Bill Gross Is COVID-Free And “Betting The Farm” On Value Over Growth

Tyler Durden

Tue, 07/14/2020 – 10:10

After a 9-month hiatus, bond guru Bill Gross is back with his second investment outlook since retiring from money-management in March 2019 saying that “value stocks, versus growth stocks, should be an investor’s preference in the near-term.”

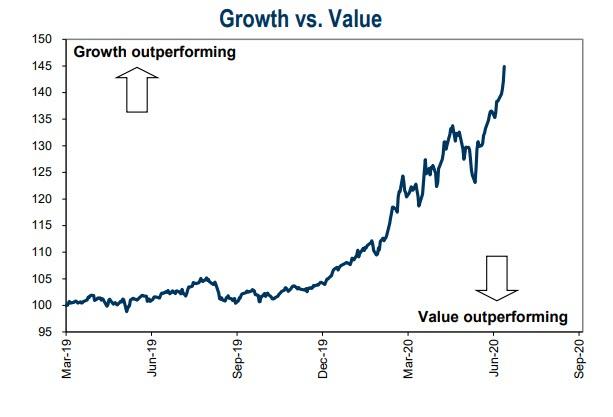

It has certainly been a wild ride for growth…

Critically, Gross says the dominance of Amazon, Microsoft and other technology giants throughout this year’s stock-market slump and recovery won’t last if inflation-adjusted bond yields rebound from their record low.

July: The Real Deal

So, hello again. It’s been a while since I wrote last and what a different world. COVID, the economy, markets and nothing on TV to watch but FOX or CNN… depending. There’s CNBC in the West Coast mornings of course, but even that has changed. Male and female “experts” seem to occupy 50/50 airtime (good), as opposed to 90/10 six months ago and all of the guests seem so appreciative of each other and the host commentators. I remember back in my early years on CNBC that the maestros like Brian Sullivan, Jim Cramer, et. al, would always end the interview by saying, “Thanks for coming” and I would say, “Thank YOU” or even, “You’re welcome”. The latter sounds a little pretentious, but hell, I had driven two hours up to Burbank and had three hours in heavy traffic going home and of course, it was me who owed them a “thank you”, but my Mom always taught me to say, “you’re welcome”, so I did. Even so, they always asked me to come back.

These days though, the guests to a man and a woman, always open their comments with a “thanks for having me on”. Little do most of them know that Sullivan/Cramer don’t even know who they are but it’s the producer or an assistant who has done all the scheduling – and then only 20 seconds later, they kiss derriere by saying, “that’s a great question” and then a minute later, “excellent questions” and on and on until they have little time for the answer.

I guess I should blame it on Trump, for whom everything is great or the best, but it’s so cloying.

Get over it, people – you’re on TV and you get one to two minutes and stop talking about the great questions and provide the Viewer with some great answers.

Anyway, like I wrote in the beginning, – hello again – I’ve got quite a few more rants, but you want to read what I’m thinking – I hope!

I write this time to try and provide a not necessarily unique, but certainly rare, take on stocks and the reason they have done so fabulously well – especially the Fab 5 and growth stocks in general. Of course, there’s the reopening of much of global economies, and the hope for a vaccine, or if not, that COVID-19 will just fade away like Douglas Macarthur’s old soldier who never died, but just faded away…faded away. But there’s another likely explanation that centers on interest rates – real interest rates that have come down, down over recent years and are still reaching historic lows. A value investor (are there any left?) would know that over time a stock’s price is significantly influenced by real rates – not so much by nominal rates, which incorporate an outlook for inflation and (these days) deflation. A value-oriented investor would know that the Gordon dividend discount model expressed as

where “P” equals stock price and “D1” equals the current dividend amount and “r-g”, a most confusing “required rate of return” minus the expected growth rate of future dividends.

Overtime, this formula provides a decent estimation of a stock’s price, but Fed intervention, their implicit guarantees, and trillions of dollars of deficit spending sort of ruin the apparent logic of this formula’s logical approach to investing. Many investors these days trust (or fear) algorithms based on momentum and hope for a return to an old normal economy and a Fed focused more on inflation, and the real economy than stock prices and unemployment.

Not often does one hear about Treasury Inflation-Protected Securities (TIPS) or real interest rates and their influence on markets or even sectors of the markets like growth, versus value stocks and the illogical reason why future growth rates should be trusted more than a more verifiable current real interest rate to explain why the “P” of Apple has done so much better than the “P” of Coca Cola.

One significant reason I believe is that the “P” of dependable growth stocks is much more significantly influenced by a declining real interest rate. The (r-g) in the formula basically assumes that R goes down when the real interest rate of 10-year or long-dated TIPS goes down, all else being equal, and that because high-quality growth stocks like Amazon or Microsoft will maintain a consistent future growth rate, COVID-19 or no COVID-19.

