-chip index ended just barely higher, down from an earlier rise of as much as 0.7% amid speculation of less stimulus. The index has rallied more than 8.5% since the beginning of December, fueled by hopes for improved trade relations with the United States. Shares in Australia and South Korea both rose, with Japan’s Nikkei climbing to a 15-month high while Japan’s Topix rose after two days of declines.

“This is all good news and positive for the China story,” said Daniel Gerard, senior multi-asset strategist at State Street Global Markets in Hong Kong.

Still, as Reuters notes, analysts say global equities may find it difficult to maintain momentum from their recent rally as optimism over the trade truce gives way to uncertainty over the next steps in trade talks. While the Phase 1 deal signed on Wednesday may defuse the 18-month trade row, analysts said it was unlikely to ease broader friction between the two countries. Most of the tariffs imposed during the dispute remain in place and a number of issues that sparked the conflict are still unresolved.

“The challenge from here is how long we can maintain these improvements,” said Steven Daghlian, market analyst at CommSec in Sydney.

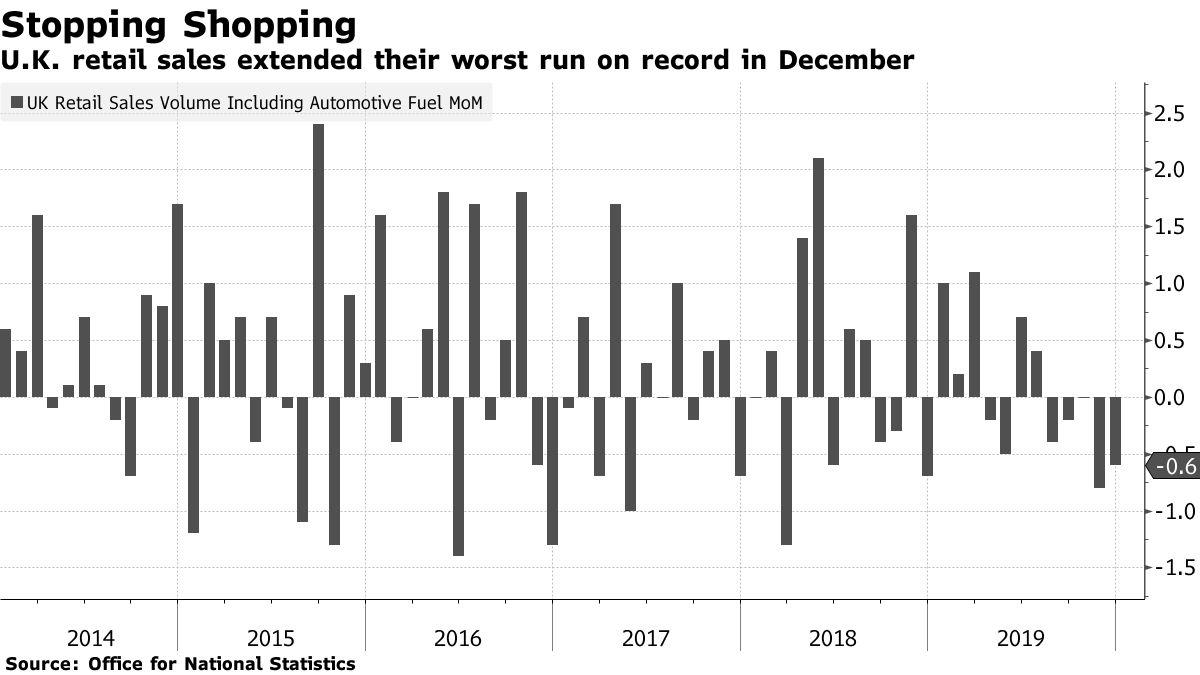

In FX, the dollar held steady, reaching eight-month highs against the yen boosted by encouraging data from the United States on Thursday, before trimming its advance to 0.09% to 110.24, while the pound slumped after U.K. retail sales unexpectedly extended their worst run on record, increasing the probability of a Bank of England interest-rate cut later this month

Most major currencies were contained within tight ranges as large option expiries were in focus

In rates, the longest-dated Treasuries dipped and the U.S. yield curve steepened modestly after the Treasury said it would start issuing 20-year bonds in the first half of 2020 while German bonds were steady; the Italian bond curve bull flattened after Italy’s constitutional court rejected Matteo Salvini’s demand for a referendum on introducing a British-style first-past-the-post electoral system. Elsewhere, the yield on Taiwanese government debt fell to a record intraday low as insurers roared back into the market.

