Japan’s Three Decades Of Depressive Stimulus Schemes

Tyler Durden

Thu, 06/04/2020 – 20:05

Authored by Richard Salsman via The American Institute for Economic Research,

he New York Times reports optimistically that “Japan Approves Fresh $1.1 trillion Stimulus to Combat Pandemic Pain.” As the Times elaborates, Japan’s “record stimulus of 117 trillion yen ($1.09 trillion), which will be funded partly by a second extra budget, followed another 117 trillion yen ($1.09 trillion) package rolled out last month. The new package takes Japan’s total spending to combat the virus fallout to 234 trillion yen ($2.18 trillion), or about 40% of gross domestic product.” “The packages (this year) took the size of the budget to a record 160 trillion yen, with new bond issuance making up 56.3% of annual budget revenue and raising the spectre of more bond issues later to offset falling tax income.”

It’s a “record stimulus,” the Times gushes. Very exciting stuff! Surely it will work!?

But why would any of it help “combat” a “virus fallout” or “stimulate” Japan’s economy? By “economy” do we not, as economists, refer to output, the production of goods and services, to real GDP at the least? If so, how can deficit spending create wealth? There is no evidence for that.

The “fresh” part of the Times’ headline is best translated as “recent” because for the past three decades, amid various crises, Japan has adopted literally dozens of alleged “stimulus” schemes – including not just massive deficit spending but rate-cutting, a zero-interest rate policy (ZIRP), “QE” (central bank monetization of public debts), and even direct purchases of private debt and equity securities. None of these programs has ever been proved to improve Japan’s economic-financial performance. Indeed, its performance has eroded amid the cascade of higher spending.

Japan’s economic-financial performance peaked in 1989-1991 and periodic revivals aside, it has stagnated since, amid degeneration in public finances. The causes of the peak and subsequent “lost decades” are worth recalling. In the late 1980s the Bank of Japan (BoJ), on the advice of leading economists, interpreted the decade as artificial, a mere “bubble,” and set out to “pop” it with punitive interest-rate hikes. The BoJ inverted the yield curve, which is a recession signal in part because it makes credit intermediation (“borrowing short, lending long”) unprofitable.

After the BoJ-authored yield curve inversion, Japan’s real GDP decelerated from growth of 9.4% in 1988 to only 4% in 1989; by 1993 GDP was contracting. Industrial production also decelerated, from 7.4% in 1988 to only 3.5% in 1989 before contracting by 13% between 1991 and 1993. Today Japan’s industrial production index remains 12% below its 1991 peak. The NIKKEI equity index also crashed after the BoJ’s policy assault, by 60% from the end of 1989 to mid-1992. The index low in 2009 was 80% below the 1989 peak; today the index remains 46% below its 1989 peak.

One could say the BoJ certainly “succeeded” in its mission to combat the supposed artificiality of Japan’s economic-financial performance in the 1980s; since then, Japan’s policymakers have dutifully followed the advice of Keynesians like Paul Krugman, implementing dozens of “stimulus schemes;” in effect, they’ve tried to artificially revive Japan’s economy, not by deregulating it, not by cutting tax rates or restraining growth in government but by massive public deficit spending.

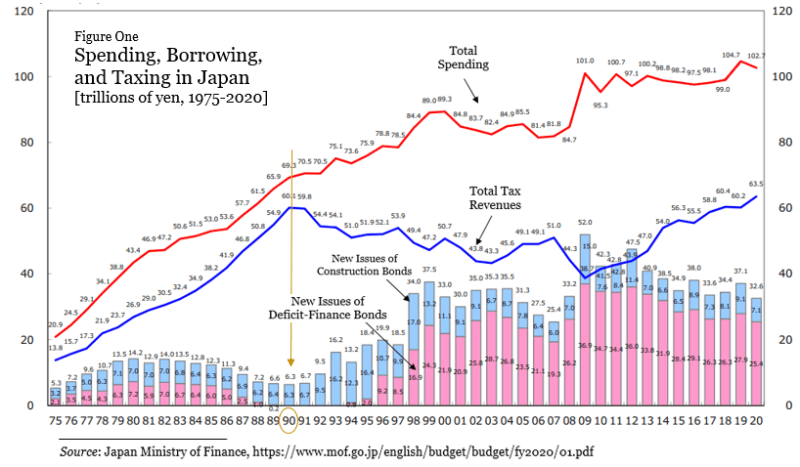

Figure One illustrates the dramatic shift in Japan’s public finances after 1990. In the fifteen years prior to 1990, growth in public spending and tax revenues closely tracked; new debt issuance was limited and even declined between 1982 and 1990. Since then, however, spending growth has far outpaced growth in tax revenues, due mainly to tax rate hikes and a stagnant economy. Deficit spending and new debt issuance have been preferred – the genuine Keynesian prescription.

