Italian Debt Crashes Prompting ECB Intervention

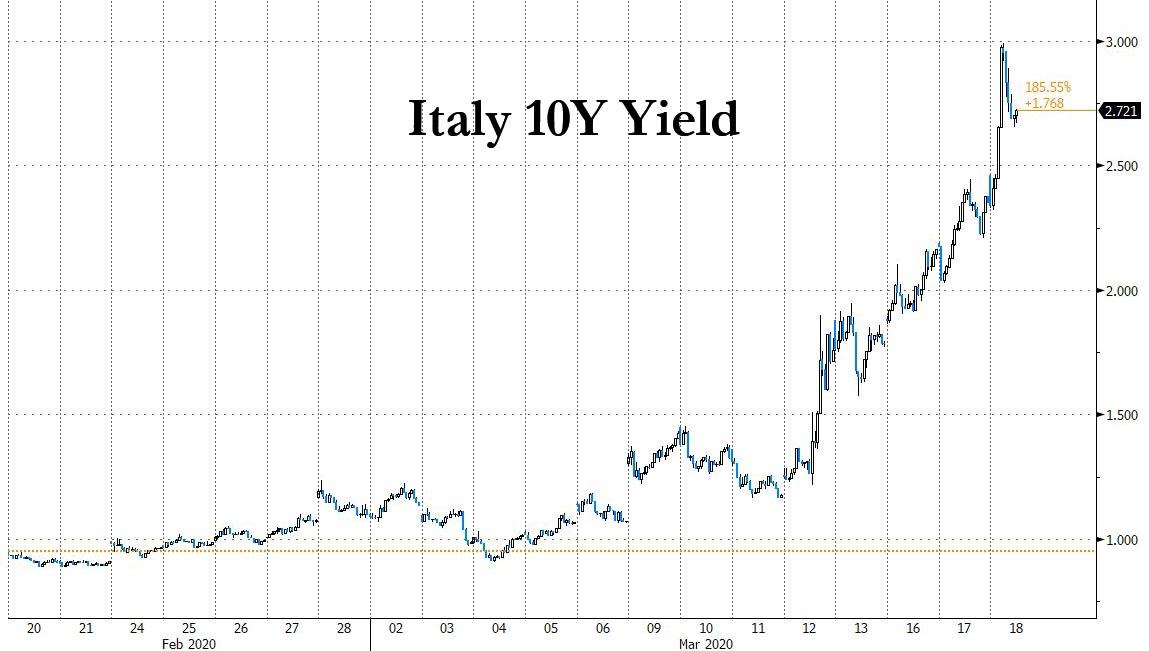

Welcome to the brave new world of a helicopter money, aka the Magic Money Tree (MMT), where everything is crashing and nowhere more so than in Europe, which having made a dramatic U-turn on its historic fiscal stinginess, and where a flood of debt is now expected, bond yields across the continent are soaring even as European stocks crater, and nowhere more so than in Italy where the 10Y bond yield, which was trading below 1% as recently as one month ago, exploded as high as 2.99% this morning, before easing some of the rout following media reports that the ECB is intervening via the Bank of Italy.

Earlier in the session, Italy’s 10-year yield climbed as much as 64bps to 2.99%, pushing the BTP-bund spread up to 44bps wider to 323bps, the most since 2018 after a La Stampa report that Rome may extend the nationwide lockdown to beyond April 3.

Then shortly after 6am ET, Italian bonds trimmed declines after Radiocor reported the ECB was invervening in the domestic market through the Bank of Italy. “Moves are flexible in terms of timing and of markets targeted, and can continue as long as needed”, Radiocor news agency reported, citing central banking sources.

Even that, however, barely made a dent, with Italy’s 10-year yield still almost 40bps higher at 2.72% after earlier climbing to 2.99%.

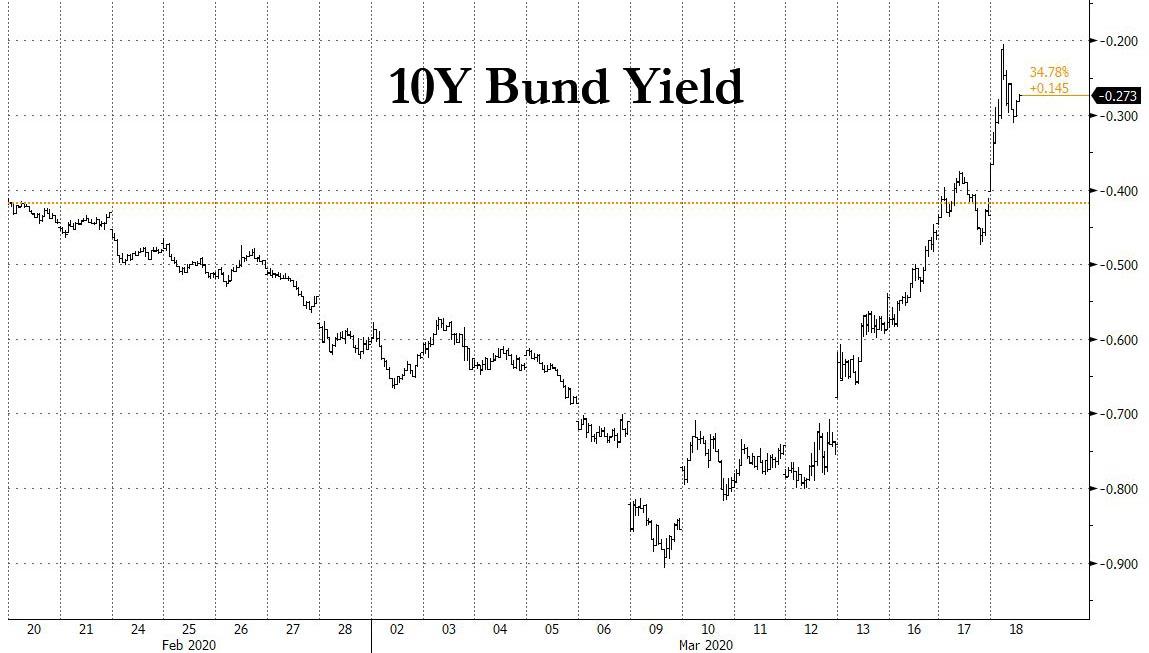

There was no ECB intervention in other European bonds, although they certainly also need it, with Bunds suffering sharp losses as the 10Y Bund yield surged as high as -0.20%…

