Dip-Buyers Battered As Stocks, Bond Yields, & Oil Plunge Intraday

NY Gov Cuomo summed things up best today “no need for undue fear…” which we suggest is the same theme that President Trump will proclaim at 6pmET. TBH it all reminds us of ‘The Naked Gun’…

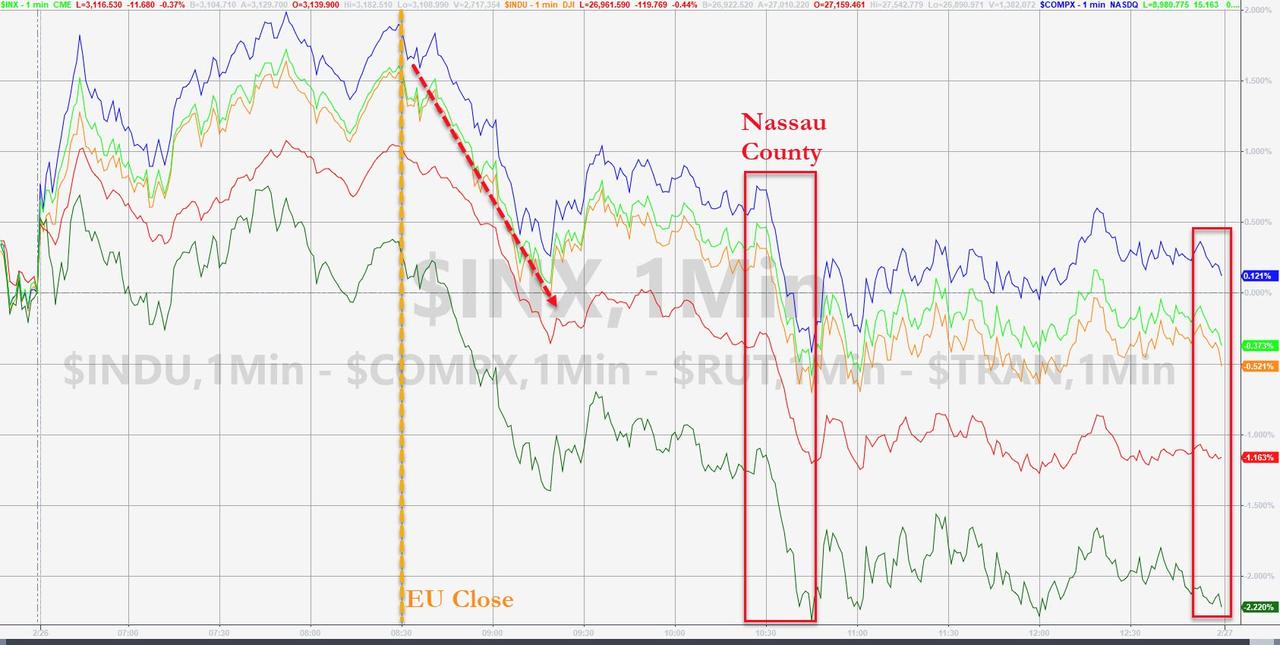

And sure enough, the overnight exuberance in futures and opening BTFD efforts, failed dramatically as more US cases were reported in Nassau County and NY Gov Cuomo spoke…Dow futs rallied 800 points from overnight lows to the highs at around 1100ET before falling hard…

As we noted earlier, this all fits with comments from the infamous Dennis Gartman, who last year ended his daily newsletter after three decades, who appears to be right in his retirement. Equities are “egregiously” over-valued relative to measures such as sales, profits and the size of the economy. The spread of the coronavirus is threatening global growth, and investors should buy safety assets such as gold and government bonds, he said.

“I’m afraid rallies are to be sold into, not weakness to be bought,” Gartman said in an interview on Bloomberg Radio with John Tucker.

“I’m amused or dismayed at how many people are still willing to buy the dip, and this dip is far more serious than people want to anticipate at this point.”

Gartman’s view echoes that of Mohamed El-Erian, who wrote on Tuesday that the virus-induced sell-off “isn’t a buy-the-dip opportunity” because there’s little evidence right now supporting the notion of a V-shaped recovery.

Dr.Doom, Nouriel Roubini, is also a skeptic, calling hopes for a quick rebound in China’s economy “delusional.”

