Foreign Buyers Flee, Bid-To-Cover Tumbles In Ugly, Tailing 10Y Auction

Tyler Durden

Tue, 06/09/2020 – 13:14

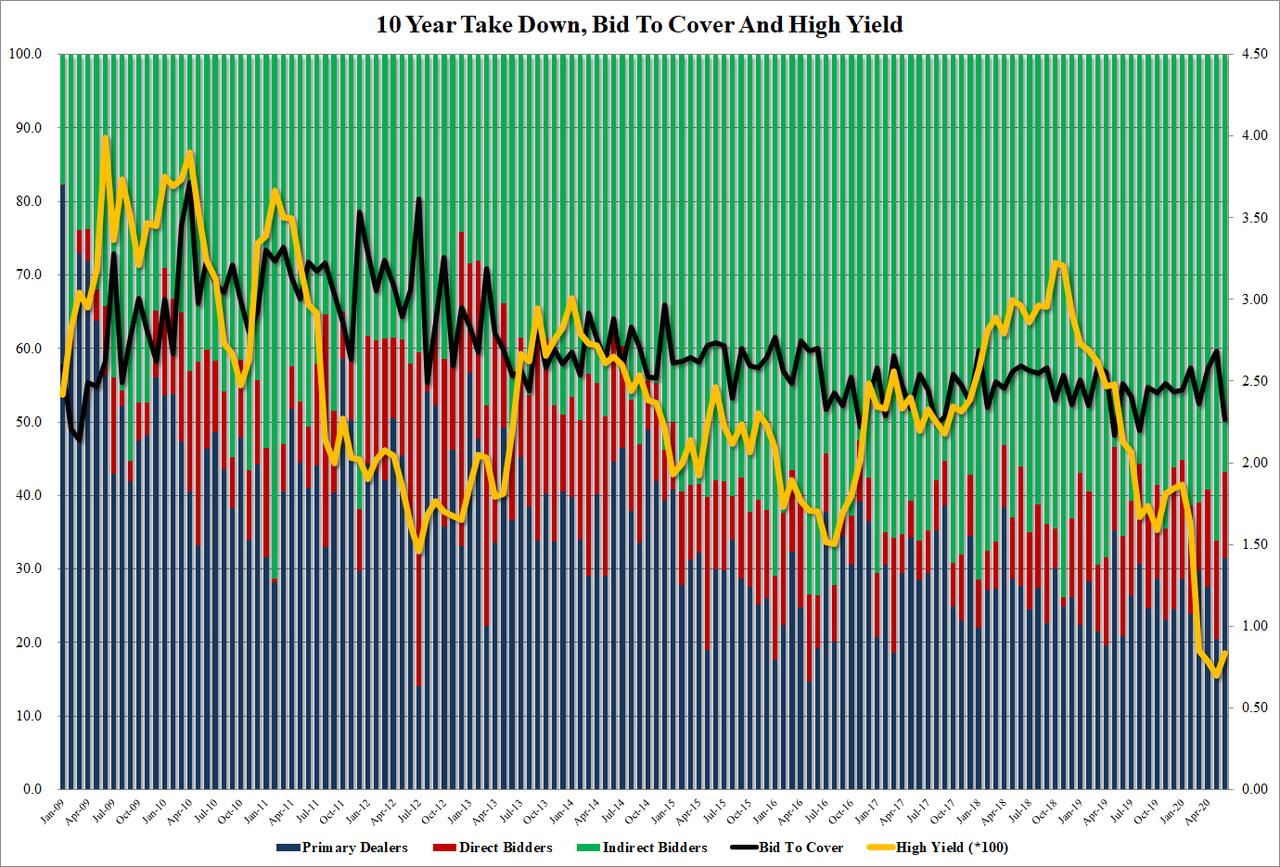

After a mediocre 3Y auction to start the week, moments ago the Treasury sold $29BN (down from $32BN last month) in a 9-year-11-month reopening, which was downright ugly after today’s sharp drop in yields, which saw the 10Y slid as much as 6bps.

The high yield of 0.832% tailed the 0.819% When Issued by 1.3bps, the widest tail since January, and was 13.2bps higher than May’s record low 0.70% yield.

Just as ugly was the plunge in the bid to cover swung sharply lower, from 2.69 last month – the highest since Jan 2018 – to just 2.26, the lowest since August 2019.

The internals were also quite disappointing, with Indirects taking down 56.7%, down almost 10% from last month’s 66.1%, the lowest since January and below the 6-auction average of 59.8. And with Directs also paring down their interest, taking down 11.8%, below the 14.3 six-auction average, leaving Dealers with 31.%, the most since May 2019.

Overall, a very ugly auction which however can be attributed to the sharp runup in the bond market today amid the broader equity market weakness.

via ZeroHedge News https://ift.tt/30u66j1 Tyler Durden