Larry Fink Says Fed Must “Provide More Support” To Markets, Expects Higher Corporate Taxes

Since the Fed first revealed that it was hiring BlackRock, the world’s largest asset manager, to administer several of the central bank’s new debt-buying programs, front-running the central bank’s asset purchases has became the latest rec du jour.

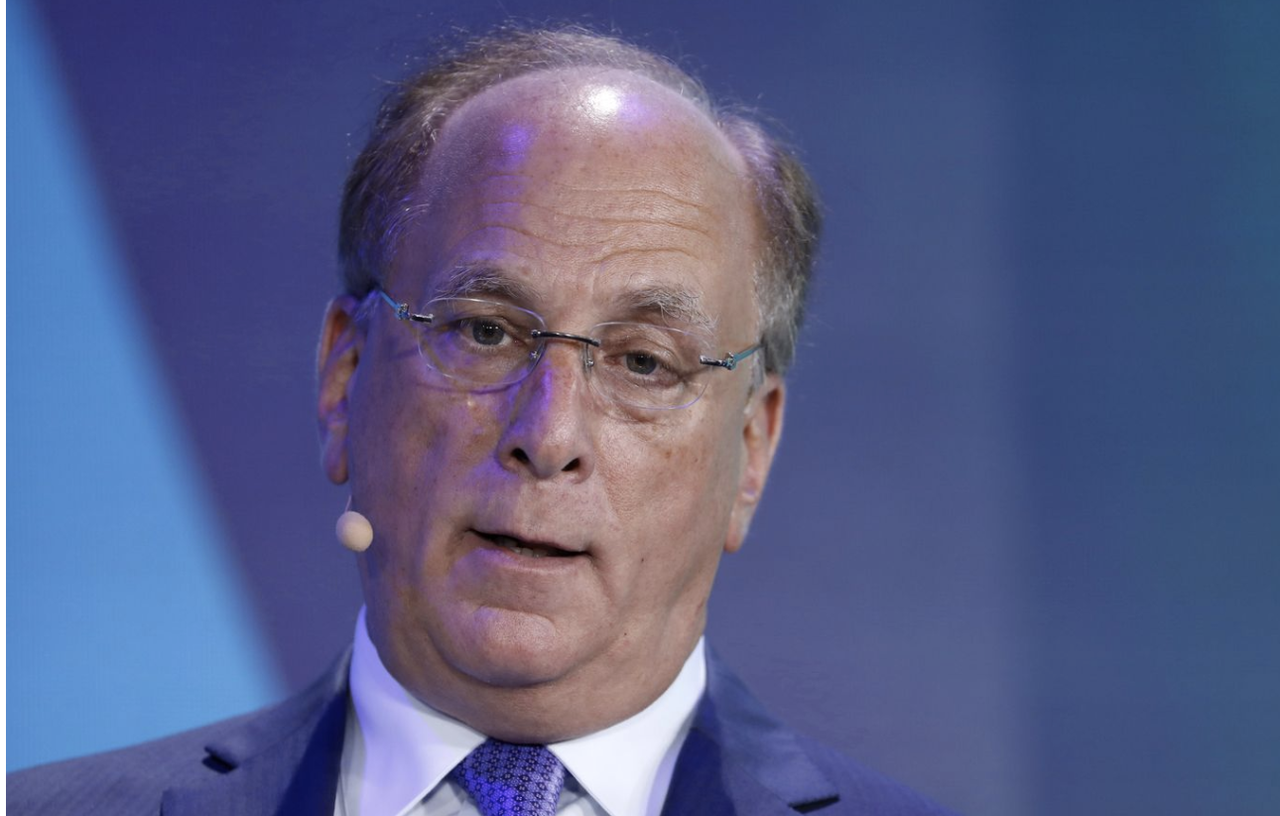

Mnuchin may play down the likelihood of the Fed buying stocks, but at this rate, the central bank and Mnuchin are really just waiting for the opportunity to justify backstopping equities outright (we’re surprised they didn’t jump at ‘Murder Hornets’). And whatever happens, we’re sure BlackRock will be there to act as the central bank’s faithful intermediary. BlackRock’s Rick Rieder says the $7 trillion ETF giant will continue to buy “whatever DM central banks are buying” as well as “assets that rhyme with those,” while its CEO Larry Fink, who has always tried to cast himself as a friend to the American retiree, is talking his firm’s book to whoever will listen, warning that the economic fallout is only beginning, and the Fed might want to consider turning the stimulus knob up to ’12’ – and send more of that sweet, sweet gravy BlockRock’s way.

During a private phone call, Fink shared a grim outlook with a ‘private’ audience: As bad as things have been for corporate America in recent weeks, conditions are likely to get worse, he said.

Investors can expect mass bankruptcies, empty planes, absent consumers and – eventually – a return of the corporate tax rate to levels as high as 29% (we wonder: did Fink just pick that number out of a hat?)” with taxes soaring for wealthy individuals as well.

Of course, with Larry Fink, you never know. The man is the personification of Wall Street clout. BlackRock is working with the administration and the Fed to guide the policy response to the crisis, and Fink himself is a personal advisor to Trump and the president’s team.

But, as BBG noted, “the message from the leader of the world’s biggest asset manager is a stark contrast to the ebullient tones of a stock market that has snapped back from recent lows” as stocks sank into the close, rattled by Trump’s latest reminder that the US relationship with China has probably deteriorated to its most tenuous in more than a century.

Fink is only the latest (see: Buffett, Zell) who suspect it might take years from Americans to return to taking flights and restaurants see traffic at levels from before the crisis. Fink reportedly told clients of a wealth advisory firm that bankers have told him they expect a cascade of bankruptcies to hit the American economy, and – get this – he wondered if the Fed needed to do more to provide support. Since a collapse in asset prices would lead to an explosive tightening of financial conditions and almost immediately spill over into the real economy, taking everything down.

Fink also said taxes would need to rise for wealthy individuals as well, probably to the chagrin of all the wealthy people on the call.

An unnamed individual who was on this call purportedly went and told Bloomberg about it. The details are so precise, we almost wonder if Fink simply let a reporter secretly join. A BlackRock spokesman “declined to comment” when approached by BBG.

The implication here, of course, is that Democrats will swiftly move to hike taxes if they win over Trump in November. Meanwhile, if Trump wins a second term, we presume he will pursue another strategy like leaning on the Fed to allow inflation run wild, like the US did after World War II (remember stagflation?).

In which case, gold is in for a secular bull market, while inflated asset prices might see more pain in the offing.

Fink also said he sees tax rates for individuals going up. Raising taxes would water down the biggest legislative achievement of Trump’s time in office, when he and a Republican- controlled Congress drove through the most significant changes to the tax code in decades.

In summary: an economic reckoning is inevitable. The notion that the economy and asset prices will escape this without some serious scarring is magical thinking.

Tyler Durden

Wed, 05/06/2020 – 17:45

via ZeroHedge News https://ift.tt/2SINpDt Tyler Durden