Neiman Marcus Files For ‘Prepack’ Bankruptcy, Joining J Crew

Just three days ago, we reported that Neiman Marcus – aka “Needless Markups” – was on the cusp of striking a deal with creditors for financing that would help tide it over through bankruptcy.

Well, it looks like the big day has finally arrived. Bloomberg reports that Neiman Marcus Group has officially entered into a Restructuring Support Agreement with a significant majority of its creditors to undergo a financial restructuring and file for “voluntary prearranged” bankruptcy protection.

Here’s a summary of the deal (courtesy of BBG):

- Secures $675 million debtor-in-possession loan and commitment to fulfill $750m exit financing package from creditors

- Commences voluntary prearranged Chapter 11 proceedings

- Sees to emerge from process in early fall 2020

- Creditors have committed to fulfill a $750m exit financing package that would fully refinance the DIP financing and provide additional liquidity for the business

- Commences voluntary prearranged Chapter 11 proceedings in U.S. Bankruptcy Court for the Southern District of Texas, Houston Division

- Upon emergence, planned capital structure is seen to be long dated with no near-term maturities and to eliminate approximately $4b of its existing debt

- CEO says pandemic has placed “inexorable pressure” on the business

- Company says transaction is supported by existing holders and, pursuant to the agreement, creditors participating in the RSA will become majority owners

Of course, NM is just the latest retail name to go under. And like many of its peers, its cashflows have been sapped by onerous debt from a 2013 LBO involving Ares Management Corp and the Canada Pension Plan Investment Board, as BBG explains.

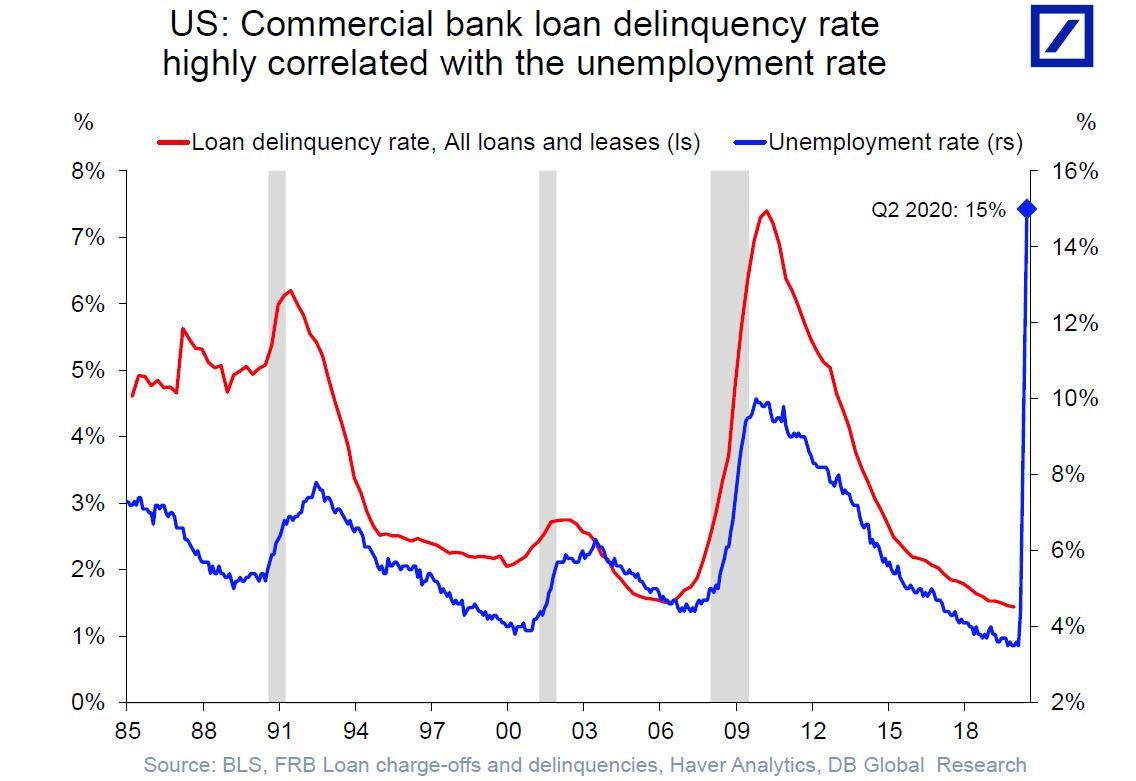

The latest weekly report on the number of Americans filing for unemployment benefits showed that more than 30 million jobs have now been destroyed thanks to the outbreak.

