U.S. Taxpayers Face $200 Billion Bill From Student Loan Forgiveness Plans

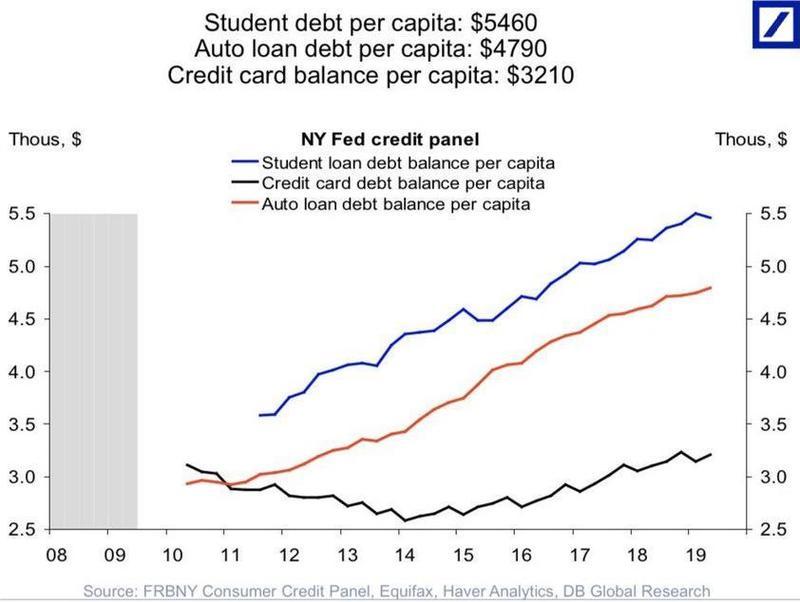

The student loan bubble continues to inflate.

It’s now a $1.64 trillion problem that has increased over 120% since 2009. Student loan balances equate to 7.6% of GDP. That’s up from 5.1% a decade ago.

Much of the millennial generation has insurmountable student debts that have prevented them from family formation, home buying, and growing savings. This has severely weighed on the economy, but it appears relief could be on the way, paid for by the U.S. taxpayer.

The Congressional Budget Office (CBO) said this week that a $207.4 billion student loan forgiveness program would help Americans who are unable to pay their debt through 2029.

The CBO said borrowers who attend graduate or professional schooling would benefit from the program the most.

The government is expected to forgive $167.1 billion of the total amount, and this includes the original loan amount and unpaid interest for borrowers over the period.

The CBO estimates that the government will forgive $40.3 billion on new loans made from 2020-2029, or about 21% of the original amount.

There are more than 50 million Americans with student loan debt. The CBO estimates that most of the borrowers are stuck in low wage and low skilled jobs with large balances that may never be paid pack. Many of these folks are millennials, stuck in a renting society with absolutely no economic mobility.

The student loan bubble is another imbalance that will correct and end very badly when the next recession strikes, hence why the government has created a new program to fund student debt forgiveness.

Let’s call the program for what it really is: a massive bailout of the millennial generation.

Like all bubbles, this one will eventually pop. And when it does, it will end very badly.

what stage of the cycle is this @awealthofcs @michaelbatnick pic.twitter.com/rBrGyLZhKM

— LVD (@LVDTrades) February 4, 2020

But in the meantime, some millennials are flipping stocks and making money in “COLLEGE (in class)” to have “NO MORE student loans.”

Tyler Durden

Thu, 02/20/2020 – 23:25

via ZeroHedge News https://ift.tt/2SXh4Iw Tyler Durden