Futures, Global Markets Soar For Second Day As Virus Fears Fade, Dollars Slides

Global markets rallied for the second day as signs of progress against the coronavirus in both Europe and the United States and more aggressive helpings of stimulus kept investors charging back in. US index futures bounced for a second straight day on Tuesday as risk appetite returned on tentative signs that the coronavirus outbreak was starting to plateau in hard-hit U.S. states.

At 0730 ET, Dow e-minis were up 816 points, or 3.7%, S&P 500 e-minis were up 83.75 points, or 3.1% and Nasdaq 100 e-minis were up 235 points, or 2.9%. Tuesday’s rally followed a 7% surge on Monday after the governors of New York and New Jersey said their states, hot spots of the COVID-19 disease, were showing early signs of a “flattening” of the outbreak. But they warned against complacency as the nationwide death toll approached 11,000 and global infections surged past 1.3 million.

“Even if we have reached the peak, the lockdowns around the globe may be extended for a while more as governments may want to ensure that the virus has indeed been contained,” said Charalambos Pissouros, senior market analyst at JFD Group. “We believe that the global economy may start recovering well after the peak of the pandemic.”

Worldwide, the virus has infected more than 1.3 million people and killed over 74,000, and though the numbers are still rising in many highly-populated countries, some tentative improvements have given hope. In hardest-hit Italy and Spain, authorities have started looking ahead to easing lockdowns after steady falls in fatality rates. In the United States too, the daily number of deaths in the country’s worst-affected area, New York, has also shown signs of steadying.

There was an added boost from commodity markets as oil climbed nearly 3% on supply cut hopes, after Russian Tass reported that OPEC+ is discussing an output cut for 3 months, while currency markets also came alive as a tumbling dollar saw the euro race out of a six-session rut of falls. Exxon Mobil, Marathon Oil and Apache Corp rose between 4% and 10% in premarket trading as oil prices rallied amid hopes the world’s main oil producers including Saudi Arabia and Russia would agree to cut output at a meeting on Thursday.

Oilfield services firm Halliburton Co jumped 7.3% after saying it was cutting about 350 jobs in Oklahoma and that its executives would reduce their salaries.

European stocks also put in another healthy start with Eurostoxx 50 and DAX rallying ~3-3.5%, with various European markets entering a 20% bull market from the lows. Travel and Leisure stocks lead, gaining over 7%, autos and insurance names join in the outperformance. S&P futures rise 2.5%. The Stoxx Europe 600 Index also advanced, led by travel and leisure shares, after the rate of new infections slowed in France and in Italy, the original epicenter of the continent’s outbreak. The Eurogroup of finance ministers within the single euro zone currency bloc are scheduled to meet later on Tuesday, and analysts expect more joint action to help prop up the economies of member states.

“A day does not a trend make, a week does not a trend make… but we think the market is bottoming out,” said Jeff Mortimer, Director of Investment Strategy at BNY Mellon Wealth Management. “We are trying to get clients to understand that (in market performance terms) better times ahead can come more quickly then you expected.”

Earlier in the session, Asian stocks also gained, led by energy and IT, with the MSCI Asia Pacific Index rising more than 2% after adding nearly 3% a day earlier. Most markets in the region were up, with India’s S&P BSE Sensex Index gaining 7.4% and Thailand’s SET rising 6.8%, while Jakarta Composite dropped 0.7%. Japan’s Nikkei followed up Wall Street’s 7% surge on Monday with a 2% jump as its government promised a near $1 trillion stimulus package – equal to a fifth of its GDP. The Topix gained 2%, with Artra and TORQ Inc rising the most.

Chinese stocks climbed and the yuan strengthened in the wake of further targeted stimulus by policy makers as Shanghai reopened after a long weekend with Liaoning SG Automotive Group and V V Food & Beverage posting the biggest advances. China said it didn’t have any new deaths for the first time since the pandemic emerged.

“Optimism on the direction of equity markets will be difficult to maintain until we see more clarity on the corporate earnings outlook and until the dispersion of analysts’ forecasts subsides,” Marija Veitmane, a multi-asset strategist at State Street Global Markets, wrote in a note.

