Online Trading Academy Sued By FTC For Bilking Boomers Out Of $370 Million

An investment training program called Online Trading Academy (OTA) collected $370 million for classes over six years, misleading predominantly baby boomers in how to time the stock market.

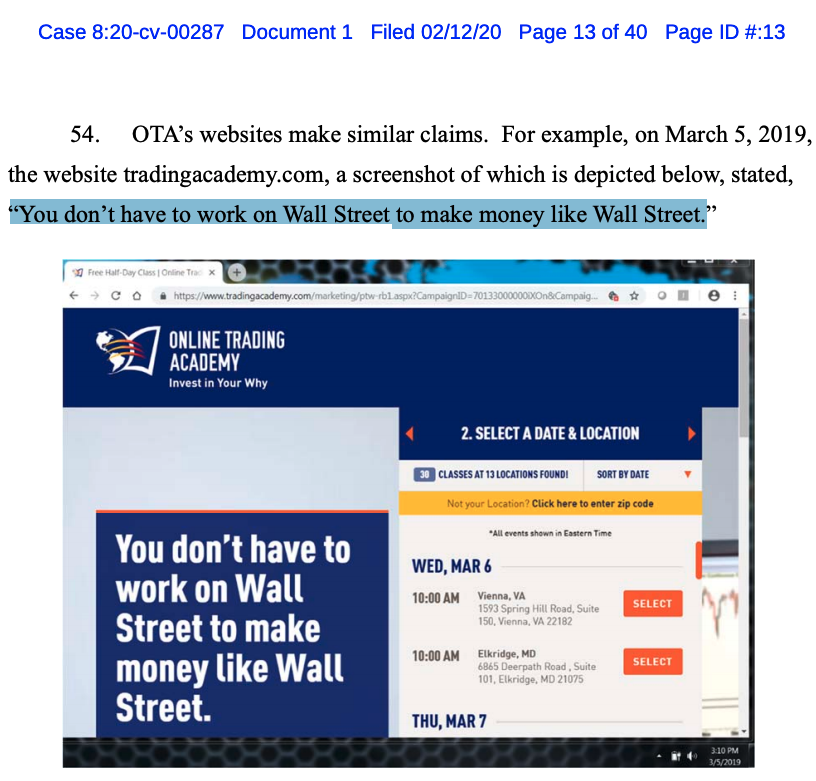

The Federal Trade Commission (FTC) on Wednesday, Feb 12, charged the California-based operation for overstating how easy it was to make money from their exclusive trading system.

The FTC said retirement-age students paid up to $50k for classes, with promises that these folks could “invest like the pros on Wall Street. No matter your experience and goals,” people were swindled out of tens of thousands of dollars by being told OTA had a “proven” strategy was “designed to make money in any market, whether it’s going up or down.”

OTA has ten academies plus 31 franchised locations across the country and in the United Kingdom, Canada, India, Singapore, Indonesia, and the United Arab Emirates.

The FTC alleges that OTA lured in potential boomers by enticing them with $299, three-day “orientation,” where sales agents would push more classes that would cost tens of thousands of dollars.

The FTC said OTA couldn’t support its claims of ‘trading riches’ – indicating that a company survey showed just 3% of people who responded claimed to be making “a lot of money,” 31% reported making “a little money,” and 66% said they were “making no money at all.”

“It is illegal to make earnings claims in marketing investment opportunities or training unless the seller has a reasonable basis for making such claims,” said Andrew Smith, director of the commission’s Bureau of Consumer Protection. OTA “used unfounded earnings claims to bilk Americans out of their savings.”

It should be noted that day trading for a living or gambling your retirement savings is a dangerous business.

A study from the Social Science Research Network titled Day Trading for a Living?, published last fall, found 97% of Brazilian day traders lost money.

The most successful day trading technique over the last decade has been crafted by the Federal Reserve flooding markets with an unprecedented amount of liquidity, resulting in the “buy the (f*cking) dip” (BTFD).

BTFD works well when the Fed is expanding its balance sheet, but as we found out on Thursday, term repo is expected to decline next month, so maybe BTFD becomes exhausted…

Tyler Durden

Fri, 02/14/2020 – 20:05

via ZeroHedge News https://ift.tt/2HlW1Kp Tyler Durden