The Secret Is Out: “The Fed Is Busted”

Tyler Durden

Fri, 06/26/2020 – 14:04

Authored by Sven Henrich via NorthmanTrader.com,

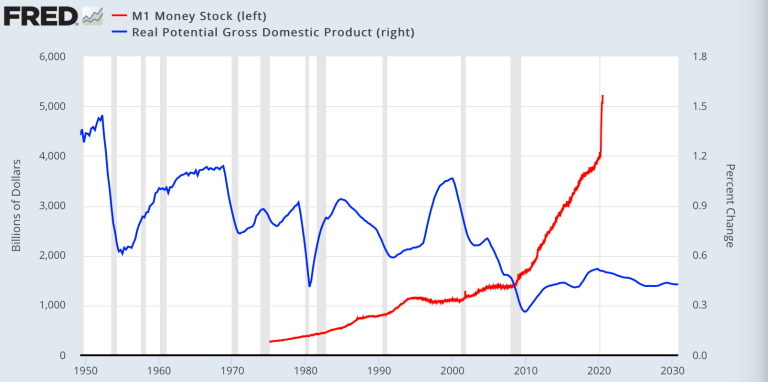

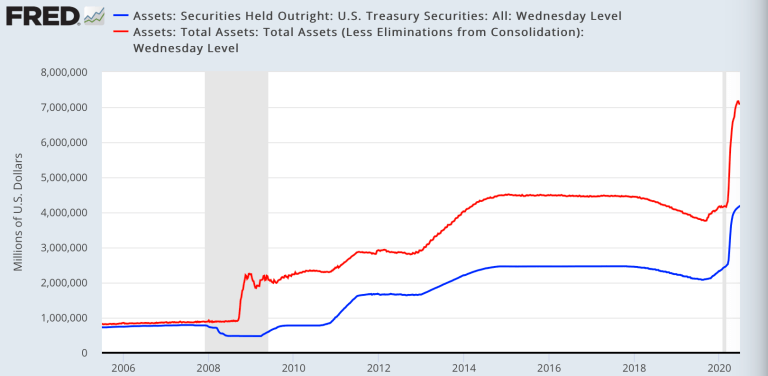

First they dismiss you as a conspiracy theorist then they join you. The secret is out, the Fed is busted: Central banks have distorted asset prices far above the economy.

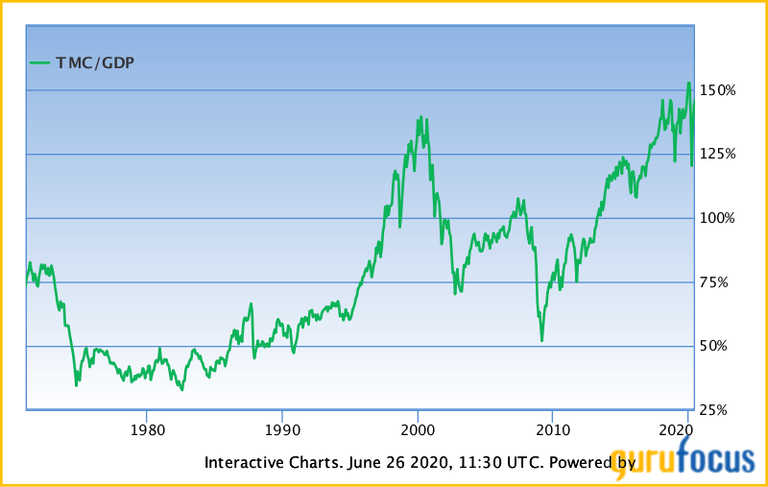

I’ve been harping about the market cap to GDP ratio for a while and even called the Fed’s asset price distortion operation a direct threat to the economy.

Now it appears the IMF agrees:

“This disconnect between markets and the real economy raises the risk of another correction in risk asset prices should investor risk appetite fade, posing a threat to the recovery”

Posing a threat to the recovery. This was precisely my point on CNBC Fast Money last week:

Thanks @MelissaLeeCNBC & @CNBCFastMoney for having me on the show.

Well, at least you know where I stand 😉 https://t.co/UZNuPceDAO

— Sven Henrich (@NorthmanTrader) June 17, 2020

The Fed is the danger. None of what we are seeing here is normal nor healthy as seen in market cap to GDP:

And be clear: Everything is about the Fed. It’s gotten so bad that a broad sense of resignation is making itself felt. Wall Street analysts are reduced to cite nothing but the Fed and further stimulus to justify a buy stocks narrative. Everything is so distorted that the very tenants of capitalism are crumbling.

