Futures Reverse Rally As Oil Slides Ahead Of Surge In Unemployment Claims

U.S. stock index futures dipped on Thursday, reversing a 3-day rally as investors braced for another staggering weekly jobless claims number, while European stocks clung to modest gains on the last trading day before the Easter holiday. Oil initially rose in the wake of Russia signaling readiness to cut output although US resistance to join the conversation has sparked concerns today’s OPEC+ meeting could end up a major disappointment.

Early in the overnight session, futures continued their multi-day ramp on early signs the coronavirus outbreak in U.S. hot spots was close to peaking, with the S&P 500 ending more than 3.4% higher after President Trump suggested the government could reopen the country in phases and maybe ahead of schedule. However, sentiment has warned as the session continued ahead of today’s plethora of risk events.

First and foremost, traders will eye the number of initial jobless claims which are expected to have surged by 5.5 million this week, and to 15 million in the past three weeks. Estimates in the survey were as high as 9.295 million, and the final report from the Labor Department is expected at 8:30 a.m. ET.

Then again, the worse the initial claims number, the better it will likely for stocks. As DB’s Jim Reid writes, “brace yourself ahead of what will likely be the strangest Easter weekend in your lifetime as today we have another weekly jobless claim report to look forward to in the US. Having said that the S&P 500 has rallied on the day of the staggeringly bad numbers over the last two weeks (+6.24% and +2.28% respectively) so it may be as much a curiosity of how bad unemployment is going to be in the short term as much as it is about markets.”

A major event today will be the OPEC+ virtual meeting, where the Kuwait Oil Minister said the intention is moving towards reaching an agreement to lower output by a large amount between 10mln-15mln bpd, even though the Kremlin declined to comment on reports their maximum cut would be 2mln BPD. Russia and Saudi Arabia still need to settle differences regarding plans for a global oil production cut according to sources, regarding baseline and quantity with Vladimir PUtin saying he has no plans to talk to Trump or the Saudis. Meanwhile, yesterday we learned that consumption in India, the world’s third-biggest user, has collapsed by as much as 70% with the country in lockdown which is why Goldman said that even a 10mmb/d oil cut would have no impact on its $20 oil price target.

In Europe, the Stoxx Europe 600 Index trimmed an advance amid reports that Italy and the U.K. may extend lockdowns to combat the coronavirus outbreak, though it stayed higher overall. The impact of the outbreak continued to surface in corporate results with Switzerland’s largest banks bowed to pressure to delay dividends even as UBS Group AG reported a surprise jump in first-quarter profit.

Earlier in the session, most Asian stocks rose, led by energy and finance, after rising in the last session. Australia’s S&P/ASX 200 gained 3.5% and India’s S&P BSE Sensex Index rose 3.1%, while Japan’s Topix Index dropped 0.6% as did the Topix with Hiramatsu and Bic Camera falling the most. The Shanghai Composite Index rose 0.4%, with Jiangsu Jiangnan High Polymer Fiber and Lifan Industry Group posting the biggest advances.

Investors have been trying to figure out how and when the $90 trillion global economy can begin to reboot in the wake of the coronavirus. While the White House’s top health advisers develop criteria to reopen the U.S. in the coming weeks if trends hold steady, the pandemic continues to exact a heavy toll. Italy’s new cases crept up after several days of declines, raising questions about whether plans will be delayed for relaxing the stringent restrictions on public life. The coronavirus may be “reactivating” in people who have been cured of the illness, according to Korea’s Centers for Disease Control and Prevention.

“It’s all a question of when the economy reopens and how quickly that happens,” said Nancy Davis, chief investment officer of Quadratic Capital Management LLC. “We aren’t out of the woods.”

