Futures Soar Above 3,000, Dollar Tumbles On Vaccine Hopes, Reopening Optimism

Tyler Durden

Tue, 05/26/2020 – 08:04

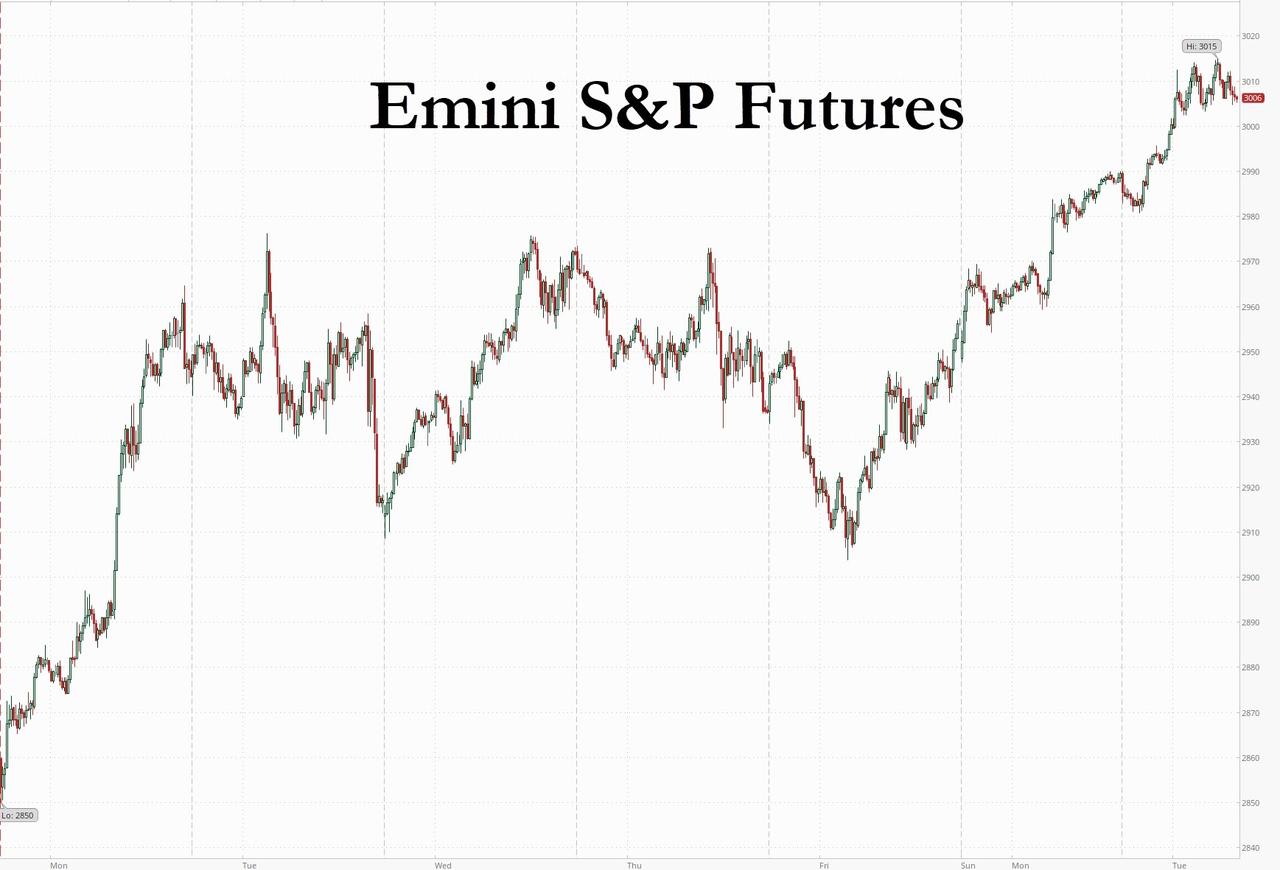

S&P futures continued their Memorial Day surge, rising 2% and breached the key 3,000 level on Tuesday morning as global easing of lockdowns, hope over new vaccines and business restarts boosted optimism about economic recovery among investors returning from a long weekend while putting concerns over a Hong Kong crackdown on the backburner. The Bloomberg dollar index concurrently tumbled below the key 1,240 level while 10Y yields jumped to 0.70%.

