Survivor’s Euphoria

Tyler Durden

Fri, 06/05/2020 – 14:16

Authored by Jeffrey Snider via Alhambra Investments,

It’s called survivor’s or survival euphoria. Having just gone through a traumatically dangerous experience, and lived, a person might naturally become euphoric for it. Not uncommon in combat situations, your body marshals all its resources including many physiological responses and counteractions. When it’s all over, there’s evolution working overtime in your brain rewarding these survival instincts.

And it can be a huge problem if left unchecked. Long-term mental health issues, yes, but more immediate, too. Whilst dosed up with pleasurable neurotransmitters like dopamine you might not notice just how badly you were yourself wounded in the process, unable to more precisely appreciate the gravity of your situation beyond the very short run.

There’s a common sort of community response along similar lines, too. The expression lightning never strikes the same place twice is this idea that having experienced tragedy once nothing so bad should happen again. Irrational euphoria at the first instance, depressed reality when the precursor feelers of that second bolt begins charging the air around you.

Unexpectedly, of course.

I highly doubt many people remember that the best percentage day for Lehman Brothers stock was the Tuesday following Bear Stearns’ engineered demise (some call it a rescue; posterity has judged otherwise). It was March 18, 2008, and Bear had dominated the headlines the prior weekend having emerged on March 17 owned by JP Morgan (only with considerable assistance from the Federal Reserve, courtesy of 13-3).

That particular Tuesday was earnings day for Lehman, and the numbers it published were absolutely atrocious. Revenue was down 31% compared to the same three-month period the year before, while earnings per share plummeted 57%. For major banks, these were unheard of.

But the stock finished March 18 up 46% from a March 17 when all eyes were on Bear. Not just Lehman, but the entire system was just beginning its bout with survivor’s euphoria.

The subprime mortgage crisis, as everyone had been told that’s what was going on, had finally claimed a big-name victim. For half a year the world had held its collective breath completely captured by the worried fascination over events everyone felt were much more appropriate for the Great Depression rather than our modern, 21st century world.

Banks on the brink, money markets broken down, the stock market tanking almost 20% in mere months. Armageddon! It appeared like some nightmare which, after so many generations without one, was beyond surreal. Everyone started to brace for impact, an economic collision whose outcome could not be anticipated by regular folks. There was simply nothing in their experience for them to go on.

Instead, Bear had unleashed a huge sigh of relief: We’ve been scared out of our minds by all this horrible news in the media…and that’s it? Just one crummy Wall Street bank?

Euphoria, as was written right into the pages of the Financial Times in London on March 18. It wrote:

Relief is coursing through the veins of bankers and investors with the Federal Reserve apparently having circumvented an immediate Wall Street banking crisis.

Prices in equity markets rose on Tuesday and, in the credit markets, spreads narrowed across all types of corporate bonds.

Bill O’Donnell, strategist at UBS, said global markets had “that strong whiff of ‘survivor’s euphoria’ as equity markets are up nicely”.

The Fed, many suggested, had performed superbly, utterly perfect in its technocratic, dispassionate genius. Maybe Ben Bernanke looked like he had been helpless as a kitten, but by March 18 he was a lion and a tiger but more importantly using Bear to show this was no time to be a bear.

Of course, none of that was true; sorry, Mr. UBS, it really was just the euphoria talking. And it didn’t last very long, either. By the summer of 2008, a very different reality dawned on the public once lurking damage hidden underneath it all became too obvious again to ignore.

The monetary system hadn’t survived Bear at all, in fact more deeply wounded by the event than anyone could imagine (even those like Bill Dudley who actually said the words “long-term damage” but apparently didn’t really understand what he was saying). The difference was entirely expectations, more so the lack of appreciation for timing. If X then Y, but sometimes Y takes its sweet time arriving in data and our collected consciousness.

Bear hadn’t immediately turned into Lehman and AIG, but they were all very much connected; the same thing in each. The fact they were all separated by six months only added to the confusion, and contributed much to the interim ecstasy and jubilation. People were led to believe that if the worst hadn’t happened right away, then there could be nothing worse.

A sinister form of confirmation bias, I suspect.

We are in the window of euphoria again. Having, seemingly, survived the shutdown as well as the market events of March 2020 there’s no other feeling quite like it. The whole world has turned a corner, and increasingly the data shows that’s just what happened.