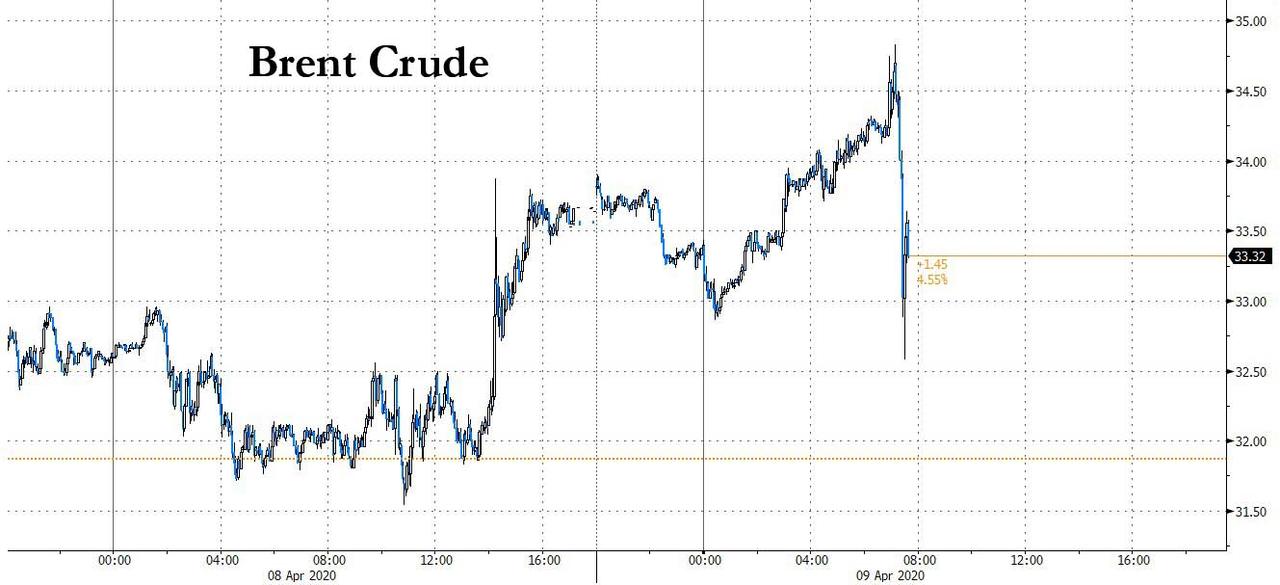

Attention also is turning to oil where Bloomberg reports that Saudi Arabia and Russia are still disagreeing over the baseline for OPEC+ oil-production cuts, with the kingdom insisting that reductions should be measured against a baseline of April output (i.e. the 12mmb/d) not the February baseline of 9mmb/d, which is what Russia demands. The group is debating supply cut in the range of 15-17%, said one delegate, while Russia is ready to cut its production by 1.6m b/d, or about 14%, according to the Energy Ministry. All OPEC+ members expect voluntary cuts from the US, even as Trump says organic decline in US production will meet the production cut quota, while OPEC insists these would come too late. Last minute jitters hit the price of Brent which tumbled by $2, erasing all the session’s gains.

In FX, the USD was initially weaker, with the Bloomberg Dollar Spot Index edging lower and most Group-of-10 currencies were range-bound. EUR/USD gained modestly. Norway’s krone climbed against all G-10 peers after Algeria’s energy minister was reported as saying an OPEC+ meeting on Thursday will discuss an output cut of up to 10 million barrels a day. The yen was steady while Japanese government bonds climbed after a sale of five-year notes drew the strongest demand in a year

In rates, 10Y yields dropped by 5bps from 0.78% to 0.73% last, while bunds were little changed while Italian government bond curve bear-flattened.

To the day ahead now, and there are a number of highlights to look forward to. From central banks, Fed Chair Powell will be giving an online webinar hosted by the Brookings Institution, where he’ll give an economic update. We’ll also hear from San Francisco Fed President Daly. In terms of data releases, in addition to the aforementioned weekly initial jobless claims and also the University of Michigan’s number, we’ll get March data including US PPI and Canada’s net change in employment. Looking back into February, there’ll also be the UK’s monthly GDP reading, the German trade balance, Italian industrial production and the final wholesale inventories reading from the US.