Tim Seymour acknowledged as much last night: Capitalism is dead:

The Fed has killed it https://t.co/jMWjLhJrcl

— Sven Henrich (@NorthmanTrader) June 25, 2020

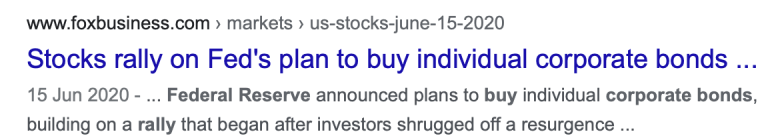

The very notion of price discovery is reduced to a central bank command order operation. Ever more ready to intervene at an ever more frantic pace, fearful of any downside in markets.

Just take the month of June. Two corrective moves in June and both seeing markets bounce back on what? The Fed coming to the rescue:

I keep asking how desperate they are behind the curtain.

One can’t help but wonder if we are approaching a moment of singularity:

The coming moment of singularity: When central bank intervention no longer works to boost asset prices.

— Sven Henrich (@NorthmanTrader) June 26, 2020

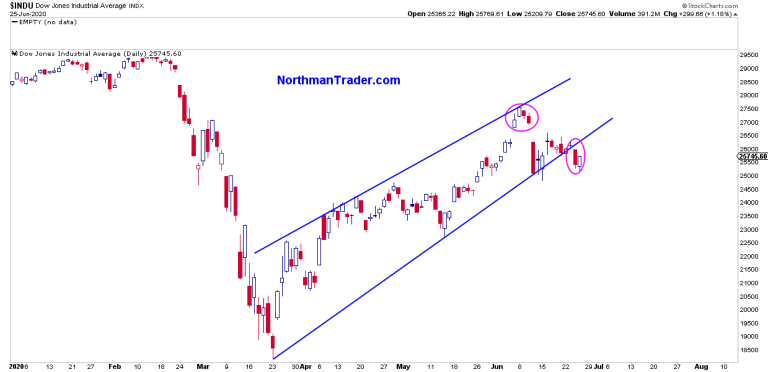

For all the bullish narratives out there nobody can hide from a very self evident fact: Markets peaked on June 8th. It was the same day I asked the Crash 2 question. People mostly think of a crash as a fast event, but that’s not necessarily so. February/March was a crash because it happened so fast. But 2000 was a crash and it took 2 years to play out.

Not everything happens in a day, week or month.

And so I want to highlight some charts that suggest something more sinister may be in play than currently recognized.