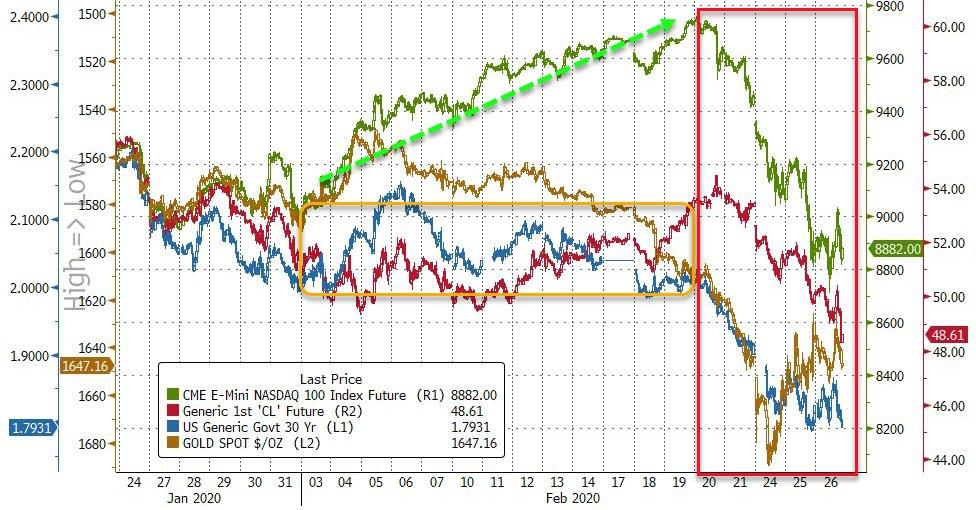

It would appear that bond yields, oil prices, and gold safe-haven flows agree…

Source: Bloomberg

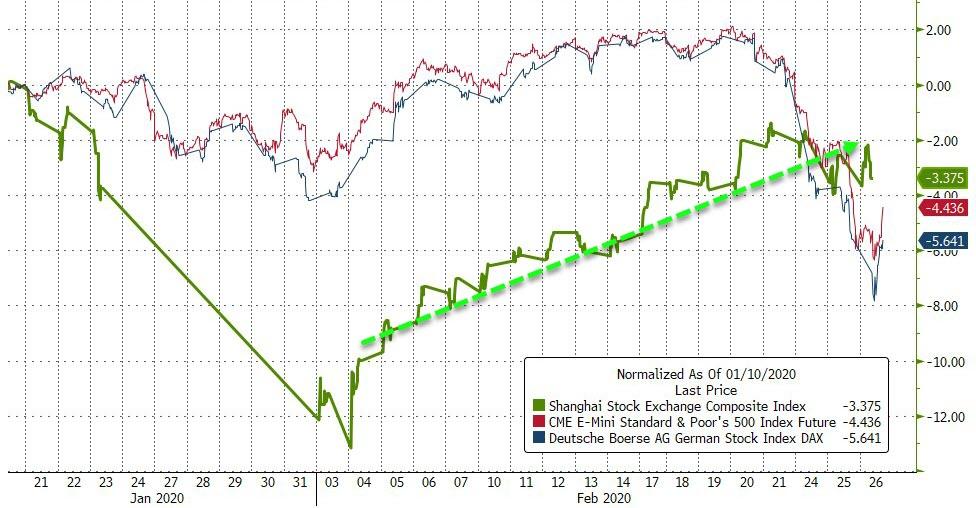

China remains the outperformer, despite its being the nexus of the virus impact…

Source: Bloomberg

So much for month-end rebalancing flows…

Nasdaq clung to the green today but the rest of the markets gave up their BTFD gains…

Source: Bloomberg

SPY (the largest most liquid S&P ETF), saw huge outflows this week – the biggest since the start of the carnage in October 2018…

Source: Bloomberg

As Stocks tumbled from overnight highs, the market broke… twice… but it did not help the bounce back

-

1441ET CBOE OPTIONS DECLARS SELF-HELP AGAINST NASDAQ BX OPTIONS

-

1511ET NYSE AMERICAN OPTIONS DECLARES SELF-HELP VS NASDAQ BX OPTIONS

Source: Bloomberg

The Dow, Russell 2000, and Trannies broke below their 200DMA; S&P held below its 100DMA and Nasdaq held below its 50DMA…