Market Snapshot

- S&P 500 futures up 0.2% to 2,740.50

- STOXX Europe 600 up 1.2% to 330.66

- MXAP up 0.7% to 140.61

- MXAPJ up 1.5% to 454.19

- Nikkei down 0.04% to 19,345.77

- Topix down 0.6% to 1,416.98

- Hang Seng Index up 1.4% to 24,300.33

- Shanghai Composite up 0.4% to 2,825.90

- Sensex up 3.5% to 30,928.06

- Australia S&P/ASX 200 up 3.5% to 5,387.32

- Kospi up 1.6% to 1,836.21

- German 10Y yield fell 0.7 bps to -0.313%

- Euro up 0.2% to $1.0874

- Italian 10Y yield rose 3.6 bps to 1.479%

- Spanish 10Y yield rose 0.8 bps to 0.849%

- Brent futures up 3.2% to $33.90/bbl

- Gold spot up 0.6% to $1,655.84

- U.S. Dollar Index little changed at 100.06

Top Overnight News from Bloomberg

- ECB President Christine Lagarde renewed her plea for a strong fiscal response to the impact of the coronavirus, urging governments to get over their differences as they go into a second round of talks on Thursday

- A rise in new coronavirus infections in Germany, Italy and Spain is raising questions about the speed with which Europe can begin to relax its stringent restrictions on public life

- The coronavirus may be “reactivating” in people who have been cured, according to Korea’s Centers for Disease Control and Prevention

- U.K. Prime Minister Boris Johnson spent a third night in the critical care unit where his condition was improving, as British officials draw up plans to extend the lockdown in an bid to control the coronavirus crisis

- U.K. Chancellor of the Exchequer Rishi Sunak is poised to increase emergency borrowing from an overdraft at the Bank of England to keep injecting fiscal aid to the economy while staving off immediate pressure to sell more gilts The U.K. economy unexpectedly contracted 0.1% in February from the previous month, with the downturn driven by a huge drop in construction. In the three months through February, growth stood at 0.1%

Asian equity markets were mostly higher as the region marginally benefitted from the tailwinds from Wall St where major indices were underpinned by hopes of a coronavirus peak nearing and amid a surge in energy prices on optimism for a potential output cut deal at today’s OPEC+ meeting. ASX 200 (+3.4%) was buoyed after parliament approved the record AUD 130bln stimulus bill to support jobs and with upside led by notable strength in financials and tech, while energy names were lifted by the surge in oil prices after reports suggested potential cuts of 10mln-15mln bpd were being touted and that Russia was ready to join in on an OPEC+ deal. Nikkei 225 (U/C) lagged amid a choppy currency and after source reports noted the BoJ is to project an economic contraction but added there was no consensus yet within the central bank whether this would warrant additional easing. Hang Seng (+1.4%) and Shanghai Comp. (+0.4%) also traded positive but with gains capped as the former heads into the extended Easter weekend, while upside in the mainland was also limited after the PBoC refrained from liquidity injections and the Politburo reiterated the view that China was facing increasing difficulties for economic development. Finally, 10yr JGBs nursed the prior day’s losses and reclaimed the 152.00 level amid the underperformance in Japanese stocks and following stronger demand at the 5yr JGB auction.

Top Asian News

- Turkey to Temporarily Ban Layoffs, Offers Help Seen as Pittance

- Bank Indonesia Sees Further Gains in Rupiah as Currency Rallies

- Taiwan Rejects WHO Claim of Racist Campaign Against Tedros

- Bank of Japan Sees All Parts of Country Hurting From Virus

European stocks initially followed suit from the mostly positive APAC handover but drifted off highs as the session got underway (Euro Stoxx 50 -0.3%). Sentiment was originally supported as hopes lingered of a coronavirus peak nearing and amid firmer energy prices heading into the “make or break” OPEC+ and G20 energy meetings. However, tail risks remain that the Eurogroup may reencounter a roadblock in talks later today. Bourses overall see a mixed performance, Switzerland’s SMI (-0.6%) underperformance as heavyweights Nestle (-2.0%), Roche (-1.6%) and Novartis (-0.9%), which together account for over 50% of the index’s weight, extend on losses. Germany’s DAX (+0.4%) remains somewhat resilient, potentially aided by cautiously upbeat comments from the German Health Minister, who stated that recent infection numbers indicate a positive trend and lockdown measures could soon start to be eased gradually if the trend continues. UK’s FTSE (+1.7%) outperforms as energy names see large-cap tailwinds from the energy complex. Sectors have also lost steam after opening firmer across the board – now mixed, albeit no clear risk tone can be derived. The breakdown also offers no real signal of the sentiment, although hopes of a slowing virus outbreak see Travel & Leisure outperforming. In terms of individual movers, Credit Suisse (+0.4%) and UBS (-0.4%) waned off opening highs – the Swiss banks decided to split their dividends in half, as advised by the Swiss Regulator FINMA. SAP (+2.0%) rises despite guidance cuts for total revenue and operating profit – the Co. raised its predictable revenue guidance.

