“Hundreds Of Millions Of Dollars Lost” As Shipping Rates Collapse Due To “Hugely Disruptive” Virus

Covid-19’s effect on the global economy, energy markets, and the shipping industry have been absolutely disastrous, borderline crisis, if not, has already triggered the onset of the next financial crisis.

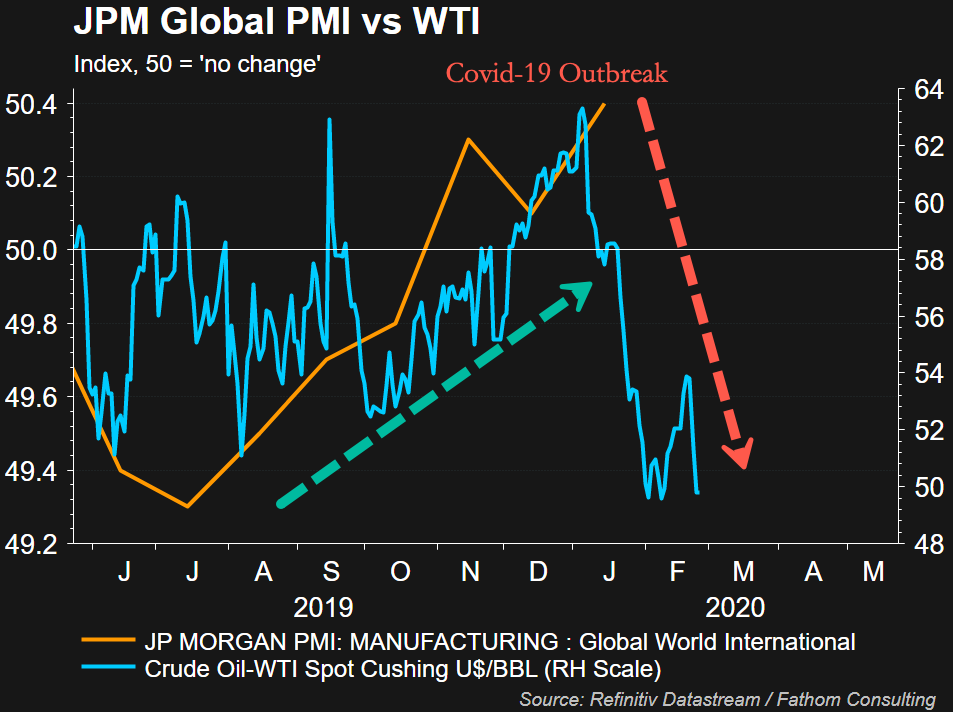

OPEC slashed its oil demand forecast earlier this month, and Goldman Sachs doubled down on its bearish oil take and has cut its oil price target by $10 to $53 for the year, as a result of a “demand shock” that has collapsed Chinese oil demand by at least 20%, or as much as 4 million barrels per day.

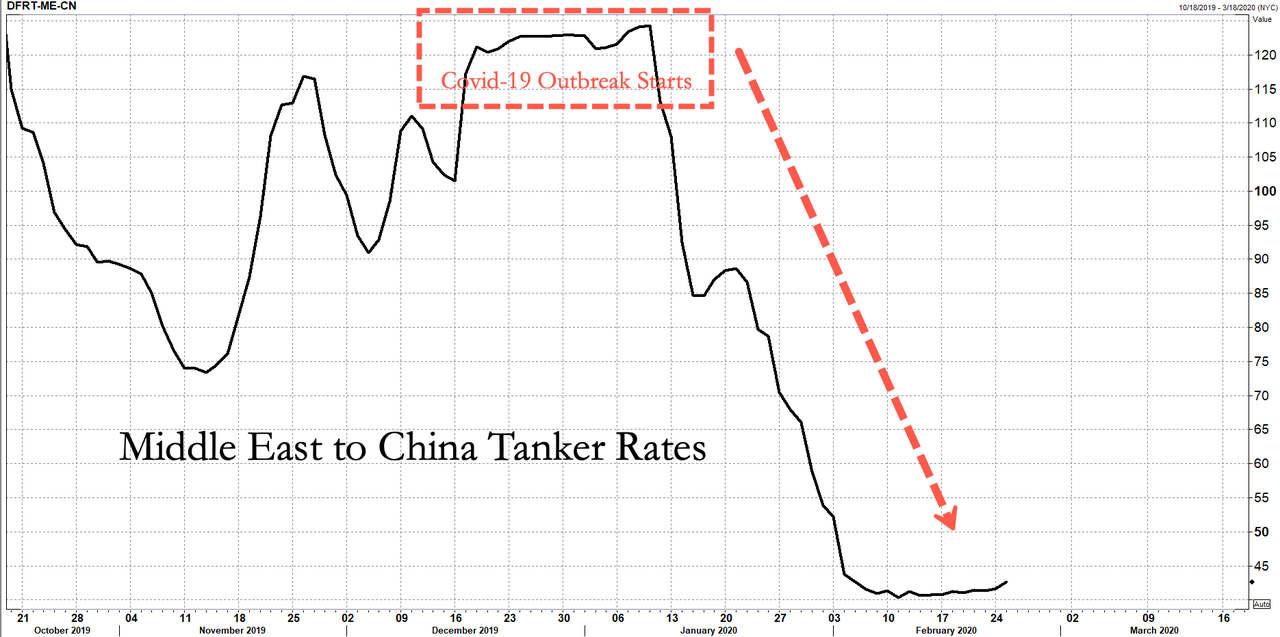

The plunge in energy demand in China, which by the way, is the world’s largest oil importer, has stranded oil cargoes off the coast of the country and led to an oil tanker parking lot in Asia Pacific waters.