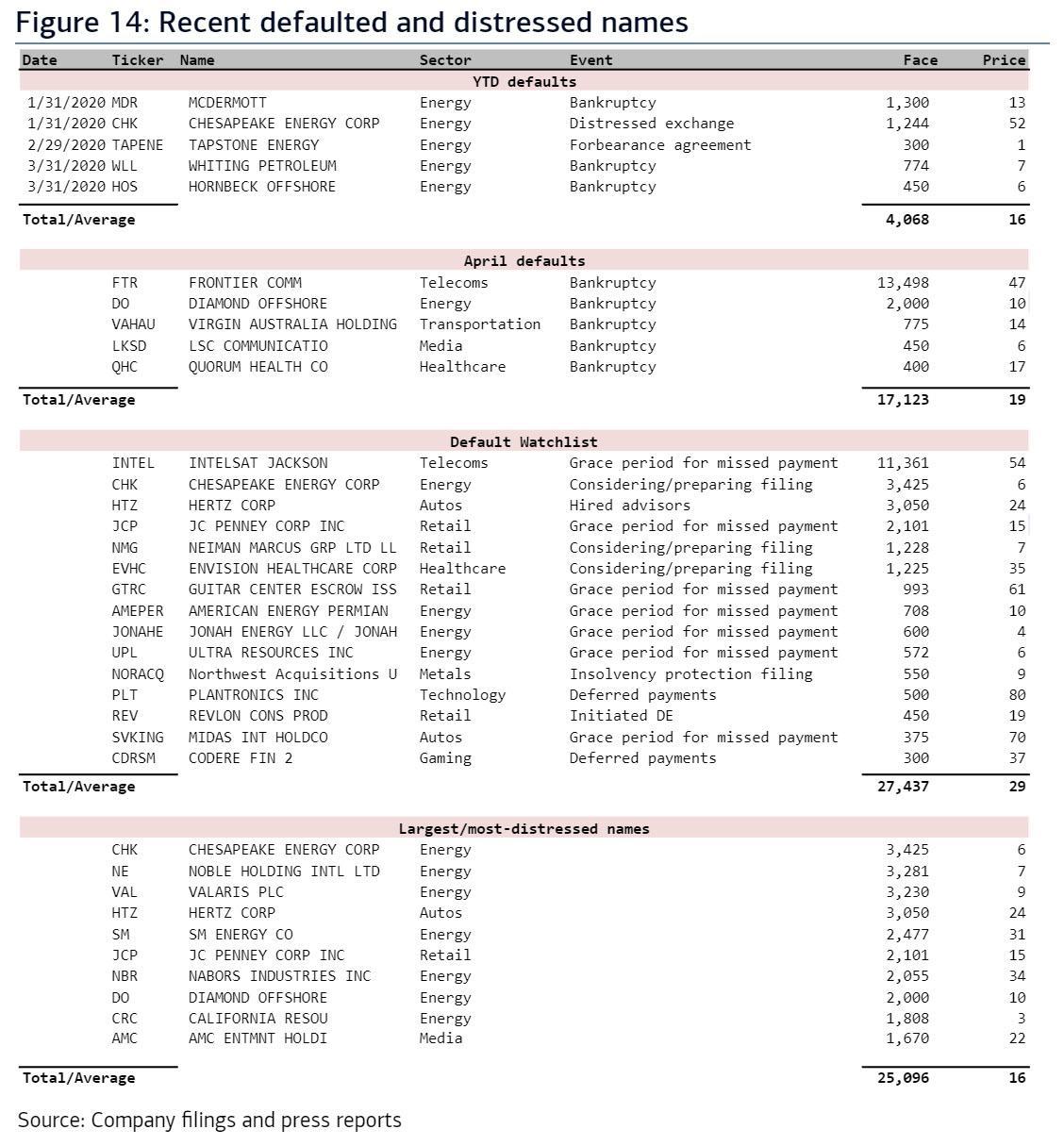

And as we noted earlier, the looming wave of bankruptcies – caused by a confluence of the virus, low oil prices, prevailing recessionary conditions, and a massive overhang of corporate debt that will soon lead to a tidal wave of downgrades, bankruptcies and liquidations.

It goes without saying that job losses are likely only just ramping up.

And just like that – another name gets crossed off “the list”.

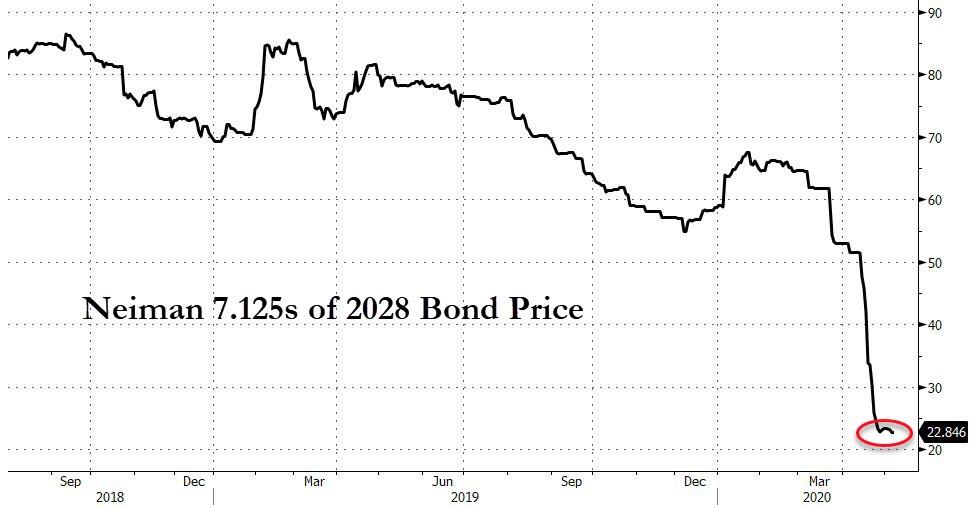

As expected, the bonds are getting hammered.

Will JCPenney be next?

Tyler Durden

Thu, 05/07/2020 – 10:37

via ZeroHedge News https://ift.tt/2WbPav5 Tyler Durden