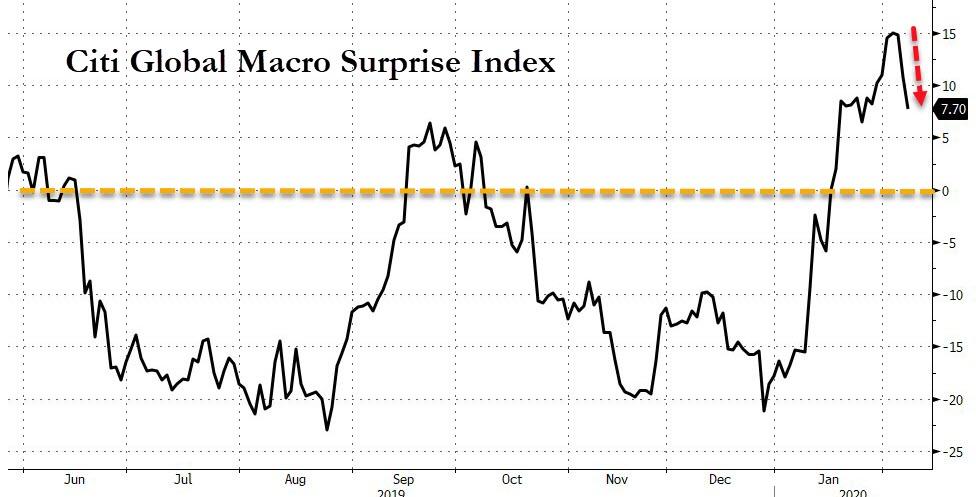

Global Stocks Soar To Record Highs As Unprecedented China Liquidity Trumps Pandemic-Panic

Despite 2020’s first weekly slump in the global economic surprise index (cough Germany cough) and the spreading deadly pandemic crushing global supply chains…