The gears of the global economy have jammed, as demand and supply shocks from China risks triggering the next economic crisis.

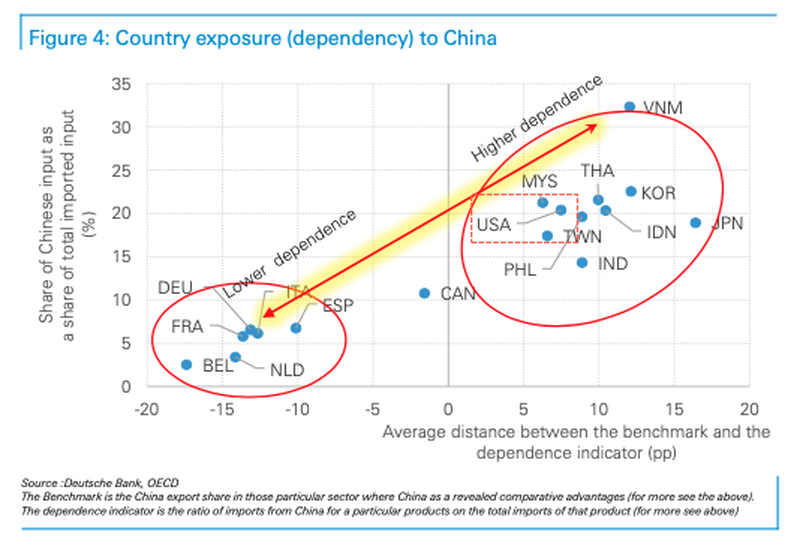

Paralysis is quickly developing across the global economy, as sea and land ports in China have reduced activity. When supply chains are severed, economies on both sides of the world are damaged.

International Chamber of Shipping (ICS) Secretary-General Guy Platten told Reuters on Wednesday that revenue shocks have already hurt shippers this year.

Platten said tanker rates had plunged upwards of 80% since the virus outbreak began last month.

He said the virus is “hugely disruptive” for the shipping industry as demand for raw materials from emerging and developed economies has dramatically slowed.

“On the finished goods side of it you’ve got empty containers for example in China and you’ve got a shortage of containers in the (United) States because the manufactured goods are not getting out of China and being transported around the world. It’s affecting all the supply chain throughout the shipping industry,” he said.

Platten said shipping rates have crashed in various vessel classes. “We know that container lines are doing empty sailings. It would be hundreds of hundreds of millions of dollars (that) would be in jeopardy now.”

“All we know is that there has been an absolute plunge in rates for various classes of ship … We know that container lines are doing empty sailings. It would be hundreds of hundreds of millions of dollars (that) would be in jeopardy now,” he said.

A.P. Moller-Maersk A/S, the world’s largest container shipping company, warned last week that factories in China are currently operating below half-speed capacity, has paralyzed global supply chains.

“As factories in China are closed for longer than usual in connection with the Chinese New Year as a result of the COVID-19, we expect a weak start of the year,” Maersk warned.

Noel Hacegaba, the Deputy Executive Director of Administration and Operations for the Port of Long Beach, California, was featured on CNBC Wednesday afternoon, warned that Long Beach, the second-largest containerized port in the US – is experiencing weakness in volume, down 6% y/y in Jan, and down another 6% y/y in Feb. For the quarter, he said the port could see a decline of 12% y/y.

Hacegaba said in the last couple of weeks, truck and rail operations at the port that extends into California have plunged “to a tune of 20 to 25%.”

He warned that economic paralysis in China would cause some goods just to be canceled altogether because many are seasonal, adding that a slowdown in China’s economy is bad news for the US.

For more color on why shipping rates and commodity prices have plunged – we specifically outlined in semi-official data from China that business conditions are printing at depression levels (as a reminder, China has been responsible for 60% of the world’s credit creation in the last decade – if China’s catches the flu – so does everyone):

- China Has Ground To A Halt: “On The Ground” Indicators Confirm Worst-Case Scenario

- China Is Disintegrating: Steel Demand, Property Sales, Traffic All Approaching Zero

- Terrifying Charts Show China’s Economy Remains Completely Paralyzed

To summarize, the outbreak of the virus has crashed China’s economy, resulting in plunging demand for commodity/energy products and the need to ship raw materials and or finished goods across the world.

The bear market in crude, forced by China’s implosion, suggests the global economy is about to plunge into a recession.

Tyler Durden

Fri, 02/28/2020 – 05:45

via ZeroHedge News https://ift.tt/2vo4Fpe Tyler Durden