Tailing 7Y Auction Prices At Lowest Yield In 7 Years

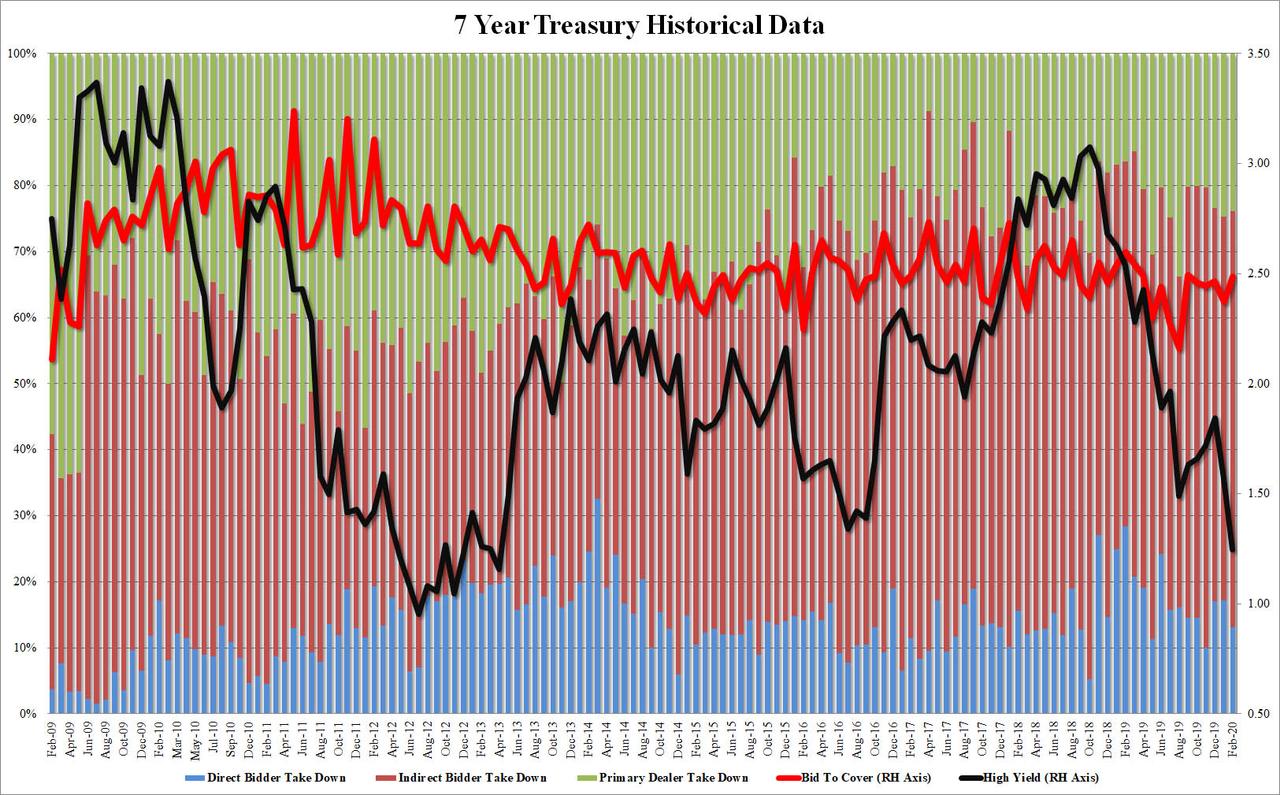

With 10Y and 30Y Treasury both hitting all time low yields, the belly of the curve has been notably slower in catching down to the long end. However, today’s 7Y auction helped bridge the gap: stopping at 1.247%, far below January’s 1.570% and the lowest yield for the 7Y tenor since 2013, however due to the dramatic move lower in yields in the past few days, the auction tailed the When Issued by a substantial 1.4bps, which was the highest since August 2019.

The weakness however was only superficial, with the Bid to Cover surging from 2.371 to 2.487, the highest since September, and above the six-auction average of 2.40%.

The internals were also impressive, with Indirects taking down 63%, up sharply from 58.1% last month, and above the six auction average of 61.3%; and with Directs taking down 13.1%, or below last month’s 17.2%, it left Dealers holding 23.9%

Overall, this was a mediocre 7Y auction – if one ignores the near record low yield – but one which appears to have had a favorable impact on the market as it top-ticked the move higher in 10Y yields, which have been slide more than 2bps from the 1pm high of 1.3254 just before the auction.

Tyler Durden

Thu, 02/27/2020 – 13:43

via ZeroHedge News https://ift.tt/2T5tOy8 Tyler Durden