BofA Says Next “Extreme Move” Will Be In Treasuries, But What If It Remains In Stocks

Tyler Durden

Fri, 06/05/2020 – 14:00

Earlier today we showed that in the aftermath of today’s stellar jobs (if very bizarre) report, the reflation narrative has decisively won out for the time being, with 10Y Treasury yields blowing out well above the 84bps CTA selling “red line” -which means momentum chasers are now going short rates – and finally breaking out of their 3-month trading range:

And with short-term rates still locked by the Fed’s ZIRP policies, the bear steepening as seen in the surge in the 5s30s is in full force.

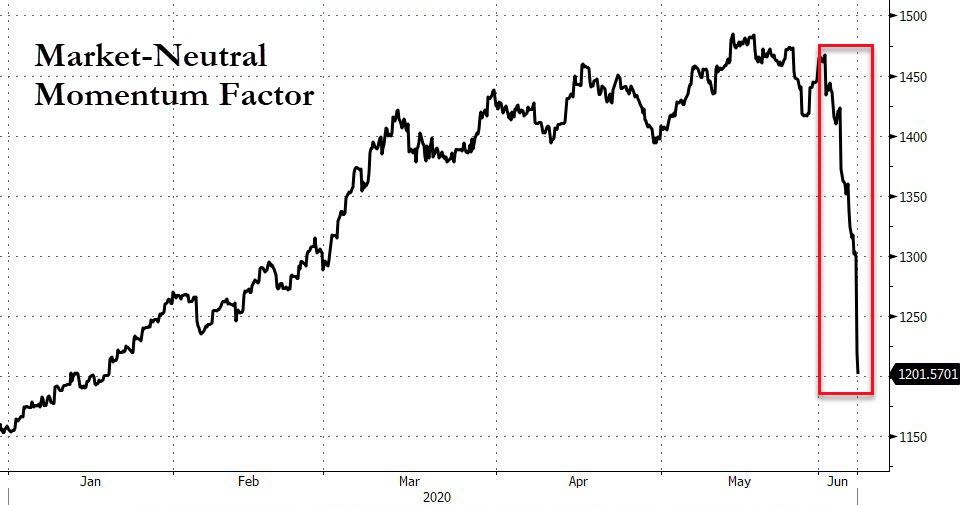

And since the reflation signal as telegraphed by this curve is what drives value stocks higher, it explains why value continues to soar today even as momentum suffers a historic crash.

With yields breaking out from their recent range and forcing CTAs to capitulate on long positions, BofA’s CIO Michael Harnett chimes in and writes that the “biggest summer pain trade is disorderly rise in government bond yields” namely with the 30Y toward 2%, and the 10Y through 1%. Besides the violent move higher in risk assets, Hartnett notes the following factors to justify the move higher in yields:

- US dollar was the only safe haven in March that was “safe”; the best indicator of the passing of the tempest, the start of recovery was always a weaker dollar, and it’s happening.

- Global fiscal frenzy is real & big: $10tn of announced fiscal stimulus in 2020 now greater than $8tn of monetary stimulus; fiscal is more powerful direct stimulus for economy than monetary policy.

- Ability of macro to surge in Q3 is high as Q2 pandemic/lockdowns end (and even skittish consumers could front-load spending in anticipation of Q4 “second wave”);

- US household savings rate is currently 33%; US mortgage loan applications/housing demand surging; China service sector PMI highest in 3 years.

- US corporations have raised $2.4tn of funds YTD; there have been no credit events; Wall Street leads Main Street.

- Fed fails to deliver YCC at June 10th FOMC.

If Hartnett is right and a “disorderly” liquidation of Treasurys ensues, this means that stock will naturally levitate higher which the BofA strategist agrees with, but sees the S&P rally – driven by benign supply-demand conditions in credit markets…massive inflows + small issuance = “air pocket” for lower credit spreads – fizzling around around 3,250 (25x PE of 130 EPS) in June/July, for the reason noted above: namely that the next “extreme move” will be in Treasurys, as “a disorderly rise in government bond yields forces correction.“

What if Hartnett is wrong and the “extreme move” is also in equities… higher? Working under the assumption that the current melt up remains just another bear market rally, the BofA CIO then compares the 3 greatest bear market rallies of all-time which were:

- 1929 (onset Great Recession)

- 1938 (prior to WW2)

- 1974 (prior to NYC bankruptcy)

Assuming a similar trajectory off the Feb lows suggests the SPX would rise to 3300-3600 sometime between Aug & Jan’21…

… and would be in response to the “extreme times, extreme moves” of the current period where “COVID-19 crash saw $30tn market cap loss, global GDP loss is $10tn, policy stimulus is $18tn (Table 3), cash on sidelines $5tn.”

Of course, such a historic surge in stocks would inevitably send yields surging in an “extreme move” too, at which point the question becomes just what yield on the 10Y will be the trigger for the next stock selloff, assuming the Fed ever allows one.

via ZeroHedge News https://ift.tt/2zWhuJS Tyler Durden