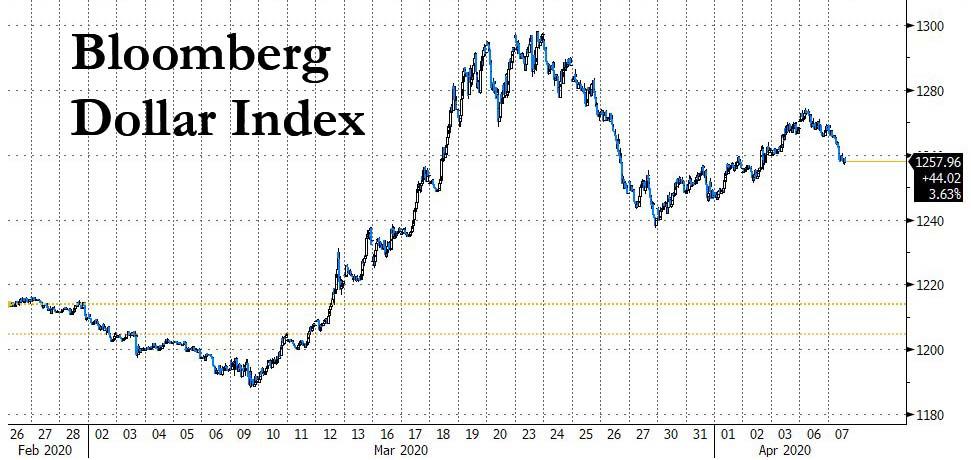

In FX, the dollar, which has been soaking up safe-haven flows for weeks, slipped against most major currencies. The Bloomberg Dollar Spot Index fell as much as 0.8% to the lowest since April 2 as the greenback fell against all Group- of-10 peers.

Norway’s krone and the Australian dollar led gains as equity markets traded higher and oil prices rose on signs that producers are moving toward a deal to end their price war. The euro shot up 0.7% to $1.0865 to snap a six-day run of falls, the pound climbed despite Britain’s Prime Minister remaining in intensive care, and the Australian dollar jumped over 1.5% to its highest in a week. New Zealand’s dollar rose 1.3% too, while the Japanese yen shook off an early dip to clamber up to 108.92 per U.S. dollar.

In rates, bonds are broadly offered, curves bear steepening. USTs underperform Bunds by 1.5bps with 10y Treasury yields. U.S. yields rose to 0.73% having fallen almost 9 basis points on Monday, and Bund yields were up 6-9 basis points across the curve. Cyprus, one of the lower-rated countries in the bloc, is marketing a seven-year and 30-year bond issuance. In Asia Indonesia issued a 50-year bond.

“Investors have recently been detecting growing public support for the concept of coronabonds in European Commission and ECB circles,” said DZ Bank analyst Daniel Lenz, adding that German ECB Executive Board member Isabel Schnabel was among those who appeared to voice support.

In commodities, it wasn’t only oil driving commodities markets higher either, copper punched up to a 3-week high with a 3% gain for industrial metals, while safe-haven gold faded after a furious rally on Monday.

Market Snapshot

- S&P 500 futures up 2.5% to 2,709.25

- STOXX Europe 600 up 2.8% to 329.57

- MXAP up 2.3% to 139.42

- MXAPJ up 2.4% to 450.51

- Nikkei up 2% to 18,950.18

- Topix up 2% to 1,403.21

- Hang Seng Index up 2.1% to 24,253.29

- Shanghai Composite up 2.1% to 2,820.76

- Sensex up 7.8% to 29,742.13

- Australia S&P/ASX 200 down 0.7% to 5,252.29

- Kospi up 1.8% to 1,823.60

- German 10Y yield rose 5.2 bps to -0.373%

- Euro up 0.6% to $1.0858

- Brent Futures up 1.4% to $33.51/bbl

- Italian 10Y yield fell 6.0 bps to 1.319%

- Spanish 10Y yield rose 2.9 bps to 0.752%

- Brent futures up 2.2% to $33.79/bbl

- Gold spot down 0.3% to $1,655.44

- U.S. Dollar Index down 0.5% to 100.18

Top Overnight News

- The U.K. is facing a leadership crisis as it heads into the peak of the coronavirus pandemic, with PM Johnson in intensive care and his government under pressure to get a grip on the outbreak. U.K. risks a new surge in hospital demand as hospices fear closure

- The EU’s finance ministers on Tuesday will seek to endorse a list of measures worth more than half-a-trillion euros to mitigate the impact of the coronavirus on the region’s economies

- Australia’s central bank kept its interest rate and yield target unchanged Tuesday, having scooped up A$36 billion ($22 billion) in government bonds since implementing unconventional monetary policy

- China reported no new coronavirus deaths for the first time since the pandemic emerged, adding to signs that the crisis may be easing in some areas. Italy, France, Germany and Spain reported lower numbers of new cases while in New York, Governor Andrew Cuomo said deaths were showing indications of hitting a plateau

