"The Data Is Likely To Be Horrific": Previewing The Worst Jobs Report In US History

Tyler Durden

Thu, 06/04/2020 – 23:11

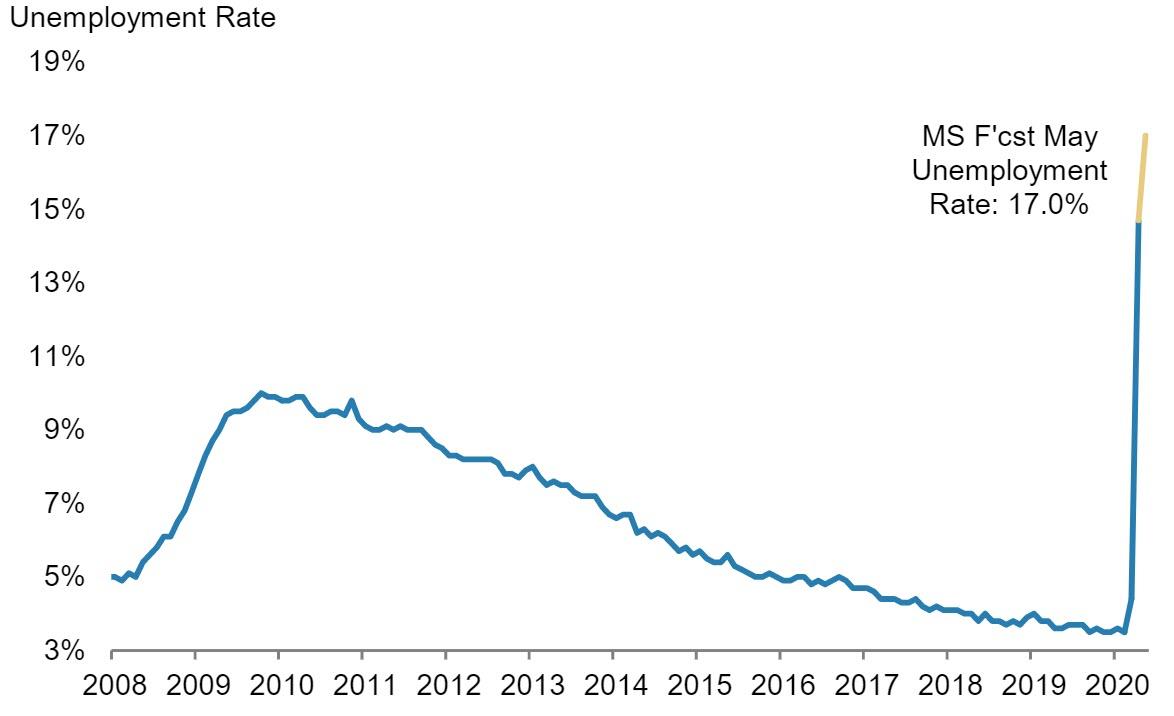

Tomorrow’s jobs report will be one for the history books: with a record 19% Unemployment, and an additional 7 million job losses added to the 20 million from last month, the labor picture will be far worse than anything observed before in US history, eclipsing the darkest days of the Great Depression.

Indeed, as NewsSquawk writes in its payrolls preview, “the data is likely to be horrific, although it tells us what we already know.” So will stocks close green? Probably, since the extent of the pandemic gloom has already been heavily discounted by the market which is expecting a miraculous V-shaped recovery, and instead traders’ focus is on the direction and speed of travel. Furthermore, there is little in the BLS report that will offer any forward-looking insight – that will depend on progress regarding the reopening of economies, and official support measures. With that said, a ‘solid’ ADP report which was much better than expected stoked a rally in risk assets, which resulted in significant curve steepening and equity upside along the lines of a reflation trade, offering hope that the economy may be more resilient than feared (the more likely explanation is that the ADP report was once again massively wrong).

Meanwhile, as US data surprises have improved over the last two weeks, and risk assets seem more asymmetrically sensitive to ‘re-opening and recovery’ developments, progress on treatments, testing and tracing, as well as stimulus from global policymakers; this has underpinned the recent rally in the S&P 500 despite historically stretched p/e valuations, negative headline risk (US/China), and a limited appetite in Washington for another hefty fiscal injection.

