The ‘Golden Age Of Plastic’? Banks Are Quietly Raising Credit Limits For Freespending Borrowers

Credit-card lenders are calling it the ‘Golden Age of Plastic’. But that’s mostly because they’re the ones hoarding all the gold.

Gloom-and-doom economists who have portended the imminent collapse of the American consumer (we don’t want to name names) might have a reason to put off their calls for a downturn of epic proportions just a little bit longer. Because at a time when the American consumer is already leveraged to the hilt, and when credit data suggests some are finally biting the bullet and curbing spending to pay it down, lenders have hit on a novel strategy to boost growth.

And that strategy is, according to Bloomberg, raising certain borrowers’ credit limits without a request from the borrower. In other words, some consumers are waking up to notices or emails from their credit-card lenders informing them that their credit limits have just been raised – sometimes by a wide margin.

Capital One CEO Richard Fairbank told BBG that the company’s resistance to unsolicited credit-limit hikes is a “radical theology” because it goes above and beyond post-crisis safeguards. But now that lenders are being pressed to keep showing revenue growth at a time of record excess, Capital One has changed its mind with the explicit goal of trying to convince consumers to borrow more that they can afford to pay back – or at least not all at once.

Of course, while debt-fueled spending registers as growth in the all-important consumption metrics, there will eventually come a time when they debt must either be repaid, or written off.

“It’s like putting a sandwich in front of me and I haven’t eaten all day,” said D’Ante Jones, a 27-year-old rapper known as D. Maivia in Houston who was close to hitting the ceiling on his Chase Freedom card when JPMorgan Chase & Co. nearly doubled his spending limit a year ago without consulting him. He soon borrowed much more. “How can I not take a bite out of it?”

Banks insist that they raise credit limits “carefully”, and that they limit reckless borrowing.

But at this point, anybody who does make the mistake of carrying a balance is going to get hurt.

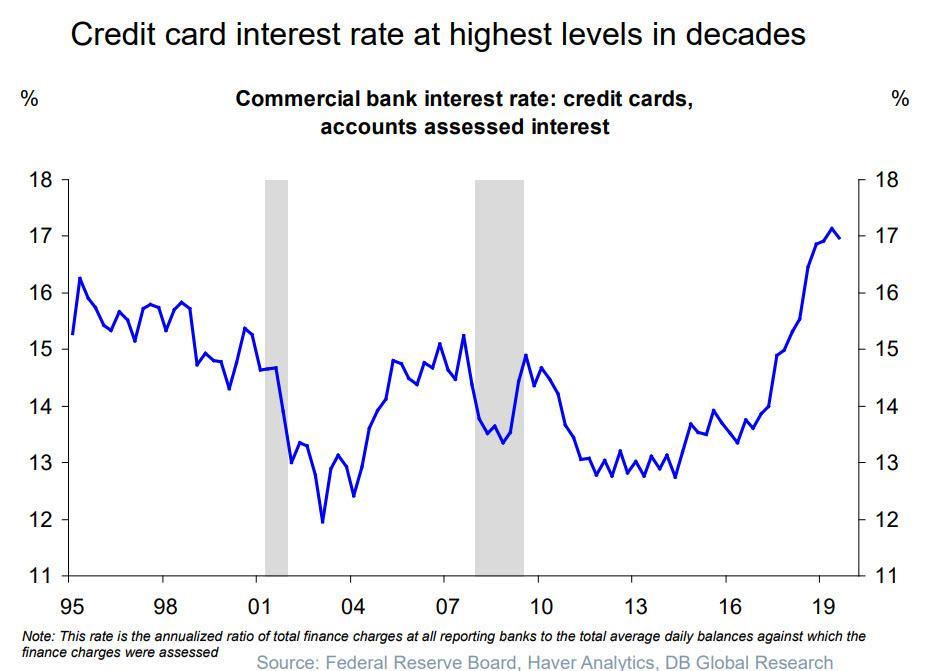

As we pointed out last month, something strange happened after the Fed started cutting interest rates again last year. While lenders were quick to lower the deposit rates they paid out to customers, interest rates on credit cards and other loans climbed, while the rates on credit cards hit all-time highs. It’s a trend we’ve documented before.

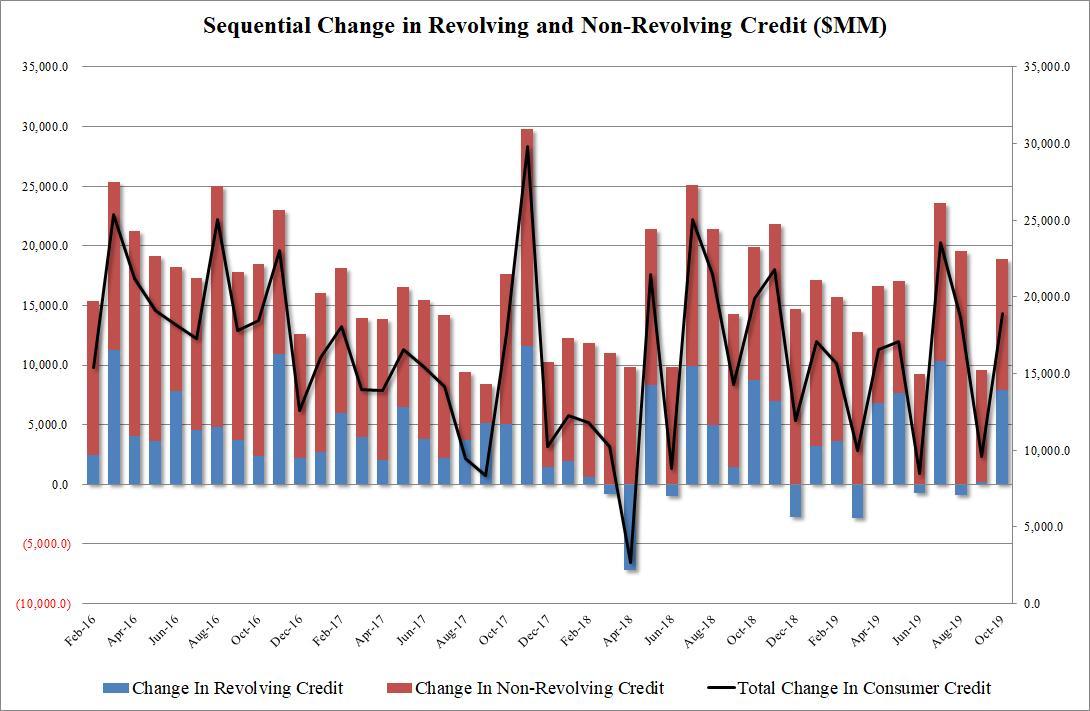

Revolving credit outstanding (i.e. credit card debt) cooled in the fall after a surge in July and a near record surge in August. And total outstanding credit-card borrowing hit a record $880 billion at the end of September, according to the New York Fed…

…but the problem here is that this is a double-edged sword. Because if American consumers really are finally cutting back on their spending to pay down debt, this would be bad news for the consumer-dependent economy.

Ironically, around the same time that Bloomberg published their story, Discover saw its biggest crash since the financial crisis on the highest Q4 charge-off rate in history.

So maybe giving irresponsible borrowers even more rope to hang themselves with wasn’t the best strategy.

Tyler Durden

Sat, 01/25/2020 – 22:30

via ZeroHedge News https://ift.tt/38FL4ic Tyler Durden