Following disappointing news from Remdesivir late on Friday, Merck has become the new vaccine darling du jour, jumping in pre-market trading after it unveiled development plans on both a treatment for Covid-19 and a vaccine against it. Beaten down travel-related stocks gained in premarket trading with United Airlines Holdings, Expedia, and Marriott all up about 8% each. This is a continuation of the trends seen last week, when indexes ended mixed on Friday as China-U.S. tensions heated up, but still managed to log more than 3% gains for the week, fueled by hopes of an eventual coronavirus vaccine and easing of virus-related curbs.

Europe’s Stoxx 600 Index jumped, with travel stocks surging on reports that Berlin plans to lift travel warnings for 31 European countries from June 15. The Stoxx 600 Travel & Leisure Index jumped 5.7% to the highest since April 30. Package holiday company TUI was the biggest gainer, up 37%; British Airways parent IAG gains 18%, EasyJet +9.8% and Intercontinental Hotels +9.6%. Deutsche Lufthansa, which rose 7.5% Monday after Germany reached agreement on a bailout, gains 6%.

Also on the reopening front, Spain urged foreign holidaymakers to return from July as it eases one of Europe’s strictest curbs, while Britain was looking to reopen thousands of High Street shops, department stores and shopping centers next month, sending the pound up by the most in almost a month.

In Asia, Japan led the equity advance as the world’s third-largest economy reopened, and shares rose in Hong Kong, which showed signs of stabilizing after weekend unrest. Asian stocks gained, led by materials and industrials, after rising in the last session. Most markets in the region were up, with Australia’s S&P/ASX 200 gaining 2.9% and Japan’s Topix Index rising 2.2%, while India’s S&P BSE Sensex Index dropped 0%. The Topix gained 2.2%, with J-Lease and Nippon Chemi-Con rising the most. The Shanghai Composite Index rose 1%, with Panda Financial Holding and Shanghai Fenghwa Group posting the biggest advances.

Largely locked down investors have come out of the holiday weekend in a swinging risk-on mood, even as tensions between Washington and Beijing continue to flare. Over the weekend, China condemned the U.S. for adding 33 Chinese entities to a trade blacklist, but without announcing any retaliatory steps even as it accused the US of being a paper tiger and one unwilling to intervene in Hong Kong due to its own pandemic problems. Meanwhile, Beijing sought to reassure Hong Kong that its judiciary would remain independent under a new national security law.

Offsetting geopolitical tensions are mounting signs that coronavirus infection rates are moderating. The Japanese government ended its nationwide state of emergency Monday, while Germany recorded a decline in the number of new virus cases. Signs that more euro area stimulus is on the way is also helping support the appetite for risk.

According to Marc Ostwald, chief economist at ADM Investor Services, “the narrative for markets is shifting somewhat, with hopes associated with the easing of lockdown measures in many countries and still very exaggerated hopes of a vaccine being found short-term, needing to be balanced against escalating U.S./China tensions.”

In rates, Treasuries begin holiday-shortened U.S. week under pressure as bear-steepening left yields cheaper by 1bp to 3bp ahead of $127 billion auction cycle consisting of 2-, 5- and 7-year notes this week. Treasury 10-year yields around 0.687%, cheaper by nearly 3bp vs Friday’s close, with 2s10s steeeper by ~2bp, 5s30s by ~ 1bp. Bunds cheaper by 2.5bp vs U.S. 10year, gilts by ~2bp. Auction cycle begins Tuesday with $44b 2-year note sale at 1pm ET, followed by $45b 5-year and $38b 7-year Wednesday and Thursday. The German government’s 2-year debt auction received bids worth more than 3 times the amount on offer. Germany currently pays around -60bps to borrow money for two years. “That and the demand at auction speak volumes”, according to BMO strategist Stephen Gallo.