Bank stocks extended their losses…

Source: Bloomberg

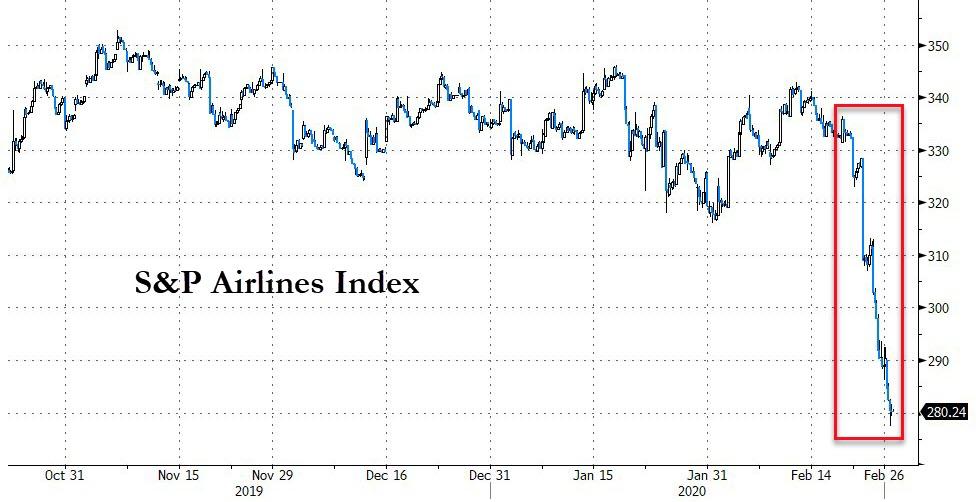

FANG stocks managed very modest gains but Airlines were hit further…

Source: Bloomberg

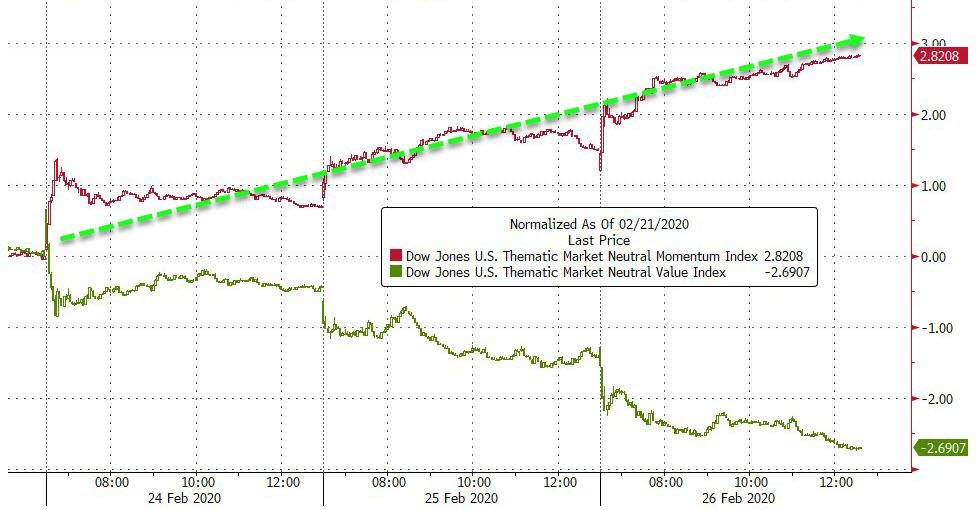

Amid all this carnage, momentum continues to charge higher…

Source: Bloomberg

VIX, rather stunningly, did not collapse back as it usually does… holding at its highest since Dec 2018