Here’s what Wall Street expects tomorrow, courtesy of NewsSquawk.com:

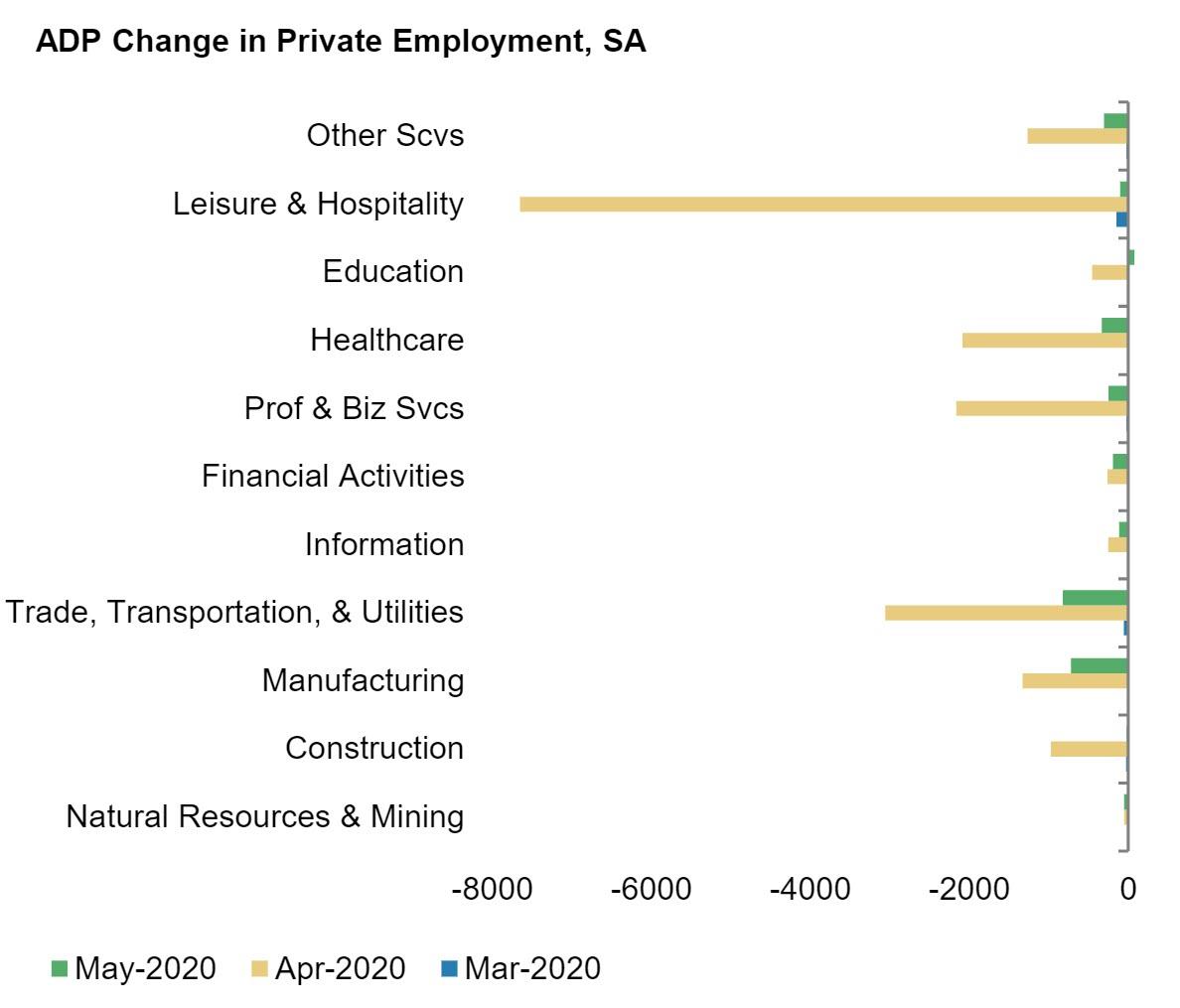

- Nonfarm Payrolls exp. -8.25mln (range -17mln to -1.7mln), prev. -20.5mln);

- Unemployment rate exp. 19.8% (range: 17.0-27.0%), prev. 14.7%;