Source: Bloomberg

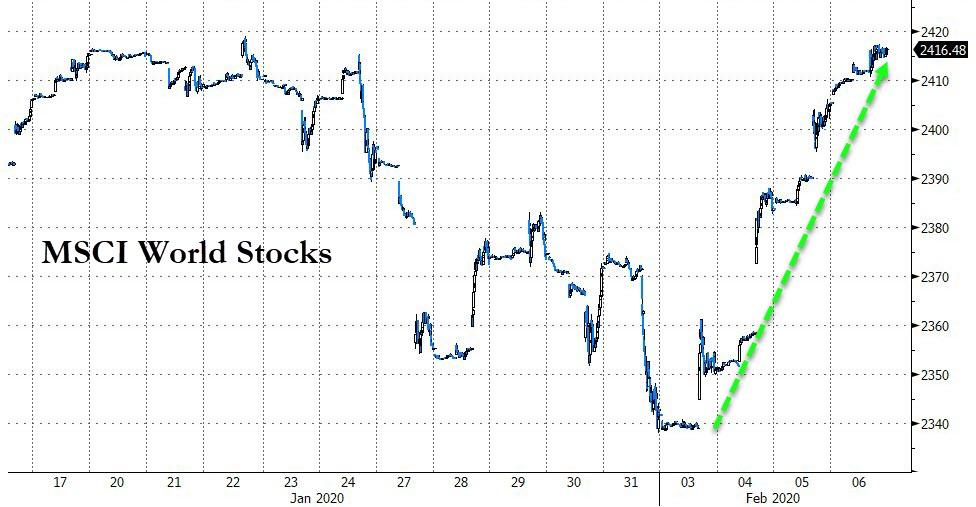

The world’s stock markets exploded this week…

Source: Bloomberg

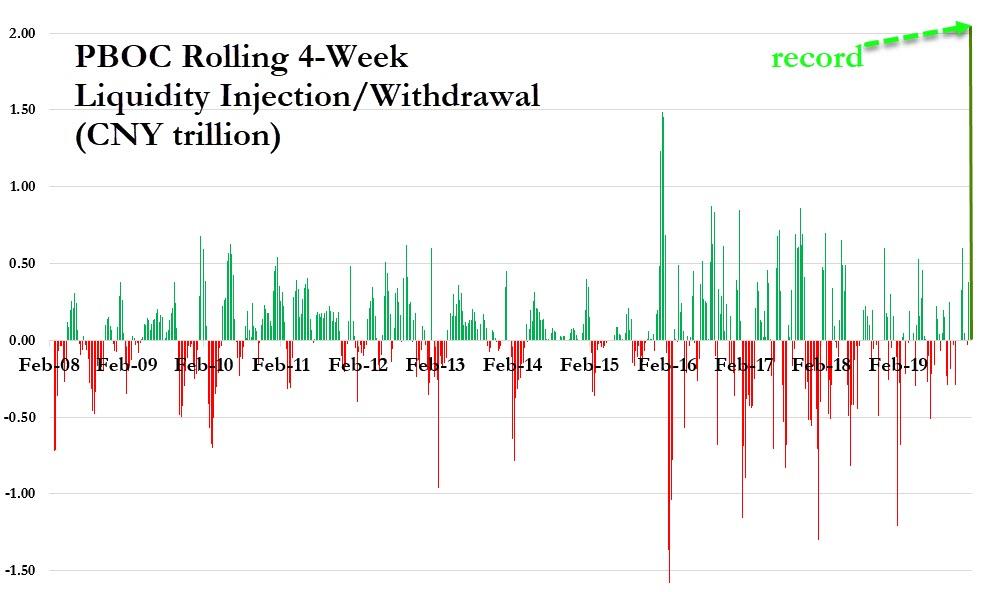

Thanks to an unprecedented flood of “all liquidity is fungible” cash from China…

And that liquidity water-boarding, jedi-mind-tricked the world into believing that the worst is over…

It’s not, just ask Bonds!

Source: Bloomberg

China’s ChiNext (small-cap-tech dominated) exploded higher after the re-opening crash on Monday and while the rest of the major Chinese markets ended lower, they were all well off those opening lows…