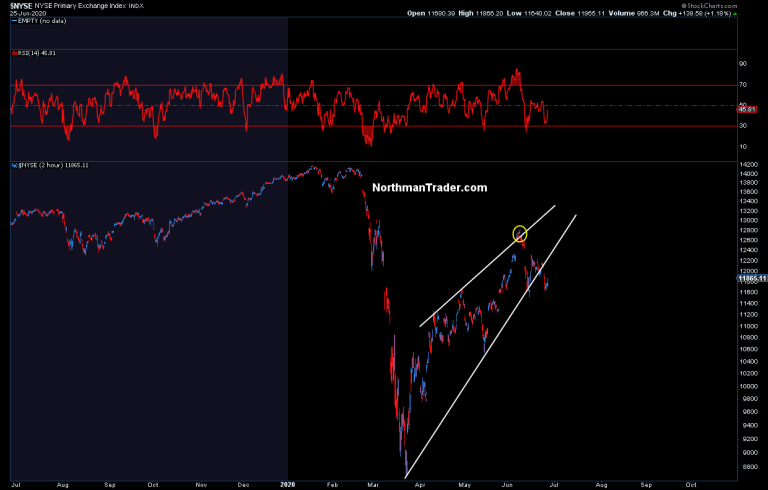

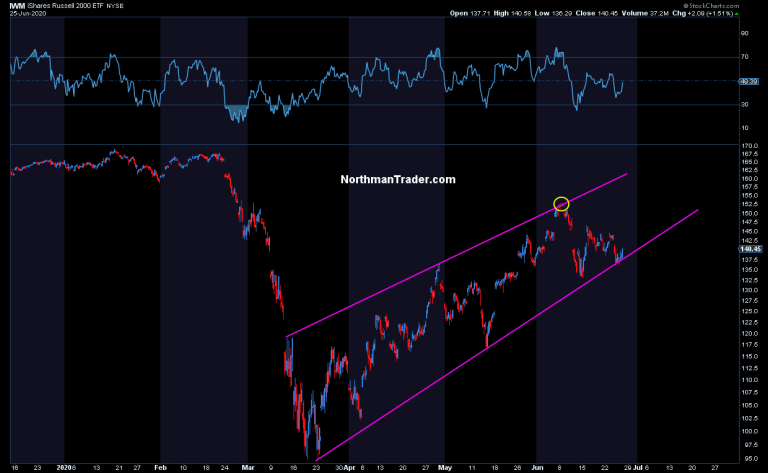

Markets did peak on June 8th and the island reversal patterns we discussed in Straight Talk #6 remain in place:

$DJIA:

$NYSE:

$IWM:

All of them peaked on June 8th.

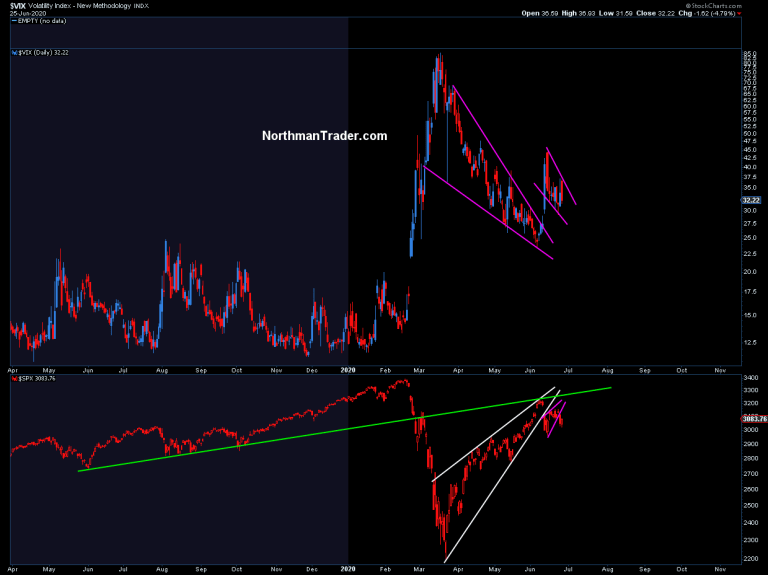

Including $SPX and the $VIX bottomed that day and have broken out since, the pattern busted to the upside:

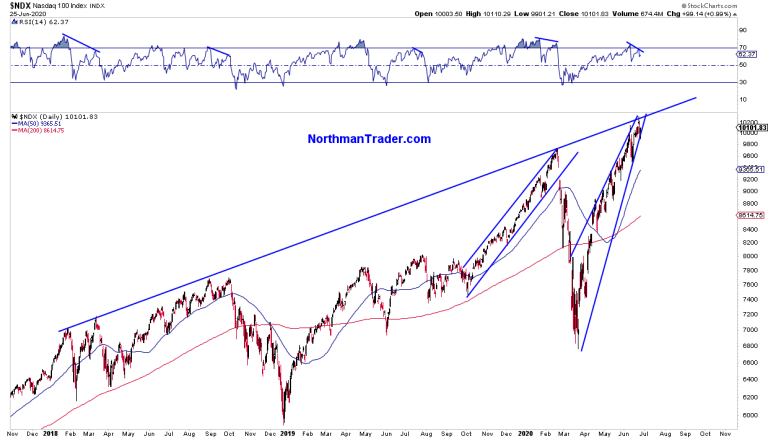

All except one index who’s new record headlines made these market peaks fade into the background: The almighty Nasdaq managing to hit all time highs on a negative divergence hitting a key trend line before rejecting.

