Pandemic-onium Sparks Global Market Meltdown, Bonds Soar Most In 5 Years

After months of cool, calm, and collected risk-on rallies, January saw traders shit the bed as BTFD strategies faltered across every asset-class…

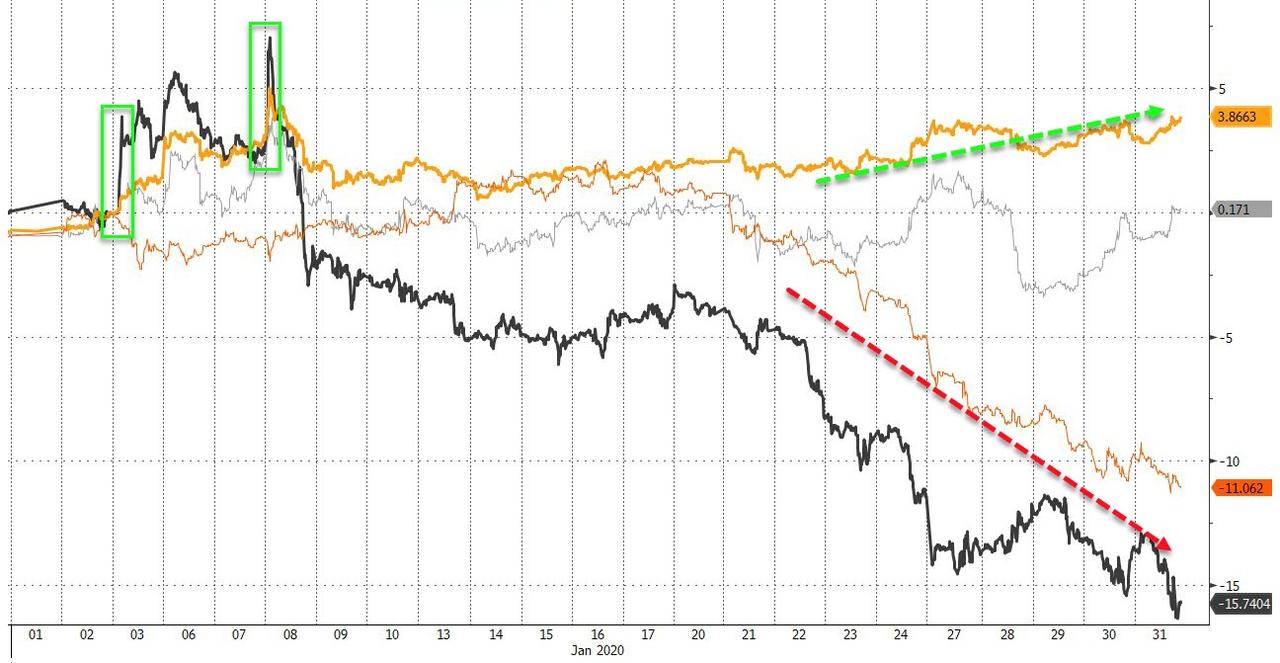

…as The Fed balance sheet stopped expanding…

Source: Bloomberg

How bad was January?

