US Services Economy Best In A Year Or Worst In 7 Years – Take Your Pick!

On the heels of PMIs showing China’s services economy collapsing at the worst rate in history, US Services data was expected to slip lower from January, and it did, with PMI back into contraction.

-

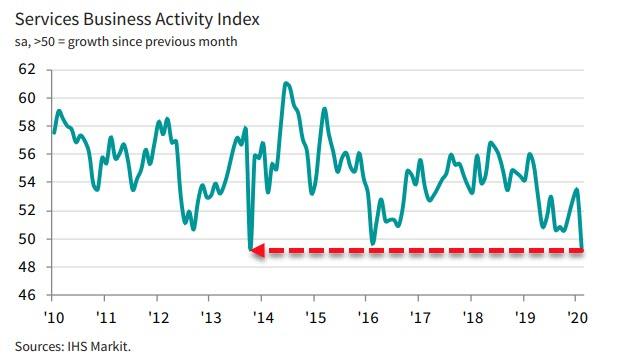

Markit’s Services PMI plunged into contraction at 49.4 – lowest since 2013 – with orders and employment slumping

-

ISM’s Services survey soared to 57.3 – highest in a year – with orders at the highest level since June 2018 and employment at a 7-month high.

You have to laugh…

Markit Services PMI at 49.4 from 55.5 – the weakest level since October 2013…

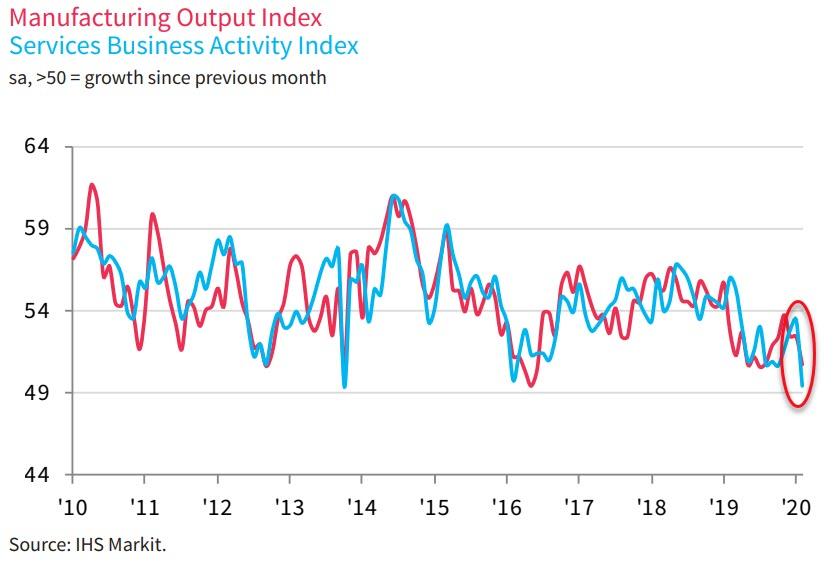

The service economy is now contracting faster than the manufacturing side of the economy…

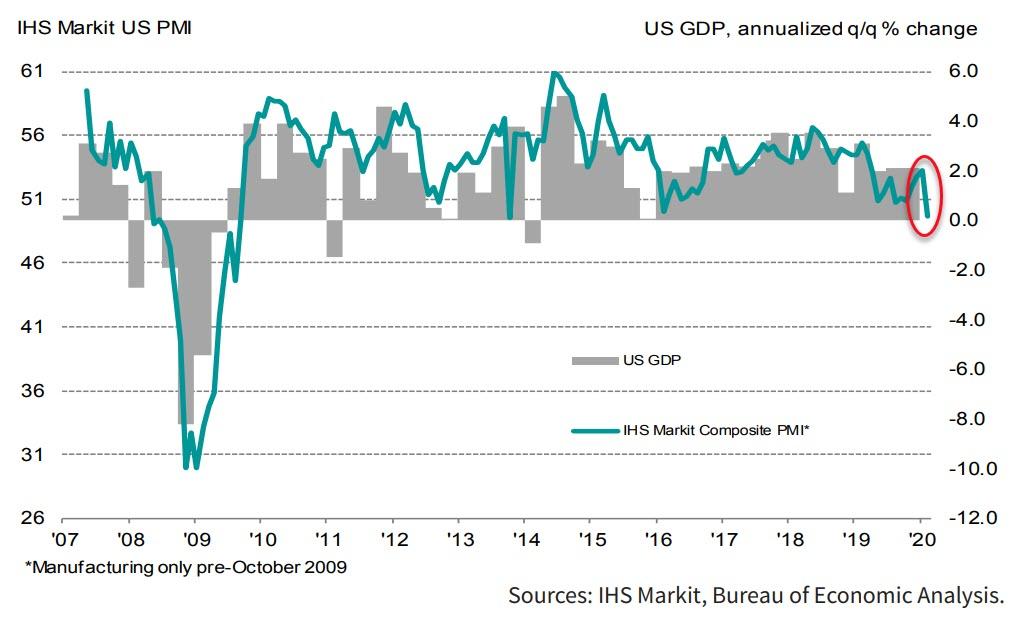

The US Composite PMI slipped into contraction…

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The US service sector took a knock from the coronavirus outbreak and growing uncertainty about the economic and political outlooks in February. The fall in the headline index measuring business activity levels was the second largest seen since the global financial crisis over a decade ago, exceeded only by the brief slump in activity during the 2013 government shutdown.

“Business sectors such as travel and tourism are reporting weakened activity due to the virus outbreak, most notably in terms of foreign visitors and overseas sales. However, other sectors such as financial services and business services are reporting virus-related hits to demand, suggesting a more broad-based weakening of demand across the economy, exacerbating the supply-shock that is constraining manufacturing.

“Companies have meanwhile grown increasingly concerned about client spending and investment being curbed ahead of the presidential election. Political and economic uncertainty, the coronavirus outbreak and financial market turmoil all risk building into a cocktail of risk aversion that has severely heightened downside risks to the economy in coming months. Much will depend of course on the speed with which the virus can be contained and how quickly business can return to normal.”

Finally, Williamson notes, that “combined with a weak manufacturing survey in February, the data are consistent with annualised GDP growth slipping from around 2% at the start of the year to just 0.7% midway through the first quarter.”

Perhaps that’s why the market is demanding two more rate-cuts in March still… despite yesterday’s emergency 50bps cut.

Tyler Durden

Wed, 03/04/2020 – 10:04

via ZeroHedge News https://ift.tt/2vtQaQY Tyler Durden