Gordon Johnson: Warranty Accounting Impropriety At Tesla Similar To Accounting At Wirecard

Tyler Durden

Tue, 06/30/2020 – 20:25

Right around the same time that Tesla was leaking to electrek that the company could break even in Q2 despite the pandemic, analyst Gordon Johnson of GLJ Research was putting his clients on notice about “continued deception” and “accounting impropriety” that is “similar” to Wirecard.

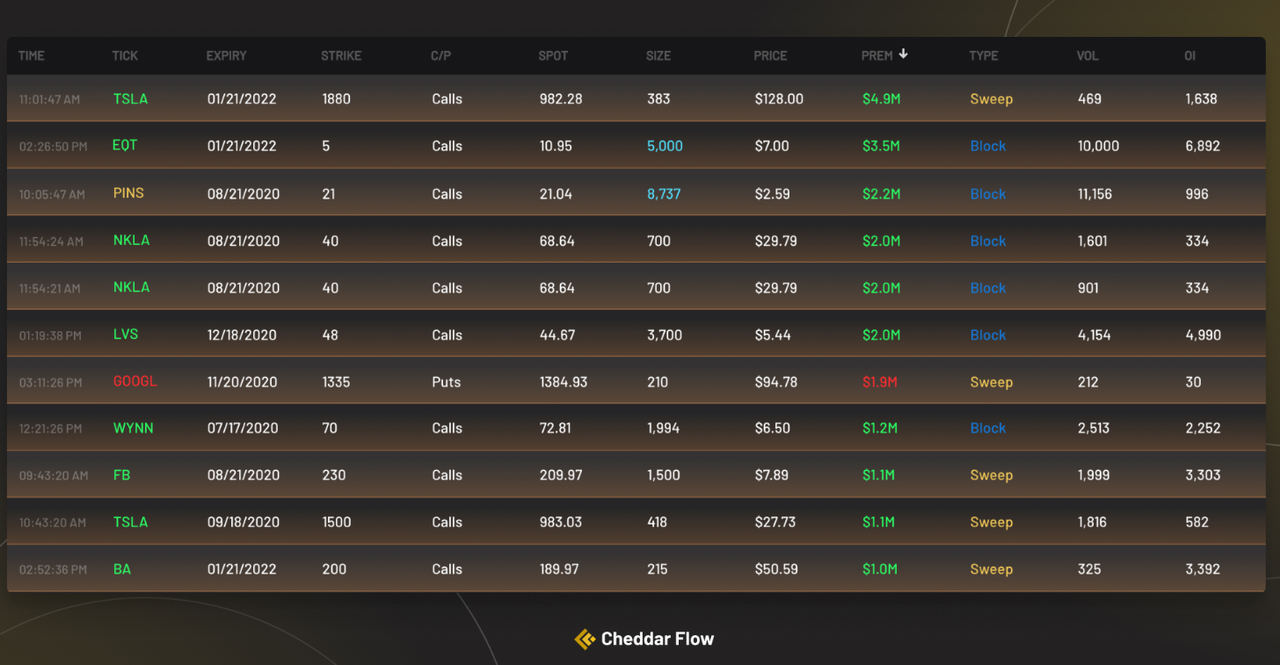

Of course, the stock responded on Tuesday to only one of these two reports, surging higher on the back of Musk’s comments and a continued gamma squeeze helped along by multi-million dollar sweeps of $1500 and $1800 calls on Monday.

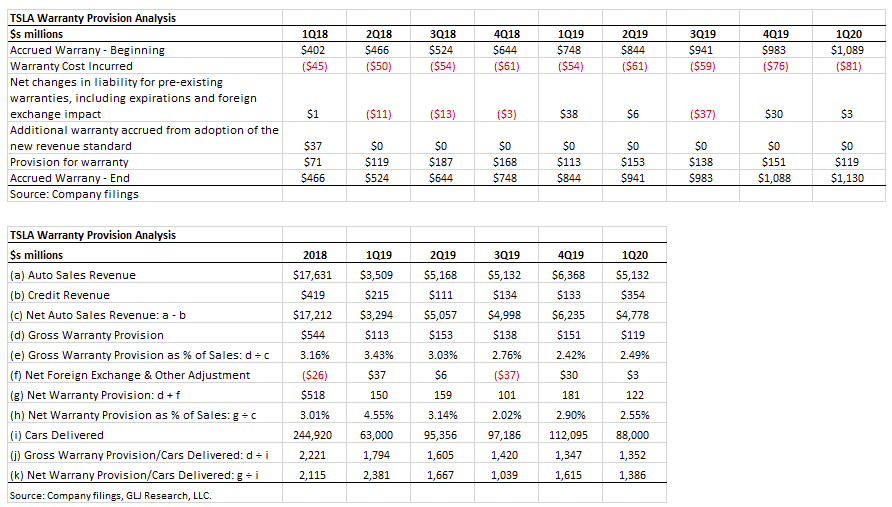

Regardless, Johnson’s note about Tesla’s warranty accounting talks about serious issues that eventually may not be able to be ignored. Johnson estimates on Monday that Tesla has recognized just $1,427 per car in warranty reserves versus the $3,308 per car that it should. This has led to a gross profit overstatement of $148.93 million, according to Johnson:

If you take TSLA’s adjusted warranty reserve in 1Q20 of $78.95mn and divide by its adjusted aggregate cars on the road of 763,755, you arrive at a number of $103.37/car; thus, given TSLA provides an 8-yr battery/motor warranty, and thus every car sold is still under warranty, $103.37/car x 32 = $3,308/car of lifetime expense x 79,200 cars sold and on the road in 1Q20 = the amount TSLA should have taken in 1Q20 pre-adjustment warranty provision (~$275mn) ; yet, taking the adjusted 1Q20 warranty provision of $119mn vs. 79,200 cars on the road, TSLA recognized just $1,427/car in reserves in 1Q20.