- Congress’s next stimulus bill to prop up the U.S. economy during the coronavirus crisis will be at least another $1 trillion, House Speaker Nancy Pelosi told Democrats on a private conference call

- Oil resumed gains on signs the world’s biggest producers are moving toward a deal to call off their price war and cut output as the coronavirus eviscerates energy demand around the world

- Japanese Prime Minister Shinzo Abe moved to declare a state of emergency in seven prefectures including Tokyo and Osaka, and announced a record economic stimulus package as the country braces for a surge in coronavirus infections

- The number of daily recoveries from coronavirus in Germany for the first time exceeded new cases

- There’s a bit of a correction underway in funding markets. The spread between three-month dollar Libor and overnight index swaps has been edging tighter, suggesting domestic funding conditions are easing

- Chinese firms are getting ready for discount deals in Europe, where the coronavirus pandemic has sent companies scrambling for cash to stay in business

Asian equity markets traded mostly higher as the region took impetus from the considerable pick up on Wall St where all major indices finished higher by at least 7.0% and the DJIA notched a more than 1600-point gain amid hopes of a slowdown in the coronavirus outbreak after encouraging numbers from various hot spots, although some economists warned caution given that the economy was far from out of the woods and the latest reports suggested the daily death toll in the US remained at an alarming level of 1150 according to the Johns Hopkins tracker. ASX 200 (-0.7%) and Nikkei 225 (+2.0%) were both boosted and surged over 2% shortly after the open although gains in Australia then waned amid losses in the healthcare sector and cautiousness heading into the RBA decision, while the Japanese benchmark briefly broke above the 19000 level supported by better than expected Housing Spending data and plans for a JPY 108tln package but later gave back a majority of gains heading into the state of emergency declaration. Hang Seng (+2.1%) and Shanghai Comp. (+2.1%) were also positive with outperformance seen in the mainland as it plays catch up on return from the extended weekend and took its first opportunity to react to the PBoC’s 100bps targeted RRR cut announcement. Finally, 10yr JGBs were higher as prices bounced back from support around the 152.00 level and with the BoJ offering to buy JPY 150bln of corporate bonds, although upside was also capped due to the mostly upbeat risk tone and following weaker results at the 30yr JGB auction.

Top Asian News

- Dubai Weighs Bond and Emirates Mulls Loans as Virus Hits Economy

- Qatar Looks to Raise More Than $5 Billion With ‘Dream’ Eurobond

- Indonesia Says New York Fed Will Provide $60 Billion Credit Line

- U.S. Blacklist Hurt Megvii’s Sales Before IPO Attempt

European stocks post another straight session of gains in early trade [Euro Stoxx 50 +3.5%], following a mostly positive APAC handover, as participants see optimism on the COVID-19 containments front and heading into the Eurogroup meeting on Finance Ministers, in which three stimulus measures are expected to be discussed. Broad-based gains are seen across the major European bourses, whilst Italy’s FTSE MIB (+5.2%) outperforms in the periphery, with the index’s large financial sector benefitting from price action in the fixed income complex – and as the region feels tailwinds from the ECB allocating a lion’s share of its bond-buying (35%) to Italian debt in March. Sectors are all in positive territory and reflect a “risk-on” mood, with cyclicals outpacing defensives, Financials benefit from the high-yield environment. The theme of today is a sharp rebound across stocks and sectors that have been decimated on the COVID-19 outbreak. The sector breakdown sees Travel & Leisure notably outperforming, whilst Auto names follow a close second. Thus, easyJet (+18.9%), Carnival (+18.8%) among the top gainers in the region, whilst aircraft engine makers Rolls Royce (+14.0%) and Safran (+9.0%) also see gains in excess of 10%, having recently been hit on the prospects of declining aircraft productions on lower demand. On the flip side, Healthcare names are softer given the sector’s relative buoyancy during the demise of riskier stocks – AstraZeneca (-1.8%), Novo Nordisk (-1.5%).

Top European News

- Europe Seen Facing Imminent Risk of Critical Medicine Shortages

- Germany’s Number of Coronavirus Recoveries Exceeds New Cases

- Europe’s Electricity Demand Slump Shows Signs of Stabilizing

- Swedish Banks Get Reprieve on Bail-In Bond Rule Amid Tumult

In FX, the Dollar is softer across the board amidst another upturn in sentiment on the hope that tentative signs of COVID-19 curve flattening do not prove short-lived and completely dashed by Tuesday’s global updates on the state of the virus. The DXY has retreated a bit further from recent recovery highs just shy of 101.000 as a result and is now hovering a fraction above 100.000 with little in the way of technical support before March 31’s high (99.948) to supplement the obvious psychological props.