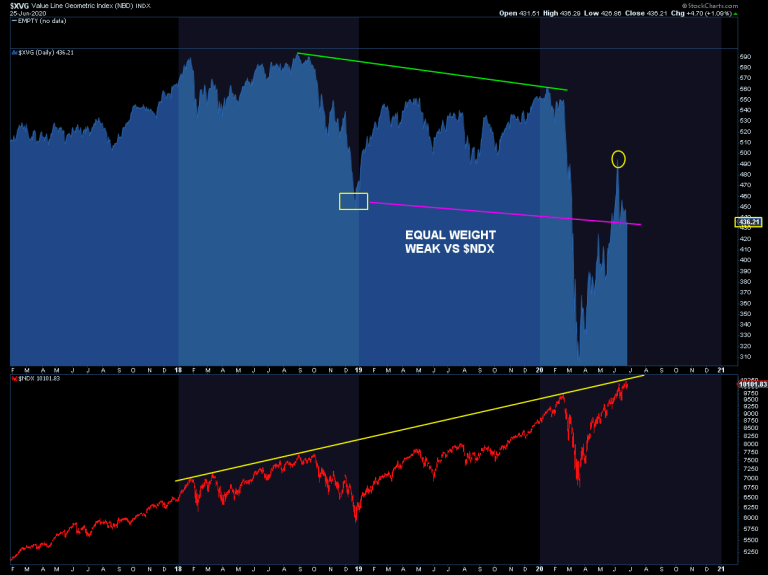

And the market cap concentration of the Nasdaq hiding the most striking fact: Equal weight remains below the December 2018 lows also peaking in June:

Hence I call all this still a bear market.

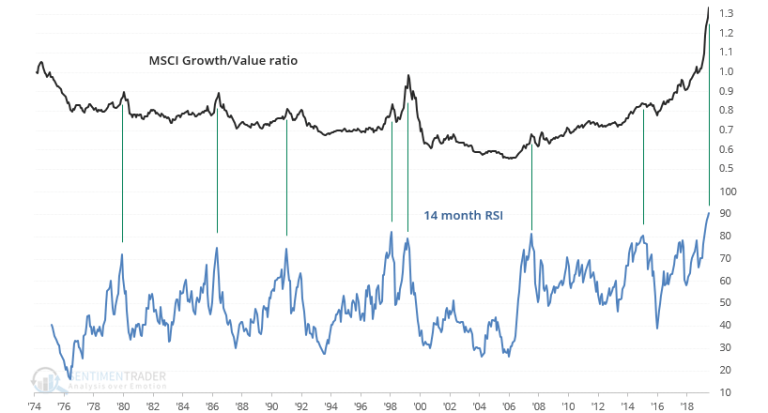

A bear market that hides in the details hidden beneath and asset prices distorted by the Fed that also can’t hide from this truth:

This market remains about control. It can’t maintain asset price levels this historically disconnected from the economy without artificial intervention expanding. Reduce it by a sliver and asset prices drop.

So far the Fed has succeeded in its mission to save markets from pain commensurate with the crisis unfolding, but it is killing capitalism itself in the process.

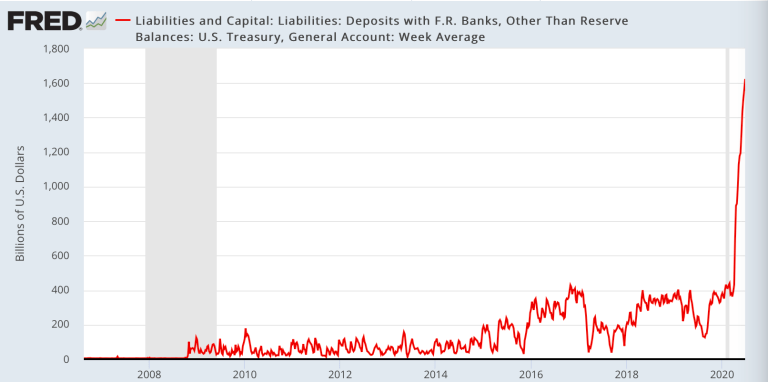

Now desperately intervening in one form or another on every down day the Fed soon will run out things to do and buy and market participants having chased nothing but the Fed put have greatly aided and abetted this historic distortion:

I’ve called this a battle for control between fundamental reality on the ground and artificial liquidity injections.

Everything we’re seeing are vertical distortions that are non sustainable:

But worse than vertical they are not changing reality on the ground. They are just masking it.

No bull market without central bank intervention has now been proven beyond a reasonable doubt. The Fed is busted and Wall Street exposed to be nothing but a suckling at the Fed’s liquidity chest.

Rallies still occur when the Fed intervenes. But despite two interventions in June prices now remain below the June 8th peak. The Fed and markets now have to prove they can exceed above these prices or potentially face the point of singularity: No bull market even with central bank intervention. If they can’t, then this bear market will come out of hiding.

via ZeroHedge News https://ift.tt/3eCLmK1 Tyler Durden