In commodities, Oil edged higher alongside gold. Emerging-market equities also climbed, on course for a seventh week of gains.

Earnings season ramps up next week with the likes of Procter & Gamble and Intel reporting. Friday’s economic data include JOLTS job openings, University of Michigan consumer sentiment. Schlumberger and State Street are due to publish results.

Market Snapshot

- S&P 500 futures up 0.2% to 3,325.00

- STOXX Europe 600 up 0.7% to 423.31

- MXAP up 0.4% to 174.43

- MXAPJ up 0.4% to 572.52

- Nikkei up 0.5% to 24,041.26

- Topix up 0.4% to 1,735.44

- Hang Seng Index up 0.6% to 29,056.42

- Shanghai Composite up 0.05% to 3,075.50

- Sensex up 0.1% to 41,973.36

- Australia S&P/ASX 200 up 0.3% to 7,064.13

- Kospi up 0.1% to 2,250.57

- German 10Y yield unchanged at -0.218%

- Euro down 0.08% to $1.1128

- Italian 10Y yield rose 3.5 bps to 1.265%

- Spanish 10Y yield fell 1.7 bps to 0.45%

- Brent Futures up 0.7% to $65.07/bbl

- Gold spot up 0.1% to $1,554.69

- U.S. Dollar Index up 0.1% to 97.38

Top Overnight News

- The U.S. Treasury will start issuing 20-year bonds in the first half of 2020, expanding its roster of securities as the government seeks ways to fund a ballooning deficit

- China’s economy stabilized last quarter, with the first acceleration in investment since June signaling that a firmer recovery could be underway. Industrial output rose 6.9% in December from the same period the previous year, versus the median forecast of 5.9% China’s economy displayed greater-than-expected strength in December, handing Beijing vindication of its new- found moderation in economic stimulus and suggesting the approach will continue through 2020

- President Donald Trump plans to nominate Judy Shelton and Christopher Waller to join the Federal Reserve, the White House said. The two economists have widely different backgrounds, but their policy comments suggest they’d be inclined to be open to Trump’s calls for easier monetary policy.

- The European Union’s new trade chief pulled no punches on an inaugural visit to Washington, saying President Trump’s tariff threats amount to short-sighted electioneering and warning him about widespread economic damage from protectionism

- Oil held its biggest gain in almost two weeks on optimism a more conciliatory approach on trade from the U.S. will help revive growth, but was still headed for a weekly drop amid persistent demand concerns.

- The White House budget office violated federal law when it withheld about $214 million appropriated by Congress to the Defense Department for security aid to Ukraine, an independent congressional watchdog agency concluded.

- European Central Bank watchers are virtually convinced President Christine Lagarde will change the institution’s inflation goal for the first time in 17 years as she attempts to achieve the price stability that eluded her predecessor. Almost 90% of respondents in a Bloomberg survey predicted the ECB will officially alter its strategy to give equal weight to too-low and too-high inflation

- The European Union’s trade chief said the race is on to avert an escalation in transatlantic commercial tensions as a result of U.S. objections to a French digital- services tax

- The trade deal struck between U.S. President Donald Trump and Beijing will allow financial services companies from the U.S. to apply for licenses to buy Chinese non-performing loans directly from banks, cutting out the middle man they have to go through now

Asian equity markets traded positive after taking impetus from another record-setting session on Wall St. following the recent Phase 1 deal signing and where sentiment was underpinned by encouraging earnings and data, while participants also digested a flurry of key Chinese data including GDP which grew inline with expectations. ASX 200 (+0.3%) extended on all-time highs led by broad strength in mining names including Rio Tinto despite the Co. printing weaker Q4 iron ore shipments, although Nufarm was at the other end of the spectrum with double-digit losses after it flagged weaker earnings across several segments. Nikkei 225 (+0.4%) was kept afloat by favourable currency flows, while Hang Seng (+0.6%) and Shanghai Comp. (U/C) initially gained after the continued PBoC liquidity efforts and slew of tier-1 Chinese data in which GDP printed inline with expectations and both Industrial Production and Retail Sales topped estimates. However, the data showed China’s 2019 growth slowed to 6.1% from 6.6% Y/Y which was the weakest since 1990 albeit still within the official 6.0%-6.5% target range. Finally, 10yr JGBs were marginally higher in a reclaim of the 152.00 level with the rebound unfazed despite the positive risk tone and all metrics pointing to weaker results at today’s 20yr JGB auction.

