US Exports, Imports Crater Most On Record As China Refuses To Comply With Trade Deal

Tyler Durden

Thu, 06/04/2020 – 12:05

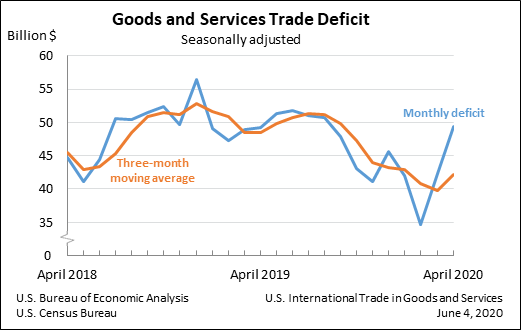

While today’s trade balance print at $49.4 billion came generally in line as expected, the relative calm on the surface belies what has been a stunning collapse in absolute trade levels.

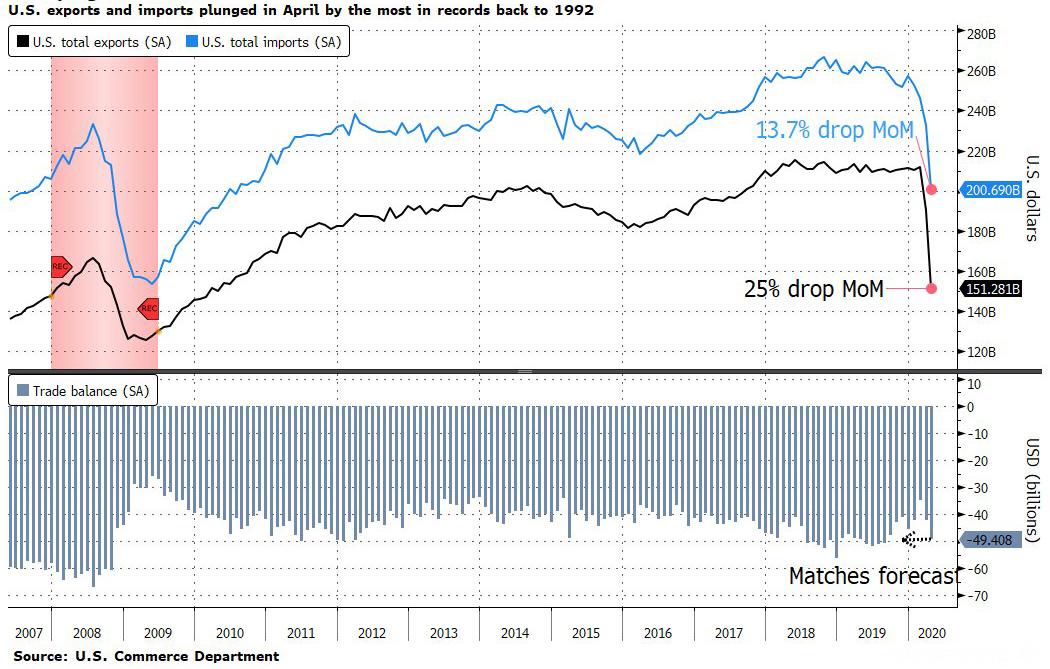

The problem is how the US got to that deficit print, and this is where it gets ugly: April exports were $151.3 billion, $38.9 billion less than March exports. In percentage terms, the 20.5% export drop was the biggest on record, going back to 1992. At the same time, April imports were $200.7 billion, $31.8 billion less than March imports, and a decline of 13.7%, also the most since records started in 1992.

The decline in merchandise exports was widespread with companies shipping less capital equipment, motor vehicles, consumer goods and industrial supplies such as oil. The nation also received fewer capital and consumer goods, vehicles and food from overseas producers as the US economy was put on ice.

Reflecting the global pandemic and lockdowns, the value of travel-related imports and exports slumped to $4.4 billion, an all-time low in data back to 1999.

Combined, the value of U.S. exports and imports decreased to $352 billion, the lowest since May 2010!

However, since both exports and imports tumbled by roughly a similar amount, the move in the total monthly trade balance was far more muted, sliding from $42.3BN to $49.4BN.

To be sure, foreign trade was already easing prior to the pandemic, and now, but faced with what Bloomberg called unprecedented supply-chain disruptions, a previously incomprehensible surge in U.S. unemployment and a drop-off in demand, the world’s largest economy has pulled back more dramatically.