Top European News

- U.K. Economy Unexpectedly Shrank Before Virus Restrictions Hit

- Sunak Taps BOE Overdraft to Keep Crisis Stimulus Cash Flowing

- Polish Anti-Crisis Shield Comes With Risk for Private Owners

- Czech Stocks Are Set to Exit Bear Market; Patria Says Buy CEZ

In FX, the Greenback is relatively mixed and rangebound vs G10 counterparts awaiting the latest weekly US jobless claims release for further evidence of COVID-19 collateral damage to the labour market. However, the next big directional and sentiment drivers could well come from external sources such as the OPEC+ meeting and Eurogroup response to the coronavirus if global oil producers and Finance Ministers can overcome differences to set a deeper output cut pact and deliver coordinated fiscal stimulus. In the meantime, little motivation for the DXY to deviate outside recent ranges that have been tethered to the 100.000 anchor as the index rotates from 100.300 to 99.899.

- GBP/NZD/EUR/CHF/AUD – Major outperformers to varying degrees as the Pound rebounds firmly from post-UK (trade in the main) data lows after another update on PM Johnson indicating further improvement, with Cable finally breaching multiple tops around 1.2420 and Eur/Gbp retesting the 0.8750 mark that sits just above key chart support in the form of the 200 DMA (0.8748) and a Fib retracement (0.8747). Meanwhile, the Kiwi is consolidating above 0.6000 and Euro remains capped circa 1.0900 awaiting news from the delayed Eurogroup and any extra insight from ECB minutes in the interim – preview of the release available in the Research Suite. Elsewhere, the Franc is still straddling 0.9700, but rooted to 1.0550 against the single currency and Aussie has lost some altitude from a 0.6250 peak.

- JPY/CAD – Even tighter confines for the Yen either side of 1.0900 and some decent option expiry interest also keeping the headline pair in check (1.2 bn at 108.40 and 1.3 bn from 108.95 to 109.00). However, the Loonie continues to unwind gains and may even extend its retreat towards a 1 bn expiry at the 1.4100 strike depending on how bad looming Canadian jobs are – Usd/Cad currently nudging 1.4050 for reference.

- SCANDI/EM – Back to winning ways for the Nok and Sek, as the former forges more momentum on firm pre-OPEC oil prices alongside the Rub and Mxn, while the latter gleans some encouragement from signs of peaks in daily nCoV case and mortality rates elsewhere. Similarly, the Zar is making more headway ahead of an expected briefing from the SA Finance Ministers to outline anti-global pandemic measures.

- RBA Financial Stability Review said regulatory authorities have been working together to minimise economic harm from pandemic but noted financial market uncertainty is elevated and that the heightened uncertainty related to pandemic is compounding usual volatility in financial markets. RBA added that capital levels are high and banks’ liquidity positions improved over recent times, while banks also entered the downturn with high profitability and very good asset performance. Furthermore, it stated that many households in the period ahead will find finances under strain due to efforts to contain the virus. (Newswires)

In commodities, WTI and Brent front month futures continue trade firmer amid hopes of a coordinated OPEC+ output cut at today’s historical call among producers, and with scope for further action at tomorrow’s G20 energy webinar. Prices were bolstered late-doors State-side after the Algerian and Kuwaiti Energy Ministers expressed optimism towards a joint cut towards the upper end of the expected range, with the latter floating a cut between 10-15mln BPD. The complex received another boost in EU trade after sources stated that Russia is reportedly willing to curtail output by a maximum of 2mln, more than the 1.6mln BPD (equivalent to 15% of Russian oil output) reported yesterday. That being said, separate sources note that sticking points remain between Saudi and Russia regarding volumes and baselines – with Riyadh opting for current production levels to be used as a benchmark whilst Moscow prefers an average of Q1 output levels. Nonetheless, WTI extends gains above its 21 DMA (USD 24.69/bbl) and remains near session highs. Brent futures meanwhile breached resistance at the psychological USD 34/bbl, whilst the difference between the benchmark widened to above USD 7.50/bbl from around USD 5/bbl this time last week. Elsewhere, spot gold prices remain perky above USD 1650/oz after rebounding from recent support at USD 1640/oz ahead of the Eurogroup meeting later today, whilst a modestly softer Buck offers some tailwind. Copper meanwhile remains on the back foot after failing to convincingly breach resistance just above USD 2.3/lb, with prices hovering around USD 2.275/lb at the time of writing.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 5.5m, prior 6.65m; Continuing Claims, est. 8.24m, prior 3.03m