In FX, the broad USD declined sharply as risk appetite rallied while commodity-related currencies paced gainers vs the USD (NOK, NZD, AUD, ZAR & MXN jumping from +1.0% to +1.7%).

The dollar fell against all peers except for the yen, while commodity currencies rallied as oil prices advanced following a prediction from Russia that the market may rebalance as early as next month after historic output cuts from global producers to drain a glut. The euro rallied after touching more than a one-week low against the dollar on Monday; German bonds fell, extending declines and underperformance against Treasuries as haven demand was unwound; Italian bonds rallied, tightening the spread over Bunds. The pound rose against the dollar and the euro, helped by news that restrictions on U.K. retailers will begin to ease next week. Australia and New Zealand’s currencies advanced as the end of a nationwide emergency in Japan and a slowdown of U.S. virus infections bolstered risk sentiment. According to Stephen Gallo, “a close in the BBDXY below the 1,240 level – which looks increasingly likely – could cement near-term USD weakness. When deciding whether this is a positioning story for FX or a realignment, we would err on the side of realignment. This move in the USD should not be fought (yet).”

In commodities, WTI crude oil advanced to around $34 a barrel on hopes the market may rebalance after historic output cuts. WTI and Brent front month futures continue to post gains, albeit the benchmarks have waned off highs in recent trade. Eyes remain on the wider implications on global trade and sentiment from the fallout of the US-Sino trade spat threatening a cold war, whilst investors must not be distraction from the prospects of reinstated lockdowns should COVID-19 cases rise again. On the supply front- Russian Energy Minister Novak is to reportedly meet with Russian oil majors to discuss an extension of current cuts past the end of June – the checkpoint for OPEC to reduce output curbs.

Looking at today’s calendar, the expected data include new home sales and consumer confidence. AutoZone is reporting earnings.

Market Snapshot

- S&P 500 futures up 1.8% to 3,006.00

- STOXX Europe 600 up 0.9% to 348.43

- MXAP up 1.9% to 148.89

- MXAPJ up 1.8% to 473.73

- Nikkei up 2.6% to 21,271.17

- Topix up 2.2% to 1,534.73

- Hang Seng Index up 1.9% to 23,384.66

- Shanghai Composite up 1% to 2,846.55

- Sensex up 0.02% to 30,678.38

- Australia S&P/ASX 200 up 2.9% to 5,780.05

- Kospi up 1.8% to 2,029.78

- German 10Y yield rose 4.9 bps to -0.445%

- Euro up 0.4% to $1.0944

- Italian 10Y yield fell 2.2 bps to 1.403%

- Spanish 10Y yield fell 1.2 bps to 0.6%

- Brent futures up 1.6% to $36.11/bbl

- Gold spot down 0.3% to $1,727.40

- U.S. Dollar Index down 0.5% to 99.41

Top Overnight News from Bloomberg

- Sterling traders look set to face heightened uncertainty on multiple fronts next month — the end-June deadline to extend the Brexit transition period, the possibility of negative interest rates in the U.K. and the economy’s tentative exit from the pandemic lockdown

- A German Ifo gauge measuring trade expectations among manufacturers jumped by a record but remained below zero, indicating that pessimism receded even though it was still the prevailing sentiment

- Wuhan found 206 asymptomatic patients from 6.68 million people as it concluded a campaign to test the entire population after several infections prompted fears of a second wave

- With inflation low, there is room for the ECB to innovate and act “rapidly and powerfully,” Bank of France Governor Francois Villeroy de Galhau told a conference in Paris on Monday. He also signaled that he’d like to see even looser limits on the 750 billion-euro ($817 billion) plan

- Singapore’s economy is facing its worst contraction since independence more than a half-century ago as the coronavirus outbreak and measures to contain it pummel the trade-reliant city state

- Dominic Cummings, one of Boris Johnson’s closest allies, refused to quit his job in the U.K. government, refuting claims he flouted lockdown rules that he had helped to draft. Japan ended its state of emergency everywhere in the country and made reviving the economy its top priority. The World Health Organization temporarily halted tests on hydroxychloroquine

- China sought to reassure Hong Kong that its judiciary would remain independent under a new national security law, as concerns grow that the city may lose one of its key selling points for international companies

- People’s Bank of China Governor Yi Gang said the domestic economy is improving despite global uncertainty, and indicated the bank will continue with the current targeted easing approach.