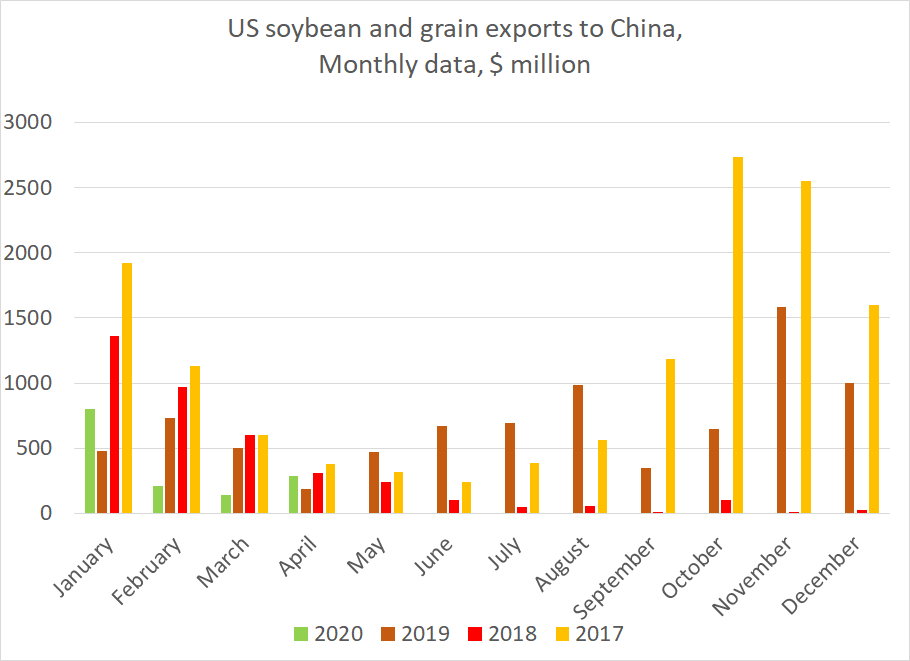

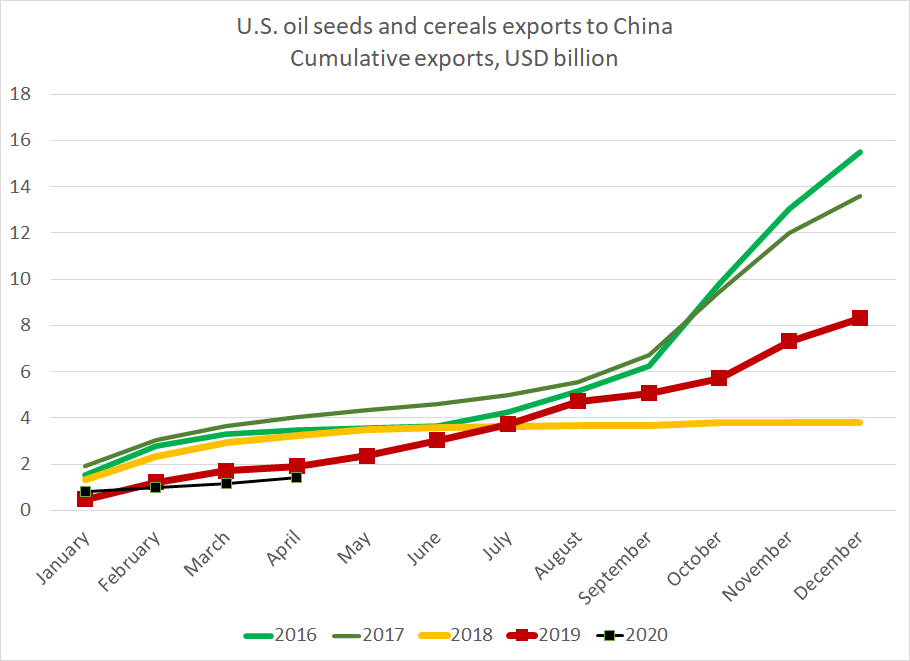

Meanwhile, in a double whammy for the Trump administration, there was no sign of any real progress on the phase 1 deal with China, with soybean exports still lagging their 2019 pace.

Furthermore, while China is generally obligated to elevate its imports from the US (on par with 2017 levels) as per the Phase 1 Trade deal, YTD data shows that there is virtually no pick up compared to 2018 or 2019.

Worse, food exports are at risk of declining after Chinese government officials this month telling state-run agricultural companies to pause purchases of some American farm goods including soybeans.

Meanwhile, in the latest slap for the Trump admin, the report showed the trade deficit with China growing as imports of merchandise from China rebounded in April to $35.2 billion from $24.2 billion in March, while exports edged up to $9.3 billion, leaving a deficit of $7.2 billion.

via ZeroHedge News https://ift.tt/2Y3HKdd Tyler Durden