When real rates decline like they have over the past few years, the discounting of current dividends (D) skyrockets the price. A drop of 150 to 200 basis points in real long-term interest rates, which has occurred in recent few years, can impact the price of Apple or Amazon by as much as 50%, everything else being equal, and they have. The effect is much less for cyclical/value oriented stocks because their expected growth rates (g) generally decline as well. For them, a 150-200 basis point drop in (g) would match that decline of real rates and keep the price of these stocks constant, by keeping the denominator in the formula unchanged.

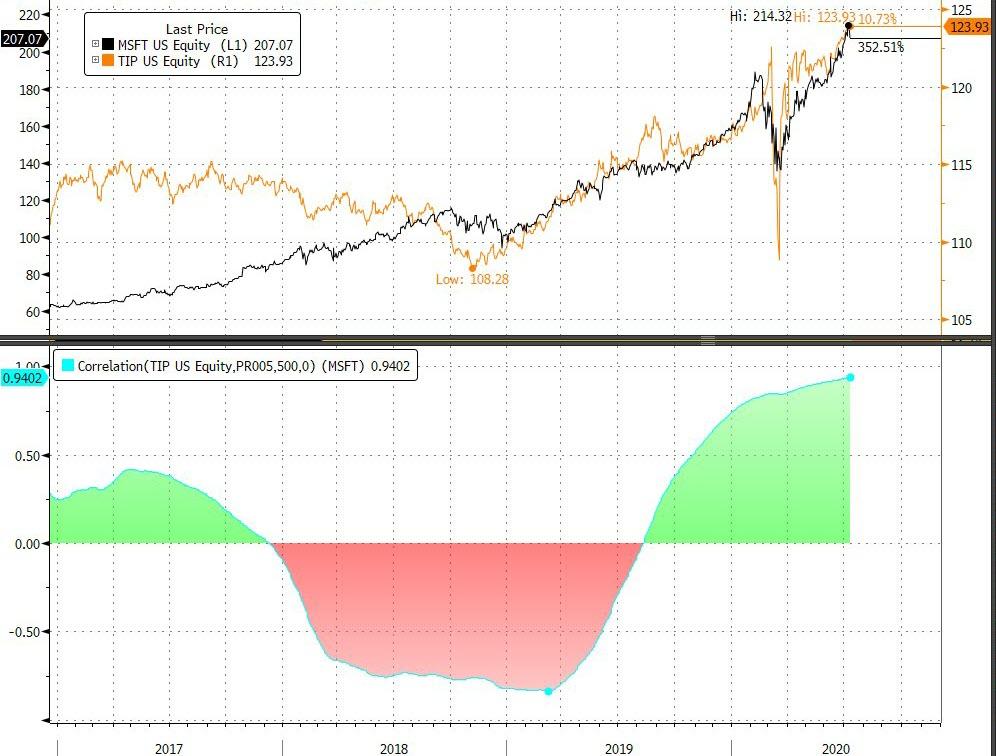

Doubt me? And would you counter that other significant influences like momentum are much more statistically correlated to price movements these days that a textbook formula that may be relevant over 10-20 years but certainly not in today’s frenzied markets? I would probably agree with you except to say “think about real interest rates as well” as a recent and ongoing influence. Here’s a juicy tidbit to contemplate. The price of Microsoft (perhaps the most consistent growth stock of all in terms of an expected “G”), has a .854 R^2 correlation to TIPS (TIP on your Bloomberg dial) over the past two years. When TIP goes up, Microsoft goes up. When TIP goes down (real yields up), Microsoft goes down. (Not daily, but over a week or two weeks’ time.)

Would I bet the farm on this correlation in the future? Well, maybe 40 acres worth. And where do I think TIP and real rates are going in the future? Well, real 10-year TIPS trade at a minus 75 basis points as I write, after being as high as a positive 100 basis points two years ago. A near 200 basis point drop over the period could account for at least half of the price increase in Microsoft over the past several years – higher growth, momentum, and Index funds providing some of the appreciation as well.

And 10-year U.S. real rates at a minus 75 basis points are quickly approaching the linker yields of Germany and Japan, which are so low that the only buyers are governments and regulated pension funds, which incredibly mandate their purchase for portfolios.

To me, then, the future price disparity of Microsoft, Apple and Amazon relative to lesser growth but still high quality stocks like Coca Cola or Proctor & Gamble, is subject to an ongoing decline in real rates, which to my mind, have seen their best days. Value stocks, versus growth stocks, should be an investor’s preference in the near-term future.

So long until the next time and next rant.

I’m COVID-19 free and just shot an 83 yesterday at my golf course. Happiness is a healthy body, sinking a few 10-foot putts, and investing in value, versus the “Fab 5”. I like EPD, MO, IBM and ABBV, to name a few. No guarantees!

via ZeroHedge News https://ift.tt/2WhS80R Tyler Durden