Goodbye V-Shaped Recovery: Morgan Stanley No Longer Expects Return To Normalcy Before End Of 2021

Two weeks ago, when the first dire Q2 GDP forecasts emerged which were however followed by hilarious V-shaped recovery assumptions for Q3 and onward, we said it’s only a matter of time before the banks throw in the towel on a V-shaped recovery as the full devastation of the Covid depression emerges.

We didn’t have long to wait.

In a report from Morgan Stanley’s chief economist Ellen Zentner, the bank has not only surpassed both Goldman and JPMorgan in sellside gloom for how bad the Q2 depression will be, now expecting a massive 38% collapse in GDP, but more troubling for all those who believe the economy will recover overnight with a snap of the fingers, Morgan Stanley now sees “a shallower rebound in 3Q, and we do not see activity returning to its pre-virus level until the end of 2021.”

The reason: “The evolution of economic activity will be a function of how quickly the number of coronavirus cases peaks as well as how quickly social distancing measures are rolled back and how quickly consumer and business sentiment recovers such that at least somewhat normal economic behavior can resume.”

In other words, as we said nearly two months ago, the longer the shutdown lasts the greater the economic, social and – in Trump’s case – political toll.

Here are some more details from the MS report:

Disruptions to economic activity have become increasingly pervasive as social distancing measures and closures of nonessential businesses have spread across the country. This will lead to a sharp drop off in activity in 2Q that is reflected in the now 38% annualized decline in GDP that we expect for the second quarter (previously -30%). That follows what we expect will be a 3.4% annualized contraction in first quarter, for a cumulative decline in the level of real GDP through 2Q20 of 12%.

The evolution of economic activity thereafter will be a function of how quickly the number of coronavirus cases peaks as well as how quickly social distancing measures are rolled back and how quickly consumer and business sentiment recovers such that at least somewhat normal economic behavior can resume.

Our base case economic outlook is conditioned on our biotechnology team’s COVID-19 outbreak dynamic model, which was recently revised to show a high expected number of cumulative infections (~570,000), with daily new infection growth expected to slow in late April. Moreover, the team sees the largest risk for the US as a second wave of infections emanating from the central region of the country after the coasts have peaked in mid-April (see Biotechnology: COVID-19: Updating US Forecast For Greater Spread, Potentially Worse Trajectory Than Italy (30 Mar 2020)).

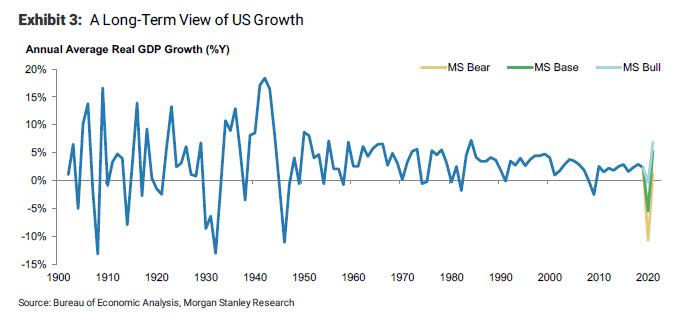

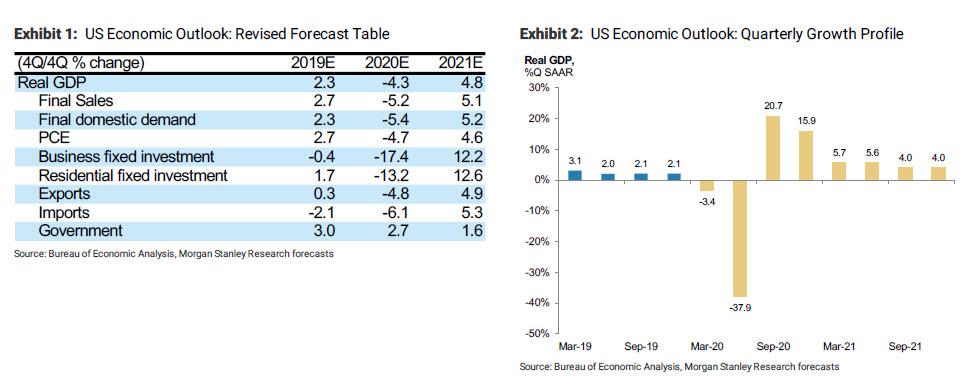

Zentner’s revised quarterly growth projections put full year GDP on course for a 4.3% contraction on a 4Q/4Q basis (Exhibit 1), the steepest four-quarter drop in activity on record in the post-war period. On an annual average basis, real GDP is expected to contract 5.5% in 2020, the steepest annual drop in growth since 1946 when real GDP contracted more than 11%

With this dynamic in place, MS now expects the US economic recovery will be more drawn out than previously anticipated, marked by a deeper drop into recession and slower climb out. The bank has revised down its expectation for 3Q GDP growth accordingly, and now look for a 20.7% annualized bounce in GDP in 3Q (Exhibit 2). Although that looks like an elevated quarterly growth number, off of such a low base our forecast implies that the level of real GDP in 3Q will recover back only 35% of the lost output in the first half of the year.