- AUD/NZD – The Aussie is outperforming after the RBA maintained rates overnight and offered some exit policy guidance, albeit somewhat premature at this still very formative stage. However, bolstered by the aforementioned less downbeat risk tone Aud/Usd has built on advances through 0.6150 and got to within a whisker of 0.6200 before running out of momentum, while Aud/Nzd has crossed 1.0300 as the Kiwi failed to sustain 0.6000+ status in wake of NZIER sentiment sinking in Q1 and ahead of latest bi-weekly GDT auction results.

- NOK/GBP/EUR – The Norwegian Crown looks all set to extend its bull run against the backdrop of firm oil prices in the run up to Thursday’s OPEC+ meeting that Russia will attend and is reportedly nearing an agreement with Saudi Arabia about how many bpd to cut in order to stabilise the cost of crude. Eur/Nok has been down to circa 11.1060 even though the single currency has unwound declines vs the Buck at 1.0880 from sub-1.0800. Elsewhere, the Pound has also regrouped after depreciation on news of UK PM Johnson’s transfer to intensive care pushed Cable down to around 1.2165, but hit resistance into 1.2350 and is still below 0.8800 in Euro cross terms.

- CHF/CAD/JPY – The Franc is back near up the top of a 0.9725-95 or so range after SNB reserves data showing a fall in stark contrast to weekly Swiss sight deposits supporting the notion that intervention has picked up markedly of late, with little reaction to rises in jobless rates that are likely to pale in comparison to increases in unemployment to come. Similarly, the Loonie has pared post-BoC business outlook survey losses with the aid of buoyancy in oil to retest 1.4000 ahead of Canada’s Ivey PMI and awaiting the nation’s contribution to the joint crude output cut, assuming there is consensus. Meanwhile, the Yen has also profited at the Greenback’s expense, though to a lesser extent as a renowned safe-haven and with Japan confirming 7 prefectures in an official state of emergency, including Tokyo. Usd/Jpy is currently pivoting 109.00, but from a chart perspective still on an upward trajectory while above the 200 DMA (108.34) and not likely to stir hefty option expiry interest from 108.00 to 108.50 rolling off on Wednesday unless things change quite dramatically in the next 24 hours of course.

- EM – Widespread rebounds vs the Dollar, and with the Rand unwinding more of its significant underperformance through 18.3000 vs 19.3500 at the other extreme due to consolidation and short covering more than anything fundamental, aside from the broad improvement in risk sentiment.

In commodities, WTI and Brent front-month futures have resumed their rise in the run-up to a “make or break” OPEC+ meeting, with members outside the group urged to join in on a potential coordinated move. In terms of where we stand, the OPEC+ meeting is due to take place at on Thursday at 1500BST, with a presser to follow (all times tentative) – OPEC+ press conferences tend to be delayed. Reports also noted that G20 ministers to convene an extraordinary meeting on Friday at 1300BST, to discuss the energy market turmoil, according to reports. Energy Intel notes of a meeting on Friday in which members outside OPEC+ will be asked pledge additional reductions, “over and above 10mln BPD”. OPEC sources stated that OPEC+ group is reportedly likely to agree to oil production cuts on Thursday although it is contingent upon the US joining in with the production cuts, according to three OPEC+ sources. That said, earlier reports intimated OPEC+ still can’t reach a preliminary consensus on individual volumes of oil production cuts, particularly the largest producers, according to three delegations cited by TASS. As a reminder, under one of the touted OPEC+ scenarios: 10mln BPD cuts will include North America; Saudi would cut a minimum of 3mln BPD; Russia 1.5mln BPD; US, Canada, and Brazil almost 2mln BPD (Texas at least 500k BPD) according to sources cited by WSJ’s Summer Said. Furthermore, today will see the release of the first monthly oil report, the EIA STEO, which will depict a clear impact of the coronavirus outbreak – thus eyes will be on the magnitude of further demand downgrades and revisions lower to US crude output as a function of lower oil prices. That being said, the release may be overshadowed by the tentative OPEC+ congregation later in the week, which will shift the dynamic in the oil market. In terms of data, the weekly API releases at the usual time, with forecasts for a headline build of around 9mln barrels over the last week. WTI May’20 hovers around USD 27/bbl (vs. low of USD 26.29/bbl, and high USD 27.19), whilst its Brent counterpart re-eyes USD 34/bbl to the upside having briefly breached the level during late APAC trade. Elsewhere, spot gold fails to benefit from the weaker Buck, as the rise in equities proves the yellow metal to be less attractive, with prices back below 1650/oz after rising to a whisker away from 1680/oz in the overnight session. Meanwhile, copper prices continue to mimic the rise in stocks, with the red metal piggybacking overall risk appetite and breaking out of its recent range (USD 2-2.25lb), with red metal prices around USD 2.3/lb at the time of writing.