-

US Stocks worst start to a year since 2016

-

China stocks (futures) worst start to a year since 2016

-

UK Stocks worst start to a year since 2014

-

Biggest January jump in VIX since 2014

-

Treasury yields biggest January drop since 2015

-

Yield curve flattened 2nd most in four years

-

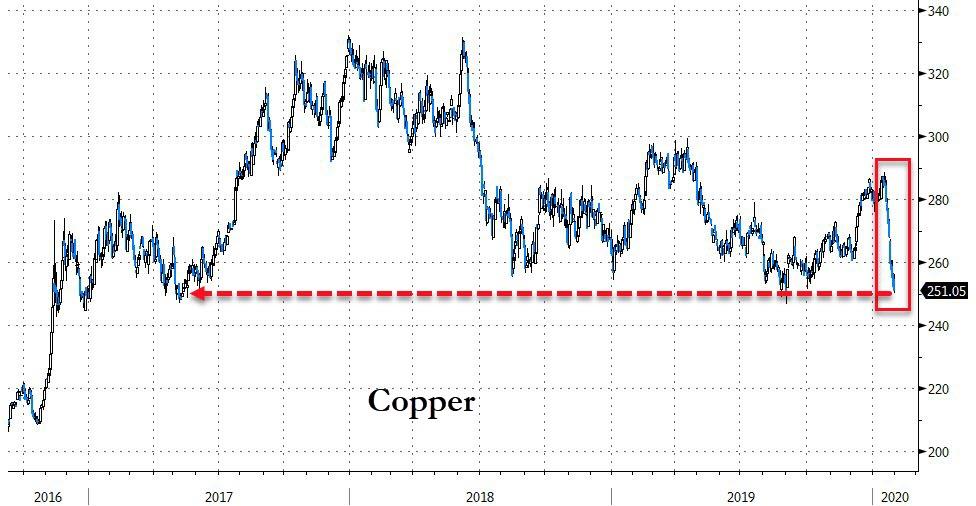

Copper’s worst start to a year since 2015 (and worst losing streak in history)

-

WTI’s worst start to a year since 1991

-

Gold’s best start to a year since 2017

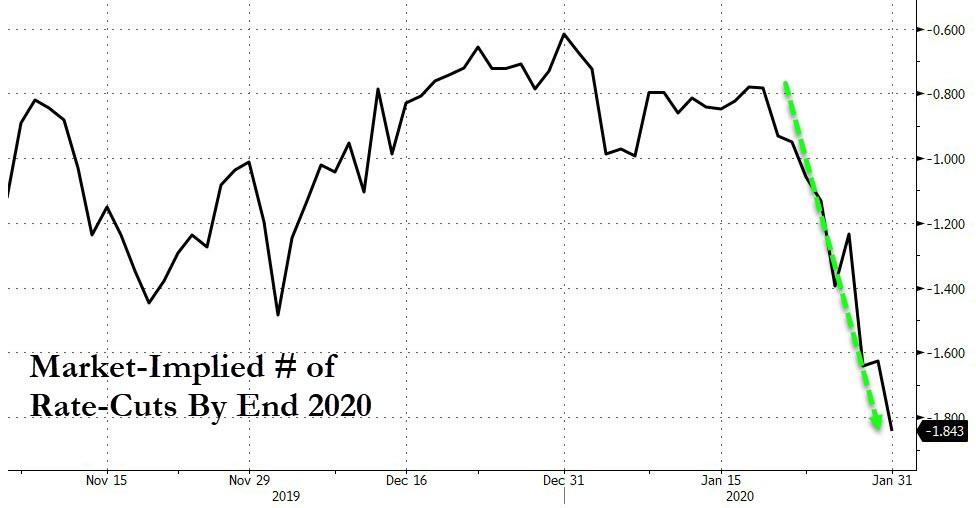

And as stocks and industrial commodities plunged, so the rates market panicked and started to price in almost 2 rate-cuts in 2020 – Please Jay Powell, save us!!

Source: Bloomberg

Chinese markets have been shut all week but judging by A50 futures, the Shanghai Composite is set to open down 350 points (about a 12% drop)

