“The 1999 Question”: When Will The Fed Put An End To What BofA Calls An “Irrational Bull Phase”

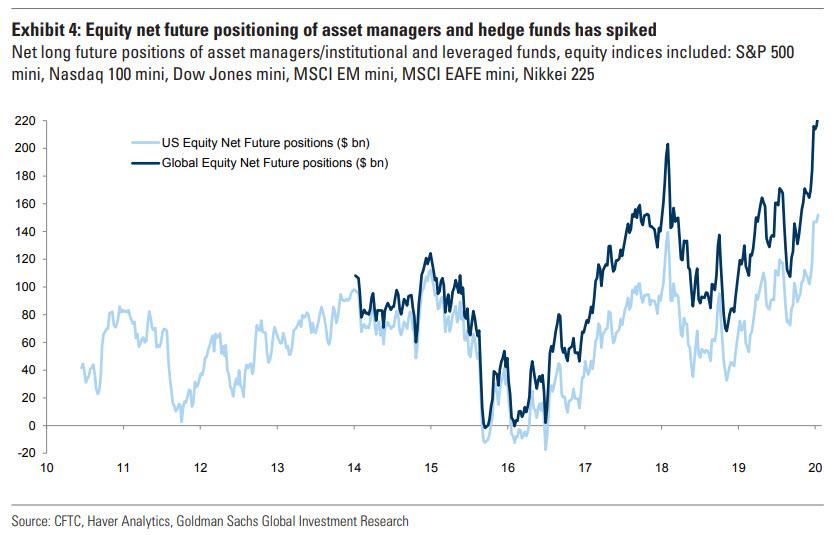

While it remains to be seen if the Wuhan coronavirus epidemic is finally the mutating “black swan” that puts an end to the thunderous market rally unleashed by the Fed last September, with the launch of repo injections and and Bill purchases, one thing is clear: coming into this week, we had “never before seen market complacency” as everyone – from hedge funds, to risk-parity, to CTA, to retail investors – had gone “all in” the stock market.

And it is this unprecedented euphoria, last seen during the first tech bubble which culminated with the bursting of the dot com bubble, that prompted today BofA’s Chief Investment Strategist, Michael Hartnett, to ask what he called “the 1999 question”, namely what level of irrational exuberance on Wall Street causes Fed to tighten?

Assuming that next week the Fed makes no changes to its policy and signals “carry on liquidity”, greenlighting a continuation of the “irrational bullish phase” into Q1 (which is the most likely outcome, alongside a modest 5bps hike to the IOER rate in a reversal of the cuts made to this rate over the past year) Hartnett notes that two decades ago, the first “1999 tech bubble” hike in the Fed funds rate occurred in June’99, just as Nasdaq soared 30% above its 200dma. That would equate to roughly 10,600 today!

Assuming a simple straight-line correlation, this would equate to roughly 3,600 in the S&P500.