- The Bank of Japan would consider changing interest rates for its yield curve control program if it were necessary, Governor Haruhiko Kuroda told lawmakers in parliament Tuesday

- England’s outdoor markets and car showrooms will be able to re-open from June 1, as soon as they are able to meet the coronavirus guidelines to protect shoppers and workers, Prime Minister Boris Johnson said on Monday. All other non-essential retail outlets including shops selling clothes, shoes, toys, furniture will be expected to be able to reopen from June 15 if the government can control the spread of the virus

- Oil rose above $34 a barrel following a prediction from Russia that the market may rebalance as early as next month after historic output cuts from global producers to drain a glut

Asian equity markets were higher across the board and US equity futures also extended on gains in which the E-mini S&P prodded the 3000 focal point, as trade picked up from the holiday lull and given the lack of fresh catalysts to force a shift in the recent constructive narrative. ASX 200 (+2.9%) was lifted as all sectors traded positive and with notable gains seen in both financials and energy, while Nikkei 225 (+2.6%) outperformed as exporters cheered a weaker currency and after PM Abe formally lifted the nationwide state of emergency. Hang Seng (+1.8%) and Shanghai Comp. (+1.0%) also conformed to the positive tone with the surge in Hong Kong attributed to dip buying and with sentiment underpinned after the PBoC injected liquidity through reverse repos for the first time in almost 2 months, while PBoC Governor Yi reiterated that prudent monetary policy will be more flexible and that they will strengthen macro policy, as well as counter cyclical adjustments. Finally, 10yr JGBs were range bound with prices marginally higher amid mixed results at the 40yr JGB auction and despite the gains in stocks, while there were comments from BoJ Governor Kuroda who reiterated the central bank stands ready to act further through various policy tools and suggested that they will conduct appropriate easing measures after the coronavirus is contained.

Top Asian News

- Wuhan Tests Millions in 12 Days as China Fears Second Virus Wave

- Singapore Slashes Growth Target With 7% Contraction Possible

- Indonesia Deploys Army to Enforce Lockdown Before Reopening

- Speculators Target Hong Kong’s Currency on Outflow Concern

European indices have extended on yesterday’s gains (Eurostoxx 50 +0.8%) with the FTSE 100 (+1.4%) top of the pile as UK participants return from their extended weekend. In terms of over-arching macro themes, there hasn’t been much in the way of fresh fundamental catalysts since yesterday’s close, however, from a technical perspective, market participants may seek some encouragement from the e-mini moving back above the psychological 3000 mark. Additionally, looking at some of the top gainers thus far, the reopening narrative appears to be playing a key role once again. The main source of traction thus far has been in the travel & leisure sector with UK-listed IAG (+15.4%), Intercontinental Hotels (+12.4%), easyJet (+11.6%) and Ryanair (+7.6%) all showing substantial gains from Friday’s close with optimism for the sector buoyed by ongoing border reopenings across the continent, whilst Deutsche Lufthansa (+5.3%) shares remain elevated after agreeing to a rescue deal with the German government. Asides from the travel & leisure sector, reopening optimism can also be seen in names such as Cineworld (+18.7%), JD Sports (+9.7%) and Hammerson (+7.9%) with UK PM Johnson’s latest update noting that the government plans to allow car showrooms and outdoor markets to reopen from June 1st and will allow all non-essential retail to open from June 15th. Elsewhere, other notable movers include Rolls-Royce (+11.4%), who, asides from benefiting from recent optimism surrounding travel, are looking to negotiate price cuts with certain supplier. Finally, Wirecard (-1.6%) are off worst levels but lower nonetheless after delaying their earnings from 4th June to the 18th June on the basis that audits of annual financial statements for 2019 will not be completed by the planned date.