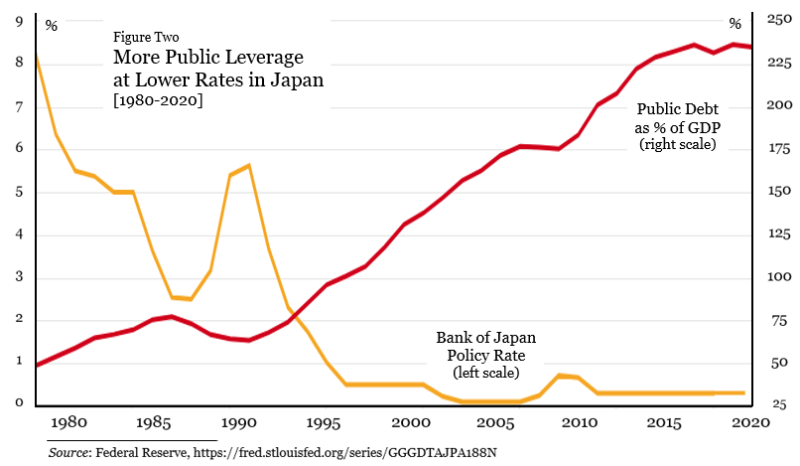

Decades of chronic deficit spending have boosted Japan’s public leverage (debt-to-GDP ratio). Figure Two shows debt is now 235% of GDP, up from 175% in 2010, 125% in 2000, 64% in 1990, and 50% in 1980. Having boosted its policy rate in the late 1980s to fight a “fake” prosperity, the BoJ has since cut the rate dramatically. For a quarter century the rate has been below 1%, not, it seems, to “stimulate” the economy (or lending) but to enable the Treasury to borrow more affordably. The BOJ has been politically dependent, serving mainly Japan’s deficit spenders.

Surely one might expect that eventually this stupendous, multi-decade deficit-spending would “stimulate” Japan’s economy or equities. But mostly Keynesians (and some monetarists) would expect it. Adherents of Saysian economics, in contrast, would not expect it; indeed, they’d predict that vast increases in public spending and borrowing would more probably impede prosperity.

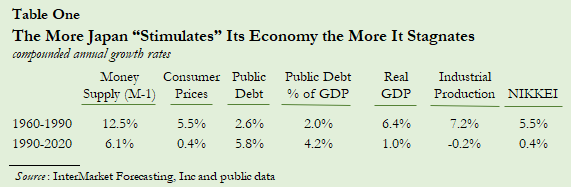

Table One contrasts Japan’s performance over the past three “lost decades” (1990-2020) and the prior three decades of robust growth (1960-1990). Public debt has grown 5.8% p.a. in the three decades since 1990 while public leverage has increased 4.2% p.a.; meanwhile, real GDP has grown only 1.0% p.a., the NIKKEI has risen by only 0.4% p.a., and industrial production has contracted. So much for Japan’s “stimulus.” The Keynesian prescription has been worse than useless. It’s been harmful. Yet the more it fails, the more its adherents insist on still larger doses of deficit spending.

In the three decades prior to 1990, before Keynesian policy advice became dominant in Japan, the nation enjoyed robust and sustainable economic growth amid fiscal rectitude. Table One makes clear that Japan’s public debt and public leverage increased by only 2.6% p.a. and 2.0% p.a., respectively, while real GDP grew 6.4% p.a., industrial output grew 7.2% p.a., and the NIKKEI advanced 5.5% p.a. In each case pre-1990 performance outpaced post-1990 performance. The difference is due mainly to the tragic suspicion of prosperity which took hold in Japan in the late 1980s, and to later adoption of so-called “stimulus” schemes, which, I argue, are depressive:

Many economists believe public spending and money issuance create wealth or purchasing power. Not so. Our only means of obtaining real goods and services is from wealth creation — production. Under barter no one comes to market expecting to buy stuff without also offering stuff. A monetary economy does not alter this key principle. What we spend must come from income, which itself must come from producing. Say’s Law teaches that only supply constitutes demand; we must produce before we demand, spend or consume. Demand is not a mere desire to spend but desire plus purchasing power.

Believers in “stimulus” also claim that government spending entails a magical “multiplier” effect on aggregate output, unlike most private sector spending. They tout a government’s greater “propensity to consume.” But consuming is the opposite of producing. Welfare states certainly consume and redistribute wealth. They divide it up. But math teaches that nothing – wealth included – can be multiplied by division. The so-called “multipliers” imagined by today’s economists are, in fact, divisors. Many studies have verified the principle.

To see why “stimulus” truly depresses, consult the basics. The creation of public money and public debt is not the creation of wealth; it is not food, clothing, shelter, energy or the like. Even privately generated money and debt, which reflect the needs of trade and lengthy production chains, represent, facilitate and circulate wealth but are not themselves wealth. Meanwhile, the savings borrowed by governments are unavailable to productive enterprises, and when a government creates fiat money beyond what money holders demand, the money loses purchasing power, which boosts the cost of living. These are not roads to prosperity.

A tragically wrong public policy should be abandoned, not emulated. Sadly (and tragically), the U.S. since 2001 has been copying Japan’s approach, with a lag of a decade or so. What some here called “unorthodox” fiscal-monetary policy was first “normalized” in Japan. The two nations differ in some important ways, including demographically, but that does not nullify the laws of economics (or of public finance). The U.S. and Japan are old welfare states that can’t afford what they’re doing; nonetheless, their politicians can’t seem to succeed electorally without persisting in their profligacy. Japan’s history signals the likely outcome for copycats: prolonged stagnation.

via ZeroHedge News https://ift.tt/3cwzIi5 Tyler Durden