Source: Bloomberg

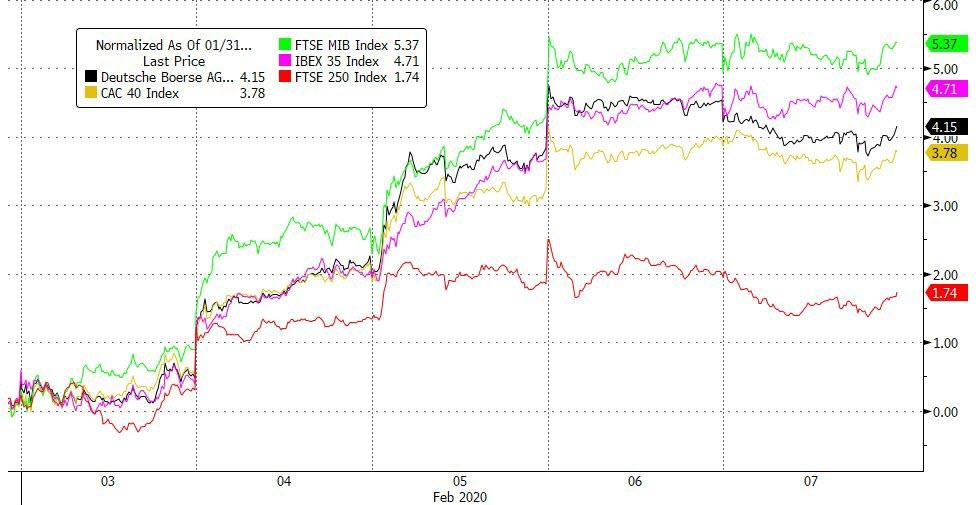

All major European markets were higher – despite disastrous economic data…

Source: Bloomberg

US markets were all dramatically higher this week (even with today’s selloff)…

Nasdaq had its best week since Nov 2018, but breadth is notably divergent…

Source: Bloomberg

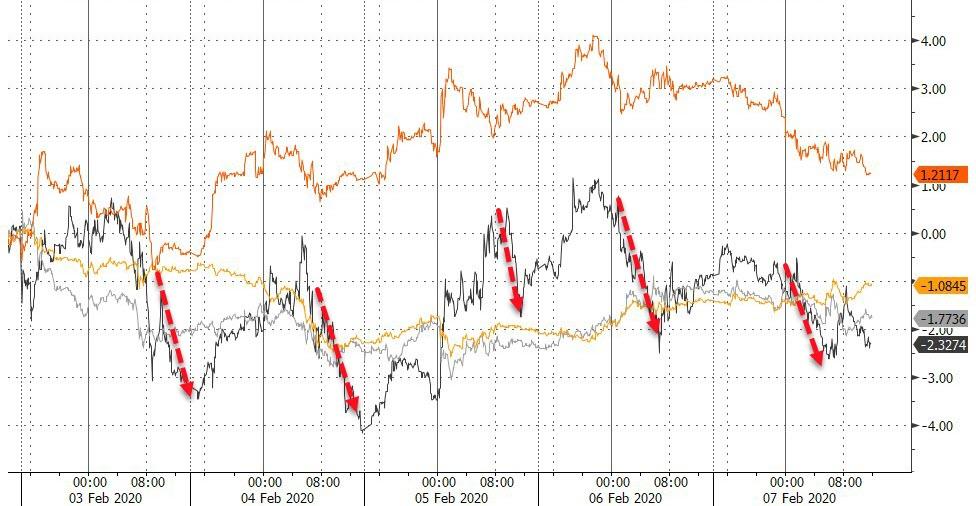

After 4 big days of short-squeezes, today saw the machines run out of ammo…

Source: Bloomberg

Even with the plunge of the last few days, TSLA was still up around 15% on the week – its 10th weekly rise in a row…