- U6 unemployment prev. 22.8%;

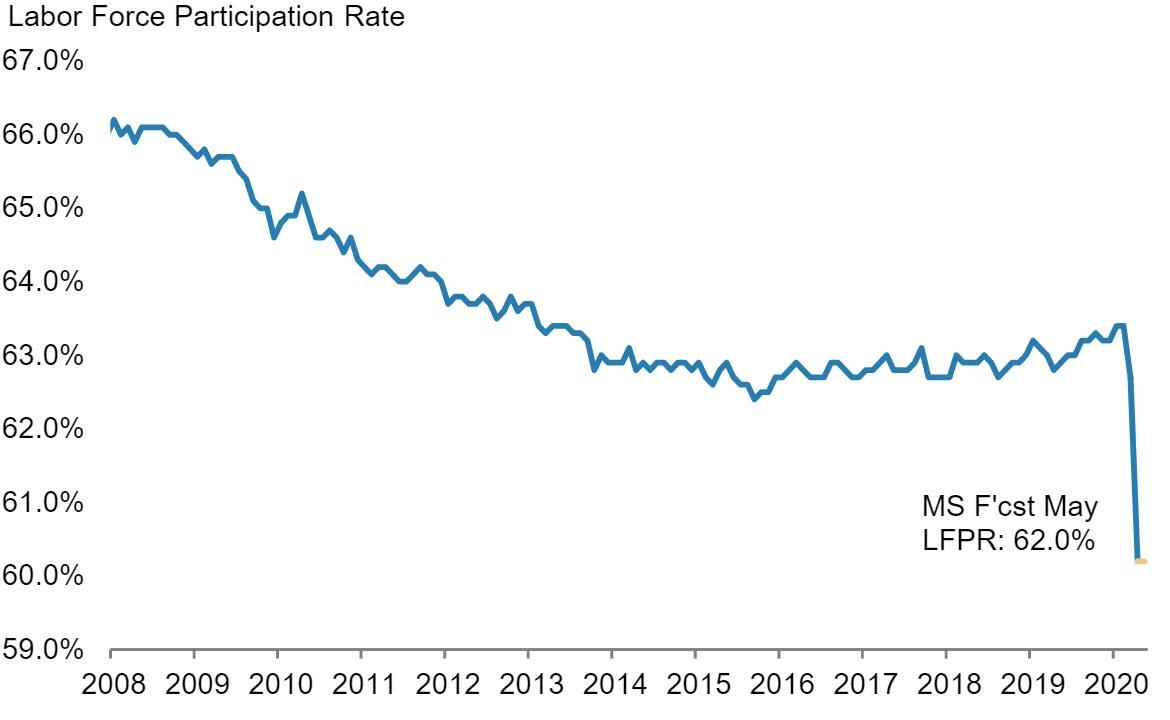

- Participation prev. 60.2%;

- Private payrolls exp. -7.5mln, prev. -19.5mln;

- Manufacturing payrolls exp. -0.4mln, prev. -1.3mln;

- Government payrolls prev. -0.98mln;

- Average earnings M/M exp. +1.0%, prev. +4.7%; Average earnings Y/Y exp. +8.4%, prev. +7.9%;

- Average workweek hours exp. 34.3hrs, prev. 34.2hrs.

TREND RATE:

Backward-looking non-farm payroll trend-rates offer little insight in this environment. Updates on how the US labor market is progressing will likely be seen first in the weekly jobless claims/continuing claims data, regional prints and anecdotal reports from corporations bringing workers back from furlough (uncertainty remains over how many workers will be recalled) rather than the BLS Employment Situation Report. At present, analysts are eyeing how soon weekly claims can fall below the arbitrary 1mln level (it is estimated to do so around the end of June), and then the evolution of joblessness; Fed voter Kaplan expects the unemployment rate to fall to 10-11% by the end of this year, and back beneath 7.0% by the end of 2021, assuming consumers are willing to resume activity. The Fed will make economic projections in June, and although they will be subject to large caveats, they will still be useful as a barometer to gauge how quickly progress is being made in lowering unemployment in the months ahead, and by extension, what further support the economy needs.