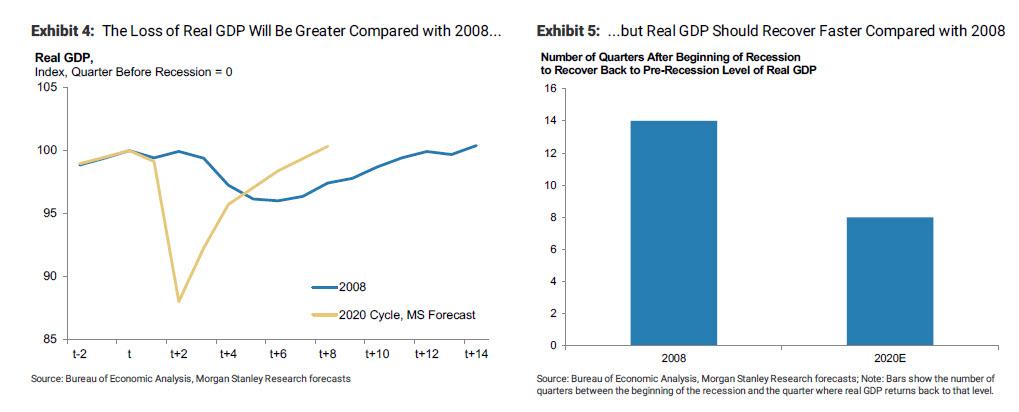

Reflecting Morgan Stanley’s loss of hope in a V-shaped recovery, the level of real activity in its forecasts remains below its 4Q19 level until the end of 2021: a sharper loss of real GDP compared with the 2008 recession (Exhibit 4). Still, the bank isn’t completely apocalyptic and expects that the rebound in economic activity should be quicker this cycle compared with 2008 when activity did not return to its 4Q 2007 level until the second quarter of 2011. We give the bank another week before it gives up on this particular optimistic view.

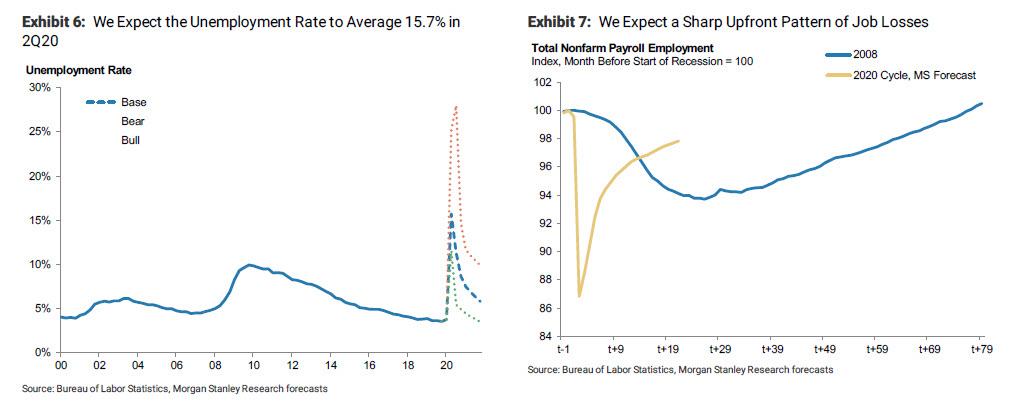

Finally, there is unemployment, which Morgan Stanley expects will peak at a ghastly 28% in late 2020.

Disruptions to economic activity and closures of nonessential businesses have increasingly weighed on the labor market. In the past two weeks alone we have seen nearly 10 million workers file for unemployment benefits, indicating that upcoming employment data on payroll growth in April and through the second quarter is likely to be deeply negative.

For the second quarter as a whole, we expect this will lead to a sharp rise in the unemployment rate to an average of 15.7% (Exhibit 6), the highest among records dating back to the 1940s. That builds in an assumption of cumulative job losses of 21 million in the second quarter, with a peak in the unemployment rate at 16.4% in May. In our bear case scenario, job losses amount to almost 40 million in 2Q, driving the unemployment rate up to 25%, and further economic weakness in 3Q20 leads the unemployment rate to drift up further to a peak of 28%, and the unemployment rate remains persistently higher over the forecast horizon in this scenario.

The pattern of job losses will largely follow the GDP pattern, although we do foresee some long-term job losses persisting over our forecast horizon. That may be particularly the case among small businesses (<100 employees), which BLS data indicate comprise more than 55% of total employment. We expect that payroll employment will begin to expand in June 2020, but will remain 2.7% below its pre-recession peak at the end of 2021. Nevertheless, that would feel like a stronger recovery compared to the persistent labor market weakness seen in the 2008 cycle (Exhibit 7).

And that’s what the second great depression looks like.

Tyler Durden

Fri, 04/03/2020 – 14:48

via ZeroHedge News https://ift.tt/3bMUtpS Tyler Durden