Cash and derivative credit markets continued to worsen…

Source: Bloomberg

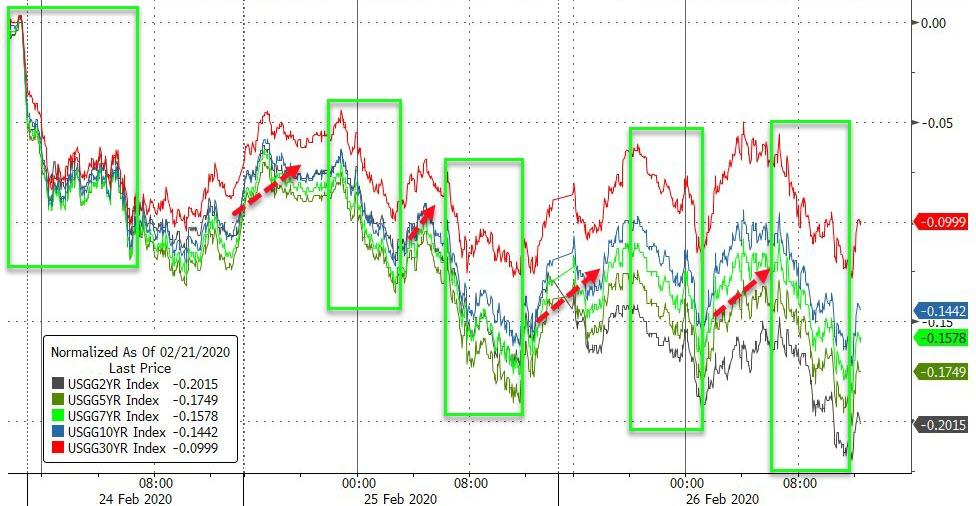

Treasury yields tumbled further today…

Source: Bloomberg

30Y crashed to a 1.79 handle and 10Y a 1.19 handle…

Source: Bloomberg

The yield curve remains drastically inverted…

Source: Bloomberg

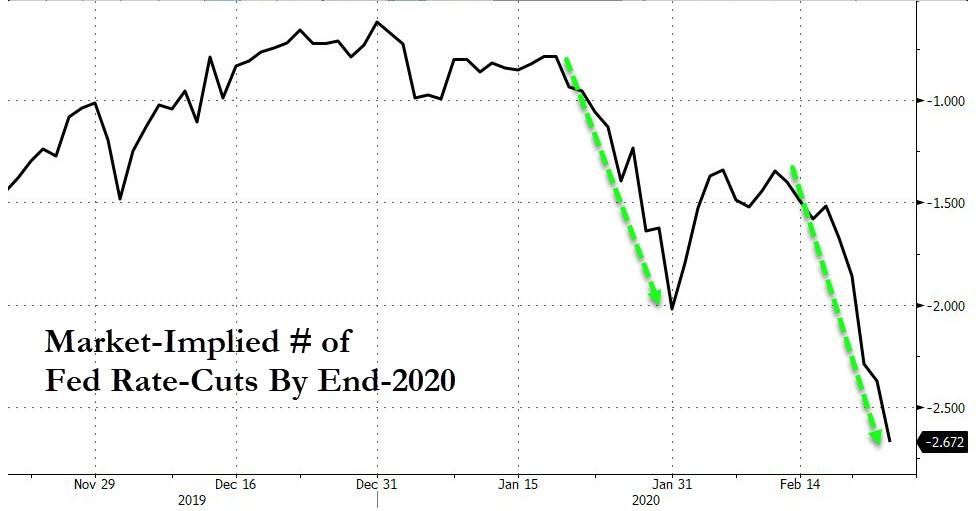

The market is now demanding almost 3 rate-cuts in 2020…

Source: Bloomberg

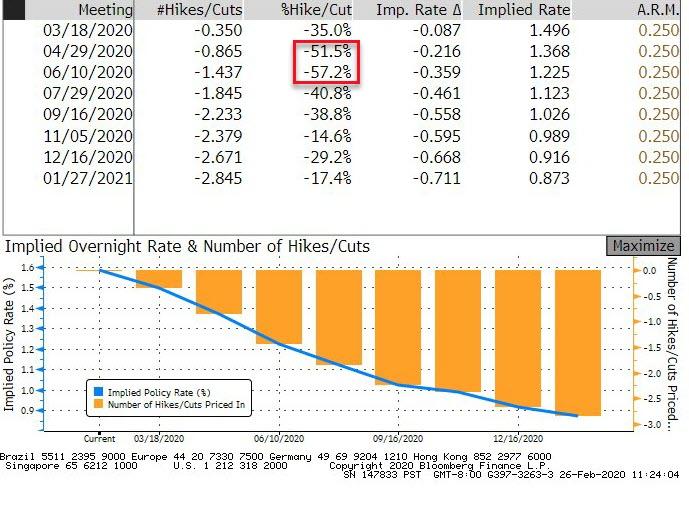

With The Fed’s April and June meetings now more likely than not to see rate-cuts…