Top European News

- ECB’s Villeroy Says More Stimulus Is Probably on the Way

- Dominic Cummings Refuses to Quit in Row Over U.K. Lockdown; U.K. Minister Quits in Protest as Johnson Refuses to Fire Aide

- Macron Set to Unveil Aid for Embattled French Auto Industry

- JDE Peet’s Sets Price Range for $2.5 Billion Amsterdam IPO

In FX, the Dollar continues its pullback early EU-doors, with little by way of fresh fundamental catalysts, but some estimates of month-end FX flows favour modest USD selling heading into the May 29th month-end fix. Looking ahead to the session, month-end factors are likely to influence the Buck in the current absence of fresh macro developments. Meanwhile, State-side data is unlikely to sway the Dollar much, but Fed’s Kashkari (2020 vote) is slated for 1800BST – who stated two weeks ago that there is unanimous opposition against NIRP, but refrained from ruling it out in the future. DXY has retreated further below the 99.500 mark (vs. high 99.979), with its 21 DMA coinciding with the psychological 99.000 mark.

- CNH, HKD – Notwithstanding Dollar softness, little action is seen in the currencies thus far. Political tensions remain elevated as Hong Kong’s special status assessment deadline at month-end, and with China threatening retaliation should US impose HK-related sanctions. Meanwhile, PBoC opted for another softer CNY fixing which participants should keep on the radar amid the looming US Currency Manipulation report. Offshore Yuan trades flat around 7.1450 vs. the USD and within a tight band. USD/HKD dipped below yesterday’s low at 7.7530 in early trade.

- EUR – EUR gains remain dimmed after dovish Villeroy alluded to a longer period of negative rates and posited possible further measures – ahead of the June 4th meeting. EUR/USD keeps its head above 1.0900 and eyes its 21 DMA at 1.0958 to the upside, having found an overnight base at 1.0890. Option expiries see EUR 720mln at 1.0900 and a some 1.3bln between 1.0935-45. Traders eye comments from ECB’s Chief Economist Lane (1345BST) and VP de Guindos (1630BST) for signs of agreement with Villeroy’s remarks.

- GBP, AUD, NZD, CAD – All beneficiaries of the USD pullback but the Aussie, Kiwi and Sterling outpace as risk appetite intensifies. Cable topped 1.2300 (vs. low 1.2175), after taking out its 50 DMA at 1.2275, 55 DMA at 1.2288 and a Fib 1.2292 (38.2% of the Apr-May fall) on the back of source reports that EU are preparing to drop its “maximalist” approach to negotiations on fisheries with Britain in the next round of negotiations. Furthermore, BoE’s Haldane said the UK economy likely contracted by over 20% in Q2, “just a shade” better than BoE’s scenario of around 25%. The MPC member said the BoE has not reached remotely yet a view on NIRP. Elsewhere Aussie and Kiwi extended on APAC gains and surpassed 0.6600 and 0.6150 against the USD respectively vs. lows of 0.6535 and 0.6092 apiece. CAD meanwhile lags its high-beta peers but remains underpinned on favourable oil prices. USD/CAD gave up 1.3900 to the downside with support seen around the 1.3860 mark for the pair – whilst BoC’s outgoing Governor Poloz and Deputy Governor Wilkins are slated for a text release at 2200BST.

- CHF, JPY – Mixed trade among the safe-haven FX – the Yen fails to benefit from the Dollar descend as risk appetite prompts haven outflows, whilst BoJ Governor Kuroda sung from the same hymn sheet regarding readiness to further loosen policy. USD/JPY failed to breach its 50 DMA (107.91) overnight but remains underpinned by the risk-on tone as focus remains on reopening economies and vaccine hopes in the absence of fundamental developments. The Franc ekes modest gains in a consolidation of yesterday’s weakness, USD/CHF dipped below 0.9700 and eyes its 55 DMA (0.9684) to the downside.