AAPL slid today as they extended their store closures across China…

But remains above $1 trillion market cap as the MAGA 4 soar…

Source: Bloomberg

Cyclicals rallied hard this week but were unable to erase all the virus losses…

Source: Bloomberg

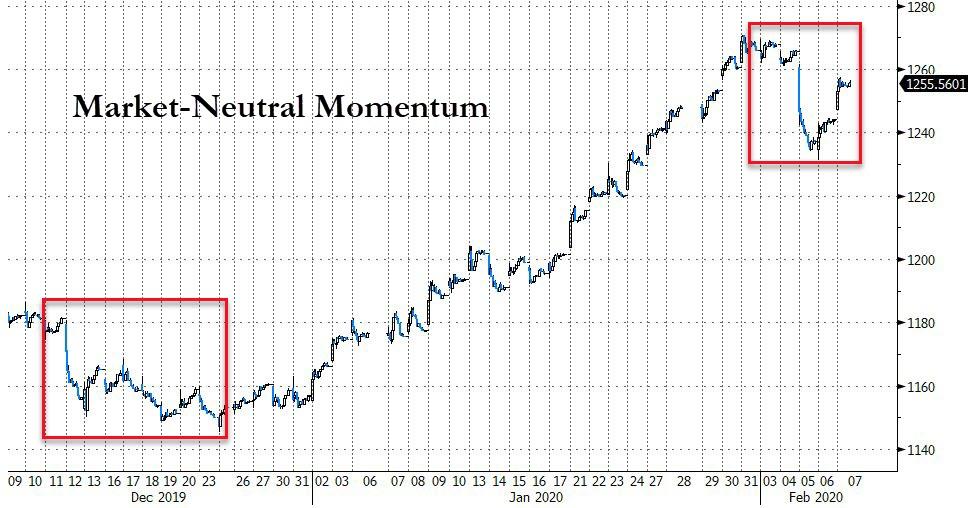

Momentum had its fits down week since mid-December

Source: Bloomberg

While stocks pushed to new record highs, VIX refused to follow to cycle lows…

Source: Bloomberg

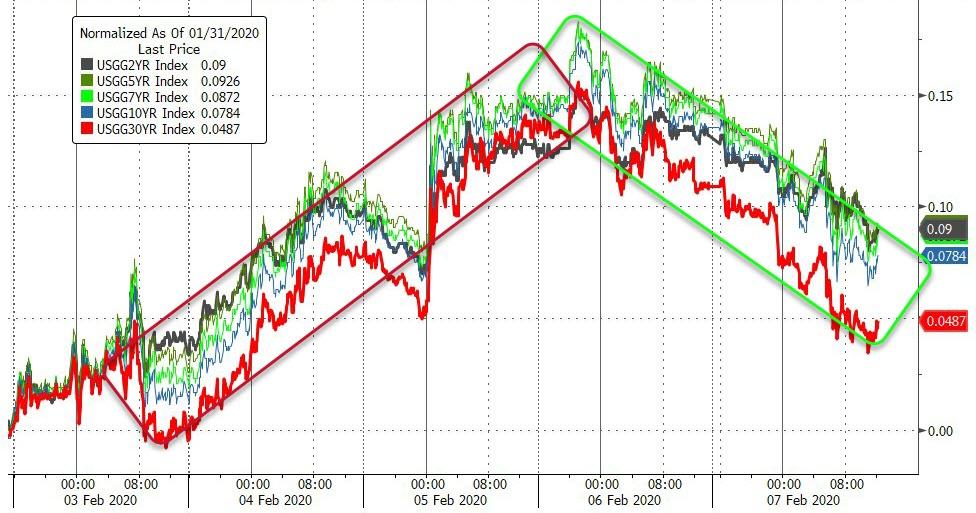

Treasury yields extended yesterday’s drop by plunging more today. Rates did end higher on the week but 30Y only +4bps (after being up 17bps midweek)…

Source: Bloomberg

The 30Y Yield has tumbled in the last two days…

Source: Bloomberg

The yield curve flattened back to 2020 lows this week…

Source: Bloomberg

This week’s equity rally seemed to lift the market’s desire for more dovishness from The Fed…

Source: Bloomberg

The Dollar has surged the last 3 days (and 4 of the 5 days in the week) to its highest since early December…

Source: Bloomberg

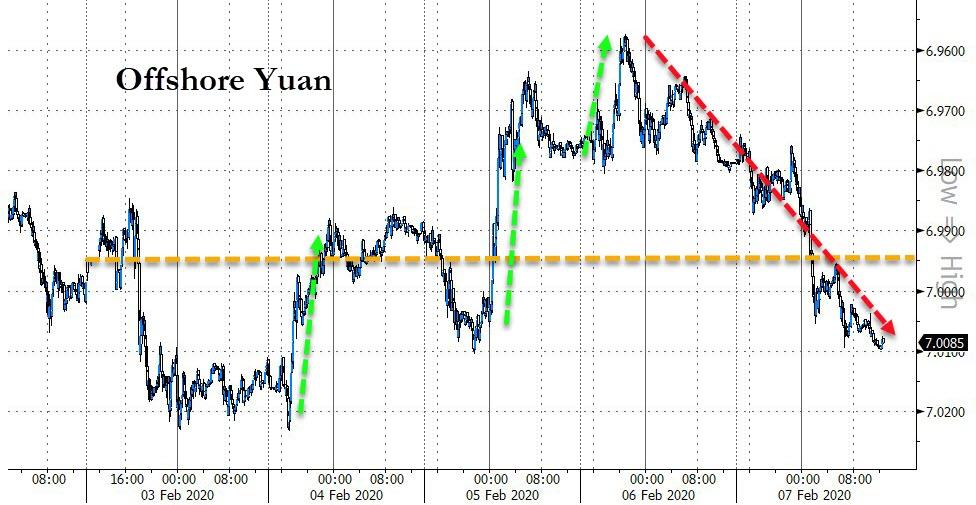

Yuan ended weaker on the week, falling back above the key 7.00/USD level…

Source: Bloomberg

Cryptos had a big week with Ethereum soaring over 20% to $220 (biggest week since May 2019)…

Source: Bloomberg

And Bitcoin is testing back towards $10,000…

Source: Bloomberg

Dollar strength did not help commodities this week with PMs lower and crude dropping in demand (and supply) concerns. Copper managed to hold on to gains…