US Event Calendar

- 6am: NFIB Small Business Optimism, prior 104.5

- 10am: JOLTS Job Openings, est. 6,500, prior 6,963

- 3pm: Consumer Credit, est. $14.0b, prior $12.0b

DB’s Jim Reid concludes the overnight wrap

It seems odd to be discussing how the global virus trend numbers continue to get better whilst the PM of your country is moved into intensive care trying to battle it. However that’s where we stand at the moment. The latest percentage growth in new cases and fatalities have slowed notably in recent days even in the US and U.K. which are at the rear in terms of Western World progress through the virus. If the U.K. numbers just stabilise today that will be a big deal as over the last three weeks Tuesday’s numbers have been notably higher as the weekend data gets properly absorbed. See today’s Corona Crisis Daily for full evidence of the recent trends including new case growth in Italy and Spain both dropping below 3%.

Staying with Italy our equity strategist Binky Chadha has produced a chart that shows the correlation between the S&P 500 and Italian new case numbers over the last few weeks is very high. We’ve recreated it in the pdf of this report today for those interested. The correlation clearly can’t go on indefinitely but given Italy is the leader of the West in terms of development of the virus then it makes sense why markets have been linked to it. Indeed the S&P 500’s +7.03% surge yesterday was testament to that.

More on markets later but the hottest topic around the world continues to be the exit strategy. The slowing new case and fatality growth rates are broadly in line with the potential reopening dates flagged in our “The Exit Strategy” note link here we published last week. However as we discussed yesterday in the EMR it’s still unclear how the West will reopen their economies, what % of the economy will be functioning as we enter Q3 (and beyond), and how we can avoid rolling lockdowns as new cases re-emerge as economies come back to life. So the data is looking better but the return to normal strategy still needs a lot of work.

On this Austria took a lead yesterday as Chancellor Kurz said that small stores would be allowed to reopen from April 14, before other stores could open in May, with restaurants and hotels following in mid-May. Note that they’ve had new case growth slow to a crawl in recent days so are in a position to start to think about this. Another country that seems to be inching towards an exit strategy is Denmark, where they announced yesterday that kindergartens and primary schools would re-open April 15th, dependent on where numbers and citizen behaviour goes from here. In the U.K. a report from academic body CAGE from Warwick University (link here – note I’m a supervisory board member of the group but have no input into their work) suggested that 20-29 years olds that don’t live with their parents should be allowed back to work in the U.K. citing the Imperial College stats that suggest a covid-19 fatality rate of 0.03% and a critical-care rate of 0.06% amongst this group. So clearly as case and fatality rates continue to slow these conversations are going to get more and more frequent.

That said, Merkel said it was too soon for Germany to set a date for easing restrictions, and concerns remain given events in Japan and other areas (e.g. Singapore) that an easing of restrictions could just lead to another wave of infections. So while the slowing of new cases and fatalities is a big positive, the exit strategy is still clouded in great uncertainty.

Today, the main highlight will be the Eurogroup meeting of Euro Area finance ministers taking place via video conference this afternoon, the follow-up to the European Council meeting on 26 March when no solution was reached. DB’s Chief European economist, Mark Wall, published a blog yesterday (link here) where he writes that press reports suggest the debate has narrowed in on a three part package. As we mentioned yesterday, that would include a healthcare funding plan from the ESM worth up to EUR200bn, which would see conditionality tied to healthcare alone and not economic policy, which would be more politically costly. The second element would be the EIB offering re-insurance of credit guarantees, either taking a fixed proportion of these guarantees or a first-loss piece. The third element relates to the labour market, with a new EU-wide partial unemployment scheme based on Germany’s Kurzarbeit. Given it could potentially be as much as 4.5% of GDP, that’s a meaningful size, and would bypass the need for a new EU institution to issue “coronabonds”. However, as Mark says this should only be seen as a necessary first step, and the probability of needing to follow up with further demand stimulus is rising.