In commodities, WTI and Brent front month futures continue to post gains, albeit the benchmarks have waned off highs in recent trade. Eyes remain on the wider implications on global trade and sentiment from the fallout of the US-Sino trade spat threatening a cold war, whilst investors must not be distraction from the prospects of reinstated lockdowns should COVID-19 cases rise again. On the supply front- Russian Energy Minister Novak is to reportedly meet with Russian oil majors to discuss an extension of current cuts past the end of June – the checkpoint for OPEC to reduce output curbs. Aside from that, news flow for the complex remained light in early EU hours. On the data front, the weekly Private inventories will be watched tomorrow – particularly in regards to Cushing storage. WTI and Brent July remain north of USD 34/bbl and USD 36/bbl respectively having printed bases at USD 32.50/bbl and USD 35.50/bbl apiece. Spot gold succumbs to the risk appetite and see modest outflows, with losses cushioned by the weaker Buck as the yellow metal straddles USD 1725/oz. Copper prices post decent gains amid the risk tone and softer Dollar – with prices eyeing USD 2.45/lb to the upside.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, prior -4.2

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.3%, prior 0.45%; S&P CoreLogic CS 20-City YoY NSA, est. 3.4%, prior 3.47%

- 9am: House Price Purchase Index QoQ, prior 1.3%

- 10am: New Home Sales, est. 480,000, prior 627,000; New Home Sales MoM, est. -23.44%, prior -15.4%

- 10am: Conf. Board Consumer Confidence, est. 87, prior 86.9; Expectations, prior 93.8; Present Situation, prior 76.4

- 10:30am: Dallas Fed Manf. Activity, est. -62, prior -73.7

DB’s Jim Reid concludes the overnight wrap

There was a remarkable press conference yesterday here in the U.K. by PM Boris Johnson over his top aide Dominic Cummings. Lockdown has meant different things to different people but this story has whipped the U.K. up into a frenzy the likes of which I can’t remember witnessing for a very long time. Our lockdown has had its dramas but not quite on this scale. One such drama was that my wife decided that she’d spend any spare time she had during it planting all sorts of new plants and shrubs around the garden. A massive effort. However she didn’t count on only having one day of rain in 10 weeks and now has to spend 60-90 minutes each day watering the plants or risk them dying in the extreme unseasonal heat. We’ve even trained the kids to do it although this invariably ends up in a water fight and tears.

While we were watering the plants, yesterday was a quiet day for markets with the US and the U.K. on holiday. However the mood was good as more global progress was made towards reopenings and no notable new escalations between the US and China have emerged over the last few days. On these types of days the market gladly sucks up the liquidity that central banks and governments have injected. The Stoxx 600 closed +1.47% led by the DAX (+2.87%) which saw Bayer (+7.77%) outperform as they were said to have settled a substantial amount of legal claims hanging over the company. Lufthansa (+7.57%) was also up after reports that the German government is proposing taking a €9bn stake in the company – albeit one that has to go through EU approval. US equity futures remained up during the afternoon session and are +1.62% this morning.

Asian bourses are also trading up this morning with the Nikkei (+2.27%), Hang Seng (+1.83%), Shanghai Comp (+0.71%) and Kospi (+1.57%) all advancing. Elsewhere, the USD is a shade weaker while yields on 10y USTs are up +1bps. WTI oil prices are also up +2.83% to $34.18.

In terms of newsflow, Hong Kong’s Carrie Lam has voiced support of China’s moves to impose sweeping national security laws in the territory saying it was untrue that the new security law would ban street protests or calls for her dismissal, and pledged that Hong Kong’s freedoms would be preserved. China has also said that the new legislation “will not change the one country, two systems policy, Hong Kong’s capitalist system, high degree of autonomy, nor will it change the legal system in Hong Kong SAR, or affect the independent judicial power, including the right of final adjudication exercised by the judiciary in Hong Kong.”

There’s not a lot of top tier data over the remainder of the week (see the day by day calendar at the end) but highlights will include continued discussions on a European recovery fund, remarks from Fed Chair Powell (Friday), alongside with a few remaining earnings releases. Furthermore, the Fed will be releasing their Beige Book on Wednesday, which provides information on current economic conditions in the different Federal Reserve districts.

