Rabobank: The Key Question Is Why China Decided To Jump-Start Its Stocks Now?

Tyler Durden

Tue, 07/07/2020 – 10:44

Submitted by Rabobank’s Michael Every

At time of writing the Shanghai stock exchange was up merely 1.8% on the day, quite disappointing after the 5.8% leap yesterday, but still meaning it has gained nearly 14% in just a few of sessions. That’s the best performance since late 2014, just before the same market went on its dizzying 2015 run. The same dizzying run that was overtly and blatantly a state-led bubble: and one that ended in a disastrous crash with all manner of nasty recriminations, including ‘don’t sell!’ off-the-record instructions, and apparent threats of arrest for those short-selling, or even writing negative research reports.

One wonders what the decision-makers at MSCI, who in the total absence of any comprehensive reforms in Chinese stock regulation post-2015 nonetheless decided to increase the country’s global portfolio weighting, are thinking right now. More so with hawkish US politicians already talking about the dangers of US capital being pumped into Chinese markets – and that US rhetoric is not going to get any less hawkish as Hong Kong CEO Carrie Lam introduces sweeping new police powers including warrant-less searches, property seizures, online surveillance, and not allowing people to leave the territory. That as Trump tweeted: “China has caused great damage to the United States and the rest of the world!” yesterday, and as a White House aide stated an executive order on China is apparently imminent.

While this is not an equity-focused, nor specifically China-focused Daily, this scale of market move needs some examination. What is going on? Let’s run through the options quickly:

-

Is it led by Chinese demand? The data say no. We aren’t even back to the pre-Covid trend, and that would not justify a 14% gain.

-

Is it led by Chinese supply? Much more likely – but is there any global demand for that supply? Not at the moment, and increasingly less so going forwards if you listen to the talk about shifts in supply chains out of China. So it’s stock-piling or product-dumping ahead, perhaps.

-

Is it led by lower interest rates? No. There hasn’t been any major easing in China to generate the same lower rates/higher stocks knee-jerk response seen elsewhere. It isn’t able to ease so overtly because it needs to stop capital outflows.

-

Is it led by QE? No. Yet even though Bloomberg today says China isn’t doing QE, look at a country with a 10-12% consolidated fiscal deficit pre-Covid, and perhaps nearer 20% at the moment; ask how it’s being funded (by the PBOC), and how much of that deficit spending flows into infrastructure; and consider that what one sees is quasi-MMT. Which is why China cannot afford to run a current-account deficit without losing control of its quasi-currency peg, or at least needs a net inflow of USD.

-

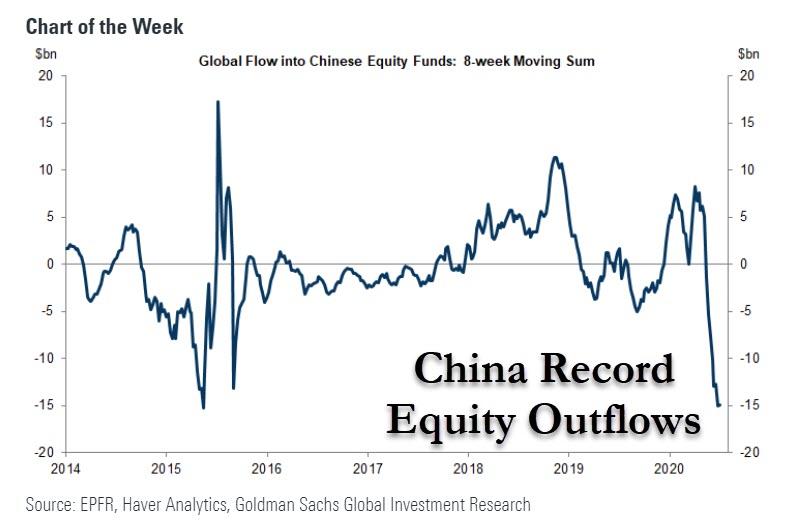

Has this been a net-inflow/foreign-capital driven rally? No. This is a domestic story…so far – and one that seems engineered in the hope that it will become a foreign-driven rally. In all fairness, it’s not as if other major markets are not seeing blatant ramping from authorities one way or another –Trump uses Twitter to the same effect– or fundamentals-defying trends.

Yet the key question is why China has decided to jump-start its stocks now? Why, when locals will act accordingly and listen to the authorities when they tell them where they are about to get their “guaranteed” minimum 20% annual return; and they follow that smooth, paved path through the financial jungle;…until it all ends in 2015 chaos again. Moreover, why given bond yields are spiking as a result, which a debt-laden economy cannot afford? Why, as punters walk away from Wealth Management Products, pulling the funding rug out from under the feet of many property projects as a result?

Perhaps to jump-start consumption? Yet property is more widely-held than stocks. Perhaps to stop the property bubble getting out of control? If so, stocks are hardly a less dangerous tiger to ride. Perhaps to swap debt for equity? Except bond yields are rising, which hurts most borrowers more than some can gain through stocks. Perhaps to encourage firms to tap unlimited CNY equity capital and not (soon to be limited?) offshore USD debt? Perhaps to help push CNY back to 7.01 to try to ease some of the looming US political pressure on China in that USD regard? Or, as suggested yesterday, if pressure can’t be eased, perhaps to allow for an immediate signal-sending 2.5% fall in CNY without taking it into a range that would suggest to the world that China is no longer master of its own destiny? (And on USD/CNY it isn’t: not while the US holds the sanctions trump card.) Perhaps simply to try to get those USD capital inflows by hook or by crook to keep the game going: “Look, you can’t miss out on this!”?

One might notice that none of the above analysis involves traditional market metrics. That is because we do not have traditional markets, or metrics, and there is nothing market-based about what is happening in this “market”. The far better form of analysis, as above, is to try to play market ‘Cluedo’ (‘Clue’ in the US). “So was it the stock bull-market in China with the quasi-MMT?” Who did it? Who benefits? And who ends up being done in by the lead pipe?

Meanwhile, the RBA today held rates and its yield curve targets, as fully expected, but underlined that FISCAL and monetary support will be needed for some time. What is another term for fiscal and monetary support? It starts with M and ends in T. And there is another M. The RBA also pledged to scale up its bond buying if needed. This implies the massive increase in the Aussie defence budget just pledged will be de facto covered by the RBA. Throw another submarine on the barbie, mate. The RBA will meanwhile “do whatever it takes” to keep the bond market functional: presumably this just means yields staying low, because the Japanese example clearly shows that if you issue lots of public debt, and the central bank buys it, then the central bank eventually becomes the market; so the RBA is saying it is going to keep itself functional.

via ZeroHedge News https://ift.tt/2Z5LtIK Tyler Durden