If The US Was Japan, The Fed’s Balance Sheet Would Be $25 Trillion

Tyler Durden

Mon, 07/13/2020 – 20:05

If anyone still needs a simple yet infallible thesis to buy gold, here it is from Deutsche Bank’s chief credit strategist Jim Reid.

Fed Balance Sheet – One-way traffic again

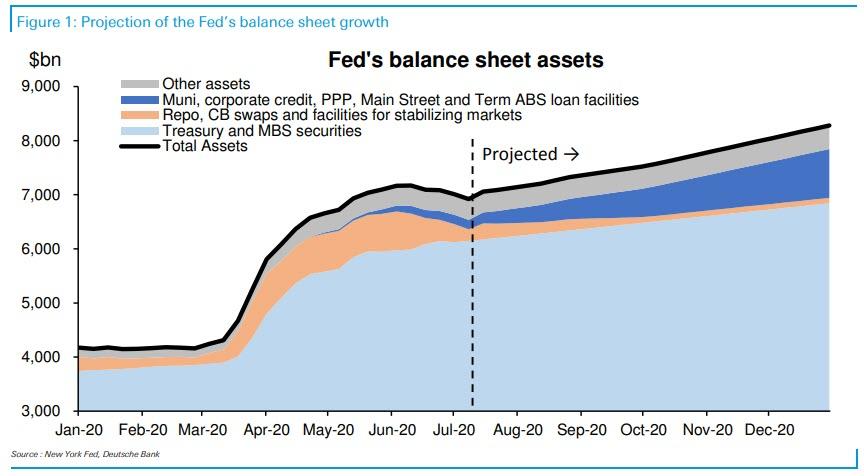

Last week the Fed balance sheet dipped below $7tn and is now -3.5% below its peak a month ago. However, this reflects emergency pandemic liquidity facilities rolling off rather than anything more structural. DB’s Steven Zeng now thinks it will start to climb again with QE and various other loan facilities to around $8.3tn by year end, double where it was at the start of 2020.

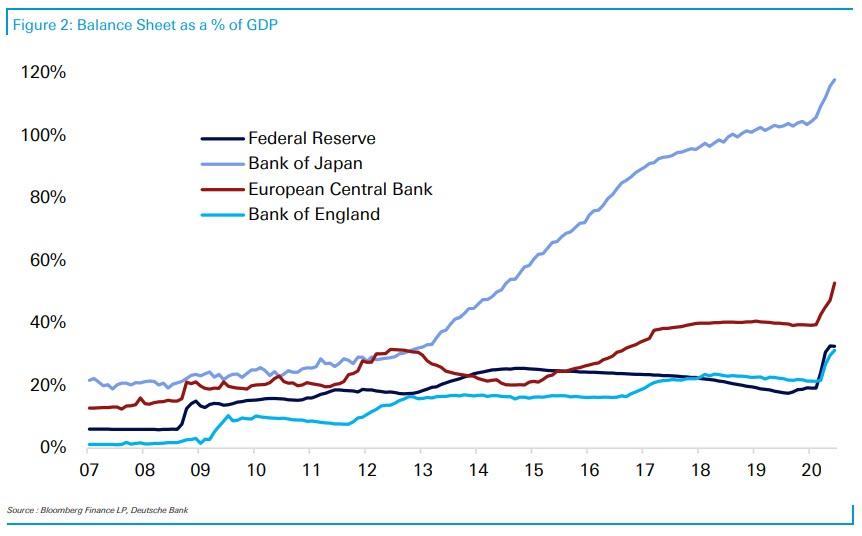

Some believe this is already a huge amount, but as the second graph shows, the Fed’s balance sheet as a % of GDP is notably lower than the ECB and BoJ’s. If they were aligned, the Fed balance sheet would now be around $11tn and $25tn, respectively.

With DB’s Matt Luzzetti expecting that US debt to GDP will be above 100% in 2020 and near 140% by 2030 from just shy of 80% at the start of this year, it seems inconceivable to me that the Fed and other central bank balance sheets will do anything other than explode over the next decade and perhaps beyond.

via ZeroHedge News https://ift.tt/3gYW1PY Tyler Durden