Global CapEx To Plunge 12%, Worst Than GFC; A Sign Recovery Will Underwhelm

Tyler Durden

Tue, 07/07/2020 – 13:20

Capital expenditures, generally known as CapEx, are funds used to acquire, upgrade, and maintain physical assets. We can learn a lot about a company and how it is investing in existing and new fixed assets to sustain or expand its business. More importantly, CapEx is the critical driver of growth in the future.

With that being said, companies globally are slashing capital spending this year as the virus-induced recession has forced management teams to rein in costs.

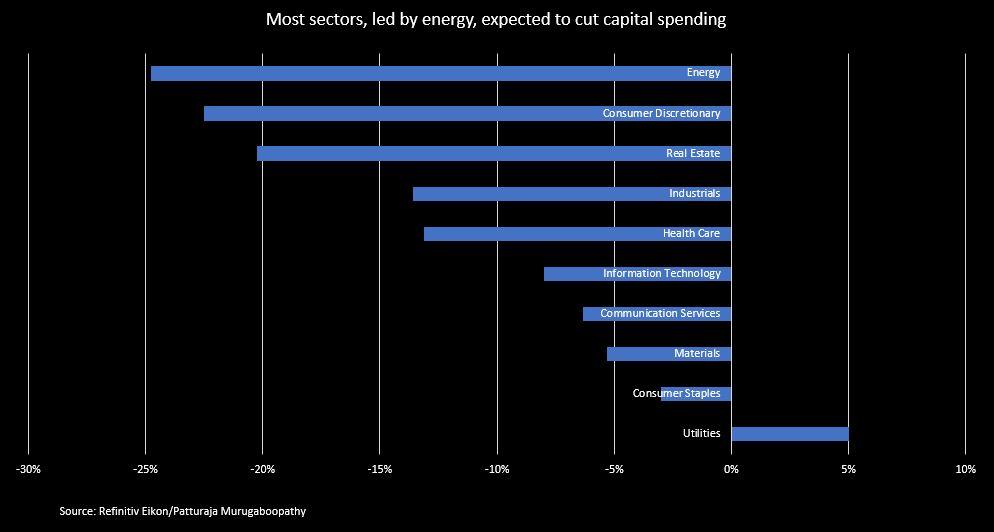

Refinitiv data (of nearly 4,000 firms) estimates 2020’s CapEx cut will be on average 12%, much larger than the 11.3% decline during the global financial crisis in 2008-09, or the largest in over a decade.

“For many firms the near-death experience of the lockdown – where cash flows have simply dried up – will have a long-run effect on their willingness to take risks and invest,” said Keith Wade, the top economist at British asset manager Schroders.

Wade explains weaker business investments are typically associated with slower economic recovery, one that may not resemble Wall Street’s “V” but could look more like an “L” or “U.”

“Weaker investment will also hamper a recovery in productivity and reinforce the outcome of slower GDP growth,” he said.

By sector, energy (-25%), consumer discretionary (-23%) and real estate (-20%) had the largest capital expenditure cuts.

CapEx cut by sector

Refinitiv showed Exxon Mobil and BP Plc, two major multinational oil and gas companies, have already told investors CapEx will be slashed by at least 20% this year.

This all suggests the market is widely misinterpreting the shape of the economic recovery – as it appears a steep reduction in global CapEx could result in a 2H bounce that underwhelms, leading to levels of GDP and earnings in 2021 to be lower than hoped for.

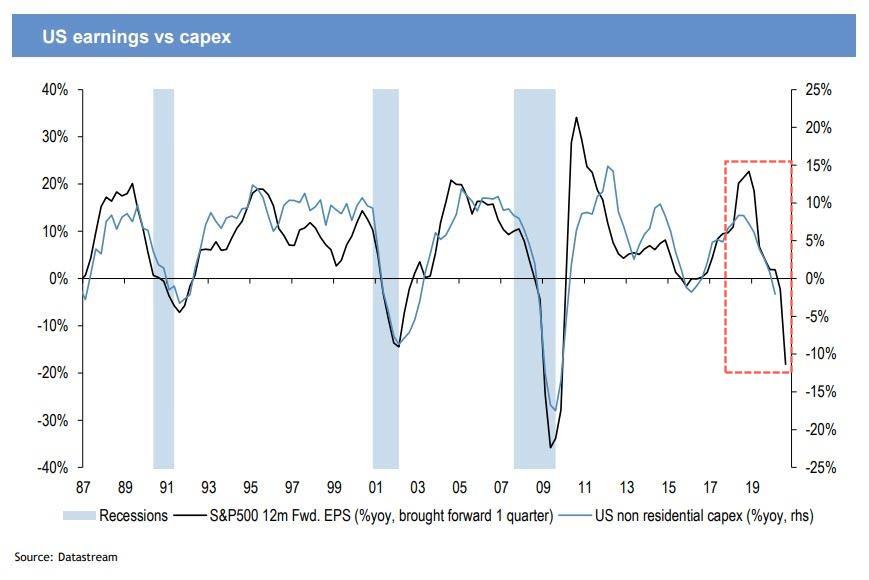

CapEx serves as a guide, or better yet, a warning that US corporate profits will continue to fall.

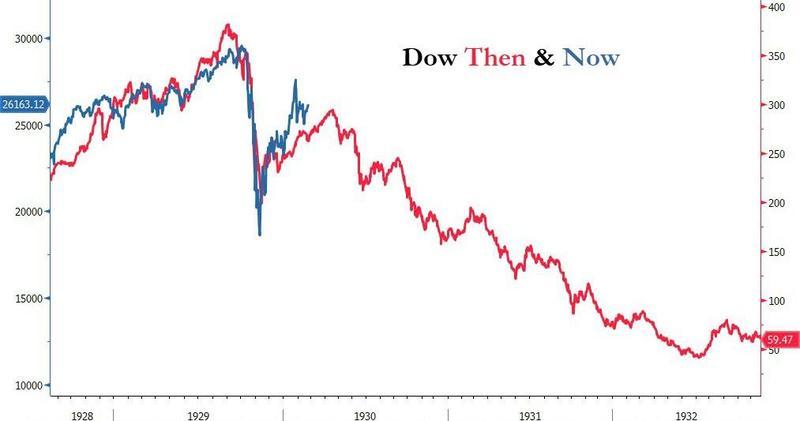

As to what happens next, we’ll let Gary Shilling, the president of A. Gary Shilling & Co., sum up his recent thoughts stated on CNBC, of where he believes Wall Street has the shape of the recovery entirely wrong and what is ahead could be a 1930-style decline in markets.

CapEx weakness is suggesting the global recovery won’t resemble a “V” this year.

via ZeroHedge News https://ift.tt/31TKNIz Tyler Durden