Silver Shines As Gold Glut Weighs On Barbarous Relic

Tyler Durden

Thu, 05/28/2020 – 18:25

The last two months have seen silver dramatically underperform gold…

…interestingly tracking the dollar index…

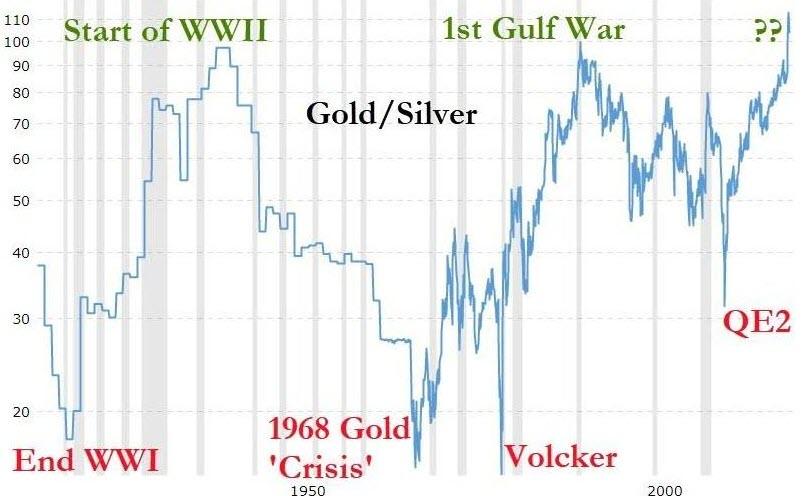

…after reaching record ‘lows’ against the yellow metal.

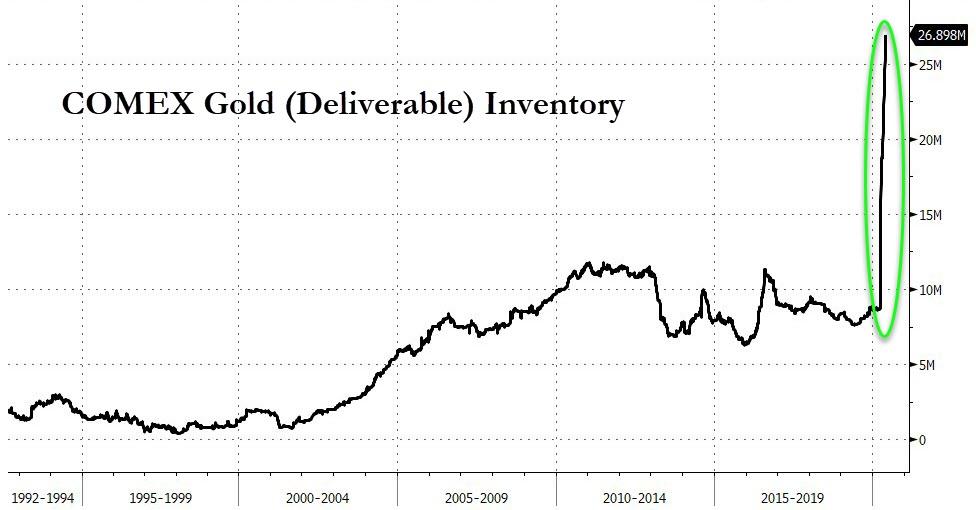

The surge in silver (relative to gold) began around the same time as the gold market “broke” with the COVID crisis causing geographical shortages of physically deliverable gold for futures contracts (decoupling the price of gold futures from the physical price for that liquidity/transportation premium).

But now, as Bloomberg notes (and the chart above shows), the New York gold market has been flipped on its head in just a couple of months, with a scramble for the metal turning into a glut.