UNEMPLOYMENT RATE:

According to Morgan Stanley, the unemployment rate will move up from 14.7% to 17.0% in May, a stronger than consensus forecast, and a number which according to the bank will likely peak in unemployment rate for this cycle. In reality, as we noted last month, the shadow unemployment rate, which includes people absent from work for other reasons, is much higher (closer to 25.5% in April). There is considerable uncertainty as to how high the shadow unemployment rate could be due to compositional and categorization noise. For example, some people that were absent from work for other reasons are counted as employed, but are presumed to be unemployed. The Bureau of Labor Statistics (BLS) can re-categorize this at any time, which could lift the unemployment rate to as high as 25%, in our view.

PARTICIPATION RATE:

The participation rate is expected to remain unchanged at 60.2%, after declining 2.5% in April. There is downside risk to the unemployment rate if labor force participation moves lower. For example, if participation declines 20bp to 60.0%, the unemployment rate would be 16.7% instead of 17.0%. The flows from employment to outside the labor force are higher than ever before, due to the provision under the CARES Act that does not require workers to actively seek work to qualify for unemployment insurance benefits.

INITIAL JOBLESS CLAIMS:

The high frequency weekly numbers offer a mixed signal: initial jobless claims data corresponding to the BLS jobs report survey period is yet to show that the easing of lockdown measures has resulted in any large scale return to work for furloughed workers (note: the data does not count those claiming the new Pandemic Unemployment Assistance Benefits). The corresponding continuing claims report, however, surprised by falling for the first time since the pandemic, suggesting that the reopening of states was in fact pushing businesses to rehire some of the people let go when the virus hit.

WAGES:

