Forget TikTok Ban, Trump Aides Discuss Busting The Hong Kong Dollar Peg To Punish China

Tyler Durden

Tue, 07/07/2020 – 19:50

While admitting that there are many pushing back against the idea, Bloomberg is reporting that the Trump administration is escalating its plans to hold China accountable for its recent global pandemic chaos and Hong Kong freedom oppression.

Secretary of State Pompeo told Fox News earlier in the day that the US was mulling the possibility of banning social media app TikTok in the US, but tonight Bloomberg reports that some top advisors have suggested the Washington should undermine the Hong Kong dollar’s peg to the US dollar.

According to people familiar with the matter, Bloomberg reports that the idea of striking against the Hong Kong dollar peg – perhaps by limiting the ability of Hong Kong banks to buy U.S. dollars – has been raised as part of broader discussions among advisers to Secretary of State Michael Pompeo but hasn’t been elevated to the senior levels of the White House, suggesting that it hasn’t gained serious traction yet.

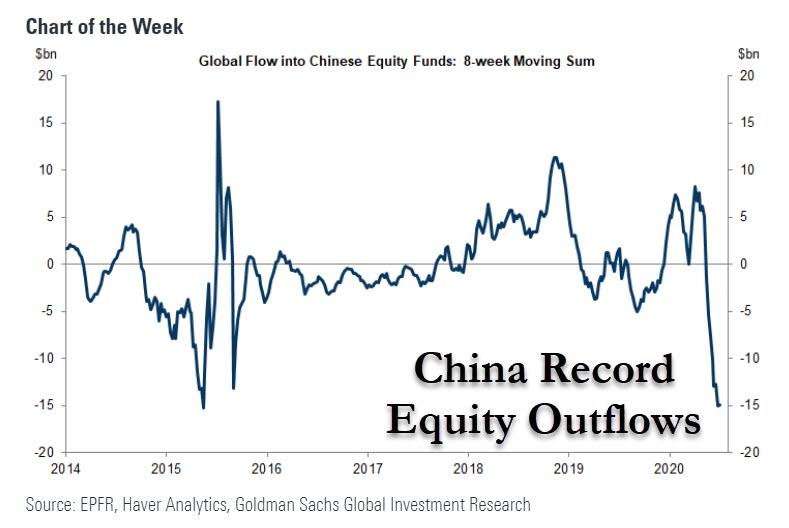

As a reminder, we suggested that one major reason for China’s recent push for everyone and their pet rabbit to buy stocks (sending Chinese markets exploding higher) was dramatic investment outflows from China.

China-dedicated equity funds saw an 11th consecutive week of net outflows.

Taking a page of the Robinhood playbook, China is desperate to halt and reverse the massive equity outflows as it urgently needs the flow of US Dollars to reverse into Chinese markets, instead of away from. To do that, it needs to create an initial upward momentum in prices which halts the selling/outflows and prompts a reappraisal of Chinese asset values. Ideally, it will also capture the euphoria of US daytraders who will buy Chinese, not US stocks.

This potential ‘strawman’ to break the HKD peg comes a day after we noted the simple maths that if 500,000 Hong Kongers were to leave the city and take USD1m equivalent with them then ceteris paribus, the HKD peg would surely have to go as all FX reserves evaporated.

In recent weeks we have seen the HK authorities publicly state they will not impose capital controls – which as a key global financial center should always be unthinkable. Yesterday, after a Chinese official response strongly opposing the UK government making clear it will offer 2.9m Hong Kongers a path to citizenship, the HK authorities had to publicly disavow rumours of a travel ban on its citizens.

Yes, that’s where we stand.

What does monetary policy have to offer here?

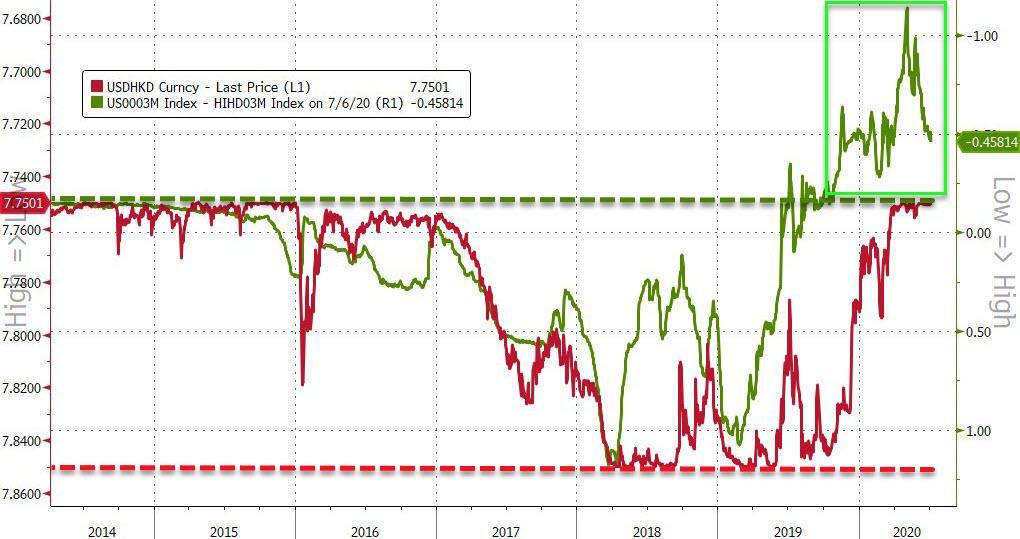

Not much, because it is The Fed’s ZIRP policy (relative to HIBOR) that is forcing carry traders’ flow to buy Hong Kong Dollars (and lend them) against cheaply-funded USDollars.

As the chart above attempts to show, the relative spread between USD funding and HKD funding implies a stronger HKD which would ‘break’ the peg band (green dotted line) and thus Hong Kong Monetary Authority had to intervene to maintain that upper peg band.

The proposal reportedly faces strong push back from others in the administration who worry such a move would only hurt Hong Kong banks and the U.S., not China.

But the very fact that this serious monetary threat has been raised (or leaked) implies two things: 1) US authorities appear to want to punish banks based in Hong Kong (especially HSBC after Pompeo singled out HSBC’s “show of fealty”); and 2) it will force a response (or pre-response) from China, which could also ripple through becalmed markets and ruin the glorious gains in Nasdaq for retail bagholders everywhere.

As Pompeo said earlier in the week: “We’d love to preserve the freedom in Hong Kong; but if we can’t, we’re going to hold the Chinese Communist Party accountable.”

via ZeroHedge News https://ift.tt/3gAgWZv Tyler Durden