Top Asian News

- Emerging Market Fiscal Deficits No Longer the Bogeyman to HSBC

- Indonesia Says Microsoft Plans to Build Local Data Center

- Here’s What You Need to Know About Friday’s Gain in Asian Stocks

- Japan Court Bars Operation of Shikoku Electric’s Reactor

An upbeat session for European equities thus far [Euro Stoxx 50 +0.8%] with firm gains seen across the board, following on from an overall positive APAC session as sentiment remains underpinned following reassuring earnings coupled and decent data. The CAC (+1.0%) DAX (+0.8%) lead the gains in the region, with FTSE 100 joining the party following early underperformance on currency dynamics. Sectors are mostly in the green with the exception of the energy names as oil stalled not far off YTD lows and natural gas prices slump. Meanwhile, sectors leading the advances include industrials, utilities, healthcare and IT, with the latter potentially feeling some tailwind from Alphabet joining the USD 1tln market cap club. In terms of move. In terms of individual movers – heavyweight Bayer (+1.0%) remains a top gainer in the DAX after reports stated the Co. could be weeks away from settling over 75k cancer claims in relation to its Roundup weed-killer. Elsewhere, Richemont (+5.0%) shares have been bolstered by a Q3 revenue beat against the background of Hong Kong protests – thus Swatch (+1.9%) are higher in tandem. On the flip side, Casino (-7.7%) shares slumped as much as 9% at the open amid dismal prelim results and a profit warning amid the French pension reform protests, with peer Carrefour (+0.8%) initially falling in sympathy but nursing losses in recent trade.

Top European News

- U.K. Retail Sales Extend Worst Run on Record Despite Discounting

- Cyberpunk Setback Sends Witcher Game Maker Shares Down 13%

- Flybe Rescue Is Said to Include U.K. Subsidies for Some Routes

In FX, sterling was in the ascendency ahead of ONS retail sales data for the festive month of December, with forecasts for a firm rebound in consumption bolstered by the fact that Black Friday fell within the reporting period. However, longs and anyone front-running the release on the prospect or rumour of an upside surprise were left high and dry by another bleak set of numbers. Cable duly collapsed from 1.3100+ to sub-1.3050 and Eur/Gbp spiked from around 0.8487 to circa 0.8533 and back above a big 1.2 bn option expiry at 0.8500 in the process.

- USD – In stark contrast to the whipsaw moves witnessed vs the Pound, trading ranges have been relatively sedate and exemplified by the DXY sticking between narrow 97.259-396 lines in the run up to another raft of US economic releases, including housing starts, building permits, ip, manufacturing output, JOLTS and Michigan Sentiment. However, the Dollar retains an underlying bid in wake of yesterday’s upbeat data and Philly Fed survey on balance, with a significantly steeper Treasury curve on longer end supply factors also lending support.

- AUD/NZD/CAD/JPY/EUR/CHF – The Aussie and Kiwi have derived a degree of positive momentum from mostly encouraging Chinese macro news overnight to pare some declines against their US counterpart and hold around or above big figures, at 0.6900 and 0.6600 respectively. Consequently, the Aud/Nzd cross is pivoting 1.0400 and could yet rebound a bit further if hefty Aud/Usd expiry interest at 0.6925 (1.3 bn) exerts some upside influence. Elsewhere, the Loonie is still meandering either side of 1.3050 and near 1.1 bn expiries from 1.3030-40, while the Yen is consolidating in a lower band below 110.00 where 1 bn expiry interest resides and the Euro remains restrained under 1.1150 amidst even bigger expiries stacked from 1.1090 to 1.1200 (totalling almost 12 bn and fairly evenly spread). Conversely, the decent Usd/Chf expiries are not that close to current levels (0.9660 or so) and the Franc failed to glean any real impetus/direction from Swiss import/export prices even though firmer or less deflationary than previously.

- EM – Pretty mixed/inconclusive performances vs the Buck thus far, but the Rand has clawed back some post-SARB weakness and Lira vice-versa as oil prices rebound to the benefit of the Rouble, while the Renminbi continues to grind higher in wake of the aforementioned upbeat (overall) Chinese data.

