Schiff: “US Is In A Gigantic Bubble… & Covid-19 Is Going To Be The Pin”

While yesterday’s collapse in stocks has been broadly blamed on worsening Covid-19 headlines; Peter Schiff, the CEO and chief global strategist at Euro Pacific Capital, dug a little deeper into the real problems behind the market’s fragility on RT’s Boom Bust this week.

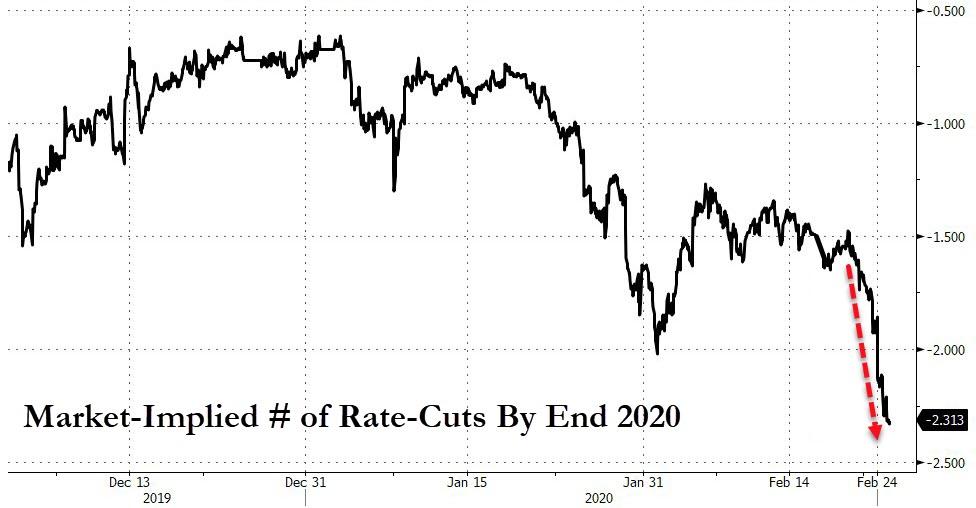

According to Schiff, “the bond market is telegraphing right now that we are going to have several more rate cuts, I think between now and the end of the year.”

In fact the market is pricing in almost 2.5 rate cuts by the end of 2020…

Peter noted that US stock markets were already vulnerable before the virus outbreak.

Remember, we’re talking about the US stock market that’s at bubble territory, nosebleed valuations, long in the tooth, the longest bull market in US history that has been fueled by the most monetary and reckless fiscal policy in US history. But this is a bubble in search of a pin. So, maybe the coronavirus is going to be the pin. But if we had a healthy market, if we had a healthy economy, it wouldn’t matter about the coronavirus. It’s because the economy is sick. That’s the problem, not the people who are infected with this virus.”

And what will The Fed do? What they always do! If all you have is a hammer, everything looks like a nail…

“Whether they commit to moving to zero or not, that’s exactly what they are going to do,” Schiff says.

“The Fed should not be cutting interest rates but that’s what they are going to do because it’s the only thing they can do.”

That is not going to cure coronavirus or the economy, it’s simply going to make US economy sicker, Schiff notes.

“The US economy is in gigantic bubble and maybe the coronavirus is going to be the pin.”

However, there are much deeper problems than the coronavirus, as the markets are generally very overvalued, according to Schiff.

“If we had a healthier economy we could better withstand… But the bigger problem is that the Fed’s cure is actually worse than this disease,” he says.

Peter said he watched CNBC throughout the day Monday and gold was barely even mentioned. But gold is exactly what you want to hold when inflation is hot and the stock market is crashing. It is a true safe-haven and his historically preserved wealth.

Tyler Durden

Tue, 02/25/2020 – 15:45

via ZeroHedge News https://ift.tt/382mZS2 Tyler Durden