- 8:30am: PPI Final Demand MoM, est. -0.4%, prior -0.6%; PPI Final Demand YoY, est. 0.5%, prior 1.3%

- PPI Ex Food, Energy, Trade MoM, est. 0.0%, prior -0.1%; PPI Ex Food, Energy, Trade YoY, est. 1.28%, prior 1.4%

- PPI Ex Food and Energy MoM, est. 0.0%, prior -0.3%

- 10am: Wholesale Inventories MoM, est. -0.5%, prior -0.5%; Wholesale Trade Sales MoM, prior 1.6%

- 10am: U. of Mich. Sentiment, est. 75, prior 89.1; Current Conditions, est. 84.1, prior 103.7; Expectations, est. 60.7, prior 79.7

DB’s Jim Reid concludes the overnight wrap

Brace yourself ahead of what will likely be the strangest Easter weekend in your lifetime as today we have another weekly jobless claim report to look forward to in the US. Having said that the S&P 500 has rallied on the day of the staggeringly bad numbers over the last two weeks (+6.24% and +2.28% respectively) so it may be as much a curiosity of how bad unemployment is going to be in the short term as much as it is about markets.

These last two weeks have come in sequentially at 3.283m and 6.648m. DB is forecasting a further 4.5m claims today. As a reminder the worst in 53 years of data previously was 695k in 1982. Ahead of this the US closed in so-called “bull market” territory after seeing this landmark hit intra-day on Tuesday. The S&P 500 closed up +3.41% with the surge in oil (more below), as another round of stimulus (in the $250-500 billion range) continues to be discussed for small businesses and also on reports that Dr. Brix and Dr Fauci, the immunologist and infectious disease experts that have been coordinating the virus task force are working with the White House to construct plans to reopen the economy. In practise this will be very challenging but the markets love the idea of it. As risk continued to rally, the VIX fell 3.4 points to the index’s lowest levels in over a month at 43.35 last night.

Oil resumed its strong rally with Brent crude up +3.04% and WTI up +6.18% on initial reports out of Algeria that OPEC+ could cut as much as 10million barrels a day, which was hoped for as a best case scenario. Then reports came out of Russia that they were ready to cut their production by 1.6million barrels per day. This gave the original price move some credence. According to our colleague Michael Hsueh, this would be many times larger than cuts Russia has made in recent history, and they had only been entertaining cuts of 1million barrels previously. While this news came out too late to affect energy companies in Europe, the S&P 500 energy sector finished +6.74% higher. After the US closing bell the Kuwaiti oil minister upped the ante by suggesting talks were moving in the direction of the 10-15 million barrels a day cut.

Both Brent (+1.40%) and WTI (+3.19%) have pushed on further this morning which is helping markets in Asia advance. The Hang Seng (+0.70%), Shanghai Comp (+0.28%), ASX (+2.10%) and Kospi (+0.90%) are all up however the exception is the Nikkei which is down -0.32% as we go to print. In FX, the Norwegian Krone (+0.71%) is the notable mover this morning following the oil move. Elsewhere, futures on the S&P 500 are flat while yields on 10y USTs are down -2.4bps to 0.749%.

In terms of the virus, yesterday was the day we passed 1.5 million confirmed cases worldwide, with fatalities above 88,000. NY State now has roughly 10% of worldwide cases, and yesterday announced the most deaths (779) in a single day yet, with the only consolation being that it was the lowest day-over-day change in fatalities. The UK also announced a new high for deaths in a day (938), even as new case rates and hospital admissions improve. We have seen this in many regions, where fatalities may be more of a lagging indicator as they can continue to rise when people who have been hospitalised for long periods sadly pass away even after case curves flatten. Elsewhere Spain and Italy continue to improve though not as fast as we saw in China which complicates the exit strategy timings even if markets are getting more confident on this. For all the tables, graphs and bullets please see our sister daily – The Corona Crisis Daily – in an inbox near you very soon.