So ($3,308/car x 79,200 cars on the road) – ($1,427/car x 79,200 cars on the road) = gross profit overstatement of $148.932mn. This is a pretty big deal, and not only overstates gross margin, but also overstates net income – see below for TSLA classifying warranty cost as “goodwill”.

Johnson then posted several examples of the company accounting for warranty costs as goodwill, thus artificially boosting its gross margin and net income.

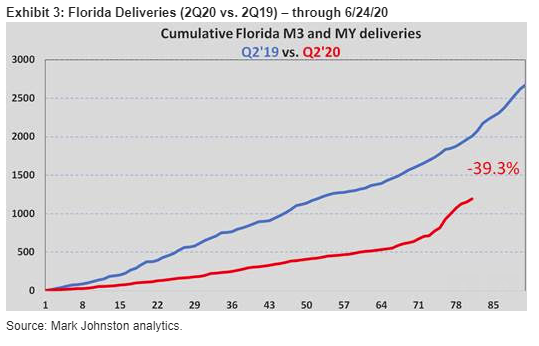

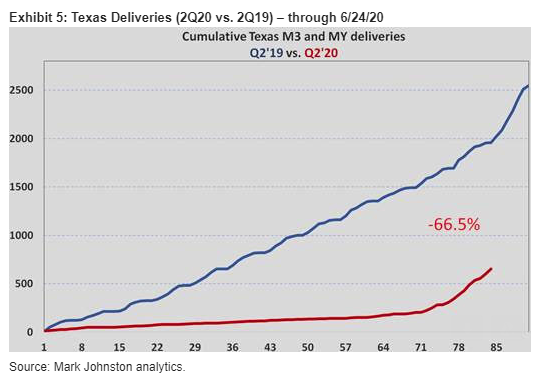

Interestingly, Johnson also noted last week that Tesla’s end of quarter push didn’t seem to be going well, which contradicts what has apparently been leaked to electrek. Johnson noted that Florida and Texas were very important markets to monitor since they were the closest to “real-time” of any U.S. Tesla data sets. New York and California, he noted, were 1-2 months behind.

Johnson noted the following trends last week:

- OVERALL THIS WEEK (i.e., the most important week for TSLA’s 2Q20 numbers): Model 3 slowing in FL; Model Y slowing in FL; Model Y slowing in TX; Model 3 accelerating, slightly, in TX.

- FLORIDA THIS WEEK (i.e., the most important week for TSLA’s 2Q20 numbers): Last week TSLA was averaging 54 3+Y/day; this week, so far, it’s 40.

- TEXAS THIS WEEK (i.e., the most important week for TSLA’s 2Q20 numbers): Last week TSLA was averaging 36 3+Y/day; this week, so far, it’s 39 (the data come in much stronger than expected today – the strength is 100% from the Model 3).

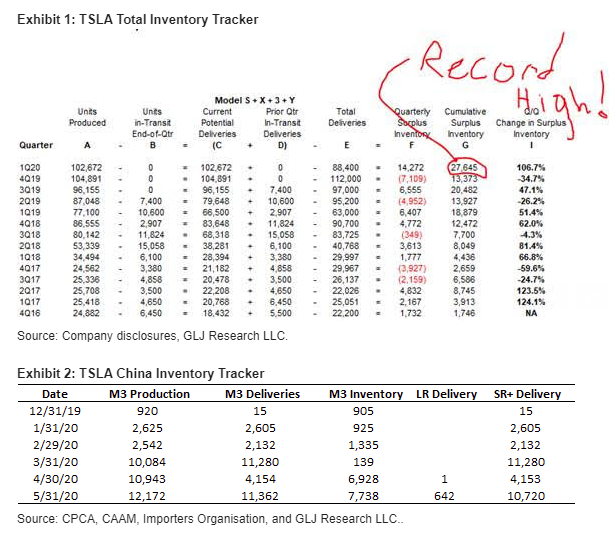

Johnson concluded that “the end-of-quarter push is the weakest it’s been since they ran out of cars in 4Q19 (unlike then, however, this time they have a record level of inventory)”.

And for those note familiar with accounting who still want the gist of Johnson’s note, we’ll refer you to this Tweet, which popped up yesterday:

Tesla Model 3 on fire & still moving. No other details known. $TSLA pic.twitter.com/UHUUfH5cUc

— KillingMyCareer (@MelaynaLokosky) June 29, 2020

via ZeroHedge News https://ift.tt/2YN2FD1 Tyler Durden