In commodities, WTI and Brent front-month futures have been lifted in recent trade in what seems to be more of a sentiment-driven move as opposed to oil-specific fundamental news. The former eyes USD 59/bbl to the upside having stalled just ahead of the psychological level, whilst the latter eclipsed USD 65/bbl. PVM notes that from this month’s oil market reports, the key takeaways are that global inventories will grow this year, with oversupply concerns continuing to persist in H1 2020, driven my rising Shale output and in-fitting with the latest US production figures with reached a record high of 13mln BPD. “In view of this, any lingering bulls ought to retreat into hibernation, remerging only in the summer when oil fundamentals shake off their bearish malaise.” – PVM states. The analysts also note that prices are underpinned after the Senate passed the USMCA trade deal yesterday but upside remains capped by concerns on whether China will live up to its promises to bolster US imports, which could bring an end to the ceasefire between the world’s two largest nations. Elsewhere, spot gold continues to consolidate from the parabolic price action seen since early December with prices currently steady just above the 1550/oz mark ahead of potential mild resistance around 1558/oz – with eyes remaining on the geopolitical landscape after US Central Command stated that 11 US troops were injured in last week’s Iranian attacks on the Al-Asad airbase, despite US President Trump claiming that there were no injuries. Copper prices meanwhile remain supported amid the overall market sentiment with price north of USD 2.85/lb, and potentially feeling some tailwinds from China’s GDP remaining within its target band.

US Event Calendar

- 8:30am: Housing Starts, est. 1.38m, prior 1.37m; Housing Starts MoM, est. 1.1%, prior 3.2%

- 8:30am: Building Permits, est. 1.46m, prior 1.48m;Building Permits MoM, est. -1.48%, prior 1.4%

- 9:15am: Industrial Production MoM, est. -0.2%, prior 1.1%

- Capacity Utilization, est. 77.0%, prior 77.3%

- Manufacturing (SIC) Production, est. -0.05%, prior 1.1%

- 10am: U. of Mich. Sentiment, est. 99.3, prior 99.3; Current Conditions, est. 115.3, prior 115.5; Expectations, est. 89, prior 88.9

- 10am: JOLTS Job Openings, est. 7,250, prior 7,267

DB’s Jim Reid concludes the overnight wrap

I’ve been in Zurich, Geneva and Paris this week with no end in sight to the travel over the next few weeks. I must admit this time of year the amount of calories my iWatch says I’ve burnt on a daily basis drops noticeably as I don’t have as much chance to go to the gym or don’t walk as much. I also eat bad food away from home. However I try to counter this by walking everywhere. Yesterday I had a delightful 6 mile round trip from Gard Du Nord to our office at either ends of the day whilst listening to a audio book on sustainability. Nearly 300 calories each way and 11,000 steps. Oh and helping the environment a little and not taking that much longer than a taxi would take. Although less helpful to the environment are the worn soles of my work shoes than need replacing regularly. What I’ve learnt about fitness over the years is that going to the gym 3 times a week for 40 minutes hardly moves the needle. If you can do that plus walk a lot every day then the weight starts to comes off. Given that I’m 2.5 stone (c.16kgs) lighter than I was 12 years ago I may bring out a fitness video in time for next Xmas. I confess that 1 stone of that came in 1 month just by cutting back alcohol intake massively at the start. That progress positively stunned me and has meant I’ve kept at around 10 units a week (save the odd blow out) for well over a decade now. It’s a bit dull and the younger me would find me very boring but it has meant that at no point have I cut back on enormous portions of food. So also look out for the (no) diet book for next Xmas as well then.

Markets don’t seem to be on a diet either at the moment as the bull run for equities showed no sign of slowing down yesterday as US stocks climbed to yet more record highs thanks to positive data and earnings releases (including decent data from China overnight – more later). It was a strong day across the board, with the S&P 500 (+0.84%), the NASDAQ (+1.06%) and the Dow Jones (+0.92%) all advancing to new highs. In the process Alphabet (+0.8%) became the fourth global member of the trillion dollar market cap club alongside Microsoft ($1.27tn), Apple ($1.38tn) and Saudi Aramco ($1.8tn). Amazon is the next cab off the rank having got very very close last year (reached it intra-day) but is now c.7% below that mark.

Although tech shone yesterday, the top performer in the S&P 500 was Morgan Stanley, which rose +6.61% following a strong set of earnings. The bank reported net income in Q4 of $2.2bn, up 46% compared with Q4 2018. Meanwhile net revenue of $10.9bn was also up +27%, beating estimates of a $9.7bn reading.

In Europe, the STOXX 600 closed up +0.22% at its own record high albeit only around 5% above the peaks in the summers of 2000 and 2007. So not much above where it was 20 years ago albeit with dividends having been paid. From the same market peaks the S&P 500 has more than doubled.