Source: Bloomberg

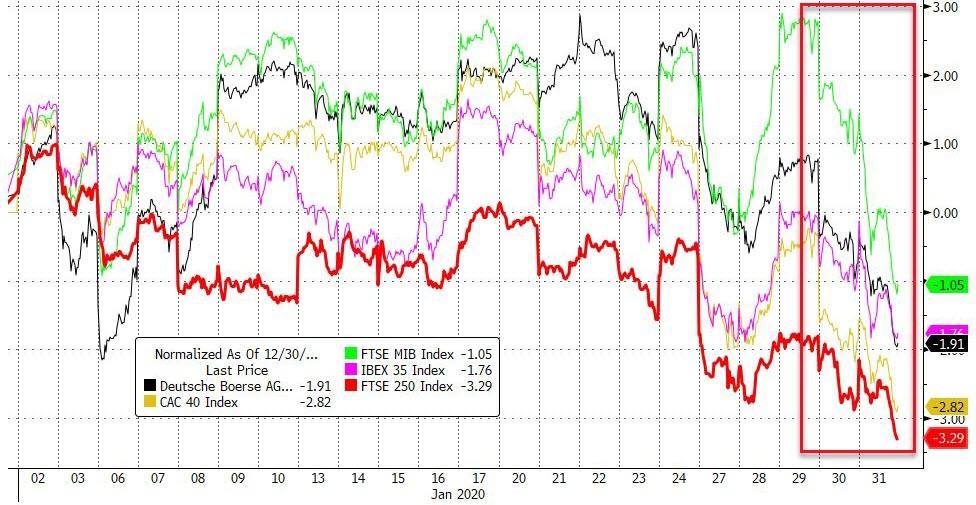

Europe was red across the board with UK’s FTSE worst as Brexit Day finally arrives…

Source: Bloomberg

“Dead-Bat-Bounce” Dies.

US markets ended the month on an escalatingly ugly note with The Dow joining Trannies and Small Caps in the red for the month and the S&P clinging to unchanged…

The final pumpathon from the Task Force was desperate to get the S&P back above 3230.78 – positive for the year…

Things could have been worse – AMZN saved the Nasdaq and S&P from worse days, and IBM saved The Dow from being even uglier.

AMZN joined the ‘cuattro comas’ club…

Source: Bloomberg

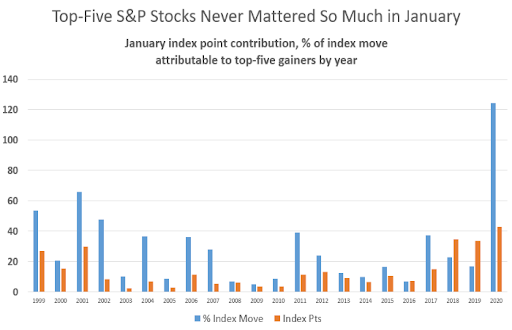

Notably, 2020’s top-five S&P 500 gainers contributed more points to the index than in any other January going back to 1999.

Source: Bloomberg

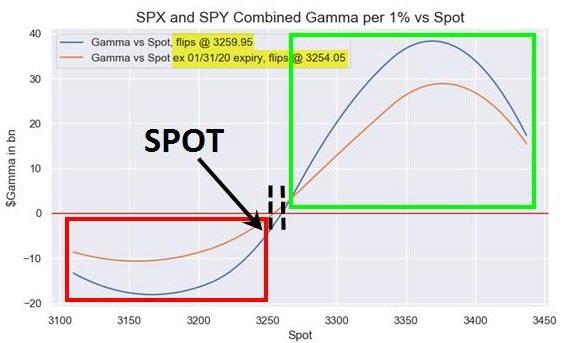

Notably stocks really accelerated as prices dropped through their peak exposure and gamma flipped negative…

All the US majors fell back through to to crucial technical levels…

Dow futures plunged over 600 points back near the Iran Missile Strike spike lows from early January…the Strike Force press conference at the end of the day was used to manipulate prices off the lows