Tomorrow we’ll hear from European Commission President von der Leyen, who’ll be presenting the revised Multiannual Financial Framework and recovery plan proposals to the European Parliament. This follows the Franco-German proposal announced last Monday by Chancellor Merkel and President Macron for a €500bn recovery fund for the EU. However, these are still early days, since unanimity among the 27 member states is required, and a number of countries have voiced their opposition to the idea of joint debt issuance. The news flow over the last few days hasn’t been great. As DB’s Mark Wall outlines in a blog over the weekend, on Saturday the Frugal Four (FF) member states (Netherlands, Austria, Denmark and Sweden) issued a counter-proposal to the Merkel-Macron (MM) plan. If the intention of the MM proposal was to force some concessions from the FF, it failed according to Mark. In summary there is no additional envelop of resources, no grants and a fair amount of ambiguity on conditionality to access the fund As Mark suggests, with no concessions from the Frugal Four, it may be all the more difficult for the European Commission to issue a credible proposal tomorrow. There appears to be no common ground between the MM and FF proposals, no basis for consensus. The risk of not having an agreement at the 18/19 June EU leaders’ meeting could be rising. However Mark continues to believe there will be a Recovery Fund but that it’ll just take longer to agree. See his weekend blog here.

Yesterday we also heard from the Bank of France Governor Villeroy and he signalled that the ECB is very likely to boost its emergency bond-buying program to fight the coronavirus pandemic. He also said that he would like to see limits on the EUR 750bn PEPP plan to be loosened even more while adding that, “it is in the name of our mandate that we will very probably need to go even further. It is its very flexibility that should make the pandemic emergency purchase program our preferred marginal instrument for dealing with the consequences of the crisis.”

For those that were on holiday yesterday a quick recap of last week now. Global equities were mostly higher as hopes of a successful global reopening and of a near-term vaccine grew. The rise in risk assets was despite consistent escalation of US-China tensions and a continuous drumbeat of negative economic data, mostly backward looking but some forward looking as well. The S&P 500 rose +3.20% last week (+0.24% Friday), erasing the prior week’s loss and closing at its highest weekly close since the first week of March. The S&P 500 is now +32.09% off the March lows and just -8.52% down YTD, while actually up +3.47% over the last 52 weeks. The rally was more diversified last week as Energy stocks joined Technology in outperforming. With tech still leading, the NASDAQ rose +3.44% on the week (+0.43% Friday). European equities also rallied on the week, in a fairly correlated fashion with every major country’s index higher as the Stoxx 600 was up +3.63% (-0.03% Friday) over the five days. The DAX rallied +5.82% (+0.07% Friday), while the Italian FTSE MIB rose +2.75% (+1.34%), and the CAC gained +3.90% (-0.02% Friday). Asian indices were more mixed than their European and American counterparts. The Nikkei was up +1.75% over the week (-0.80% Friday) while the CSI 300 lost -2.27% (-2.29% Friday), and the Kospi rose +2.22% (-1.41% Friday). In other risk assets, oil continued its recovery, rallying for a fourth week in a row. WTI futures rose +13.46% (-1.98% Friday) to $33.25/barrel and Brent crude rose +8.34% on the week (-2.58% Friday) to $35.13/barrel.

The VIX fell -3.8pts to 28.1 last week (-1.4pts Friday), which is not as low as the index fell 2 weeks ago even with equity prices higher. With oil prices rallying and equities continuing to improve, credit spreads tightened on the week. US HY cash spreads were -72bps tighter (-2bps Friday), while IG tightened -24bps on the week (-1bp Friday). In Europe, HY cash spreads were -37bps tighter (-3bps Friday), while IG tightened -11bps (-1bp Friday).

With equities rallying core sovereign bonds yields rose slightly. US 10yr Treasury yields were up +1.6bps (-1.3bps Friday) to finish at 0.659%. Meanwhile, 10yr Bund yields rose +4.4bps over the course of the week (+0.8bps Friday) to -0.49%. Peripheral debt tightened as Chancellor Merkel and President Macron agreed to support a €500bn recovery fund, which Merkel said would have the ability to borrow money. Spanish 10yr yields tightened -18bps to Bunds over the 5 days, while Italian BTPs were -31bps tighter.

via ZeroHedge News https://ift.tt/3d4EUeg Tyler Durden