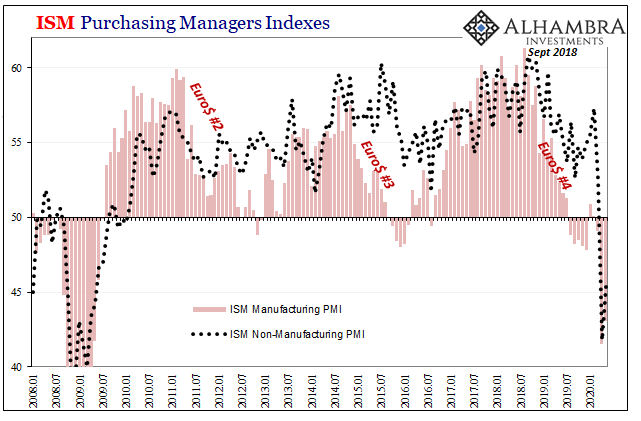

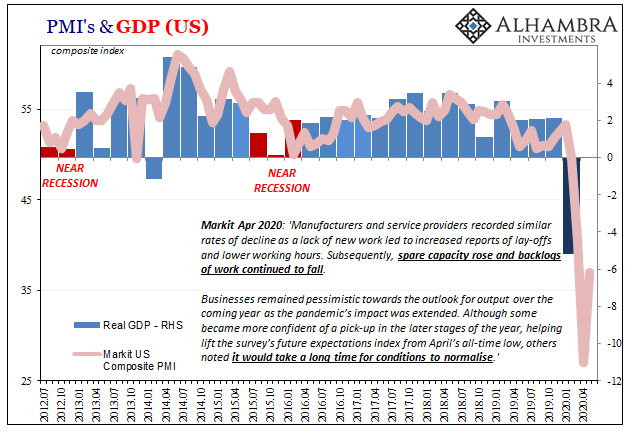

Yesterday’s ISM and other PMI’s adding still more to the impression.

April, maybe early May, that was the worst; that had been the bottom. We’ve made it through to the other side!

No second wave of COVID-19. No more stock market routs. Not even a Bear Stearns this time. We’ve been scared out of our minds by all this horrible news in the media…and that’s it? Not one crummy Wall Street bank?

And Jay Powell, man. Did he ever come through! Sure, he very much looked like he was kitten for awhile there, but, boy, he proved himself a lion and a tiger. Screw the bears*!

Having pictured the breadlines of the 1930’s, the idea of escaping that tragic fate and actually getting back to normal now seems more than possible. Likely, perhaps. A bad memory we’ll soon sort of laugh about in that uncomfortable way people do after the fact.

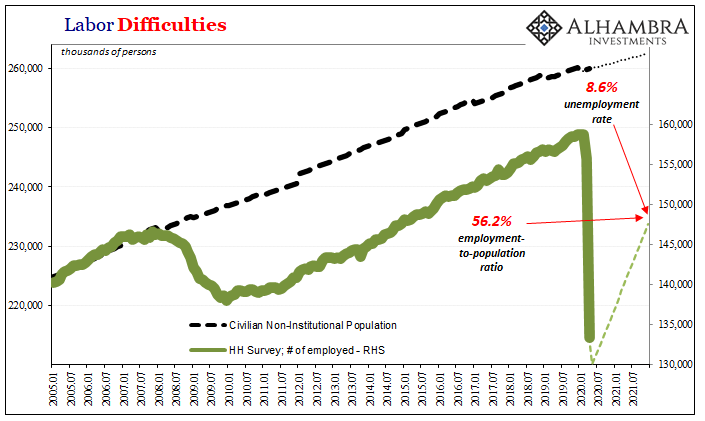

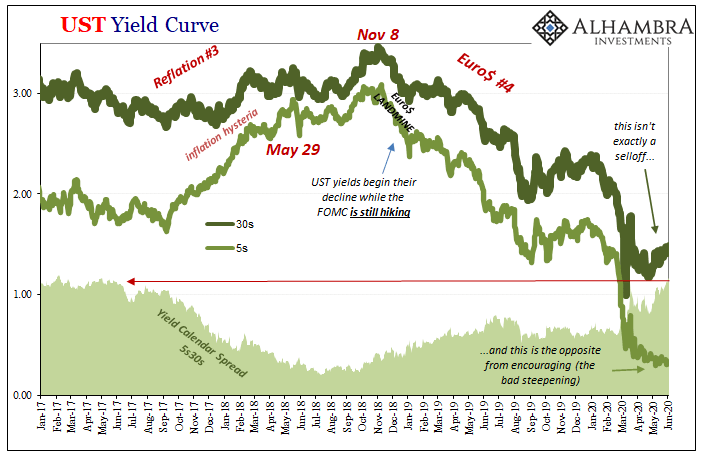

But, like 2008, ask yourself if the economy and the monetary system really have made it through this ordeal unscathed? Not in the media sort of way, where central bankers are never criticized and their word taken as the new gold standard. Unemployment. Bankruptcies. Dollar shortage. Have those critical issues really been handled and solved, or is it simply another matter of timing and confirmation bias?

The worst didn’t happen yet, so nothing worse can happen.

The 2008 crash was no instantaneous event, the word crash, after all, hugely misleading, and it ultimately had very little to do with subprime mortgages. Even the Great Depression with its Great Contraction phase is misunderstood in the same way. The stock market crash in October 1929 wasn’t close to the whole thing, nor even much of it; at most, the firing of the starter’s pistol announcing the beginning of that great marathon of destruction.

It took three and a half years for that “crash” to finally, well, crash into its bottom. GFC1 was just about two years top to trough.

These things are processes and because these involve complex systems they don’t evolve (or devolve) in a straight line or often in a straightforward manner. The ebbs and flows, twists and turns, each minor change in direction will be savagely bought (or sold) until that critical point is reached. What Economists like to call an equilibrium, only much harsher and full of long-term pain.

The Fed, most importantly, is no help whatsoever in finding and achieving a pain-free one. The best it can do is to keep hope alive a little longer, to prolong these intermittent stages of euphoria in the vain attempt to convince the world it possesses magical powers, its alphabeted programs imbued with mystical properties, all of which can transport the universe back in time to the last safe equilibrium. If only you believe.

So many really, really want to believe. But that just may be the dopamine talking.

*Bond bears, unlike all other species of market bears, are to be encouraged at every stage no matter how ridiculous.

via ZeroHedge News https://ift.tt/2XCwLbA Tyler Durden