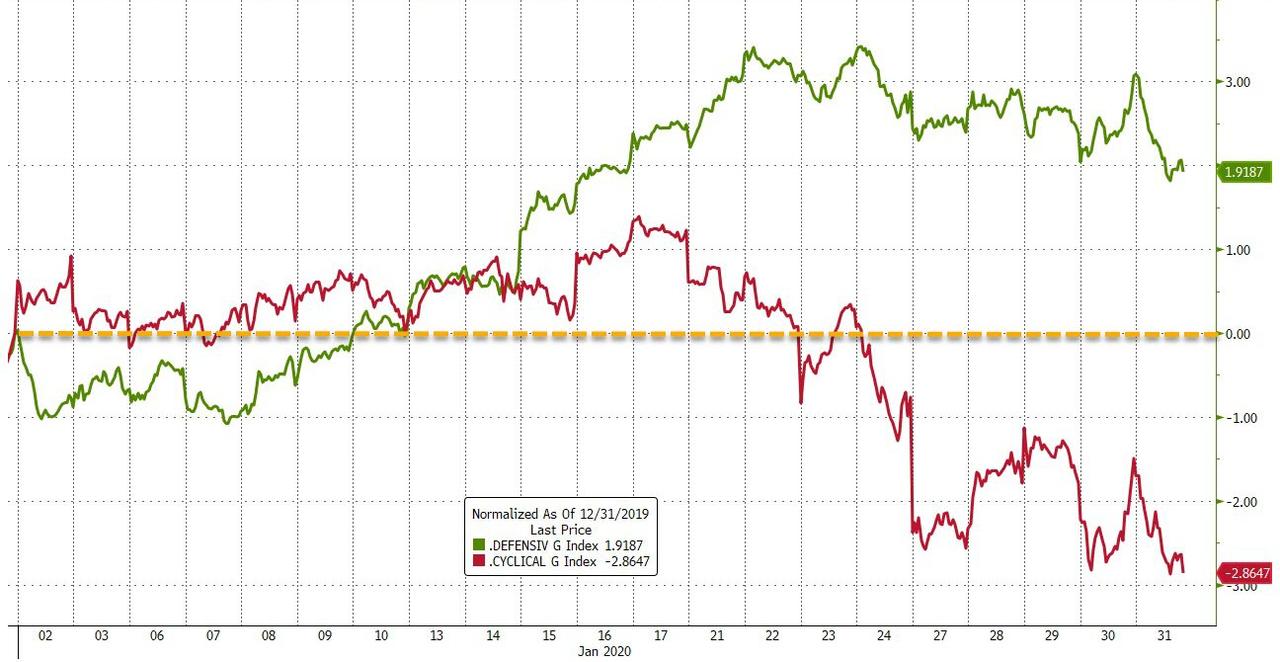

Defensives ended the month in the green while cyclicals were hit hard late on…

Source: Bloomberg

VIX soared above 19 today – highest since October 10th…

Source: Bloomberg

And both equity and credit protection costs soared in the last week…

Source: Bloomberg

HY Bond prices had their worst month since May 2019…

Source: Bloomberg

