Quant Carnage: Momentum Melts Down By Most On Record As Yields Spike

Tyler Durden

Fri, 06/05/2020 – 13:10

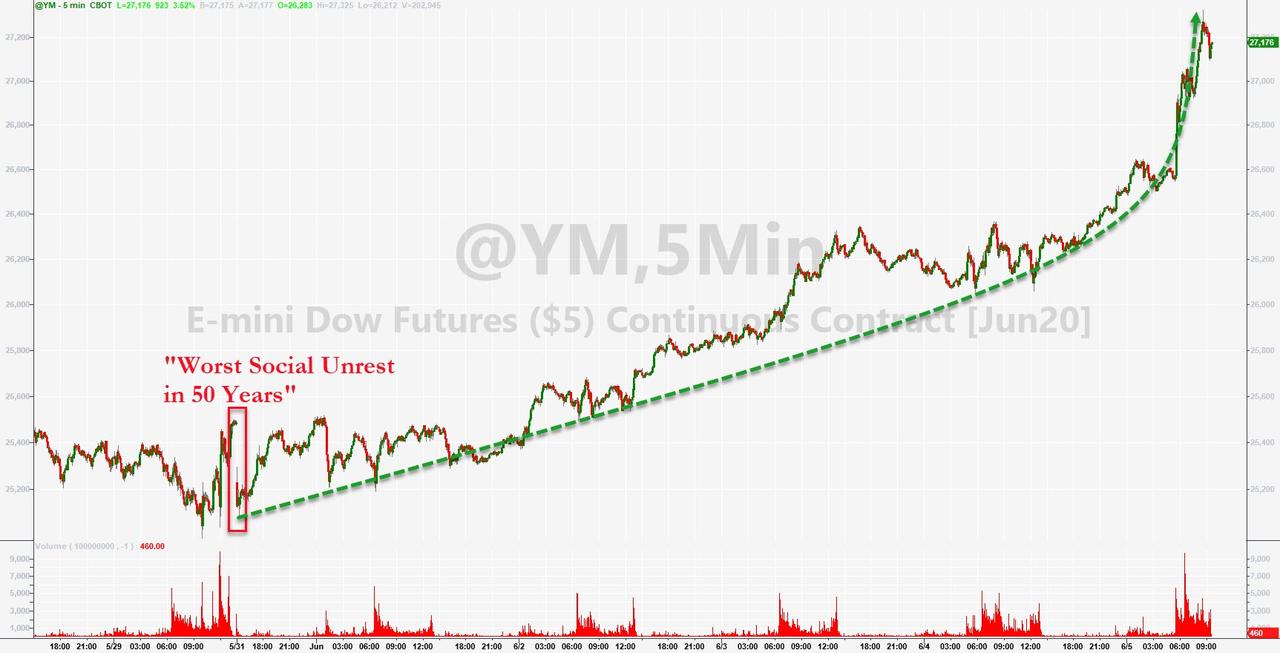

The “large gatherings” across the nation appear to have crushed any fears of COVID contagion and today’s jobs data (heavily impacted by massive swings in the birth/death model adjustment) has removed all fear from FOMO-minded investors as they chase stocks (and bond yields) higher.