… although paring some losses following reports Germany was softening opposition to Italy’s proposal for joint EU bond issuance: German’s 30-year swap spread narrows 11bps to 0bps, the tightest since 2014, amid concerns that any fiscal loosening will lead to more bond issuance.

The most notable however may be in 30Y Bund yields, which emerged back in positive territory, trading at 0.04% this morning, up from -0.5% less than a week ago.

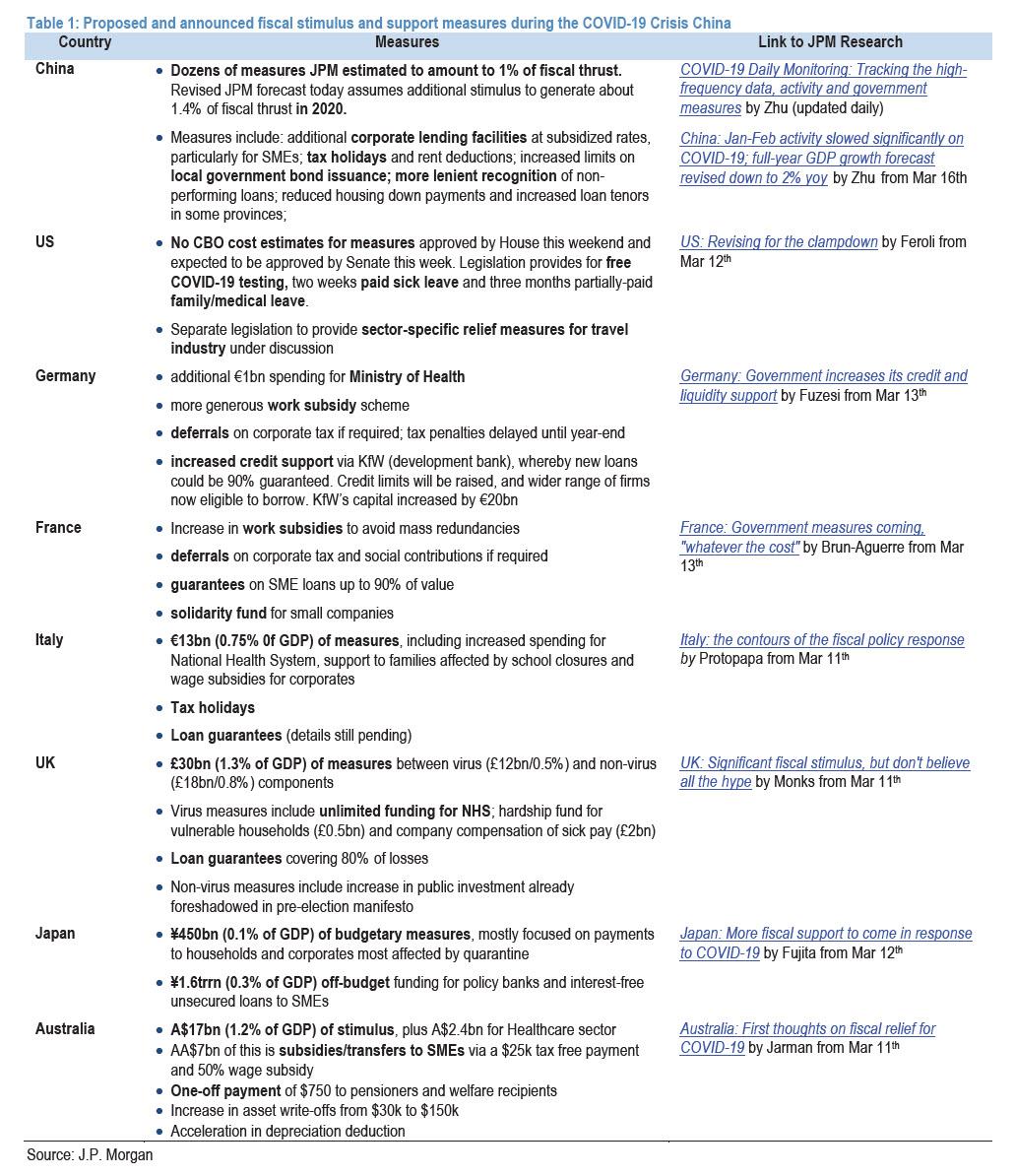

The irony is that until last week, the ECB was urging European government to stimulate, stimulate, stimulate as it was “out of ammo.” Well, Europe is finally doing as requested, which has sent yields soaring to dangerous levels, which is now forcing the ECB to intervene to push yields lower!

How soon until Lagarde wave a white flag and demands that the Fiscal stimulus tsunami which we summarized here last night…

… be immediately halted as the ECB simply does not have a large enough trading floor to buy everything that is suddenly breaking courtesy of helicopter money?

Tyler Durden

Wed, 03/18/2020 – 08:43

via ZeroHedge News https://ift.tt/2TZ10HR Tyler Durden