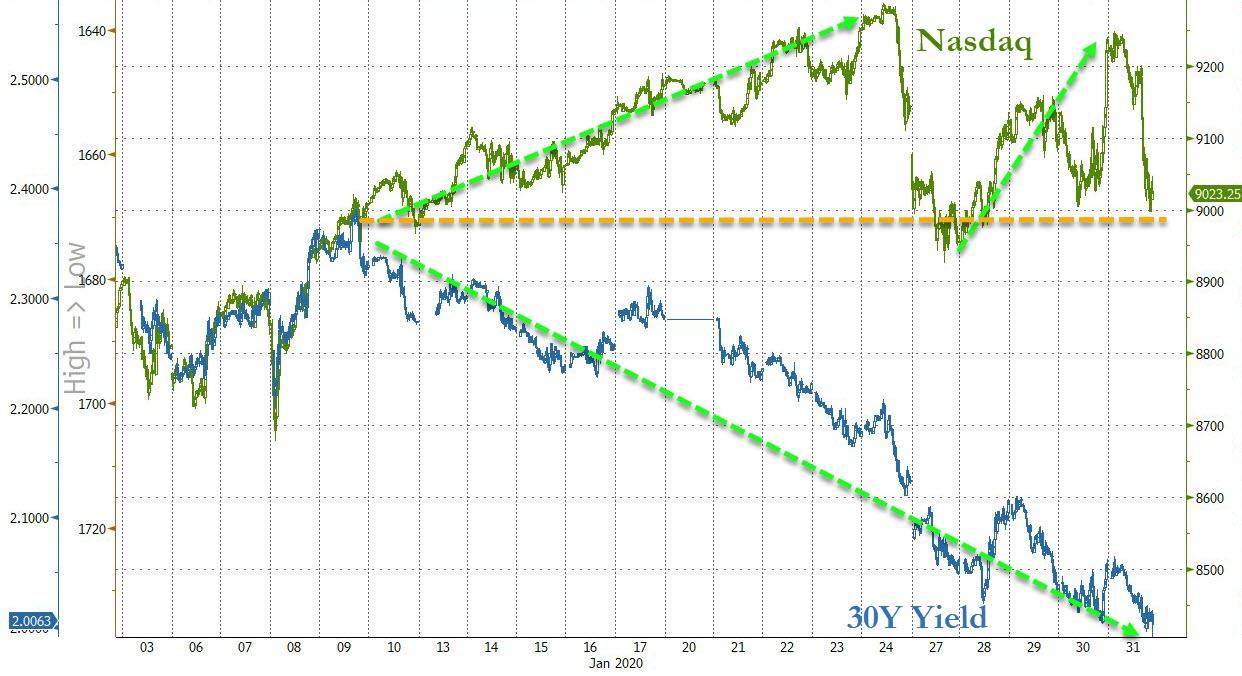

But the decoupling between bond yields and stocks this month was farcical…

Source: Bloomberg

Treasury yields tumbled this week (and month)…

Source: Bloomberg

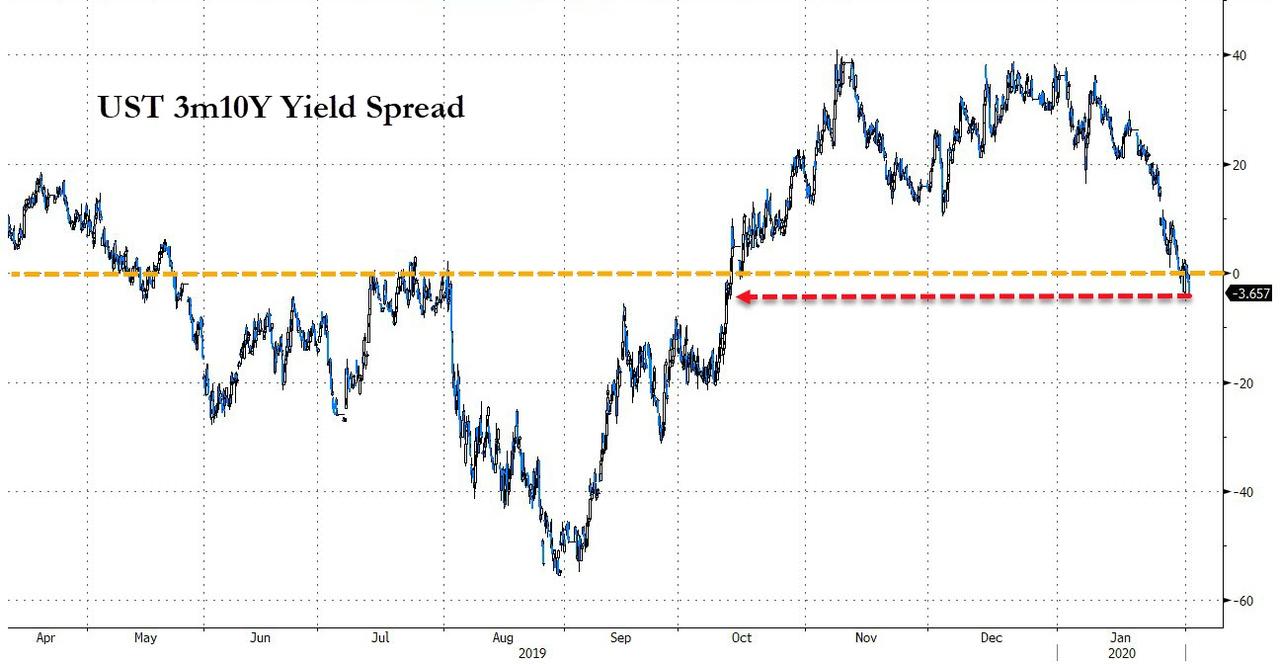

Don’t worry though…

-

Clarida: Drop in Long-Term U.S. Treasury Yields Reflects Global Uncertainty

-

Clarida: “I’m Not Today Concerned About the Inverted Yield Curve”