Onto financial markets, risk had a bumper day with the S&P 500 up +7.03% and the STOXX 600 up +3.73% with markets liking the slowing of the virus spread and death rates around the world. Volatility also continued to decline, with the VIX index down -1.6pts to 45.2pts, its lowest level in a month. Only 12 stocks in the S&P 500 were down on the day, and it was mostly consumer goods and biotech stocks that have actually outperformed over the last month. However, energy stocks relatively underperformed on both sides of the Atlantic against a backdrop of declines in oil prices after a week which saw the commodity rally over +30%. Brent crude was down by -3.11% and WTI by -7.97% ahead of an emergency meeting of G20 oil ministers planned for Good Friday. OPEC+ is also expected to meet on Monday now, with invitations being sent to countries normally not in attendance like Brazil and Norway.

Overnight, Bloomberg has also reported that the US Congress’s next stimulus bill would be at least another $1tn. The report highlights that stimulus would be focused on replenishing funds for programs established in Congress’s $2.2tn virus relief bill signed into law last month while there will also be additional direct payments to individuals, extended unemployment insurance, more resources for food stamps and more funds for the Payroll Protection Plan that provides loans to small businesses (per lawmakers on the call). Futures on the S&P 500 are trading down -0.62% nevertheless.

As for markets in Asia, the Nikkei (+0.21%), Hang Seng (+0.26%) and Kospi (+0.49%) all up but have pared bigger gains made earlier in the session. The Shanghai Comp (+1.74%) is leading as markets reopened in China post a holiday. In currencies, the US dollar index is trading down -0.13% this morning while in bond markets yields on 10y USTs are up c. 1bps to 0.682%. In commodities, WTI and Brent crude oil prices are trading up +2.99% and +2.63% respectively this morning.

In other news, Bloomberg is reporting that the IMF is preparing to offer short-term dollar loans to countries that lack enough Treasuries to participate in a Fed program that enables foreign central banks to temporarily exchange US debt for dollars. The report added that the initiative has the support of the US Treasury and may be launched within weeks. Elsewhere, Japanese PM Shinzo Abe will unveil details of a record stimulus package worth close to $1tn later today – roughly 20% of GDP. The size of the stimulus is around double of what was being reported earlier however that may include some of December’s supplementary budget.

Back to yesterday and with investors moving out of safe havens and into risk assets, core sovereign bonds lost ground yesterday, and yields on 10yr Treasuries ended the session up +7.5bps, while those on 10yr bunds were up +1.6bps. Conversely, peripheral European debt outperformed, with the spread of Italian and Spanish yields over bunds falling by -7.7bps and -3.5bps respectively. There was a similar theme over in FX as well, with the weakest performing G10 currency being the safe-haven Japanese Yen, weakening by -0.61% against the dollar. Given what happened to other safe assets, gold was something of an outlier yesterday, rising +2.48% in its 4th successive move higher, and meaning the precious metal now needs just over a 1% increase to climb above its 7-year closing high of $1680/oz seen last month. With equity’s rallying HY cash spreads tighten on both sides on the Atlantic, with US HY cash 17bps tighter and Europe HY 10bps tighter.

Economic data out yesterday continued to show the massive impact the coronavirus was having on the global economy. If you’re interested in hearing more about the overall impact, we’ve launched another of our podcast series, Podzept, with our Global Head of Economic Research, Peter Hooper, where he discusses the impact the virus is having on the global economy. See here for how to access.

In terms of that data, new car registrations in the UK in March fell by -44.4% year-on-year, a massive decline from the -2.9% in February. This decline is in fact bigger than the -36.8% fall in November 2008 at the height of the financial crisis. The country’s construction PMI didn’t show much optimism either, falling to 39.3 in March (vs. 44.0 expected), its lowest level since April 2009. Over in Germany meanwhile, the construction PMI also fell to 42.0, a 7-year low. And while the February data is rather outdated by now, for completion German factory orders rose by +1.5% year-on-year (vs. -0.2% expected), their first year-on-year increase since May 2018.

To the day ahead now, and the highlight is expected to be the video conference of the Eurogroup later, who’ll be discussing the EU’s coronavirus response. Data out includes February releases on German industrial production, the French trade balance and Italian retail sales, while from the US, we’ll also get February’s JOLTS job openings.

Tyler Durden

Tue, 04/07/2020 – 08:10

via ZeroHedge News https://ift.tt/34fJEtZ Tyler Durden