Source: Bloomberg

WTI tested below $50 this week…

Source: Bloomberg

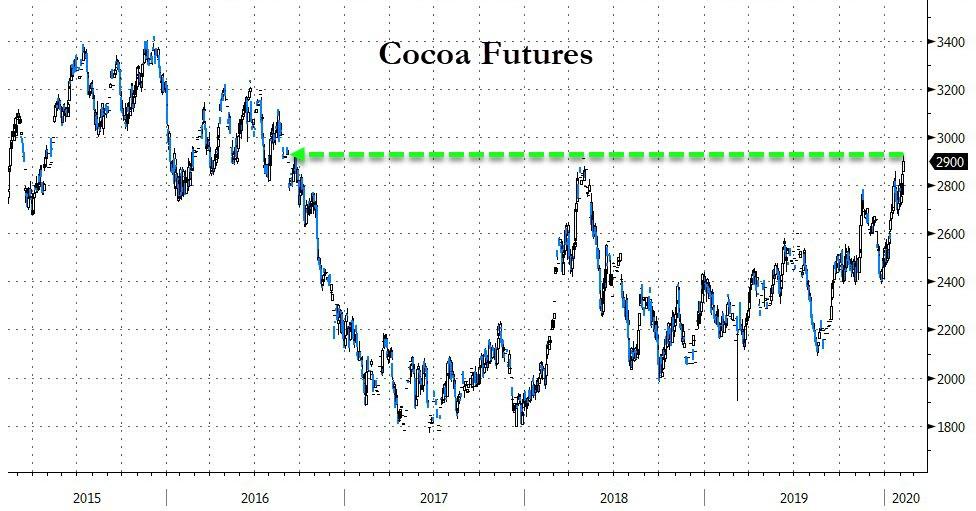

Perhaps most importantly, with Valentines Day just around the corner, the price of chocolate may be about to soar as Cocoa futures have surged about 15% in 2020 as a lack of rain in key production areas of West Africa, the world’s top supplier, is spurring concerns over yields.

Source: Bloomberg

So, finally, what happens next?

Source: Bloomberg

It’s a good job PBOC stepped in, because The Fed is done…

Source: Bloomberg

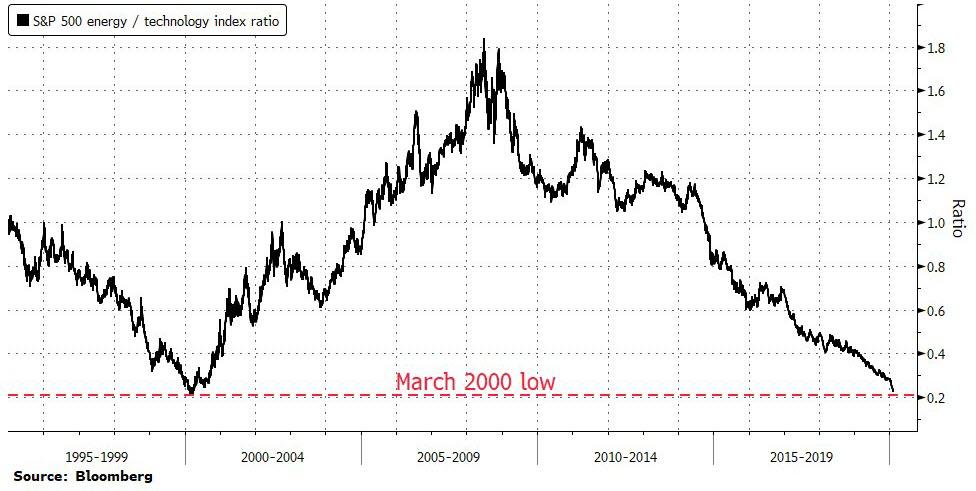

And is the great rotation (from Energy to Tech) over?

Energy producers have almost completed a 20-year round trip relative to technology companies within the S&P 500 Index. The ratio between their S&P 500 industry-group indexes fell this week to its lowest level since March 2000, when an Internet-driven bull market peaked.

Source: Bloomberg

Tyler Durden

Fri, 02/07/2020 – 16:00

via ZeroHedge News https://ift.tt/2SpxuJm Tyler Durden