30Y Yields broke below 2.00%…

Source: Bloomberg

2Y Yields plunged to their lowest since Sept 2017…

Source: Bloomberg

The yield curve flattened massively in January – the second biggest monthly drop since Jan 2016 – 3m10Y flattened 40bps and is back inverted…

Source: Bloomberg

And finally, January saw negative yielding debt jump over 20% (almost $2.3 trillion) – most since Aug 2017…

Source: Bloomberg

The Dollar dumped today but ended the month higher…

Source: Bloomberg

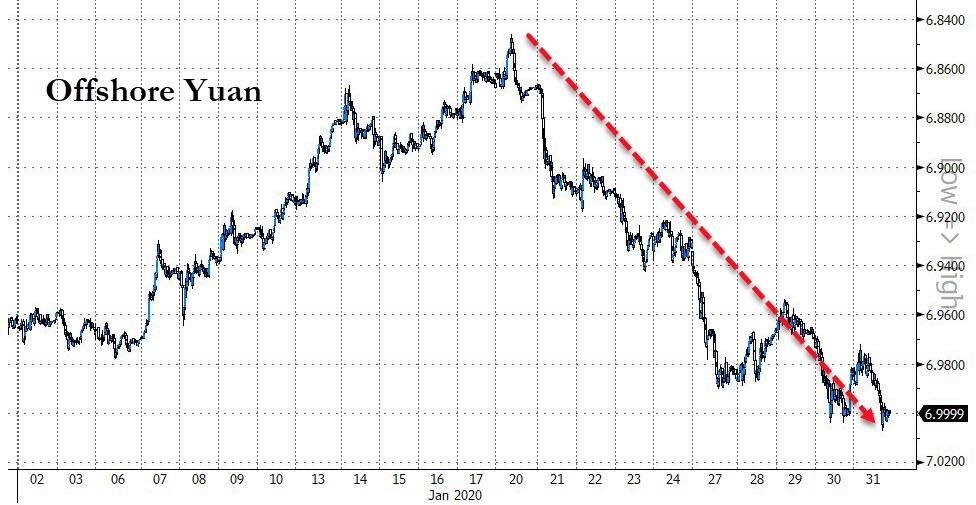

Offshore Yuan fell on the month, its first monthly drop since August, back to the crucial 7.00 level…