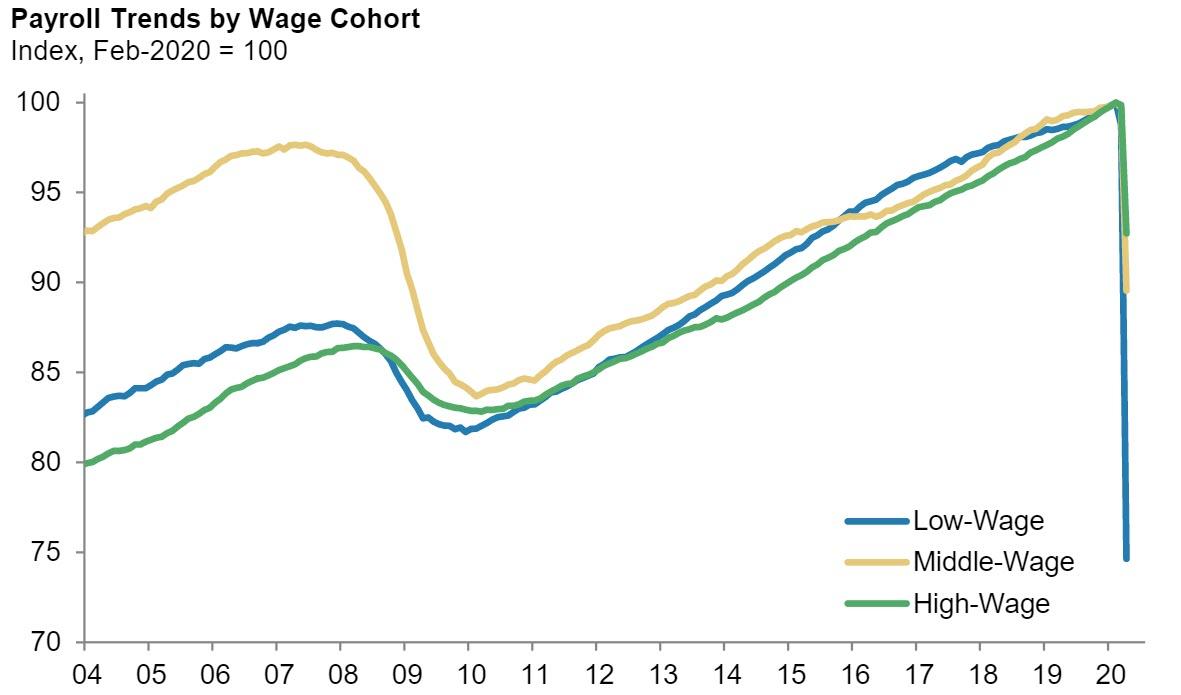

The sharp rise seen in April’s earnings metrics is a quirk due to the data not adjusting for those on low incomes who lost jobs – these people are removed from the sample, resulting in a higher average wage of those that remain in employment. The sharp rise is therefore not a positive, and if unemployment remains elevated, there will be pressure on wage growth during the recovery. As MS further explains, in the April Payrolls report, job losses were broadly based across sectors but the incidence of unemployment fell most heavily on lower-wage segments of the labor market. This created a compositional bias in the data that caused a +4.7%M increase in earnings. Layoffs in May are expected to be more evenly distributed across the pay scale.

Consumers’ appraisal of the job market was mixed, but there were signs of stabilisation, according to the Conference Board’s gauge. Whether consumers re-emerge from the pandemic with confidence to return to work will depend on stronger testing, tracing and quarantine measures needed to give consumers confidence to engage in activity; additionally, how quickly the case count declines, how soon economies can reopen, and how soon hiring picks up. For now, consumers’ short-term earnings outlook is stable, but they will likely need – and are still expecting – more fiscal

support over the coming 12-months.

STIMULUS CLIFF:

Recent government stimulus has not merely offset consumers’ lost earnings, in many cases it has exceeded them, and balances in checking accounts that had fewer than USD 5,000 of funds 12-weeks ago now have between 30-40% more money in them given minimal economic activity taking place, according to Bank of America, while BEA data last week showed the savings rate surging to a record high. Whether Americans draw savings and resume consumption in the months ahead will be a function of how confident they ultimately are that a ‘second wave’ more disruptive than the first can be avoided, particularly amid some messaging from lawmakers averse to more fiscal largesse. However, it is worth being cognizant of a potential ‘stimulus cliff’; weekly federal unemployment benefits will end in July, and there seems to be a lack of political will to extend it amid concerns of ballooning deficits. The US is still expected to follow-up with further stimulus possibly in June, likely sized around the USD 1trln mark – significantly smaller than USD 3trln in the bill that the House recently passed. And while the fiscal support might not contain another round of cheques to Americans, there could be ‘back to work bonuses’ incentivising a return to work.

BUSINESS SURVEYS

The manufacturing ISM report saw the employment sub-index pickup by 4.6 points to 32.1. But the ISM said employees returning to work in late May will positively impact the index in June. Meanwhile, the non-manufacturing ISM report showed employment conditions improving to 31.8 from 30.0, in contraction for the third straight month, with no industry reporting a rise in employment. Comments from respondents include: “Furloughed as much staff as possible to reduce costs due to COVID-19” and “Terminations, furloughs, hourly reductions [and] forced vacations.”

ADP:

ADP reported 2.76mln jobs were lost from the US economy in May, better than the 9mln of losses that the Street was expecting; the prior was also revised up to -19.56mln from the initially stated -20.24mln. This decline would be less than has been implied by the 12.2mln initial jobless claims registered between April and May, according to Pantheon Macroeconomics, but is consistent with the 3.1mln increase in continuing claims in that window. “This suggests that the re-hiring of people in states beginning to reopen was very substantial, even though reported job postings on Indeed fell further between the two surveys,” and “presumably, most people were simply rehired by email, text or phone call.” Pantheon reminds us that the ADP measure is generated by a model which incorporates macro variables as well as official payroll data from the previous month, in addition to the information gleaned from firms which use ADP’s payroll processing services. “It’s possible that ADP’s numbers are unrepresentative for May, or that the model is unreliable given the step-shift in the state of the labour market, but the safest approach probably is to assume that Friday’s official payroll numbers will be much less bad than the current consensus, -8mln, and June payrolls likely will increase substantially.”

CHALLENGER JOB CUTS:

Challenger announced US-based employers intend to cut 397,016 jobs in May (209,147 directly a result of COVID), easing from April’s total of 671,129. “Although we saw a significant drop in May over April, we are still in record territory and the cumulative number of cuts since the pandemic began is staggering,” Challenger said, “as states and cities re-open, we can expect to see these numbers decrease as more people return to work. But many lost jobs will not return soon, if ever.”

via ZeroHedge News https://ift.tt/2A4xklp Tyler Durden