Source: Bloomberg

The dollar managed modest gains today…

Source: Bloomberg

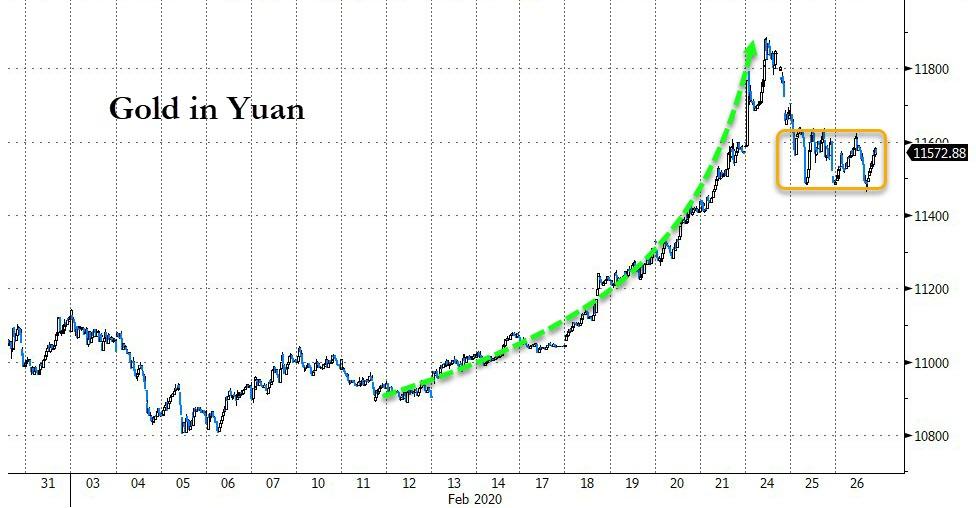

Yuan was flat today, as it seems PBOC is trying to stabilize the currency against gold (averting its move to a record low against the precious metal)…

Source: Bloomberg

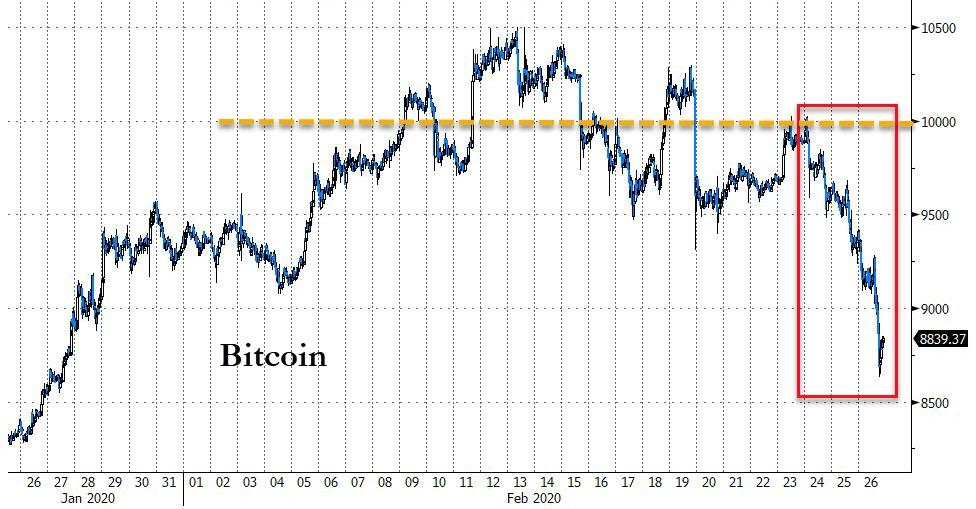

Cryptos extended their losses today…

Source: Bloomberg

Bitcoin puked back below $9000…

Source: Bloomberg

Commodities were mixed with gold gaining modestly as oil plunged…

Source: Bloomberg

Smaller than expected crude builds from API and DOE prompted ramps to $50, but as news hit of more US cases and quarantines, oil plunged back to a $48 handle