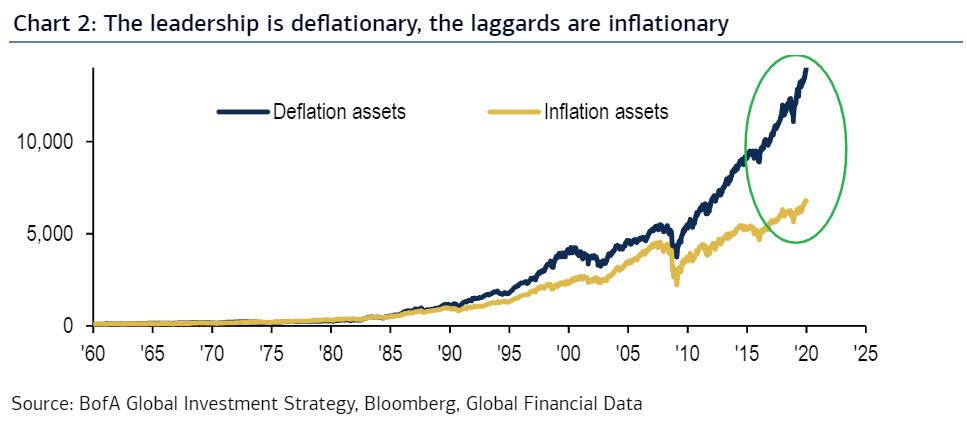

Whether Powell, who back in 2012 admitted that the Fed is “actually at a point of encouraging risk-taking”, and that “we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy”, will wait that long before he bursts the third consecutive Fed-inflated asset bubble remains to be seen. However, what remains a bizarre consequence of the Fed’s market manipulation, is that for the 10th consecutive year, equity leadership remains deflationary and laggards are inflationary…

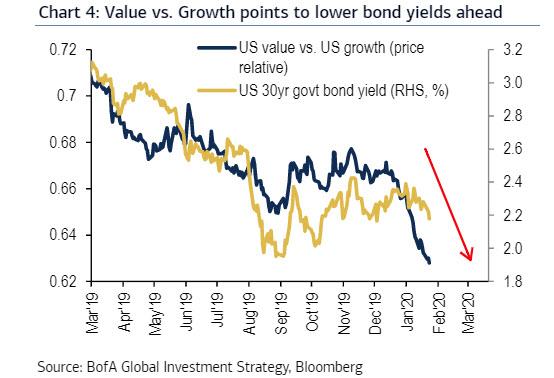

… to wit, US growth stocks are outperforming US value stocks by 633bps since the 30Y yield failed to breakout >2.4% in early-Nov; here Hartnett notes the stark contrast between the S&P500, the 30Y TSY, and the value/growth ratio since the fall of 2019:

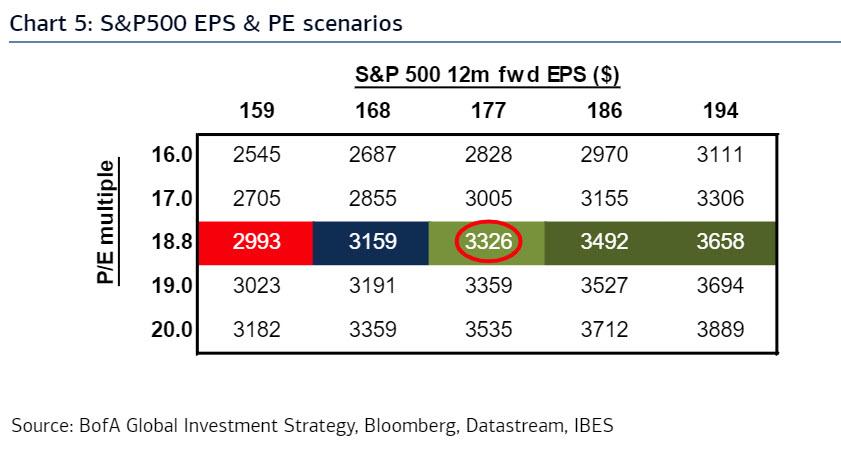

And while we await to see if the Fed will take this 1999 comp to its maximum possible extreme, any question whether the current meltup is greater than that of Jan 2018 can now be answered: as Hartnett notes, the S&P’s PE ratio of 18.8x surpassed the Jan’18 high this week…

… and giving the bulls some more chum, Hartnett also notes that if one applies the peak tech bubble 1.0 PE of 25x to the current S&P500 fwd EPS $177 results in peak bubble 3.0 S&P500 of 4,415, up 33% from here. That said, Hartnett does not think it gets that far, no matter what Trump says, and as the BofA CIO puts it, “we would buy puts as SPX approaches 3,500 (PE 20x).”

Tyler Durden

Fri, 01/24/2020 – 14:16

via ZeroHedge News https://ift.tt/38GEPLf Tyler Durden