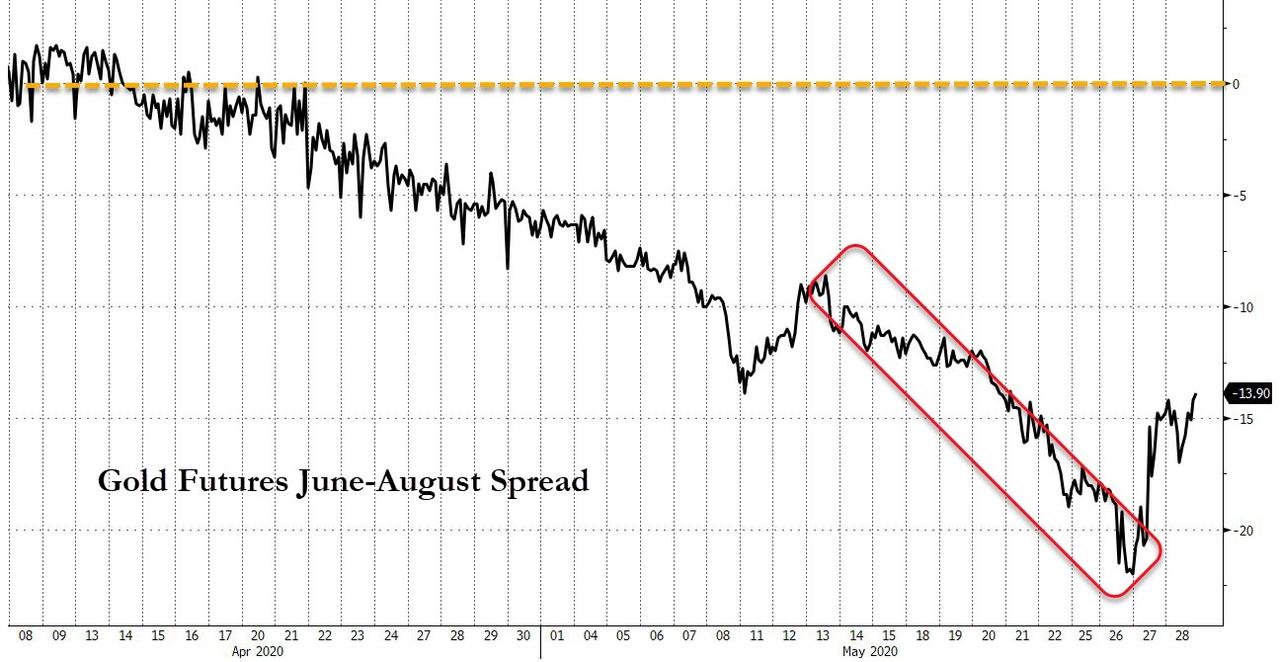

June futures sank to more than $20 an ounce below August earlier this week, from a premium in mid-April.

Notices to deliver on June contracts begin to be filed on Thursday. The June contract is also below spot prices, after fetching a $12 premium as recently as mid-May and $60 in March. As Bloomberg points out, the steep discount echoes some of what oil traders saw earlier this year, when crude stockpiles surged after fuel demand plunged.

“It’s a little bit of a game of chicken,” said Tai Wong, head of metals derivatives trading at BMO Capital Markets.

“All of a sudden you get into a similar problem that you had in crude, but slightly different: for crude they literally didn’t have a place to put it — whereas in this case speculative longs don’t want the logistical hassle of holding physical metal, which is why cost to roll has blown out.”

Just as we saw with the June crude expiration, technical pressures are likely to lift as the arb is narrowed:

“It is a seller’s market because of the premium and the buyers are stuck right now,” Peter Thomas, a senior vice president at Chicago-based broker Zaner Group, said in a telephone interview.

“Do you want to deliver now, or do you want to deliver into the back, where the premium is high?”

But, of course, the imbalance in the New York market is a localized phenomenon: gold remains in high demand around the world among investors concerned about the state of the global economy.

And, as Simon Black pointed out recently, EVERY possible scenario is on the table as far as policymakers are concerned, and no one can say for sure what’s going to happen next.

There are very few things that are clear. But in my view, one thing that has become clear is that western governments will print as much money as it takes to bail everyone out.

According to the Congressional Budget Office, the US federal government will post a $3.6 TRILLION deficit this Fiscal Year due to all the bailouts. Plus the Federal Reserve has already printed $2 trillion.

Frankly, they’re just getting started.

With this incomprehensible tsunami of government debt and paper money flooding the system, real assets are a historically great bet.

We’ve talked about this before: real assets are things that cannot be engineered by politicians and central banks– assets like productive land, well-managed businesses, and yes, precious metals.

And they all tend to do very well when central banks print tons of money.

Farmland, for example, was one of the best performing assets during the stagflation of the 1970s.

And financial data over the past several decades shows that whenever they print lots of money, the price of gold tends to increase.

Right now, in fact, the price of gold is relatively cheap compared to the current money supply.

And the price of silver is ridiculously cheap compared to gold. Again, silver has never been cheaper in 5,000 years.

This is why I’d rather just own physical silver. I’m not interested in betting against gold because I expect they’ll continue to print money. In fact I’m happy to buy more gold.

And while we cannot be certain about anything, there’s a strong case to be made that the price of silver could soar alongside gold.

via ZeroHedge News https://ift.tt/36ET3MC Tyler Durden