The risk-on sentiment spread across asset classes, with oil rallying yesterday, as WTI (+1.35%) and Brent crude (+0.81%) both performed strongly. Treasury yields also pushed higher following a strong set US data out yesterday, with 10yr yields up +2.44bps to 1.807%, while the 2s10s curve steeped by 1.4bps. That said, sovereign debt had a more varied performance in Europe, with the core countries seeing yields fall, including Bunds (-1.8bps), OATs (-1.1bps) and Gilts (-1.1bps), while in the European periphery all saw yields rise, with Italian (+3.5bps) and Spanish (+1.4bps) debt losing ground. BTP futures rallied back a bit just after the close as Italy’s constitutional court rejected the election law referendum. It’s a big few weeks in politics in Italy. For more on this see our latest research here.

In terms of those data releases from yesterday, the Philadelphia Fed manufacturing business outlook survey came in well above expectations, with the current general activity index up to 17.0 (vs. 3.8 expected), its highest level since May. Furthermore, the 6-month ahead general activity index rose to 38.4, its highest level since May 2018, suggesting a decent degree of optimism about the coming months. Given the area includes much of Pennsylvania, an important swing state narrowly won by President Trump in 2016, those numbers may be welcome news for his re-election campaign.

We also got a strong set of weekly initial jobless claims, at 204k last week (vs. 218k expected), which is the second-lowest reading since April 2019. The reading also sends the 4-week moving average down to 216.25k, its lowest since the start of November. Finally, retail sales rose +0.3% in December, in line with expectations, while the ex-autos reading was up +0.7% (vs. +0.5% expected), so a solid set of data overall notwithstanding some slight revisions to earlier retail sales.

Speaking of helpful developments for President Trump, just one day after the Phase One deal with China was signed, the US Senate passed the USMCA trade agreement yesterday in an 89-10 vote. The agreement will now head to President Trump’s desk for signing.

Overnight in Asia, markets are mixed with the Nikkei (+0.47%) and Shanghai Comp (+0.09%) being up while the Hang Seng (-0.03%) and Kospi (-0.06%) are making marginal loses. Elsewhere, futures on the S&P 500 are trading flat. More importantly we saw China’s monthly data dump. Going through it, Q4 GDP was in line with consensus at +6.0% yoy and YTD Q4 GDP came in one tenth lower than consensus at +6.1% yoy. Other data surprised on the upside with December industrial production coming in at +6.9% yoy (vs. +5.9% yoy expected) and retail sales printed at +8.0% yoy (vs. +7.9% yoy expected) while YTD fixed asset investment excluding rural came in two tenths higher than consensus at +5.4% yoy. So overall a strong set of December numbers came out from China pointing to a gradual recovery in economic activity.

In other news, the US Labour Department confirmed reports from earlier in the week that it will ban computers from the room where journalists receive advance access to major economic reports such as employment and inflation figures in an effort to ensure a level playing field. So don’t expect full stories immediately on the release of data anymore. The change will take effect from March 1. Elsewhere, Bloomberg reported that the US treasury will start issuing new 20 year bonds in the first half of 2020. Yields on 10y USTs are up +1.0bps overnight.

Back to yesterday and we also had the minutes released from Lagarde’s first ECB meeting in December yesterday. In terms of the key takeaways, it was clear that the Governing Council was happy with the monetary policy stance, with the minutes saying that “members widely agreed with the proposal … to keep the monetary policy stance unchanged, with a steady hand being warranted for monetary policy.” Notably, there seemed to be an increasing awareness of the side effects of policy, which were mentioned 5 times in the minutes, up from 1 at Draghi’s last meeting. So clearly something being thought about by the ECB. And we also had a paragraph on issues of climate change, with “members contending that there was a need to step up efforts to understand the economic consequences of climate change.”

Looking at the day ahead, we have a number of data releases coming out. In Europe, there’ll be the Euro Area’s current account and construction output for November, along with December’s CPI and core CPI, while from the UK we’ll get December’s retail sales. Over in the US, there’ll be December’s housing starts, building permits, industrial production and capacity utilisation, November’s job openings, and January’s preliminary University of Michigan sentiment reading. We’ll also hear from the Philadelphia Fed President Harker, who’ll be discussing the economic outlook.

d

Tyler Durden

Fri, 01/17/2020 – 07:38

via ZeroHedge News https://ift.tt/30vPrd5 Tyler Durden