Dow futures up over 2000 points from Sunday night’s open…

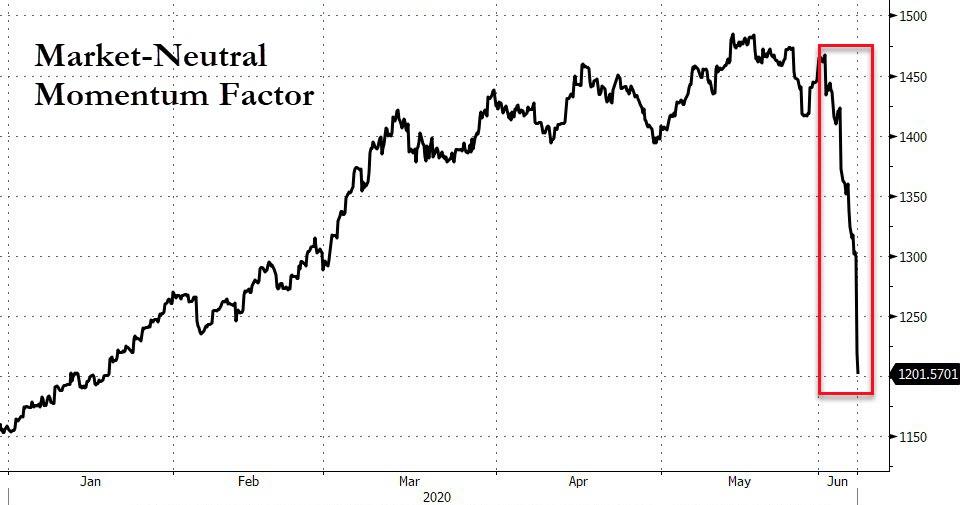

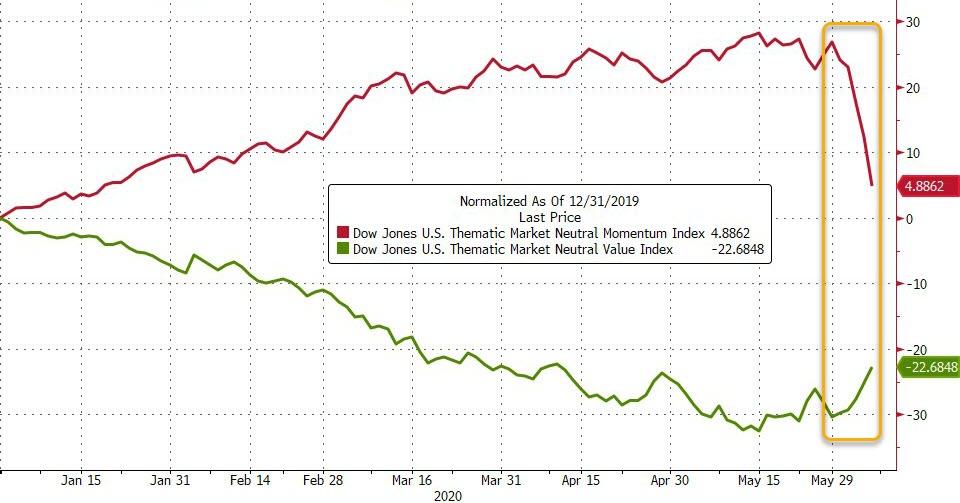

This dramatic acceleration in investors’ willingness to take on risk has become evident at the level of equity market factor preferences, with value (low-P/B over high-P/B) staging a rebound and momentum (12-month winners over 12-month losers) losing ground.

Source: Bloomberg

Similarly, cyclicals are outperforming defensives in a way that dovetails neatly with the rise in yields…

Source: Bloomberg

Source: Bloomberg

In context the regime shift in momentum vs value has been dramatic…

Source: Bloomberg

In fact, the biggest weekly collapse in the momentum factor alone on record as quant funds must be bleeding…

