Fed’s Fisher Stuns CNBC: “Time To Wean Generation Of Money Managers Off Their Dependency On A Fed Put”

With stocks reversing from record highs into correction at the fastest pace since the start of The Great Depression, Janet Yellen warning that Covid-19 fallout could throw the economy into recession, Goldman forecasting zero growth in earnings, and BofA cutting their outlook for economic growth to the weakest since the financial crisis, it is no surprise that every talking head asset-gatherer and commission-raker is out on business media demanding everything from an emergency 50bps rate-cut by The Fed to a globally coordinated liquidity bailout.

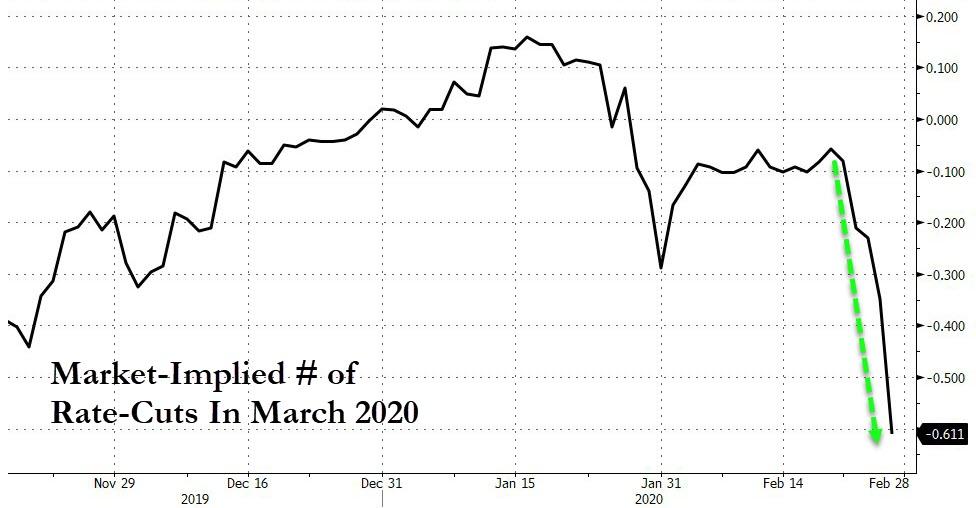

The market is already pricing in at least 3 rate-cuts in 2020 and the odds of March cut are soaring, despite the obvious fact that The Fed can’t print vaccines to ‘salve’ the supply-chain block and if lower rates are supposed to spark more consumption, where are you going to consume? Not at crowded public places like theaters, restaurants, and sports stadiums?

It’s all becoming a little ridiculous, but what is perhaps most surprising is that it took a former Fed president to put CNBC straight on a few things…

Richard Fisher, former Dallas Federal Reserve president, has not been shy to speak his mind since he left office, and was quick to dismiss comments by Kevin Warsh – who wrote an op-ed demanding emergency rate-cuts – by rather pointedly explaining “there’s an audidence of one for that op-ed – the President of the United States” as Warsh angles for Powell’s job in 2022.

But CNBC’s Scott Wapner – seemingly as desperate to reinflate stock prices – would not stop there, asking “is he right?” Do we need massive intervention, once again, to rescue us?

Fisher pulled no punches:

“Rates have dropped across the yield curve, that is what drives businesses and gives them confidence in terms of accomodative fixed income markets to issue debt… and every CFO I know, are taking advantage of this in one way or another… so as far as having the incentive to borrow and even engage in capex, it has increased, not decreased.”

Fisher added that “commodity prices were also down globally,” lowering costs for companies.

And so, the big question is “what will [a rate-cut] do for real operating businesses that are the job-makers and creators in America?”

A good question that nobody wants to answer (but what about stocks!!??).

“Is it worth lowering Fed Funds when the costs of borrowing has come down across the yield and access to credit is still very high?”

More silence…

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

Wapner was quick to jump in, exposing his liquidity-drug-addicted perspective on the world…

“How can you ‘bail them out every time’ and then not bail them out when the market needs it most?”

Fisher almost mockingly repeated the CNBC anchor’s words:

“‘needs it most’? …as we are coming off record highs? The basic rule is simple – if you’re in a hole, stop digging.”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

But, but, but… responded Wapner, “the world is being starved because the supply chains are broken…”

Fisher’s response was simple – the Chinese central bank needs to do something, the Japanese central bank, the Singapore central bank, but the question is “why does the Federal Reserve need to cut rates?”

Careful not cross into too hawkish territory, Fisher concludes,

“the market is getting ahead of itself, because the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

Watch the full interview below:

Blasphemy?!! We suspect that will be the last time Fisher is invited on CNBC…

Tyler Durden

Thu, 02/27/2020 – 14:07

via ZeroHedge News https://ift.tt/2Vwq4qT Tyler Durden