Source: Bloomberg

Cryptos had a huge January with Bitcoin up over 30% – best month since June…

Source: Bloomberg

Crude and Copper were clubbed like baby seals in January, Gold managed gains…

Source: Bloomberg

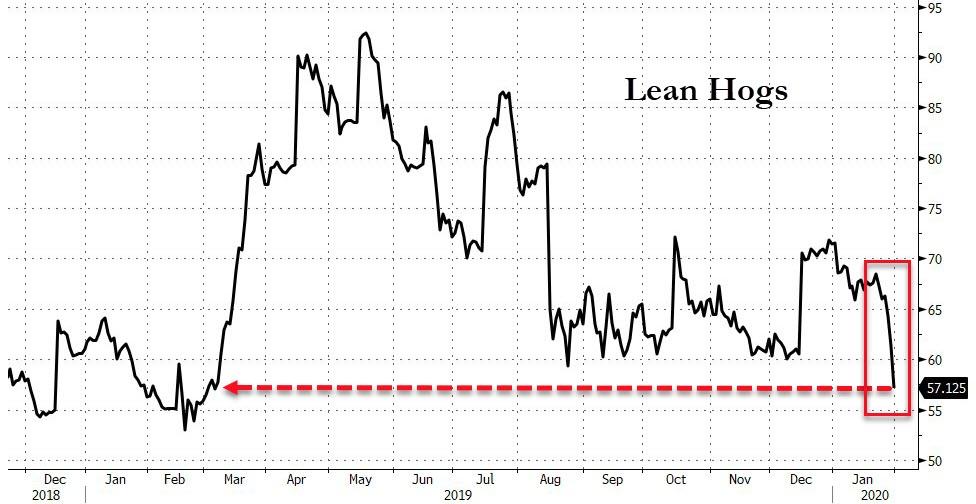

Lean Hogs collapsed…

Source: Bloomberg

Soybeans crashed…

Source: Bloomberg

Copper Carnage…

Source: Bloomberg

WTI tumbled to a $50 handle intraday – a critical support level…

Source: Bloomberg

Gold jumped back up near $1600…to its highest close since March 2013

Source: Bloomberg

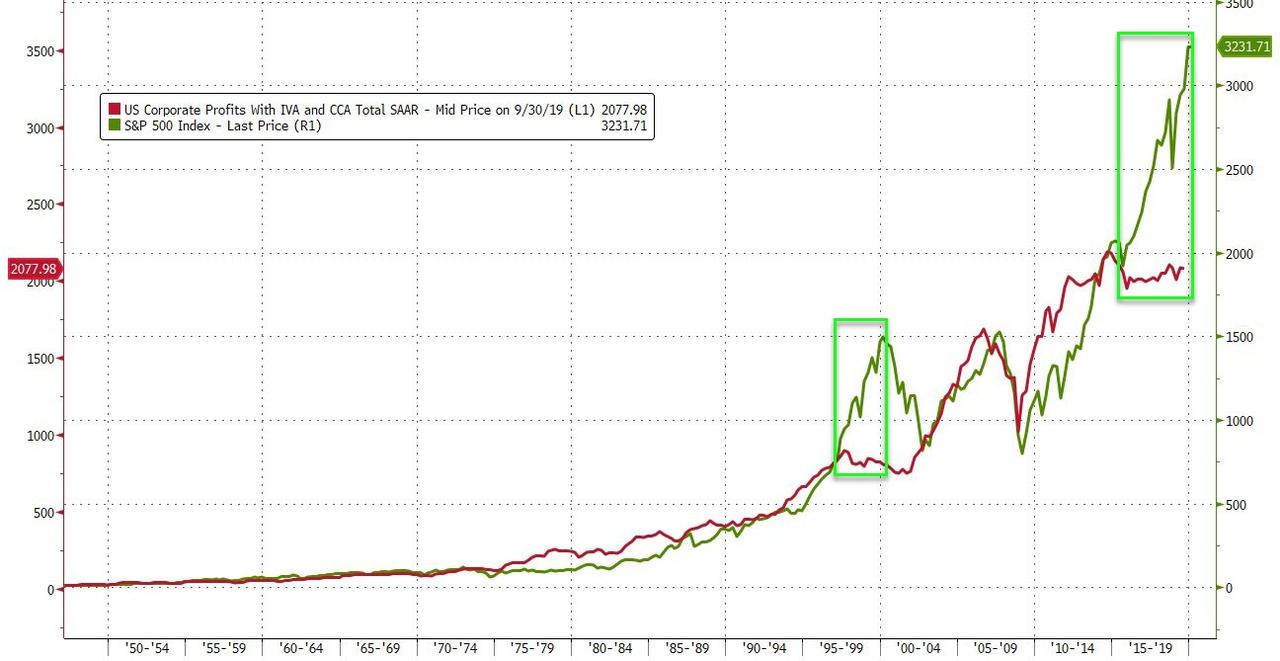

Finally, don’t forget that none of this decline should surprise you – did it really take a global pandemic to reintroduce some market rationality?

Source: Bloomberg

And if Dr.Copper is right, the global economy is in for some serious turbulence…

Source: Bloomberg

Reminder – one week ago in Davos, Ray Dalio told the world that “cash is trash!”

Tyler Durden

Fri, 01/31/2020 – 16:01

via ZeroHedge News https://ift.tt/2uUHDG4 Tyler Durden