Source: Bloomberg

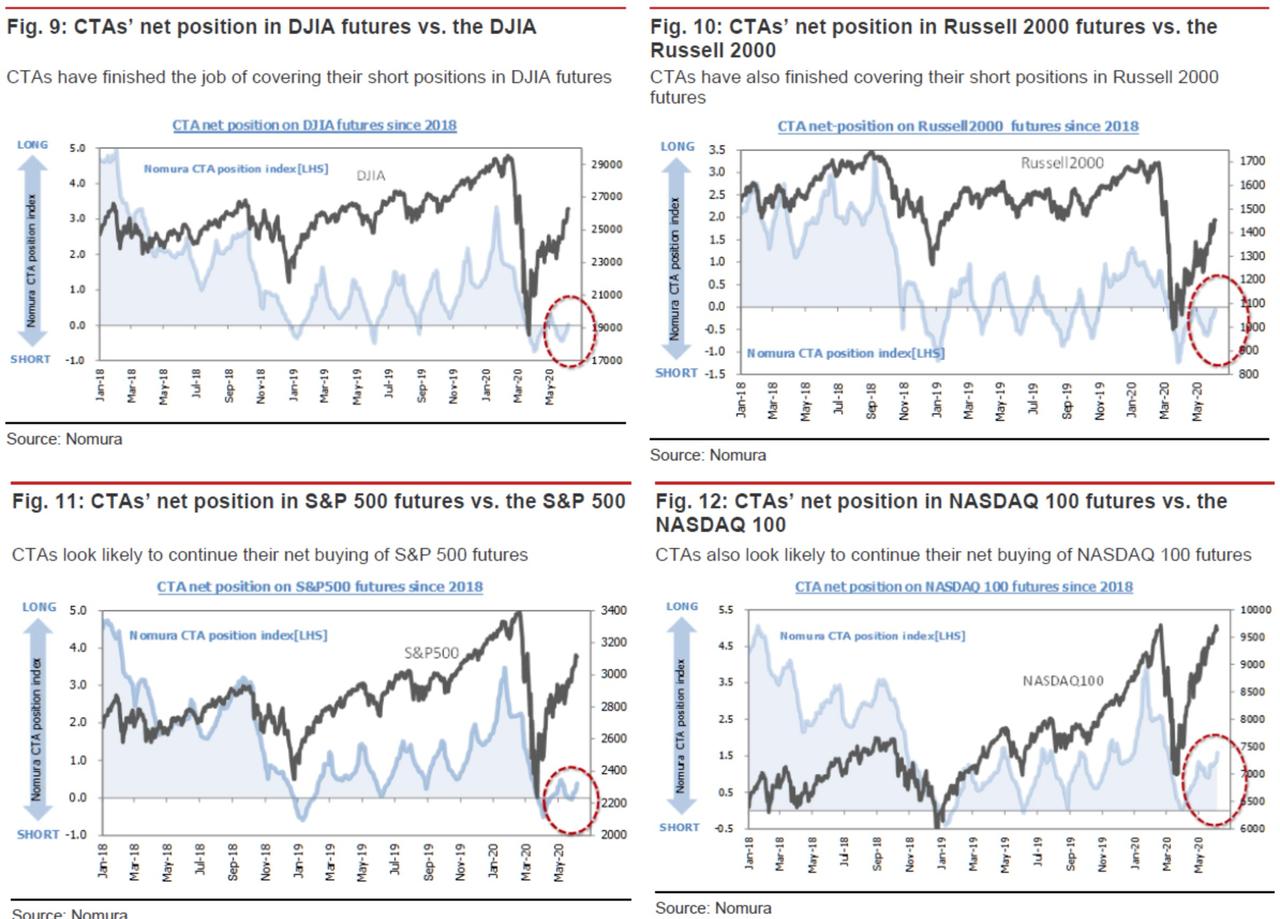

But… the soaring stock market (and collapsing momentum) may have run its course as positioning has ‘corrected’ and reflation trades have recoupled.

First, CTAs broadly speaking appear to have finished the job of covering their short positions in Russell 2000 futures and DJIA futures

And the dramatic decoupling in momentum/value relative to bond yields has finally unwound, rather dramatically… driving the correlation between the two series to near record highs…

Source: Bloomberg

A critical level to monitor is around 84bps in the 10Y which puts CTAs’ long positions in UST futures (TY) under pressure. If CTAs start exiting their long TY positions in earnest, the 10yr UST yield jump could cause a momentum crash much like the one that occurred last September.

What does all this mean? Simple, as Nomura’s Masnari Takada warns, “We see a growing possibility that these developments will lead to tectonic shifts beneath the surface of the US equity market.”

via ZeroHedge News https://ift.tt/371J8RJ Tyler Durden