Back to markets and European equities underperformed, though they managed to pare back gains into the close with the STOXX 600 ending +0.02%. Continental markets struggled a bit as shortly after we went to press yesterday, we got the news that EU finance ministers had failed to reach an agreement on an economic rescue package and would instead be resuming their discussions again today. Eurogroup President Mário Centeno tweeted afterwards that “After 16h of discussions we came close to a deal but we are not there yet.” It seemed that once again, the traditional dividing lines between north and south that dominated in the European sovereign debt crisis were at the forefront, with reports suggesting that the Netherlands and Italy clashed over the conditionality that would be associated with a credit line from the ESM.

After the meeting, the Dutch finance minister, Wopke Hoekstra, tweeted that “Because of the current crisis we have to make an exception and the ESM can be used unconditionally to cover medical costs. For the long term economic support we think it’s sensible to combine the use of the ESM with certain economic conditions.” So an offer of no conditionality in the case of medical costs, but not if this is about “long term economic support”. Italy was resistant however, with Reuters saying that while they were willing to accept a reference on sticking to the bloc’s budget rules, they were not ready to commit to anything more specific. It’s also worth noting that the Italian government are under political pressure domestically, with League leader Matteo Salvini saying that “I hope the government won’t accept ESM, it would be illegal and senseless”. So all eyes on whether they can reach an agreement today and meet the two-week deadline to present proposals that was set by the European Council summit of leaders back on March 26th.

The effect of the failure to reach agreement was evident in sovereign bond markets, where peripheral spreads in Europe widened noticeably at the open yesterday (Italy 10yr +18bps), though they went on to narrow through the day. By the close, the spread of Italian and Spanish yields over bunds (broadly unchanged) were up by +3.3bps and +2.1bps respectively. Elsewhere credit marginally benefited from the risk on move in the US, with US HY cash spreads tightening -7bps, while IG tightened -9bps. In Europe HY spreads tightened -11bps and IG -5bps.

After a series of quite savage downgrades of economic forecasts in recent weeks, the most interesting yesterday was on global trade, with the World Trade Organization’s latest forecasts projecting that the volume of global merchandise trade will fall by between 13% (in their optimistic scenario) and 32% (in their pessimistic one). Their economists think that the declines will “likely exceed” the declines in trade as a result of the global financial crisis. The falls come on the backdrop of an already weak performance for global trade, with world merchandise trade actually falling by -0.1% in 2019 as the major economic blocs ratcheted up trade tensions. This leans towards our view that domestic economies will open up quicker than international travel will. See our “The exit strategy” link here for thoughts on the sequencing.

Staying with the economy, another area seeing deterioration is the US housing market, where data is continuing to show that the impact of the coronavirus and the subsequent rises in unemployment have begun to filter through. The weekly MBA mortgage applications from the US saw a further -17.9% decline in the week to April 3rd, while the Purchase index is now down by 33% compared with a year ago.

Fed minutes from the March 15th meeting were released yesterday, revealing very little new information. Nevertheless, there was a scenario analysis laid out by the committee around the thought process regarding the surprise cuts, “In one scenario, economic activity started to rebound in the second half of this year. In a more adverse scenario, the economy entered recession this year, with a recovery much slower to take hold and not materially under way until next year. In both scenarios, inflation was projected to weaken, reflecting both the deterioration in resource utilization and sizable expected declines in consumer energy prices”. While too early to judge which of those scenarios we are currently on, the longer the restrictions are necessary, the more likely the second becomes reality.

To the day ahead now, and there are a number of highlights to look forward to. From central banks, Fed Chair Powell will be giving an online webinar hosted by the Brookings Institution, where he’ll give an economic update. We’ll also hear from San Francisco Fed President Daly while the Bank of Korea will be deciding on interest rates. In terms of data releases, in addition to the aforementioned weekly initial jobless claims and also the University of Michigan’s number, we’ll get March data including US PPI and Canada’s net change in employment. Looking back into February, there’ll also be the UK’s monthly GDP reading, the German trade balance, Italian industrial production and the final wholesale inventories reading from the US.

Tyler Durden

Thu, 04/09/2020 – 08:06

via ZeroHedge News https://ift.tt/3c3nYUr Tyler Durden