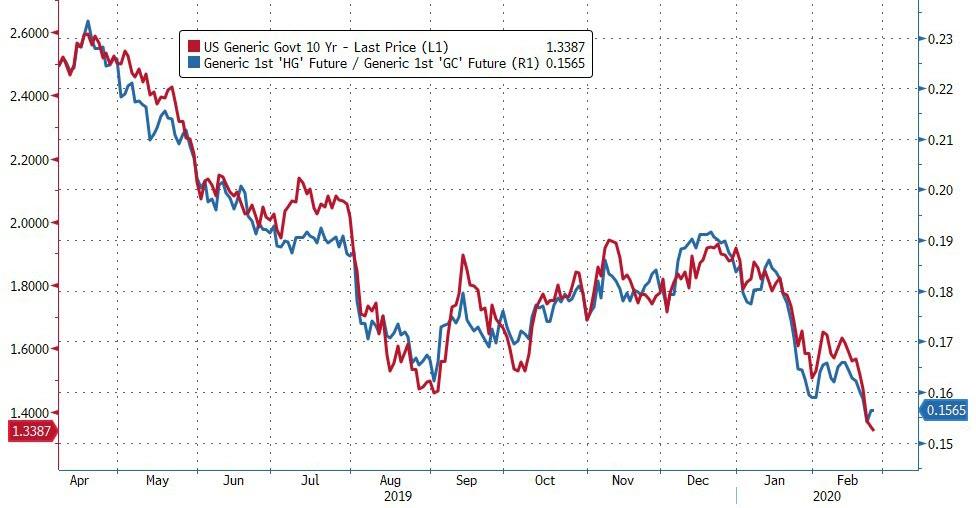

Copper/Gold reached a record low today, perfectly in sync with 10Y yields…

Source: Bloomberg

Finally, if the Y2K analog holds, we have further to fall before there is a meaningful rebound.. that will fail…

Source: Bloomberg

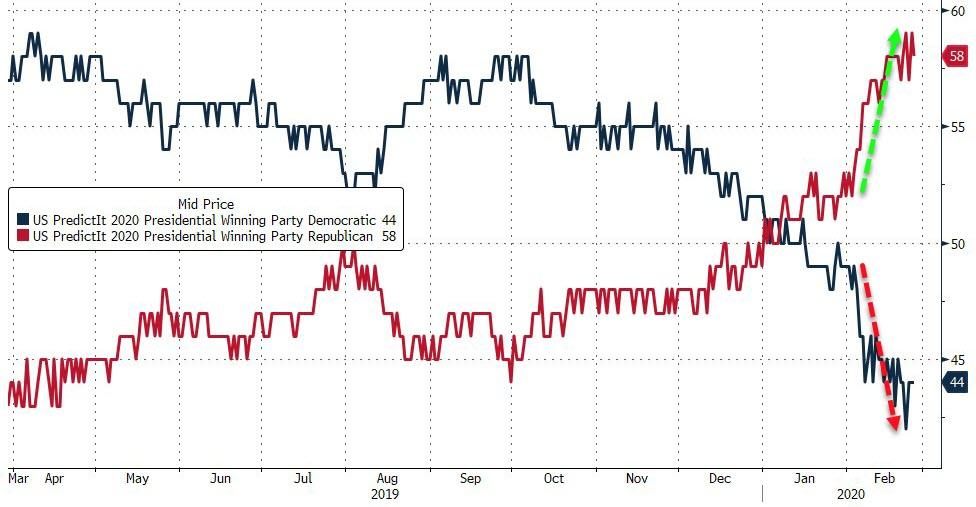

Notably, many talking heads are trying to blame some of the drop on the rise of Bernie Sanders as a virus-infected US economy may increase his chance of being elected… Jeffrey Gundlach, DoubleLine Capital CEO and Wall Street “bond king,” is pointing the finger at Democratic presidential hopeful Bernie Sanders for the market’s tumultuous rout this week.

“If this stock market reversal is due exclusively to the virus, then why is United Healthcare down far more than SPX?” Gundlach wrote in an email to CNBC’s Scott Wapner, referring to the S&P 500.

“Why is healthcare as a sector broadly not outperforming? Answer to these questions: the market is digesting a better than 50% chance of Bernie getting the nomination.”

“Maybe this is the dark side of momentum investing (which is exactly what defines ‘passive’),” Gundlach wrote.

“The market goes down in a knee jerk way on the Bernie rise, but the market going down makes Bernie’s polls go up on his rejection of a market based economy. Which makes the market go down another leg. Rinse and repeat.”

However, a quick glance at the betting lines and it’s clear -Bloomberg is right, a Bernie nomination appears to guarantee a Trump victory…

Source: Bloomberg

Tyler Durden

Wed, 02/26/2020 – 16:01

via ZeroHedge News https://ift.tt/3caxgid Tyler Durden