Top Economist Warns No Recovery Until 2022, Stock Market Correction Ahead

Tyler Durden

Sun, 07/05/2020 – 20:30

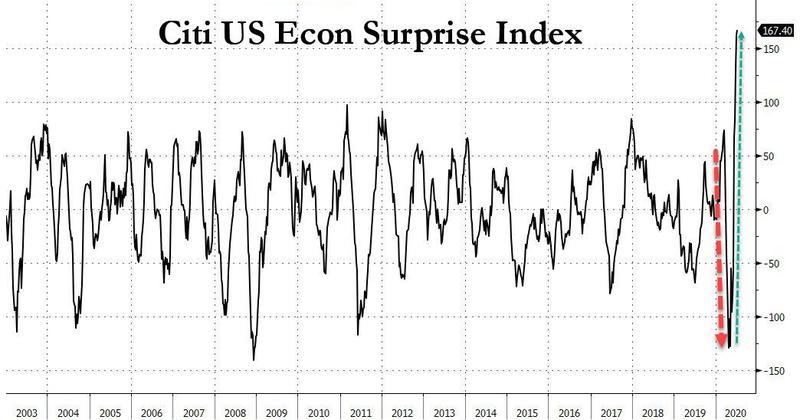

It remains to be seen if the US economy even began anything that could realistically be called a “recovery” in June. After all, virus cases are surging, states are pausing or reversing reopening plans, and retail foot traffic has stalled. The “V-shaped recovery” hype in which jobs and economic growth will surge to 2019 levels ahead of the election is nothing more than propaganda hogwash from the Trump administration.

Christophe Barraud, the chief economist of the broker-dealer Market Securities, recently told Business Insider that the economy wouldn’t revert to 2019 growth activity levels until at least 2022, adding that, “it will take a long time for life to return to normal.”

“Even if there is a vaccine by the end of the year, it likely wouldn’t be distributed until 2021, leaving a long time for the US to grapple with the virus,” he said.

Barraud said the recovery phase of the economy might not be seen until 2022 or after, and also said for Europe, recovery might not be seen until 2023.

Barraud is ranked one of Bloomberg’s top economic forecasters for the last decade. His forecasts for the US, Europe, and China have been mostly accurate. So when he indicates the probabilities of a V-shaped recovery in the US are low for this year – readers should take note.

Barraud said the stock market is priced for perfection, a lot of things have to go right at current valuations. He warns of a correction in equities as uncertainties increase over the shape of the recovery.

“Markets are not pricing in a lot of risks,” he said, adding that the latest sugar high in the economy is due to massive fiscal spending.

We noted last week that the economy could be headed for a fiscal cliff if the next round of stimulus doesn’t arrive by early August.

Barraud said around August – markets should focus on the presidential election.

“That could lead people to take some profits, and market structure might revert back to what it looked like before coronavirus,” Barraud said.

He also said dismal corporate earnings and a second virus wave could result in investors locking in gains for the year ahead of the election.

“At this point, people look a little optimistic about EPS for next year,” said Barraud, adding that analysts and investors are expecting a V-shaped recovery and aren’t pricing in the potential risks, such as increased taxes, that could come as a result of the presidential election in November.

“The market could react because, at this point, there is no room for disappointment,” he warned.

Barraud said with no imminent coronavirus vaccine – there is “still some time for a second wave, which would be very damaging” to the economy and derail the recovery, resulting in a further deterioration of the jobs market.

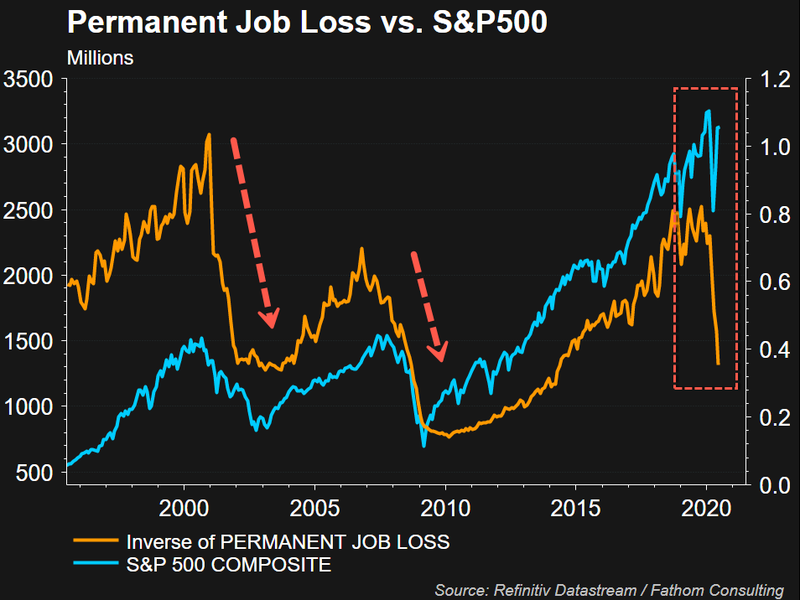

We noted Sunday morning, with the unemployment level sill at Great Depression levels, the stock market is set for a rude awakening as nearly 3 million jobs in June, up from 1.6 million in February, have been eliminated from the economy.

Permanent Job Loss (inverse) vs. S&P500

“My advice would be to be cautious from August, maybe take some protection,” Barraud said.

In a separate piece, he recently said the global trade recovery would be much slower than the market is anticipating.

It appears a lot of disappointments are ahead.

via ZeroHedge News https://ift.tt/3dYsVyB Tyler Durden