WeWork Founder Loses ‘Billionaire’ Status, Threatens Lawsuit As SoftBank Pulls $3BN Investor Bailout

We would have loved to have been a fly on the wall in the room where former WeWork CEO and co-founder Adam Neumann received the news that SoftBank was officially walking away from a promised $3 billion purchase of WeWork shares, pledged as part of a deal to oust Neumann and save the struggling rental-space startup after investors backed out of a planned IPO, robbing the company of more than $6 billion in short-term funding.

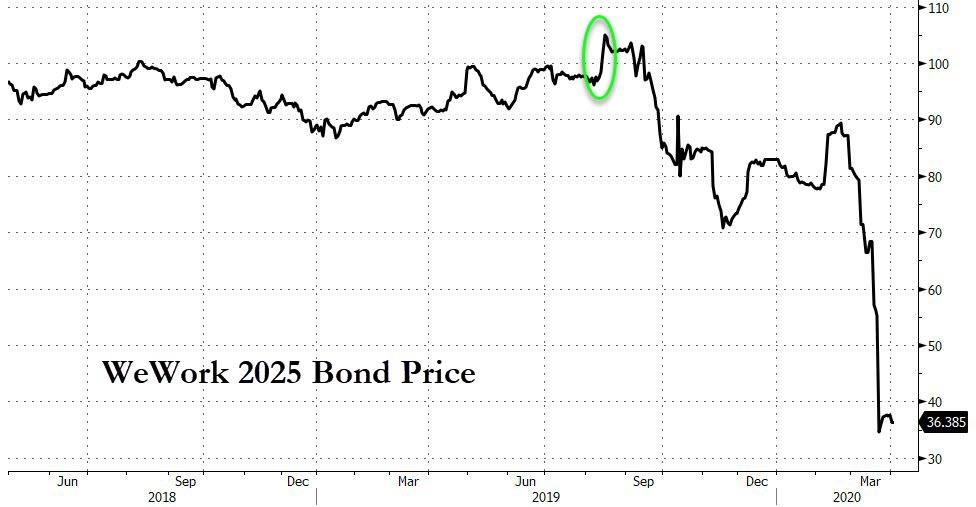

Without that money, and now, with the global travel business at a standstill and the whole world working from home for the foreseeable future, WeWork is very likely doomed. Now, SoftBank’s billionaire founder Masayoshi Son is facing serious pressure from a litany of adversaries including the US ratings agencies (Moody’s recently cut the company’s credit rating two notches deep into junk territory), notorious activist investor Paul Singer, whose Elliott Capital Management has been pressing the Japanese conglomerate to improve its performance as SoftBank, or at least buy back more stock, and the global banks to whom Masa Son has now pledged 40% of his SoftBank shares.

The ratings cut led to a repricing of SoftBank debt to all-time lows, coupled with a surge in the company’s borrowing costs.

The news that SoftBank was preparing to pull the WeWork money (only a fraction of which was expected to go directly into the company’s coffers) is hardly a surprise: WeWork board members representing the investors who will now be left with soon-to-be-worthless WeWork shares have angrily threatened to sue SoftBank if it pulls the money, claiming the contractual justification cited by SoftBank is “dishonest.”

According to Bloomberg, SoftBank had agreed to buy the shares from Neumann, Benchmark Capital and others. After the deal’s deadline passed, SoftBank confirmed Thursday that it would pull the money, citing five conditions that hadn’t been satisfied, including ongoing investigations by the SEC and others in the US.

A WeWork committee of two independent directors expressed “disappointment” at SoftBank’s decision, and hinted that the angry investors would respond with lawsuits.

The Special Committee is surprised and disappointed at this development, and remains committed to reaching a resolution that is in the best interest of WeWork and its minority shareholders, including WeWork’s employees and former employees. The Special Committee will evaluate all of its legal options, including litigation,” the committee, made up of Benchmark’s Bruce Dunlevie and another director, Lew Frankfort, said in an emailed statement.

A SoftBank spokesman insisted that the decision didn’t mean SoftBank was “walking away” from WeWork.

After all, at this point, nothing can change the fact that Masa Son and SoftBank pumped tens of billions of dollars, only to watch Adam Neumann recklessly expand, pushing into markets like China, where the company’s buildings have sat empty, and drive what could have been a modestly profitable enterprise (there are similar businesses operating profitably elsewhere) directly into the dirt.

“SoftBank remains fully committed to the success of WeWork and has taken significant steps to strengthen the company since October, including newly committed capital, the development of a new strategic plan for WeWork and the hiring of a new, world-class management team,” said Rob Townsend, chief legal officer at the company. “The tender offer was an offer to buy shares directly from other major stockholders and its termination has no impact on WeWork’s operations or customers.”

But the company said it would be irresponsible to SoftBank shareholders if it didn’t pull the money, which Neumann would have used to pay back his many debts (something that’s about to become significantly more difficult), accrued while buying up real estate like a house with a room shaped like a guitar. Bloomberg reported that rescinding the offer will likely drive Neumann’s personal wealth back below $1 billion, essentially robbing him of his membership in the ‘Tres Commas’ club…possibly for life.

“Given our fiduciary duty to our shareholders, it would be irresponsible of SoftBank to ignore the fact that the conditions were not satisfied and to nevertheless consummate the tender offer,” Townsend said.

The money is completely separate from the $5 billion SoftBank already plowed directly into the company to keep it capitalized, at least for a few more months, while SB brought in new management to figure out a turnaround plan.

But like Mike Tyson used to say “everybody has a plan until they get punched in the face.” We suspect that turnaround plan probably already needs some reworking. But at least SoftBank can breath a little easier knowing it took some steps to cut its losses.

Tyler Durden

Thu, 04/02/2020 – 12:35

via ZeroHedge News https://ift.tt/3aEuPmW Tyler Durden